Many junior resource companies explore and develop and produce just with the hopes of competing at all. But one company, Largo Resources, has a different trajectory: They expect to be a major industry player in a burgeoning part of the resource sector.

Recently, we spoke with Mark Brennan, CEO and President of Largo Resources (TSX-V: LGO). We met up with him at the Cambridge House Vancouver Resource Investment Conference, where we talked about the company's growth strategy and why investors might want to take a closer look at this company.

First, we learned a bit more about Mr. Brennan and how he came to work with Largo Resources: "My background is in investment banking in London where I focused on minerals and oil and gas companies. I got involved with starting companies and moving companies through the process to expand and produce and, in some cases, being acquired," he said. "I started with Desert Sun, a company that we started with a $10 million market cap and sold for about $700 million. Subsequent to that, I came in as CEO and President of Largo."

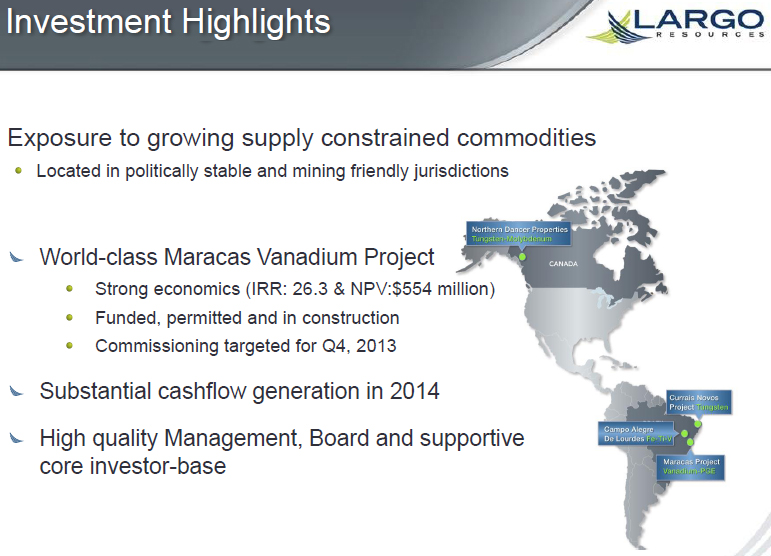

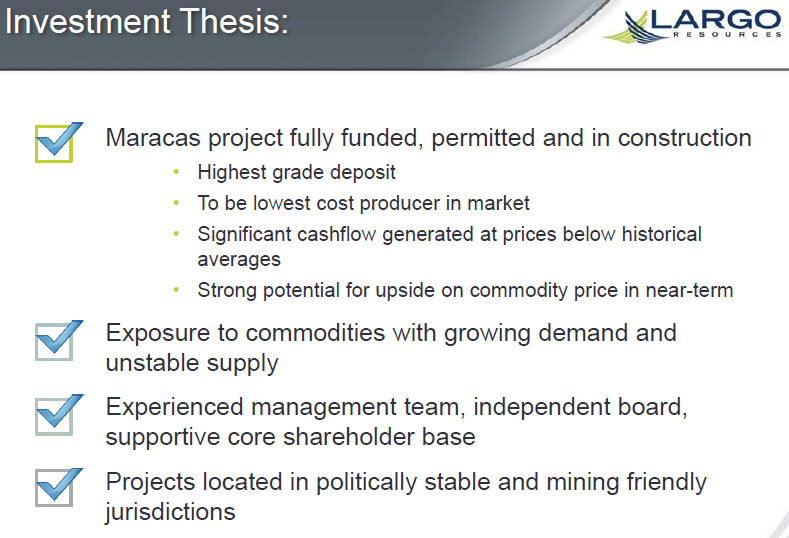

His work in Largo has been to clarify and strengthen the company's opportunities, and put them on a path that will help them to achieve an exciting place in the industry. He said, "When I joined Largo, they had a gold/copper asset in Ecuador which we moved away from. We now have the Maracas project, which is the richest Vanadium deposit in the world. We're going to have a substantial impact on the Vanadium world. We'll be the low-cost producer. We'll be the largest producer at some point and then drive very, very big markets. We'll be a very profitable company."

Vanadium is a mineral that is growing in popularity and new uses are being found for it regularly. The market has been growing steadily and recent political decisions mean that the demand for Vanadium might be growing even faster. "Vanadium is being used a lot more than it has been in the past," explained Mr. Brennan." It has the highest strength-to-weight ratio of any engineering material. The use of Vanadium is dramatically increasing. Up until 2004, it was used in very small esoteric markets. Now it's ubiquitous – used in automobiles, aviation, railways and railway lines, and construction. So there's a much greater usage of Vanadium." Then Mr. Brennan added: "The market is growing at about 5% per annum, irrespective of the global economy being week. A very big change occurred this January 1st when the Chinese government enforced the usage of grade 3 rebar as opposed to grade 2 rebar. And that looks like it's going to drive the demand of Vanadium by about 40,000 tons per annum. So a market that is currently 80,000 tons looks like it will go up 50% just because of the Chinese. So we're seeing a lot greater usage of Vanadium in all aspects of life today."

