Rick Van Nieuwenhuyse, President, and CEO, Contango ORE, Inc. (NYSE American: CTGO) Discusses Developing the Highest-Grade Open Pit Gold Mine in the World, Partnered with Kinross

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/25/2022

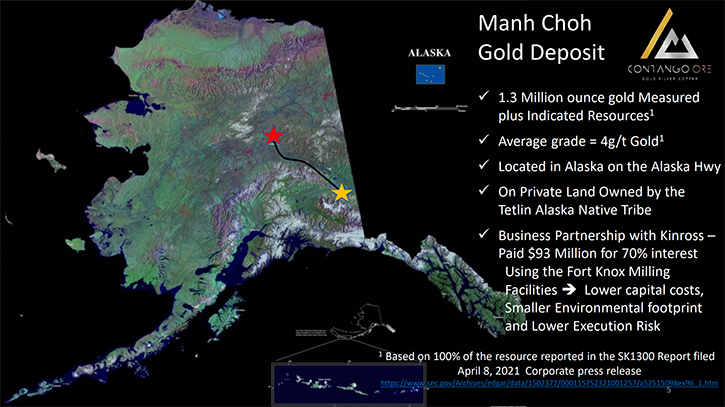

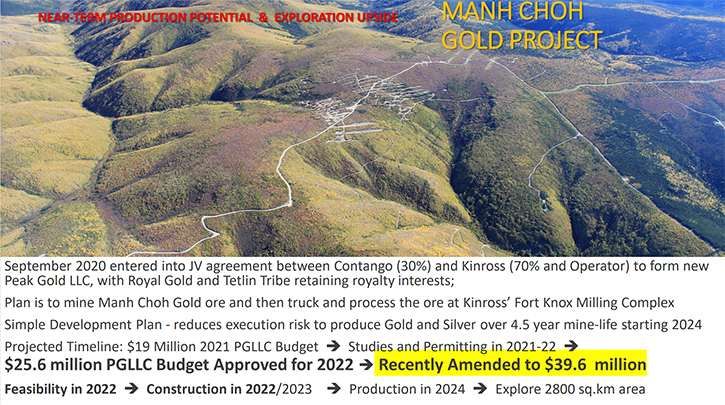

We spoke with Rick Van Nieuwenhuyse, President, and CEO of Contango ORE, Inc. (NYSE American: CTGO), a well-capitalized US gold developer, with a clear path to producing, on average, 67,500 GEO/year, with Kinross guidance all-in sustaining costs of $900 gold equivalent ounces for the Manh Choh deposit. The Company's flagship Manh Choh project, located on the Alaska Hwy on private land owned by the Tetlin Alaska Native Tribe, is the development stage project, under construction, in partnership with Kinross (70%) and the Alaska Native Tetlin Tribe (Royalty). The project holds approximately 1 million ounces of gold in measured and indicated resources, at an average grade of 8g/t gold, which is going to be mined over a 4.5 year mine-life starting early 2024. The Manh Choh ore will be trucked and processed at Kinross’ Fort Knox Mill, resulting in lower capital costs, a smaller environmental footprint and lower execution risk.

Contango ORE, Inc.

Dr. Allen Alper:

This is Dr. Allen Alper Editor-in-Chief of Metals News, talking with Rick Van Nieuwenhuyse, President, and CEO of Contango Ore. Rick, could you give our readers/investors an overview of the Company and what differentiates it from others? And tell us about your gold, copper, and silver exploration in Alaska.

Rick Van Nieuwenhuyse: Contango’s main focus, right now, is on advancing our Manh Choh Project. This is a very high quality, high-grade, open pit gold project. It's around a million ounces, grading eight grams per ton in an open pit mining scenario. So, I think it'll be the highest-grade open pit gold mine in the world. We partnered with Kinross, two years ago, to take advantage of Kinross’ underutilized mill, at Fort Knox, to advance our project rapidly to a production decision, which Kinross as manager has now done.

