John Cash, Chairman, CEO and President, Ur-Energy Inc. (NYSE American: URG), Discusses Supplying Uranium for Green Energy, with their Growing Low-Cost Uranium Mining Company, in Wyoming, USA

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/4/2022

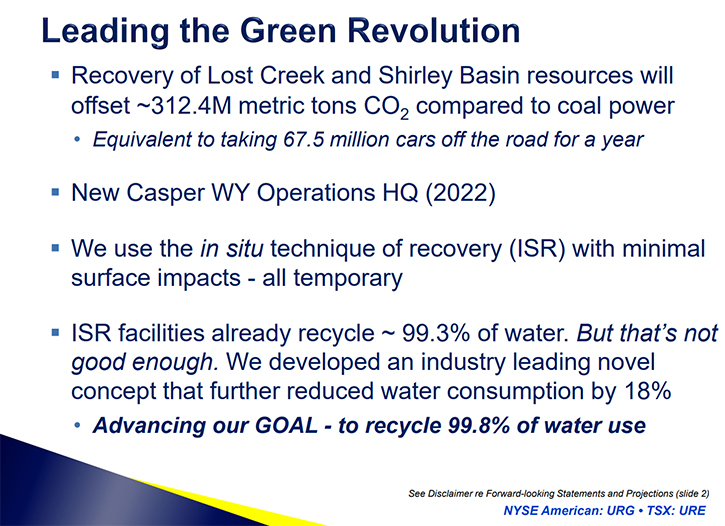

We spoke with John Cash, Chairman, CEO and President of Ur-Energy Inc. (NYSE American: URG), a uranium mining company, operating their low-cost, Lost Creek, in-situ recovery, uranium facility in south-central Wyoming. Ur-Energy has produced, packaged, and shipped approximately 2.6 million pounds of U3O8 from Lost Creek, since the commencement of operations. Ur-Energy has all major permits and authorizations to begin construction at Shirley Basin, the Company's second in situ recovery uranium facility, in Wyoming and is in the process of obtaining remaining amendments to authorizations for expansion of Lost Creek. According to Ur-Energy, the recovery of Lost Creek and Shirley Basin resources will offset ~312.4M metric tons CO2 compared to coal power, which is equivalent to taking 67.5 million cars off the road for a year.

Ur-Energy Inc.

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with John Cash, Chairman, CEO and President of Ur-Energy. John, could you give our readers/investors an overview of your Company and what differentiates it from others?

John Cash: Ur-Energy is a publicly traded company. We trade on the New York American Exchange under URG and on the Toronto Exchange under URE. We have a market cap, which is, right now, hovering around $250 million and we work exclusively in the uranium mining industry. Our flagship property, called Lost Creek, is in south central Wyoming, in Sweetwater County. It’s been in production for over nine years and in that time, we have produced about 2.7 million pounds of yellowcake. The chemical formula is U308.

The majority of the material has been sold to U.S. utilities, for use in generating nuclear electric power. Lost Creek has been producing for quite some time and is producing today, although because of market conditions, we've allowed production to decline substantially, but we still have water flowing and we are producing a few pounds. We're working now at expanding the footprint into an area called LC East and within different geologic horizons.

That permitting is going well and we expect to have it completed this year, maybe early next year, depending on how quickly the regulators move. From a resource perspective, at Lost Creek, we have 11.9 million pounds of measured and indicated resources, with an average grade of.046%. That's a weight percent. We also have 6.6 million pounds of inferred resources, at a very similar grade.

We have one other development property in Wyoming, called Shirley Basin, for which we have all three major permits. Shirley Basin is an historic, conventional and in situ mine, so it's a brownfield project that we purchased back in 2013, from a Company called Areva. Since acquiring the Shirley Basin Project, we have worked to get all the major permits in place, so it is construction ready. We are waiting for market signals, to begin construction on that project. The Shirley Basin Project has a great resource in the ground, over 8 million pounds of measured and indicated resource, at a very good grade. It was likely the first in situ uranium mine in the world, starting back in the early 1960s. We look forward to bringing it back into production.

You asked about what sets us apart, and I would say the value of the Company. We are a proven producer here in the U.S. and that is a very small club. Probably just a couple, maybe three companies can say that. We are a proven producer, at commercial quantities, in the U.S.

