Gregg Smith, President & CEO and Greg Phaneuf, VP Finance & CFO, Grounded Lithium Corp. (GLC): Discuss their Vision to Become a Canadian Lithium Producer, Supporting the Global Energy Transition

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 10/30/2022

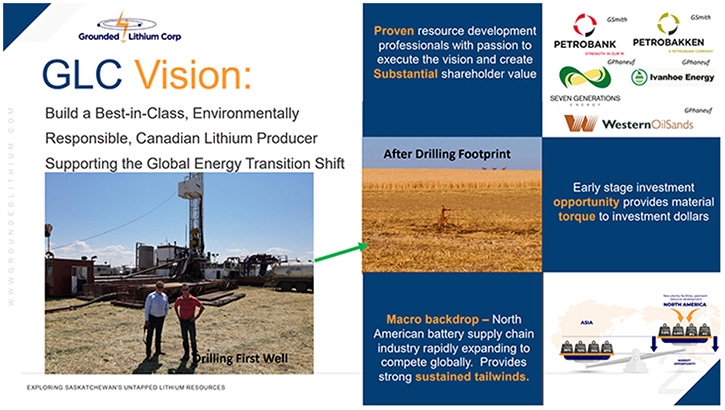

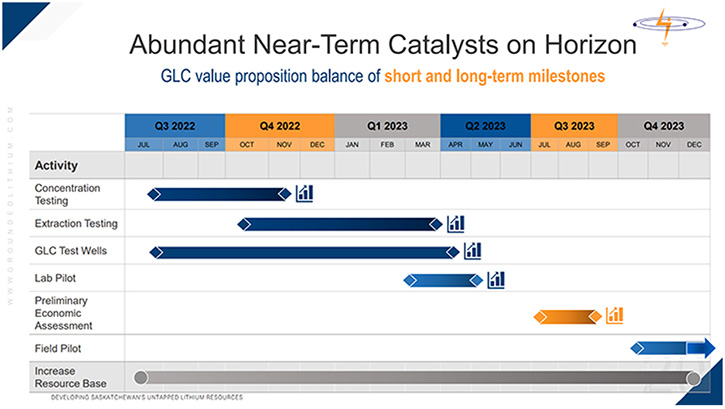

We spoke with Gregg Smith, President and CEO and Greg Phaneuf, VP Finance and CFO of Grounded Lithium Corp. (GLC), a private lithium brine exploration and development Company, with a vision to build a best-in-class, environmentally responsible, Canadian lithium producer, supporting the global energy transition shift. GLC targets and controls lands, that will support multiple 20,000 tonnes/year projects. GLC's Kindersley Lithium project has an inferred resource of 2.9M tonnes LCE. GLC intends to utilize a direct lithium extraction (DLE), in its production of battery-grade lithium carbonate equivalent, or lithium hydroxide, depending on customer preferences, an ESG-friendly process that; minimizes capital costs, reduces permitting risks and allows for faster production, with higher recoveries. Near term plans include; concentration testing, extraction testing, deliverability test results from GLC’s well, drilled in August 2022, lab pilot, additional test results from GLC proprietary wells, in addition to access to legacy oil and gas wells, and a PEA in Q3 2023.

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Gregg Smith, President and CEO and Greg Phaneuf, VP Finance and CFO of Grounded Lithium Corp. Gregg, could you give our readers/investors an overview of your Company and what differentiates it from others?

Gregg Smith:

We're a relatively young Company, we've been incorporated less than two years. In a very short time, we've moved a long way. At the end of last year, we had 35 sections of freehold acreage, that's 35 square miles of mineral rights for lithium from brines. Now we find ourselves at 284 square miles of lithium from brine. We've drilled our first well and we have been testing existing wells, within the area, for lithium concentrations. If you follow us and you follow the industry, what you would note is that in a very short period of time, we've moved a long way up the ladder, in terms of proving up our resource.

