SPC Nickel Corp. (TSX-V:SPC) : Discovering Class 1 Nickel in a World Class Mining Camp; Interview with Grant Mourre, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/29/2022

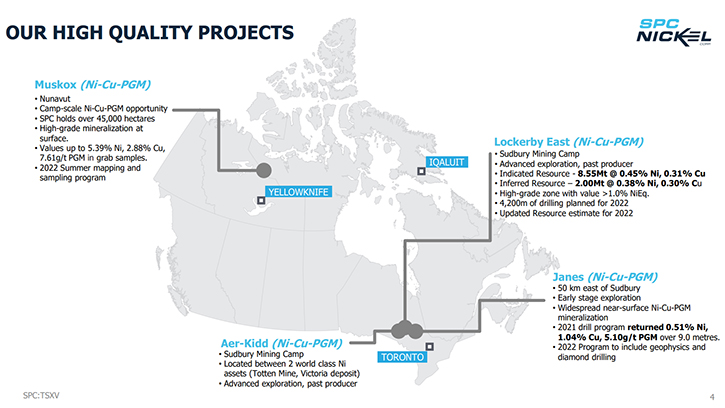

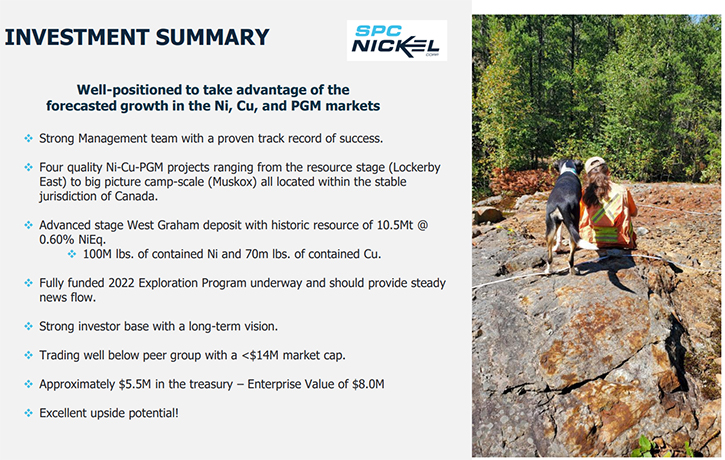

We spoke with Grant Mourre, President, and CEO of SPC Nickel Corp. (TSX-V:SPC), a Canadian public corporation, focused on exploring for Ni-Cu-PGMs, within the world class Sudbury Mining Camp. The Company is currently exploring its key, 100% owned, exploration projects, Lockerby East, and Aer-Kidd, both located in the heart of the historic Sudbury Mining Camp and adjacent to producing mines, past producing mines, or development projects. The fully funded, 2022 exploration program is underway and includes diamond drilling at Lockerby East that should provide steady news flow. SPC Nickel is also planning exploration activities, on its two other projects, the Muskox Property, located in Nunavut, and the Janes Ni-Cu-PGM Property, located approximately 50 km northeast of Sudbury.

SPC Nickel Corp.

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Grant Mourre, who is President and CEO of SPC Nickel Corp. Grant, could you give us an overview of your Company and what differentiates it from others?

Grant Mourre:

