Energy Fuels Inc. (NYSE

MKT: UUUU; TSX: EFR) visited with Metals News at the recently held Metals and

Minerals Show. Mr. Stephen P. Antony (Steve)

is the Chief Executive Officer and President of Energy Fuels. He took the time to explain current

developments in the company, and how they have positioned themselves to

capitalize on what many believe will be significant increases in the demand for

uranium in the coming years.

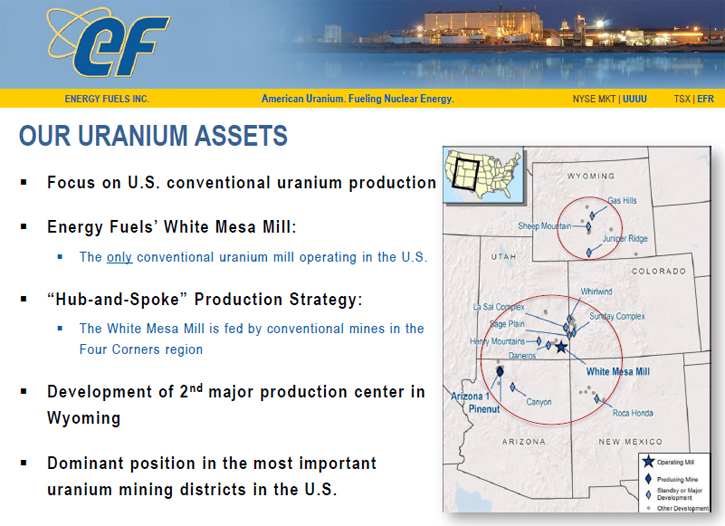

Steve said, “Energy

Fuels is a conventional uranium producer.

Indeed, we are the only conventional producer in the U.S., the 2nd

largest producer in the U.S. behind Cameco, and we accounted for about 25% of

all U.S. uranium production in 2013.”

Since the company was founded in 2005, the company has seen changes in

the market that have included both highs and lows, as changes in uranium demand

have adjusted over time. Mr. Antony

said, “We have weathered the ups and the downs since then, and right now we are

one of the strongest companies in our uranium peer group, in terms of working

capital, current uranium production, and the potential ability to increase

production significantly in the coming years.”

Energy Fuels built

their production portfolio by investing in historically significant districts

and mining properties in the U.S. In

fact, Energy Fuels is one of the largest holders of NI 43-101 uranium resources

in the U.S. Steve said, “We have knit together

uranium properties that were in production in the 1950’s through the 1980’s.” Antony’s strategic plan was borne out of his

own experience in the industry. He said,

“I have been in the business since the 1980’s with Mobile Oil. They used underground solution mining. I joined the original Energy Fuels Nuclear, when

they were focused on conventional mining of the high-grade uranium deposits in Arizona.”

With the geopolitical

changes that happened during the 1980’s, much of the uranium industry experienced

a dramatic slowdown due to lack of demand and excessive supply. Antony said, “The industry went through

hibernation for about 20 years as a result, and most U.S. production was

shut-down. However, the U.S. was once

the World’s largest producer of uranium, and there are still huge quantities of

uranium which could be mined in these U.S. districts.” Modern day issues, such as the damage done to

a nuclear power plant during a Japanese earthquake in 2011, have put what Mr.

Antony believes is a short-term damper on the projected worldwide growth in

nuclear energy and uranium demand.

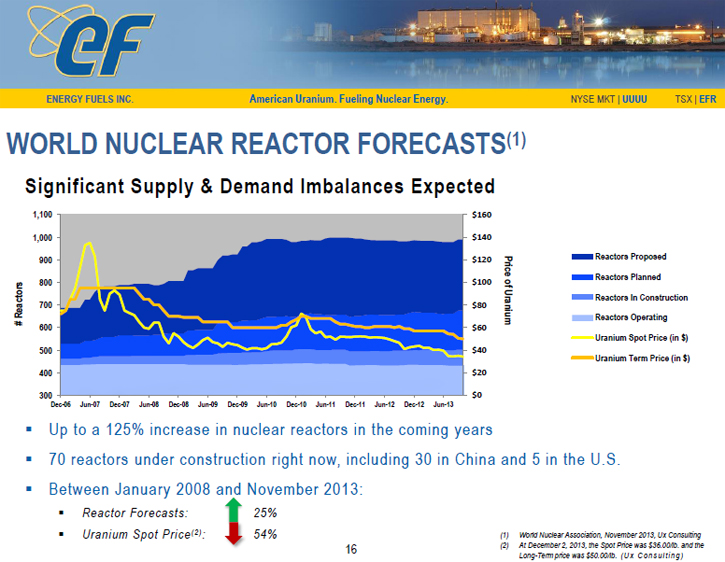

Yet, the demand for clean and efficient energy

sources remains strong. Indeed, demand

is stronger now that it was immediately prior to Fukushima, led mainly by

developing nations in Asia. Most governments

recognize that nuclear is the best technology for producing carbon-free,

low-emission, baseload electricity. As

of December 2013, there were 70 nuclear reactors under construction, 173 on

order or planned, and 314 that have been proposed around the world. Mr. Antony stated, “If all of these units are