Dr. Allen Alper:

That is excellent! Gregg, could you also talk about what your plans are for the remainder of 2022 and going into 2023?

Gregg Smith:

Certainly! This is also somewhat in our online presentation, via our website, where if you look at our presentation, you can see it there. The best way to describe it, is that we're guided by our vision. Our vision is to become the best in class, commercial producer of lithium salts. To get there, we have to execute. We've been doing that to date and we will continue to do more concentration testing, from our existing wells, within the lab environment.

We will do some extraction testing to demonstrate the ability to remove the lithium and create a lithium salt from these brines and we will drill more wells as we move forward. Our goal is, by the end of 2023, is to execute a lab pilot and possibly a full field pilot, producing brine from an appropriately scaled, small demonstration facility that would allow us to demonstrate that we can create lithium salts at commercial rates, from our brine resources.

That would take us to the end of 2022 into 2023. Timing is more specific, within the presentation. And all the time we will be looking to add to our dominant ownership position of mineral rights, which we've been very aggressive to date in achieving. You can expect to see press releases from us in this regard.

Dr. Allen Alper:

That's excellent. Gregg, could you tell us about you your Team and Board?

Gregg Smith:

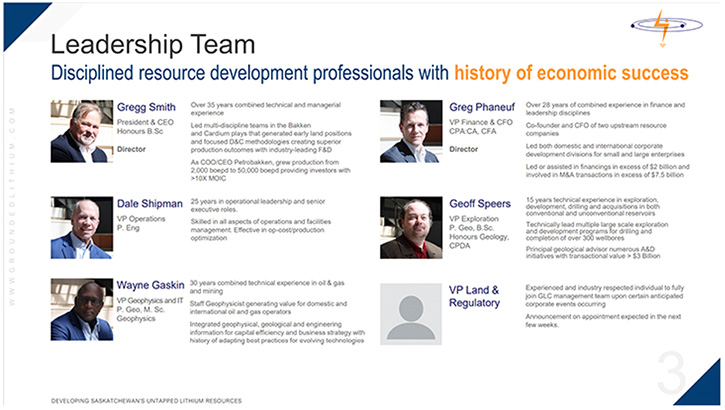

I'll talk about myself, for a little bit and then I’ll let Phaneuf talk about himself. We founded the Company together and then we brought in more Team Members, as we saw fit. My background is geology/geophysics. I first started working with Esso Exxon Resources, here in Calgary, and moved on and worked with several smaller companies. I eventually spent more of my career working as an executive than as a geologist. That exposed me to all aspects of the business, from the engineering side to the land side.

There's a lot of pressure to move away from oil and gas and we thought, well, is there an opportunity here? That took us to lithium. As I started to look at the controlling mechanisms for lithium, that then led me to high grade, out of the area that we are focused in on, which has proof of concept lithium tests in the area. When I started to note this, my first call was to Greg Phaneuf.

Greg Phaneuf:

Well, what a segue into my background. I'm a 30-year experienced CFO. Professionally, I have both a CA and a CFA. I've been in the oil and gas industry itself, directly for about 20 years. As Gregg mentioned, we got together and really took this to where it is today. I've carved out a niche, in terms of startups. I was the founding CFO of Seven Generations Energy, which went on to a substantial shareholder return. I was also the founding CFO of a more junior oil and gas company called Toro Oil and Gas.

I spent most of my career in the corporate finance, capital markets A&D world. I've been involved in A&D activities and corporate transactions. I have been involved in equity and debt capital raises in excess of $2 billion in my career. I’ve been the lead or part of a Team that's successfully closed greater than $7 billion in transactions. I love the entrepreneurial aspect of starting a Company and as Gregg mentioned, we have an energy transition idea here that is topical. Certainly, lots of tailwinds to build a business and we're keenly focused on creating shareholder value. Gregg, you want to talk about the Board Members?