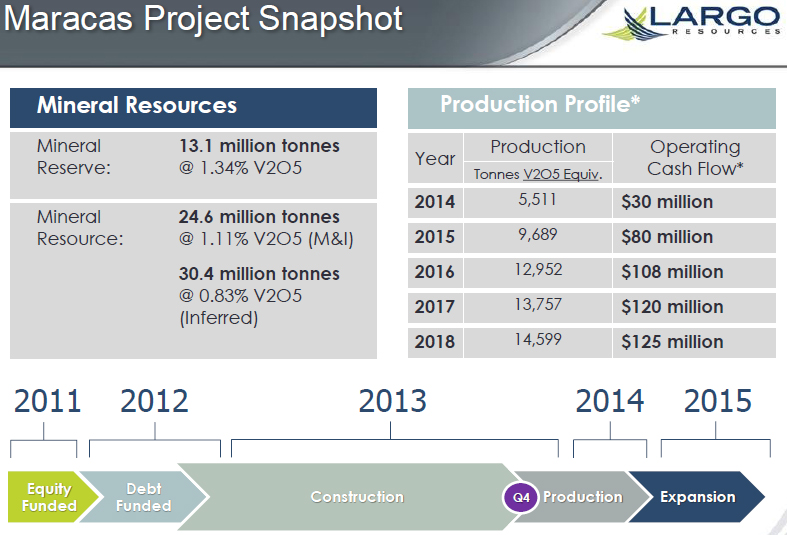

The Maracas project is located in Brazil and is one of a handful of properties the company owns. The location of the Maracas property is an advantage, asserted Mr. Brennan: "Our property is in the northeast of Brazil: The topography is an excellent place to work. We have very good infrastructure: Roads; electricity running through the property. It's a very mining-friendly country. We know the government very well [from the Desert Sun project]. They've been very accommodating, in terms of helping us with many different things, funding included. As a consequence, we're now in construction; we've completed the civil engineering, and we're now moving in to the electrical, mechanical assembly, and we expect to be in production by the end of the year."

With such a promising project in a great location, and with a corporate strategy to be a world-leading, low-cost producer, the company looked internally at its operating potential to explore what could be done to help it achieve that goal. "We moved to a model that we had already incorporated internally, and we now have third party validation by a very well regarded engineering firm, to look at expanding our production by 50%. We are in construction at the moment. We have already pre-ordered the key equipment to a capacity that can accommodate this expanding production scenario, so it's something we've been thinking of for a long while. Our production will go up by 50% and our costs will go down by 15%, making us even cheaper and even more competitive as the cheapest producer of Vanadium. And looking at returns on the project, we actually have an Internal Rate of Return of 26.3% and a Net Present Value of about $550 million. All in all, it's been a very, very attractive scenario for Largo."

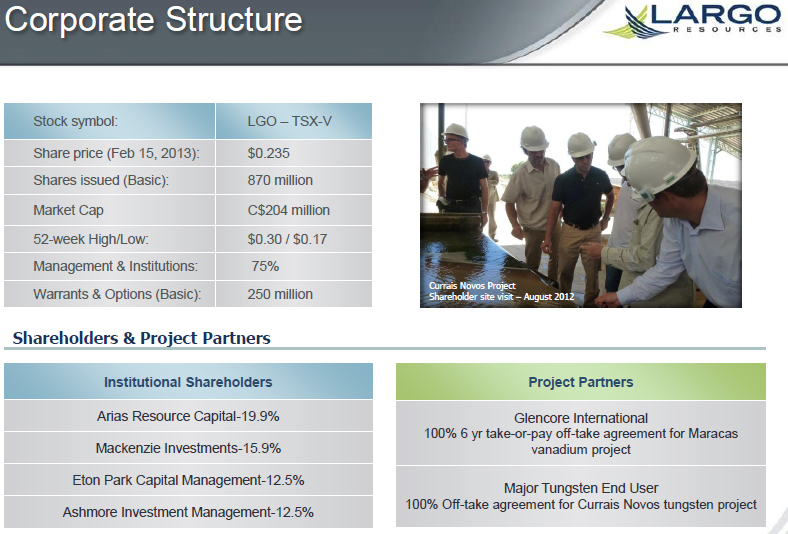

The company plans to start production by the end of the year and is targeting an $80 million per year cash flow in 2015. With this kind of growth over the next few years, Mr. Brennan believes that the company is undervalued in the market: "The company right now is [priced in the market] at about .3 times Net Asset Value whereas companies at our stage (especially metals) trade at .6 times… If we traded at .6 times Net Asset Value, that would bring us to about $0.35 or $0.36 per share… The news that we've expanded our production scenario has only come out [recently] so over the next few months we should get a re-rating of the stock price."

In the short term, the company is focusing on the Maracas project and how it can help them become a leader in providing low-cost Vanadium to a growing market. But they are looking beyond that as well. Once the Maracas Vanadium project is further along, the company is examining its longer-term options: "We're also looking at becoming a significant Tungsten producer," reported Mr. Brennan. "We have two projects in the Tungsten field that we think will be world-class projects: One is called the Currais Novas project, which is just currently ramping up production. This will be a small producer of Tungsten. But we also have the Northern Dancer project, which is one of the largest undeveloped Tungsten projects in the world. It's our belief that Tungsten prices are going to increase significantly as a consequence of the fact that the Chinese (who have been the dominant supplier to the world) are running out of high grade Tungsten." "We're pretty excited in the long-term for these two projects but in the short-term, our focus is really on the Maracas project," he said.

Largo Resources has a compelling story for investors who want to find a cheap stock in a market whose demand is growing. And, Largo Resources has a bold vision of market leadership in Vanadium in the short term… and Tungsten soon after.

Disclosure

Dr. Allen M. Alper Is on the Board of Largo Resources and the Alper family owns Largo’s stock.

REFERENCES

Largo Resources: http://www.largoresources.com

Stay connected with Largo at:

55 University Ave.

Suite 1101

Toronto, Ontario

Canada

M5J 2H7

416-861-9797

www.largoresources.com

info@largoresources.com

Facebook: Largo Resources

Twitter: @LargoResources1

YouTube: LargoResources

Cambridge House Vancouver Resource Investment Conference: http://cambridgehouse.com/node/7920