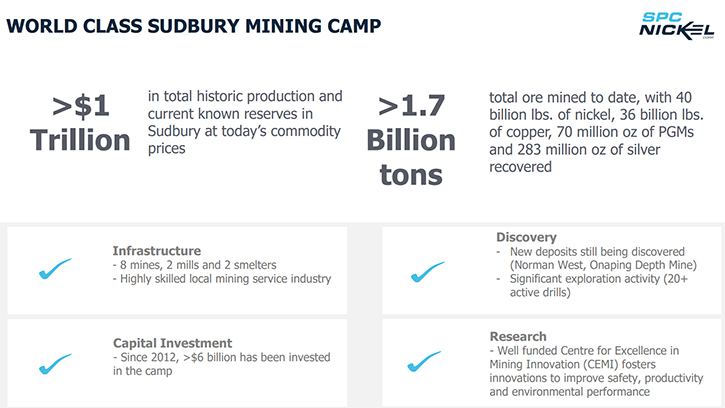

We are a junior company, listed on the TSX-V. We're relatively new. We listed about a year ago. Our focus is primarily on nickel and the commodities associated with nickel, copper, platinum, and palladium. We have four key assets, across Canada, but our real focus is on the Sudbury Mining Camp. For people who don't know, Sudbury is arguably the largest nickel camp in the world, at least in North America, next to maybe only Norilsk in Russia. I think probably one of the key points that sets us apart from a lot of other junior nickel companies out there, is that we have assets and resources, within one of the most established nickel camps in North America.

Dr. Allen Alper:

That's great. Could you tell us a little bit about your camps in Sudbury, a little bit about the data you have so far and your plans for 2022? I know you have a big drilling program that you’re working on.

Grant Mourre:

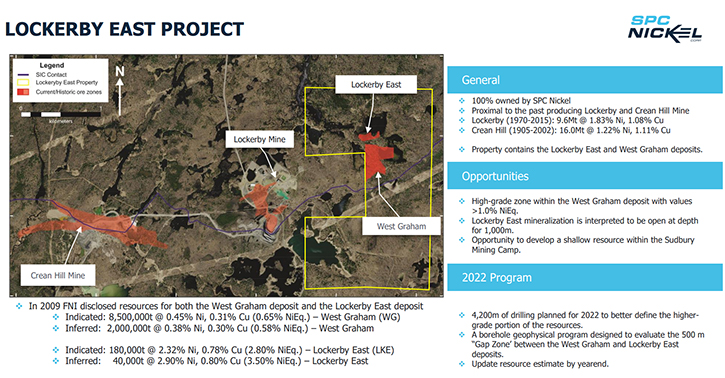

We have two projects in Sudbury. Our main project that we're working on is called the Lockerby East Project and the other project we have in Sudbury is called the Aer-Kidd. Both of these properties are located either adjacent to producing mines, past producing mines, or development projects. Not only are they in a well-established camp, they're in areas of the camp that have seen a lot of production, both current and historic.

Our emphasis, for this year, has been on our Lockerby East Property. We raised just over $3 million, towards the beginning of the year, a large portion of that is going towards the Lockerby East Property. Our project is adjacent to the historic Lockerby Mine, which was owned and operated by Falconbridge and then later by a company called First Nickel.

The property we hold has historic resources and hosts both the West Graham Deposit, which is a large resource, close to surface, that's about 10 million tons, at a 0.5 nickel equivalent. It's a lower grade deposit, but it's close to surface. Also, the higher-grade Lockerby East Deposit, which was mined at depth, from the Lockerby Mine, is much higher grade, in the 3% range, but it's down at around 900 meters vertical. There are lots of opportunities on the project. Right now, we've been drilling the West Graham Deposit, and hitting higher-grade sections of closer to 1% nickel equivalent.

We initially started off with a planned 4,200-meter drill program, back in April-May, and we subsequently expanded the program to 5,200 meters. The program wrapped up last month and we've since released results from eight of the eighteen holes that were drilled. More assay results to follow in the coming weeks.

So far, we have been very encouraged by the results that we’re seeing, which are as expected or better than the grade of the historic resource. We're getting some very thick intersections, up to 75 meters thick at the half percent nickel equivalents. In some cases, getting some thick sections, of much higher grade, so 24 meters up to 1% nickel equivalent. It is what we had hoped for and it's holding together quite well.

Dr. Allen Alper:

Well, that sounds great! What are your plans for later this year and going into 2023?