Gregg Smith:

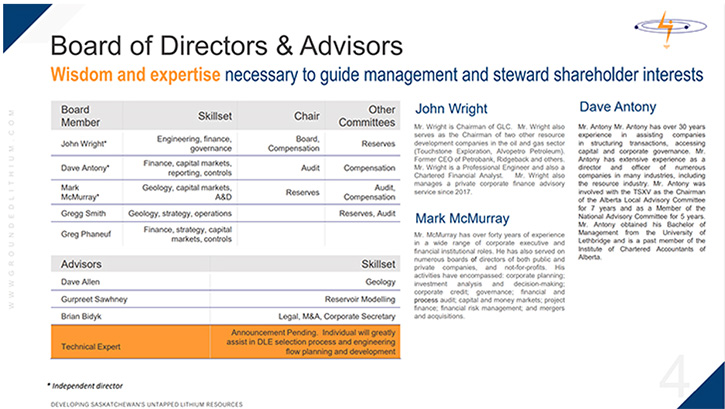

The Chairman of the Board is John Wright, with whom I worked at a Company called Petrobank, which then morphed into Petrobakken, as one of the resulting business units. We had a great deal of success. We took the Canadian business unit of Petrobank from 2,000 out to 50,000 as we emerged as a separate entity under Petrobakken. So, we have been able to demonstrate growth through the resource industry.

Also, at that time I was named Saskatchewan Oilmen of the Year, for work that we did in Saskatchewan. And you will note that these properties are in Saskatchewan, where we like to work. The rest of the Board is Mark McMurray, who is a geologist by background, but has spent most of his career working in investment banking, particularly in mergers and acquisitions. Dave Anthony brings a great deal of experience in the investment markets, as well as in financial reporting. Dave Anthony Chairs our Audit Committee, Mark chairs our Reserves Committee and John is Chairman of the Board and also Chair of Compensation and Governance.

Dr. Allen Alper:

Well, you all have very impressive backgrounds. It sounds like you're very well prepared to move your Company forward. It's very impressive how fast you have them moving your Company forward. Greg Phaneuf, could you tell our readers/investors a little bit about your share and capital structure?

Greg Phaneuf:

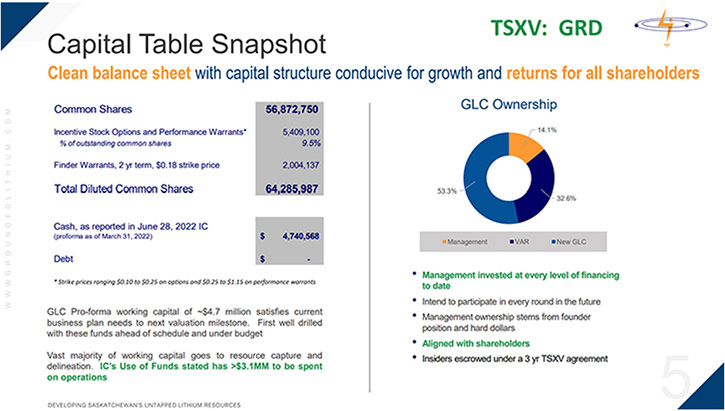

We very recently became a public Company, via an RTO reverse takeover, of a TSX Venture Company, called Var Resources. We commenced trading on August 25th, last month. We have roughly 56.9 million shares outstanding. Management, Directors, Officers and insiders hold 14% of that position. We have invested, as insiders, in every single round of this Company. We've invested, at the last private round, done at a price of 18 cents, with a mineral resource focused, brokerage firm called Red Cloud Securities, out of Ontario.

We raised in excess of $5.7 million as part of that process in conjunction with the consummation of the RTO. As we disclosed in our information circular, filed in June 2022 on SEDAR, our pro forma working capital position is $4.7 million. As Gregg mentioned, a few minutes ago, in his remarks, we have been active in the field. We have drilled our first well. So, we're using those proceeds, to address our near-term catalysts, in terms of some of the milestones, to create value for the Company.

