In the resource mining industry, where the job is to get minerals out of the ground and process them, innovation tends to focus on how efficiently that job is done. The faster explorers can find a deposit and the faster that a producer can mine it, the better.

But surely that's not the only opportunity to innovate. One company says it has developed a proprietary technology to extract mineral deposits and repurpose the mined ore for an end-use that is exceptional.

At the recent PDAC Conference in Toronto Canada on March 3 to 6, we spoke to Ric Dawson, Managing Director of Australia Minerals and Mining Group Ltd (ASX: AKA). Mr Dawson told us about the exciting developments that are underway at his company.

"AMMG was listed on the Australian Stock Exchange three years ago with the purpose of identifying sufficient resources with the potential to develop bulk mineral projects, particularly aluminous clay (or kaolin)” Mr Dawson said.

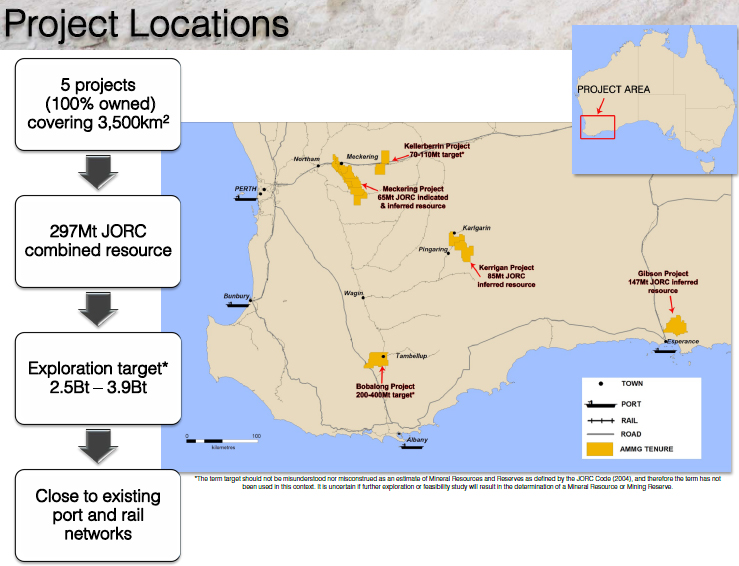

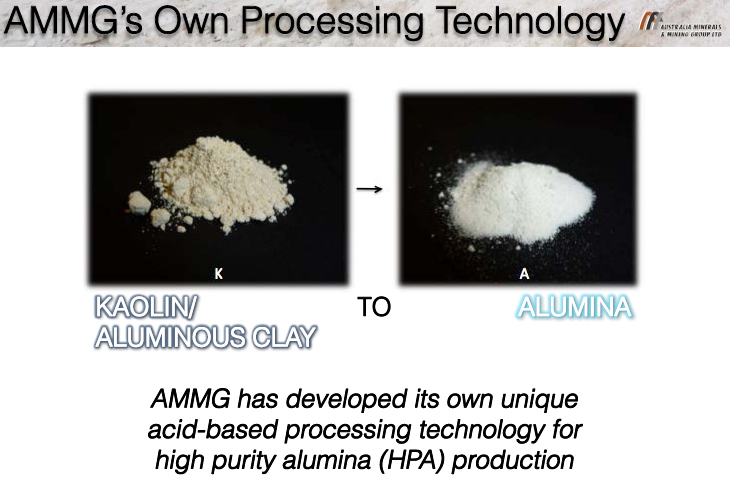

The company’s website describes their Australian-based project areas, which include holdings in aluminous clay (kaolin), iron ore, mineral sands, salt, nickel and coal. Mr. Dawson spoke to us about the company's primary focus right now, which is their South West aluminous clay project. Kaolin is the term used to describe aluminous clay for its use in the paper industry; while aluminous clay is the term used for the production of alumina. "We've developed a technology, which converts aluminous clay to alumina [Aluminium Oxide]."