Grant Mourre:

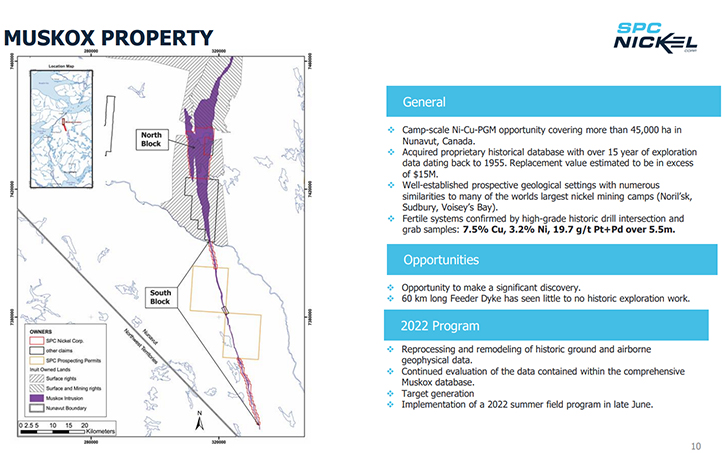

As far as from a news flow point of view, we still have 10 holes to release and those will come out, over the following months. The labs are slow right now. We do have another nickel project, located up in northern Canada, called the Muskox Property. We did a short field program in July. The property is a very exciting, camp scale, grassroots project that we feel has huge potential.

We should have our results from that, over the next couple of months. We've also initiated a ground geophysical program, on our Janes Property, which is another nickel-copper PGM project that's located about 50 kilometers to the east of Sudbury, and that's just underway. We expect to have the results from the survey in a couple of months and would look to potentially test any significant targets, with drilling this fall.

Dr. Allen Alper:

Well, it sounds great, sounds like an exciting time and it will be very interesting, as you get more data from the 10 holes and release that to the public.

Grant Mourre:

Yes. It should be a fairly steady stream of news coming out this year. Lots of exciting things on the projects we're working on. We've always been active in the nickel space, so we're always looking to add to our portfolio of projects, those are things that we're working on as well. I think we're in a really good position right now. We cashed up, at the beginning of this year, so we’re in a decent financial situation and we're just looking for the nickel markets and the markets overall to recover.

Dr. Allen Alper:

Well, that's right. Maybe you could say a few words about how important nickel and copper are and PGMs. The outlook, I think, looks very bright for those metals.

Grant Mourre:

Yes. It all revolves around the critical metals, needed for the transition from combustion engine vehicles, towards EV vehicles. That's probably been slowed a little bit, because of the current economic situation. But I think overall, that's the trend that almost all countries in the world are heading towards, as well as the automotive industries, who are certainly all headed down that road.

Expectations are that, in the next 10 to 15 years, a large proportion of the vehicles produced will be electric vehicles. We need the metals and the critical elements to produce those vehicles. Nickel is certainly a prime component of the batteries that go into electric vehicles. If the forecasts turn out the way people think they will, we're going to need a significant amount of nickel and we'll need a lot of new nickel deposits coming online.

Dr. Allen Alper:

That sounds excellent. Grant, I know you have an excellent background, and you have a very successful Team. Could you tell our readers/investors a little bit about you and your Team?

Grant Mourre:

I've been in this business for 25 years or so, almost entirely in the nickel space. Nickel, copper, platinum, palladium and gold have been my forte, for most of my career. I've spent most of it in the Sudbury area. I’m very familiar with the Sudbury Camp and most of the major nickel camps, around the world. We have a good, strong Team on the technical side and a lot of expertise on our Board, people that have made discoveries, won awards for discoveries, for nickel deposits, have built mines and have put together resources, as well as some capital markets expertise. A fairly small Company, but a very skilled, well-rounded group!