In their Q2 announcement in July, they announced a go forward decision on constructing the project. It will produce about 225,000 ounces of gold per year on average. We are a 30% owner in the joint venture and Kinross is 70% owner and manager. Our 30% ownership of the production will be a little over 67,000 ounces of gold per year. Manh Choh is a very high-quality project, and we don't have to build or capitalize a tailings facility or a new mill. The plan is simple, which will allow us to start production by 2024.

Dr. Allen Alper:

That's excellent. Could you tell me more about the project?

Rick Van Nieuwenhuyse:

It’s a skarn type of a deposit, it's small, poddy but very high grade. It's located on private lands, owned by the Tetlin Tribe and we've been working with them since 2004. They're very keen to see this project get into production and are very supportive. They'll receive a royalty, and we will obviously be working closely with them, on local hire and training for jobs at the mine site, particularly for the trucking operation and the mechanics needed to keep the trucks running. So, it’s a very good project for Alaska, a very good project for the tribe and I think for our shareholders as well.

Dr. Allen Alper:

That's excellent. Could you tell us a little bit more about some of the other projects you have?

Rick Van Nieuwenhuyse:

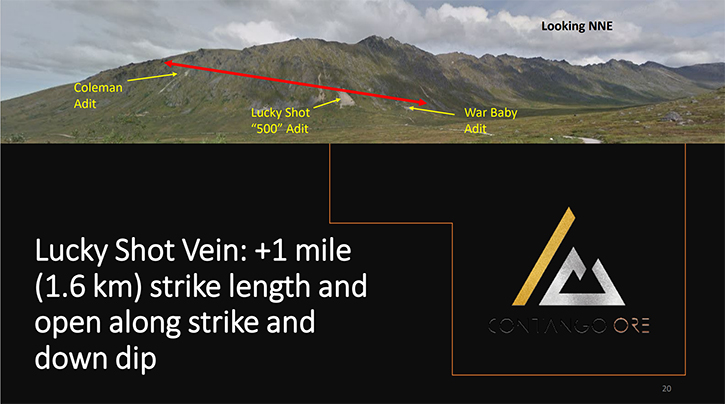

We have a number of other early-stage exploration assets in the neighborhood of the Manh Choh Project. We own those 100%, they did not go into the joint venture with Kinross. We're slowly advancing those. The main project we're working on now is a relatively new acquisition. About a little over a year ago now, we acquired the Lucky Shot Project. This is a mine that was historically in production beginning in the late 1920s until 1942, when President Roosevelt used the War Act to shut down all gold mining in the United States.

That mine, up until production was shutdown, was producing gold at about 1.5 ounces per ton, so about 40 grams per ton, a very high-grade underground mine. When President Roosevelt shut mining down in the United States, they just left. It wasn't because they ran into a fault or had too much water or the ore body changed in any way. It was just an administrative order by the federal government, and that's the last time it was mined.

We’ve been working on the project for about a year now and we have been working underground, to refurbish some of the old workings, to be able to access the vein. We're in the process of drilling the resource out from the footwall side of the vein. We have 10 pilot holes underway; we should be completing our eighth pilot hole soon. We've intersected the vein in all the holes, so we know exactly where it is.

We'll complete another two pilot holes on the eastern side of the main access tunnel and then in the next month we should complete the drift in the footwall, so we can start a detailed infill drilling program to define a resource on this high-grade vein. I think everybody's struggling to get assays back from the laboratory, us included. I don't really expect to have a significant number of assays back for probably two months – we are just starting to see things coming back now, but it’s still slow. We're seeing free gold in the veins and we're seeing what we expected the Lucky Shot vein to look like. We will report the results when we have them.

Dr. Allen Alper: Well, that will be a very exciting time when you get the data back in a couple of months. So that'll be excellent for your shareholders and stakeholders. It’s amazing the rapid plans to production of your flagship mine. That's great.

Rick Van Nieuwenhuyse: Yes, once in production Manh Choh will generate significant cash flow for us that we can then use to put our 100% owned Lucky Shot Project into production which will augment our level of production and free cash flow so we can keep building value and keep advancing our other assets to continue to add value for our shareholders.