Beyond that, we are also a proven low-cost producer, one of the lowest cost producers in the world, outside of Kazakhstan. Our cost of production at Lost Creek has been low and we believe, once we get up and running, that cost of production is going to stay low. Historically, we've been mining at around $16 a pound cash cost. If you take a look at the all-in mine site, that takes us to about $33 a pound. That doesn't include taxes or corporate overhead, but it includes pretty much everything else. We're proud of that.

We run a very tight ship. We're very careful with our cash. We've very careful not to dilute our shareholders, by being out in the market, raising money by selling equity. From a market position, we have a little over $42 million in cash and that's going to take us a long way into the future. We do have a little over $12 million in debt to pay back to the state of Wyoming. They gave us a loan that helped us get Lost Creek started. We are scheduled to have the loan paid off in October 2024.

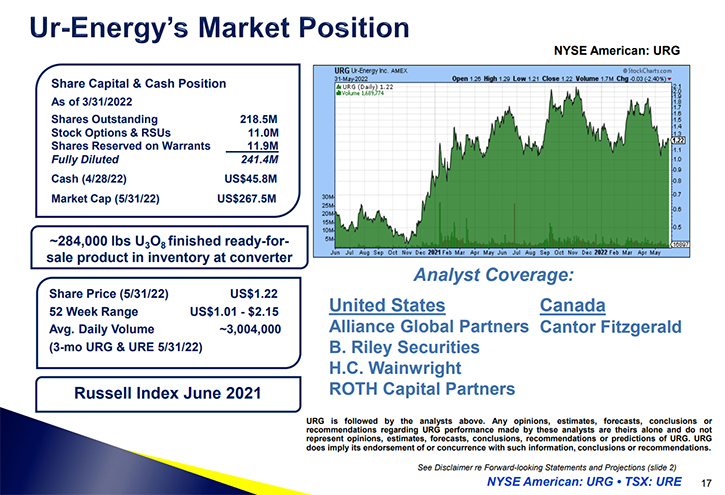

We have great analyst coverage, here in the U.S. and in Canada, from companies like Alliance Global Partners, B. Riley, Cantor Fitzgerald, Wainwright, and ROTH Capital Partners.

We are looking forward to a great future in the front end of the nuclear fuel cycle. It seems that nuclear is being brought back to the forefront, being recognized for its clean energy attributes. I think we saw evidence that support for nuclear power is growing in the Inflation Reduction Act that the Democrats have moved through the Senate and is now in the House, because it contains numerous provisions that will help support nuclear power. We think there's a very, very bright future for Ur-Energy and for the nuclear industry.

I'll be glad to answer any specific questions that you might have about the Company or our projects.

Dr. Allen Alper:

That sounds great. Could you tell our readers/investors a little bit more about what's happening in the markets, China, Europe, etc., and the move towards using uranium and its movement towards green energy and climate change?

John Cash:

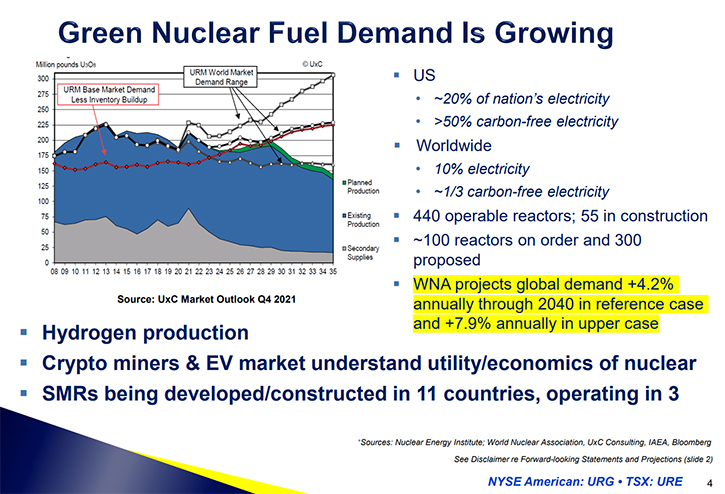

One of the things that is starting to move the uranium price, over the last couple of years, is the global acceptance of nuclear power. We are seeing countries, around the world now, recognizing the carbon free attributes of nuclear and those countries are now including nuclear in their energy portfolios. China is probably the prime example of this. They've announced plans to build 150 reactors, over the next 15 years.

It was just about two or three months ago that China confirmed they are on track to meet that goal. To put that into context, right now, there are only a little over 400 reactors in operation globally. China intends to increase that amount by 150, in the relatively short term, 15 years. That's impressive. It's not just China, India also has a remarkable build out project ongoing. England is trying to reach their carbon free objective, by 2035. Their former prime minister, Johnson, said that they were making a big bet on nuclear. South Korea has a relatively new President, who is pro-nuclear. He is reversing the previous administration's position to phase out of nuclear power.

