Toronto – August 15, 2018 - HARTE GOLD CORP. (“Harte Gold” or the “Company”) (TSX: HRT / OTC: HRTFF / Frankfurt: H4O) is pleased to announce its 2018 second quarter (“Q2”) and first half (“H1”) results ended June 30, 2018.

Mr. Stephen G. Roman, President and CEO of Harte Gold stated, “2018 is a catalyst rich year for Harte Gold. So far we have tripled our resource, published a new PEA for mining the Sugar and Middle Zone deposits, secured financing to fully fund development, announced an IBA with our proximal First Nation Band and completed construction of an 800 tpd mill. The Company is now looking forward to the transition into a cash flowing, gold producing business.”

HIGHLIGHTS

• Completion of eight months of site construction without a lost time injury.

• Confirmed commercial production in Q4 2018 on schedule.

o Construction of the mill complex is complete and ready for “power on”.

o Commissioning components of the crusher and mill complex has started.

• Full permitting for commercial production is sufficiently advanced.

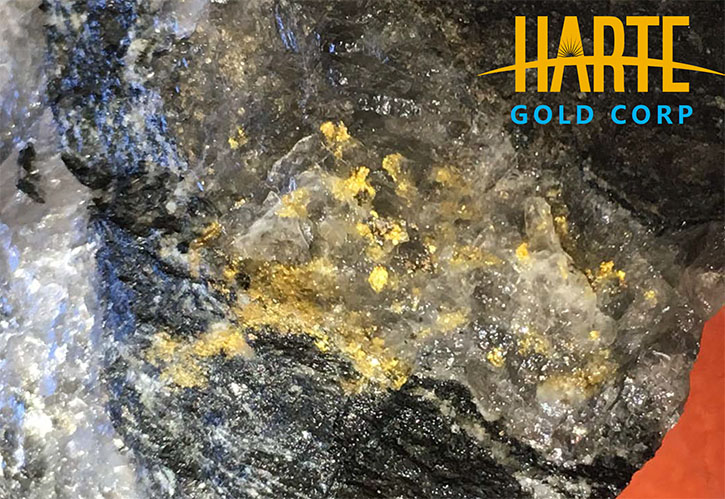

• Near mine drilling is well underway and is expected to add significant resource to the mine plan and improve overall modelled grade.

o 70,260 metres has been drilled for 2018, as at the end of July.

o A new mineralized zone named the “Fox Zone” was discovered 700 metres northwest of the Wolf Zone.

o Mineralization at the Wolf Zone was extended significantly down dip.

o High grade areas at the Sugar Zone and Middle Zone have been significantly expanded with infill drilling.

o Footwall Zone drilling at the Middle Zone returned higher grades and widths than previously estimated.

o Definition drilling at the Upper Zone area of the Sugar Zone have returned high grade sections, expected to improve modelled assumptions for stope production.

o Strike length from the Sugar Zone to the Fox Zone has been extended to 5 kilometres.

• Debt financing was secured with a US$70 million financing package including Sprott Private Resource Lending (Collector), L.P. (“Sprott”) and Appian Natural Resources Fund (“Appian”).

o As at June 30, 2018, the Company has drawn US$20 million from the Appian facility and US$20 million from the Sprott facility.

o $55 million in capital expenditures has been incurred on the ore processing facility and related surface infrastructure, with approximately $16 million estimated remaining costs.

OUTLOOK

• Commissioning will be completed over the month of August.

• Commercial production permitting is targeted for September.

• Mine site will transition to grid power in September.

• Drilling at high priority targets, the Eagle and Highway Zones, is expected to start in September.

• Declaration of commercial production is targeted for Q4 2018.

• An updated National Instrument (“NI”) 43-101 compliant Mineral Resource Estimate is targeted for early 2019.