Dr. Allen Alper:

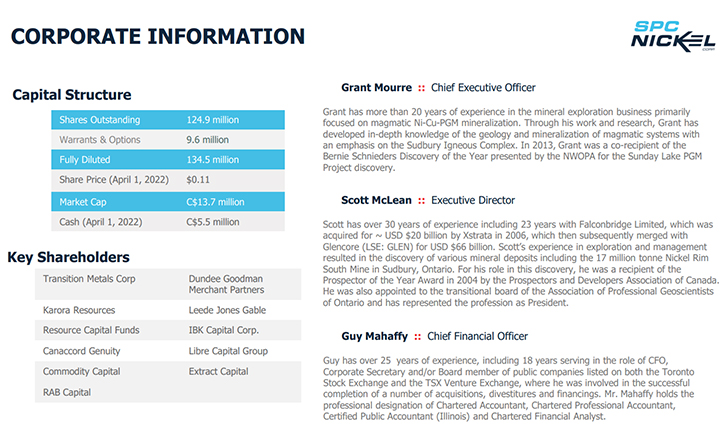

That's excellent to see such an experienced, strong Team, running that group. Could you tell us a little bit about your share and capital structure?

Grant Mourre:

We currently have approximately 125 million shares outstanding and there are another 10 million options and warrants. Our market cap is less than $10 million currently. We have about $4 million in cash. So, if you subtract our cash from our market cap and look at our enterprise value, it's probably in the $3 to $4 million range. Along with a lot of other juniors out there, we're certainly undervalued right now. I think there are lots of opportunities for growth with us, especially with the projects that we have right now, and in the results that we expect to be putting out, over the rest of the year.

Dr. Allen Alper:

That sounds excellent. From what I understand, you have some pretty long-term and sophisticated shareholders. Maybe you could say a few more about that.

Grant Mourre:

That's something that's really important now, having a good shareholder base. We've been fortunate to have quite a few people in the group that believe in the story, believe in the Team. That's kind of led by Dundee Goodman Merchant Partners, who strongly believe in nickel, believe in Sudbury, and likes what SPC Nickel brings. We have good, strong investment from groups like Leede Jones Global, IBK, RAB Capital, Canaccord and Resource Capital Fund. Lots of really good groups that are long on the stock, and believe in what we're doing.

Dr. Allen Alper:

It's great to have support of people who know the industry and are long-term.

Grant Mourre:

Yeah, without that, it would be really challenging.

Dr. Allen Alper:

Particularly in the tough times that juniors are in now. But, I would think, as things pick up and as the demand for these metals are better understood by the market and investors, that they'll have an excellent opportunity.

Grant Mourre:

Yes.

Dr. Allen Alper:

Grant, could you tell our readers/investors, the primary reasons for them to consider investing in SPC Nickel Corp.?

Grant Mourre:

Number one, it is the commodity that we're looking for. I'd say nickel is a commodity that has a very bright future. Number two is probably where we're looking. We're one of the few Companies that are exploring, within an established nickel camp. That really is a big benefit for us. If you look across Canada, there are no nickel deposits in production, outside of the established camps. I think that gives us a big benefit.

We're in established camps, we have good projects, with resources, fairly significant resources and projects that range from the resource stage to grassroots camp scale stage. We've done a lot of work this year, so we should have a steady news flow. Lots of good things are coming out. We have a good, strong Management Team and Board and at the prices right now that we're trading, I think we’re a pretty smart buy.

Dr. Allen Alper:

Those are very compelling reasons for your readers/investors to consider investing in SPC Nickel. You have great elements and the need for them is growing. You have a proven location, you have a great Team, experience, a great track record and you’re in a huge, mine-friendly area.

Grant Mourre:

The social license is important. Sudbury has a long mining history, somewhere between 120-130 years. There's certainly the social license to explore, build and develop something here in Sudbury, which certainly is a big benefit.

Dr. Allen Alper:

That's excellent! Is there anything else you'd like to add, Grant?

Grant Mourre:

Keep your eye on us, we're going to have lots of news coming out, over the rest of the summer and into the fall. So, I think it should be an interesting time ahead for SPC Nickel.

Dr. Allen Alper:

I totally agree! It will be an exciting time for your shareholders and stakeholders. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://spcnickel.com/

Grant Mourre

Chief Executive Officer

SPC Nickel Corp.

Tel: (705) 669-1777

Email: gmourre@spcnickel.com

|

|