Instead of a phase out, they intend to grow their nuclear industry and begin to export technology once again. Historically, South Korea has been a tremendous exporter of technology, and they plan to get back into that business. In France, Macron has advocated to extend the life of several of their reactors, and he's proposed to build out at least six, but as many as 14 additional reactors. There is a whole list, of other countries, considering reactor buildouts or restarts, including the Philippines, Belgium, Japan, Finland, Turkey, UAE, and Kazakhstan.

Even here, in the U.S., Southern Company is building out two reactors in Georgia. They plan on putting one into production late this year and the second one into production in 2023. So, there is a lot of construction here in the U.S. Those are conventional reactors that I've been talking about, the older style. There's also growing interest in small modular reactors, maybe as many as 300 small modular reactors in the U.S. by around 2050 according to the Nuclear Energy Institute.

Small modular reactors are small, factory produced reactors that can be put on the grid, in just about any place. And their claim to fame is, since they are factory manufactured, their cost of construction is remarkably less and they are easier to operate, with a much smaller footprint. We see a lot of growth potential, not just in the U.S. but around the world. I'm talking to you today from Wyoming where Bill Gates’ company, TerraPower, is in the process of licensing a small modular reactor that will be used to replace a coal fired, power plant. Within a few years, they expect to have the reactor licensed, constructed and up and running. We're excited, in Wyoming, to be on the cutting edge, to bring that technology to fruition. There’s a lot going on, but again, it's all based on a global desire to move toward carbon free sources of electricity, and nuclear certainly fits that bill.

I would comment on one other item. That is hydrogen production. Nuclear is good at producing green hydrogen, because the high temperatures, at which it operates, make the splitting of water into hydrogen and oxygen more efficient. We're beginning to see companies in the U.S. and globally, move toward the implementation of nuclear power to produce hydrogen.

In fact, the latest bill that's going through Congress, the Inflation Reduction Act, specifically calls out a credit to be given to companies that produce green hydrogen, including from nuclear power. So, there are several facets of nuclear power to be considered, beyond conventional power generation. So, it is certainly an exciting time to be in our industry.

Dr. Allen Alper:

That's right. I think you did an excellent job in giving our readers/investors an overview and understanding of what's happening in the marketplace today. John, could you tell us a little bit about your background and your Team?

John Cash:

I'm a geologist by training and went to the University of Missouri at Rolla, the old School of Mines. It's now called the Missouri School of Science and Technology. I got my bachelor's and master's there, in geology and geophysics. While I was in college, I worked as a contract geologist for BHP and for Rio Tinto doing exploration work for uranium. So even back as far as 1994, I was working in the uranium space and for better or worse, it's the only commodity I've ever worked in.

After college I went to work, doing exploration for uranium for BHP for a few years and then later went to work for a Company called Rio Algom, in Wyoming, at their Smith Ranch operation where I did exploration and production geology. Ultimately, I switched over to regulatory affairs, because the geology work dried up for a bit, and I stuck with regulatory affairs, with Rio Algom, for quite some time.

Rio Algom was eventually bought out by BHP and their uranium assets were then bought out by Cameco. So, I made the jump to Cameco. At that time, I went to work at their Crow Butte project, over in Nebraska. I started off in regulatory affairs, but very quickly transitioned into production and I ran the well fields and plant production for about four years.

In 2007, I made the jump over to Ur-Energy and I've been with Ur-Energy ever since, doing regulatory affairs, EHS, a little bit of lobbying, and most recently in March, became the CEO. I've been in the industry for a long time. I've worked virtually every facet, from geology and production to regulatory affairs, so, my experience is broad, within this particular commodity.

Dr. Allen Alper:

You have a fantastic background. I can see why you’re leading UR Energy. You’re really qualified to take the Company forward, as the market expands.

John Cash:

It's been an exciting career. I have no complaints whatsoever. Sometimes I've wondered if I should have stayed with uranium for so long, but I'm committed at this point. I guess there's no going back.

Dr. Allen Alper:

Well, it sounds like more than ever, the time for uranium is coming. The need for uranium for baseload energy projects, is really recognized.