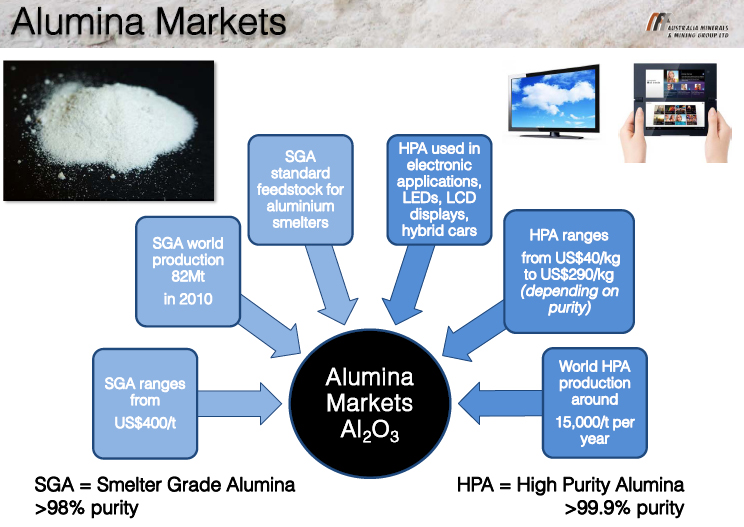

Mr. Dawson described why the company followed this path of innovation: "The kaolin industry was one that had always been historically [used] by the paper industry but we chose to try and find a new way to use kaolin somewhere else. We've managed to develop the technology where we add acid to the kaolin and then, through our patented process, we end up with high purity alumina and smelter grade alumina." Their high purity alumina achieves 99.99% (4N) purity. Their smelter grade alumina, used in aluminium smelters, achieves 98% purity, which is the standard purity level for this type of alumina

So, why is the company innovating in this area? Mr. Dawson explained: "We're chasing the high purity alumina, which is priced at around $30 to $300 per kilogram, depending on the level of purity. It's a very high-end premium product. It's used in LED lights, LCD screens, and lithium batteries for the hybrid cars. Because of its inert properties and its high quality, [and because] it doesn't conduct electricity it is used as a substrate of those products."

Investors will be interested to hear how the numbers work out on this high-grade focus: "Our pro forma looks very attractive when you consider that something goes for $300,000 per ton. We're only looking to produce one ton per day, which is 300 tons per annum. We'll be around $90 million in revenue. Our cost structure is very low, around $1,000 per ton. So there's a very substantial net revenue. If you work on those figures, you're looking at somewhere between $80 million and $90 million per year," explained Mr. Dawson.

The company has plenty of resources they can draw from to enjoy a lengthy mine life and, if their financial predictions turn out to be accurate, a long and profitable operation. "The deposit at the moment has around 300 million tons of aluminous clay resources. This should give us sufficient mine life for our new technology," explained Mr. Dawson.

We talked to Mr. Dawson about the next steps for the company. "We've chosen not to do feasibility studies – basically because the cost of building a plant is much smaller. We're not looking at big dollars. For around $20 million we can build the HPA plant and go into production. We believe that we could be in production somewhere between 6 and 12 months. We're at PDAC because we're talking to the Canadian market and we're talking to investors."

Responses have been positive on their initial work that they have tested in the market. "We've had numbers of people asking for specifications and we've had no issues with the quality of our product. Obviously when you do a pilot plant, you're doing it at a much larger scale, but we feel that we can produce the right quality of material." In this market, $20 million for a pilot plant might not always be easy to find, but a project cash flow of $80 to $90 million per year might help to generate some investor interest.

Investors will also like the fact that the company can ramp up quickly for a relatively low price, especially since there are no major infrastructure costs: "We're based in the Southwest of Western Australia. We're about 150 kilometers to the port so our infrastructure is very good. We have rail and water and electricity that go through our tenement."

There are even more advantages, suggested Mr. Dawson. "I think people can see that we are the new wave of alumina production. Going forward we are a green product – we recycle our acid. And because there are no iron tailings, then there are no red mud issues." Unfortunately, as with many junior resource companies right now, the market hasn't necessarily been kind to the share price. "At the moment, our share price isn't reflective of the quality of the assets we have," said Mr. Dawson. "I think that investors coming into a company of our size at this stage – there's substantial upside."

In an industry where the focus is trying to get more minerals out of the ground and to the marketplace faster, this "new wave" of mining is a compelling way to grow the business, especially in the growing demand industry of LED lights, LCD screens, and lithium batteries. Investors who want to find cutting-edge innovators may want to take a closer look at Australia Metals and Mining Group.

Australia Minerals and Mining Group Ltd.

ASX: AKA

3 Bay Rd, Claremont, WA, 6010, Australia

+61 (0)8 9389 5557

http://www.ammg.com.au/