In other words, we have a very tight capital structure. Gregg and I have been conservative, in our capital structure, from day one. We've built companies before. We're keenly aware that a conservative initial capital structure leaves room for subsequent investments and subsequent capital raises, at attractive valuation metrics, so as to provide a return for all investors, no matter where they sit on the risk/reward spectrum Fully diluted, we are about 64 million shares. That leaves 7.4 million, in terms of stock options, performance warrants to Management, and then also finder warrants, issued to Red Cloud, as part of the last capital raise.

Dr. Allen Alper:

Well, that's excellent! That's very impressive, what you fellows have done in a very short time. And it shows that the market has confidence, in what you're doing, and your project. One advantage is that you are in such a great location, a resource development friendly location, a location known for mining and resource development in general. And you have a product that is very important for electrification of the world and EV batteries. Gregg Smith, can you tell our readers/investors the primary reasons they should consider investing and Grounded Lithium?

Gregg Smith:

I think there are a number of things that I would emphasize. One is the clarity of our vision, which is we want to build a best in class, environmentally responsible, Canadian lithium salt producer, supporting the global energy transition. We’ve assembled a Team and we know the vision; we know our ultimate goal is commercialization and we have been executing milestones, one-by-one, to get us there. We have a business plan to take us right through to commercialization and we continue to work through all the key elements of that plan.

Second, at this point in time we're at an early entry point. We're new to the markets and it does provide that exposure to the macro energy transition investing. When Greg and I first started this business, we saw an opportunity and we thought we could make a profitable rate of return for our investors, when the price of lithium salts was $9,000 a ton. Now it's in excess of $60,000 USD per ton. The industry is experiencing notable margin expansion.

Third, from a macro perspective, if you look at the incentivization of moving towards electric vehicles, you can't escape lithium. That's why we focused there, in this short term. So, we are going to continue to move down this pathway and take this through to a commercial project, as quickly as we can.

Greg Phaneuf:

The only thing I would add to that, is that in our presentation, and inherent in the ‘DNA’ of Gregg and myself, is that we are resource development professionals. When it comes to lithium from brine, there is a certain degree of technology application. We've been true to ourselves from day one, knowing what we're good at, which is resource development, as opposed to creating the next best technology.

We've consciously decided not to commit significant capital to developing the next best technology, as it relates to extraction of lithium from brines. We are, as we say in our presentation, and these are Gregg’s words. I'm going to steal his quote, “We will stand on the shoulders of giants.” Meaning we will let others develop the technologies, in terms of extraction, and refining of lithium from brine and to lithium salts that are used, ultimately, by downstream consumers, in the battery supply chain industry.

We will approach those that have the best specifications or otherwise for our chemistry of brine, from our chosen land. So, in other words, we will not devote significant capital to technology. It's going to be spent on resource development, which is what we're good at.

Gregg Smith:

Yes. And valuing the right technology for our resource.

Dr. Allen Alper:

That sounds excellent. Those are very compelling reasons for our readers/investors to consider investing in Grounded Lithium. Is there anything else you'd like to add, Gregg?

Gregg Smith:

We were very excited by our progress to date. The Team was very energized by how quickly we're moving forward. Our first well is only the second well in the province of Saskatchewan, to be drilled for lithium, from brine, under that regulatory regime. We're going to continue to move this forward, as quickly as we can. I would invite shareholders, or anyone, to visit our website. Our website starts with drone video footage of our first well being drilled. We're really excited by all of this.

Dr. Allen Alper:

That sounds excellent! It’s an exciting time for your investors, shareholders, and stakeholders. And as you generate more information and go forward, it’s really going to be a rewarding time for all of them.

Gregg Smith, President & CEO, gregg.smith@groundedlithium.com

Greg Phaneuf, VP Finance & CFO, greg.phaneuf@groundedlithium.com

|

|