John Cash:

Yeah, I think so. The market had its ups and downs, generally it's been strengthening for the last couple of years. I think a lot of interest is growing, because of the green energy aspect. But also, several financial players jumped in, as well, so I think that's been helpful. The Sprott Physical Uranium Trust, which was formed on July 18th of last year, put a lot of pressure on the market, by going out and buying pounds of uranium for their physical trust. They've been out of the market for a little bit, but I expect that they'll be back in and put some more pressure on the market.

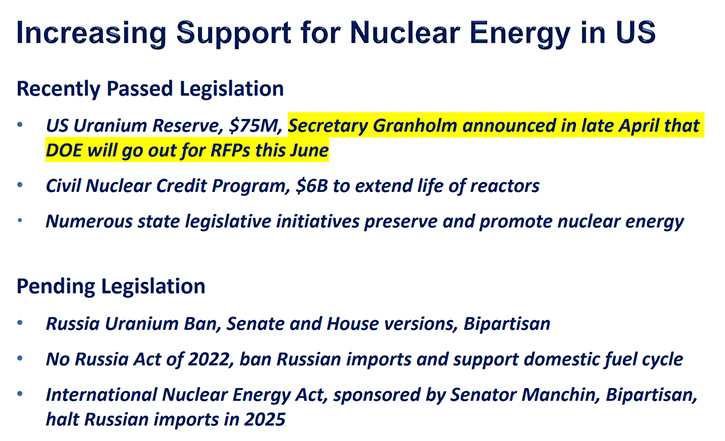

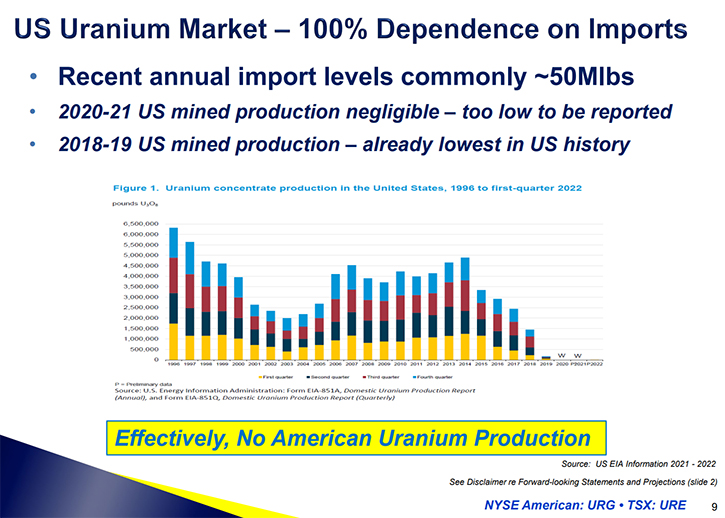

Then you have geopolitics right now, too. Russia is a major supplier globally, not just to the U.S. but globally, of enriched uranium and conversion services. That's now being called into question, so that's been putting pressure on the market as utilities begin to look for alternate supplies of raw materials and processing services. We'll see how much more pressure that puts on the market. If Russian supply gets cut off, that's going to be a big, big story, because globally it's going to be very hard to replace those processing services.

Dr. Allen Alper:

It sounds like a great opportunity for you and other companies around the world, so that’s excellent. John, could you tell me a little bit about some of your Team and Board Members?

John Cash:

We have an experienced Team. Every one of our executives has been with Ur-Energy for over 14 years now, so we have a lot of experience, with permitting, regulatory compliance, and operations in the uranium space. Our VP of Operations is Steve Hatten. He's been in the uranium space for decades now, producing uranium at a number of facilities, including Smith Ranch. He really knows what he's doing, he knows how to put the pounds in the can, and he's demonstrated that for years now.

Our CFO is Roger Smith. He's been in the uranium space for a long time. He also had a long tenure with Rio Tinto, so he's worked with the majors and the minors, and he does a great job keeping our finances in good order. Penne Goplerud is our in-house General Counsel. She keeps us all squared away, on compliance with the exchanges and various other regulatory requirements. She works nonstop for us and is incredibly efficient with her time.

We have a great Team. We are all likeminded, in that we want to be uranium miners. That's what we do, and so that's our objective. We all are conservative by nature, so Ur-Energy is a conservatively run Company.

Our Board of Directors is filled with great professionals, with long-term industry and Ur-Energy experience. A lot of our Board Members have been with us for 10 plus years. Dr. Jim Franklin used to head up the Geological Survey in Canada. He's made several ore body discoveries and he's been on our Board since the Company started back in 2004. Tom Parker worked in the silver industry for several years and brings a lot of operational experience and audit and finance experience. Rob Chang is one of our newest members, out of Canada. He used to work for Cantor Fitzgerald, as an analyst, covering the uranium space, so he's very familiar, globally, with the uranium space and finance.