Dr. Allen Alper:

That's excellent. Rick, you've had an outstanding career and success. I wonder if you could say a few words about yourself and your Team.

Rick Van Nieuwenhuyse:

I was VP of Exploration for Placer Dome and decided, at that point in my career, I wanted to venture off and build my own Company. I started NovaGold over 25 years ago. We found the Donlin Gold project, in southwest Alaska. We built that Company into a two plus billion-dollar market cap company. I joint ventured the project with Barrick and am pleased to see that project advancing to a production decision.

We then spun-out Trilogy Metals and did much the same thing, in the Ambler Mining District, with the Arctic and Bornite discoveries. We partnered those, with South32, two years ago. They brought almost $150 million to the joint venture, and I’m also pleased to see that project advancing, as well. They are two very high-quality copper and zinc projects, in the Ambler Mining District.

I moved on to Contango, two years ago, and we've done the same thing – developed the resources and identified an appropriate major company partner. My business plan is to explore and develop and take things, as far as we can take them and then partner up with a big mining company that can then advance the projects, as quickly as possible, to production. Contango will probably be the one that goes the quickest because it's such a high-quality project and it's right on the Alaska Road System. So, it's very easy to truck up to the Fort Knox mill.

Dr. Allen Alper:

That's excellent! An amazing record of success! You should be so proud of what you've achieved. You have a great legacy already, and Contango sounds like it will really be fantastic also.

Rick Van Nieuwenhuyse:

I appreciate that. We do this because we enjoy what we do. Exploration is a fun business. We like to explore and create value for our shareholders. So that's what we like to do!

Dr. Allen Alper:

Well, that's great. In the past, when I've talked to you, I've always been impressed, with your enthusiasm for exploration and discovery and your success. So that's really great. Rick, could you tell our readers/investors, a little bit about your share and capital structure? I'm happy to see that Management has a big chunk of the Company and you’re also balanced with institutions, etc. Why don't you tell us a little bit about that?

Rick Van Nieuwenhuyse:

We're somewhat unique here. We only have 6.8 million shares outstanding. We trade on the NYSE American. Management has a significant shareholding, well over 20%. We've been very cognizant of not diluting our shareholders, so we trade at a $28/$30 valuation, which I know is not typical of most junior companies. That surprises some people. But again, we just have a very, very low share count and we've been very diligent about managing the share capital structure of the Company, and we'll continue to do that. We're shareholders and we're in it for the shareholders.

Dr. Allen Alper:

That’s excellent! Rick, could you tell our readers/investors the primary reasons they should consider investing in Contango Ore?

Rick Van Nieuwenhuyse:

I think it's really to get that uplift from explorer to producer. Normally that's a difficult road, because you have to go through permitting, you have to go through a huge capital raise and all of that takes time. We've been able to short circuit that somewhat, by partnering with Kinross, who has an operating mine - the Fort Knox Operations have been operating for over 25 years. We don't have to build a mill; we don't have to permit a tailings facility. I think that transition from explorer to producer is happening very quickly with Contango.

The uplift and the value creation that typically goes from explorer to producer is happening at a much quicker rate than it would if we were trying to do this by ourselves and making that transition on our own horsepower. I think having a large Company partner, like Kinross, who has been operating for 25 years, just short circuits that whole process.

Dr. Allen Alper:

That’s fantastic. Is there anything else you'd like to add?

Rick Van Nieuwenhuyse:

I would just say, if people are interested in following up, our trading Symbol is CTGO, on the NYSE American. Visit our website at www.contangoore.com. We’re happy to answer any questions. We have an info@contangoore.com if you have questions, you can put them in there and I’ll be quick about answering them.

Dr. Allen Alper:

Well, that sounds excellent! You definitely have an outstanding Company and a very unique Company, a great partner, a great region, great infrastructure and a great resource. You’ve proven over and over that what you do is successful. I think those are all very compelling reasons for readers/investors to consider investing in Contango ore.

https://www.contangoore.com/

Rick Van Nieuwenhuyse

(713) 877-1311

|

|