built, the world will experience more than a doubling of nuclear capacity over

current levels, along with the attendant increases in uranium demand.” That

is the reason that Energy Fuels believes its ability to significantly increase

production is highly important. Said

Antony, “The world produces about 16% of its electricity utilizing nuclear

technology. However, the U.S. is the

world’s leading producer of nuclear energy and the largest consumer of uranium.” Antony continued, “The U.S. produces about

18% of our electricity from nuclear, but we are well over 90% dependent on

foreign sources of uranium. This is why

Energy Fuels’ position as a leading U.S.-based producer is particularly

strategic.” With demand increasing, Steve

said that the company is seeing new demand on the horizon both in the United

States and around the world.

While many uranium

companies are struggling to survive in the challenging mining market, Energy

Fuels is actually in production, and generating cash for their business. Mr. Antony said, “We have been a producer and

currently have three contracts with major utilities that we are fulfilling.” In 2013, the contracts called for about 1

million lbs. of deliveries. Said Antony,

“Our contracts are great assets to the company, as they have pricing that will

average above $58/lb. in 2014. This is about

65% higher than the current spot market for uranium. We have 2-4 years left on these contracts.”

One of the benefits of Energy Fuels is the amount

of resources in their portfolio that has yet to be tapped. Antony said, “We have the largest base of

pounds in the ground that are near term producible.” In addition to the company’s current

production from its Arizona mines and alternate feed materials, the company is also

developing three large-scale uranium projects at Roca Honda, Sheep Mountain,

and Henry Mountains. Mr. Antony stated,

“These are three of the most important uranium projects in the U.S. and have

the capacity to produce large quantities of uranium over long periods of time.” Having this large base of uranium, large, advanced-stage

development projects, and the only conventional mill in the U.S., gives the

company options in responding to changes in the market. Steve stated, “The best analysts think we are

looking at a 40 to 50 million pounds per year of underproduction in the 2015,

2016 time period. New reactors are

coming online around the world, each of which will require fuel produced from

uranium. But, no one knows where this

uranium will come from. We are

positioning Energy Fuels to be one of those suppliers.”

For investors who are bullish

on uranium and nuclear energy, Antony believes that Energy Fuels is worth

further investigation. He said, “If you

look at our peers in the uranium space, we offer excellent leverage to the

uranium price. We have current uranium production. But, we also have an unmatched ability to

scale-up production, once we see uranium prices recover on a sustained basis.” In fact, the company believes it can ramp up

production quickly in response to market pressures and demand. Antony said, “We are scalable. We believe we can increase production from 1

million pounds to 5-6 million pounds over the course of a few years, if markets

cooperate.” Antony said, “We are already

permitted, and we have the only producing mill in the United States. We are the only company in North America that

can process low-cost alternate feed materials.

And, we essentially have a monopoly on conventional uranium processing

and milling in the U.S.”

Energy Fuels’ production

capacity has created a solid financial base for the company. Antony said, “Our balance sheet is solid, as

we reported $16.7 million of cash on hand September 30, 2013, along with a

working capital position of $36.8 million.

We are operating very prudently in the current market, but doing the

right things to position the company for production growth once markets

rebound.”

Why should investors

consider Energy Fuels? Said Antony, “We

are truly levered to the uranium price.

We have unmatched uranium production scalability among our peers. We have the only conventional uranium mill in

the U.S. We have current production and

three large-scale uranium development projects.

If nuclear energy grows as expected, uranium demand and prices should

increase substantially. Energy Fuels

expects to be in a position to benefit.”

http://www.energyfuels.com/

Energy Fuels Inc.

2 Toronto Street, Suite 500

Toronto, Ontario, M5C 2B6

Canada

General Information:

U.S. Office

Energy Fuels Resources Corp.

225 Union Blvd., Suite 600

Lakewood, Colorado, 80228

General & Investor Information:

Curtis H. Moore

Tel: 303.974.2140

Fax: 303.974.2141

Toll Free: 1.888.864.2125

E-mail: investorinfo@energyfuels.com