Bill Boberg is a former President of the Company, who has been with us for a long time and actually did a lot of the exploration work, in Wyoming, toward uranium discoveries. We have Kathy Walker, who joins us from Kentucky. Again, she's one of our more recent additions to the Board. She's been with us for a few years now and she has worked in the coal industry, as a coal trader. We're glad to have her on the Board.

Dr. Gary Huber, out of Colorado, has a long history in the uranium industry, as well as gold and other commodities, and brings us a wealth of experience. We have a great Board and Executive Team that works well together toward our common goal of producing uranium.

Dr. Allen Alper:

Well, it's definitely a great Team, a great Board, very experienced, very knowledgeable! And it's great to have a group that works with each other and knows you can get things done. So that's excellent! John, could you tell our readers/ investors a little bit more about your share and capital structure?

John Cash:

Absolutely! I mentioned earlier that we trade on two markets, the New York American Exchange, under URG, and on the Toronto Exchange, under URE. We have about 219 million shares outstanding, right now. If you throw in the stock options, RSUs and warrants, that puts us at about 242 million shares, so we have a good structure.

Our share price has moved around a good bit lately. In the U.S., our share price has ranged from $0.95 to about $2.15. The volatility of our stock price is reflective of global news involving the Russian invasion of Ukraine, the price of uranium, market pressure from Sprott and general market movements. We are trading nearly 2 million shares a day, so we have good liquidity on our stock as well.

I didn't mention it earlier, but we do have a good inventory in place. We have about 324,000 pounds of finished product, sitting at the conversion facility in Metropolis, Illinois that is ready to sell. That 324,000 pounds could be sold quickly and converted into cash. But right now, we don't need to do that because we have $42 million in cash, so we don’t intend to sell in the spot market.

Very recently we did make a bid, in response to an RFP, by the Department of Energy, to sell a portion of our inventory into the Uranium Reserve. The Uranium Reserve was approved by Congress in December of 2020, and the program is now being stood up and filled with domestic production. We should know, by the end of September, whether our bid has been successful or not. At that point we'll have 60 days to provide those pounds to the U.S. government to fill the reserves. So, more to come on that.

Dr. Allen Alper:

That’s excellent! Great position you have! The amount of cash you have and a huge amount of salable inventory. John, could you tell our readers/investors the primary reasons they should consider investing in Ur-Energy?

John Cash:

The first catalyst, especially in the mid to long-term, is the green energy thesis. The world is moving toward green energy and nuclear is going to be taking the lead role. Certainly, wind, solar and other renewables have their place, but they really fail, when it comes to providing reliable baseload energy, at a reasonable price. The world is beginning to come to grips with that. In fact, a lot of environmentalists now are advocating for the nuclear industry. In the long term, I believe, very strongly, that there's going to be tremendous demand for uranium, as nations, around the world, move toward carbon free nuclear power. And, we're seeing that happen.

It seems like every day, we see announcements, coming out of different countries, that they're advancing their nuclear programs. Since we are a uranium provider, I think we're going to benefit dramatically from that, in the mid-term to the long-term.

In the short term, though, investors should be aware we signed a sales contract, just a few days ago, as a first step toward going back into production. We need to round that first contract out, with a couple of more sales contracts, to bring us to an economy of scale that justifies a restart, so we will be working on getting additional sales contracts, in the coming weeks.

A final short-term catalyst is sales into the uranium reserve, via the Department of Energy, which should be concluded before the end of the year.

I think those are three catalysts investors should consider, as reasons to invest in Ur-Energy. We're positioned to perform, we've proven we can perform, we've produced a lot of uranium over the years. We're not a wannabe. We are not a has been. We have great resources in the ground. We have staff ready to go, to begin moving us to ramp up and getting us back into full production. There's my sales pitch for you.

Dr. Allen Alper:

Well, that's very impressive! Those are very compelling reason for readers/investors to consider investing in ER Energy. It’s well positioned in the United States. You have low costs, and you have a great Team, great experience and a lot of uranium. The market is changing and the need for uranium is increasing exponentially. It's nice to have a safe source in the United States.

We’ll publish your press releases, as they come out, so our readers/investors can follow your progress.

https://www.ur-energy.com/

John W. Cash, Chairman, CEO & President

866-981-4588, ext. 303

John.Cash@Ur-Energy.com

|

|