Stephen Hanson, Founder, President and CEO, ACME Lithium Inc. (CSE: ACME, OTCQX: ACLHF) Discusses their World Class Portfolio of Lithium Projects in the United States and Canada

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/29/2022

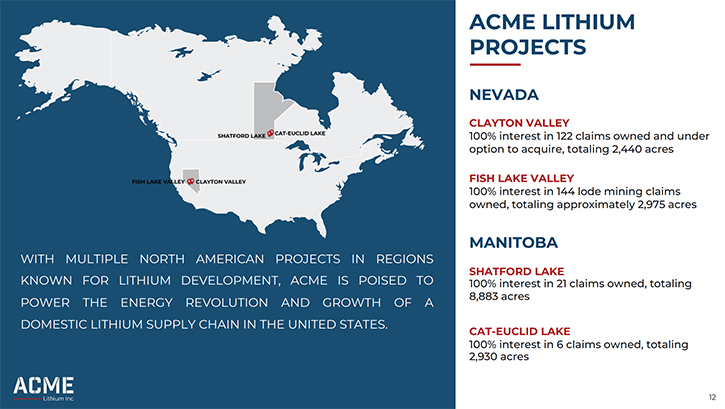

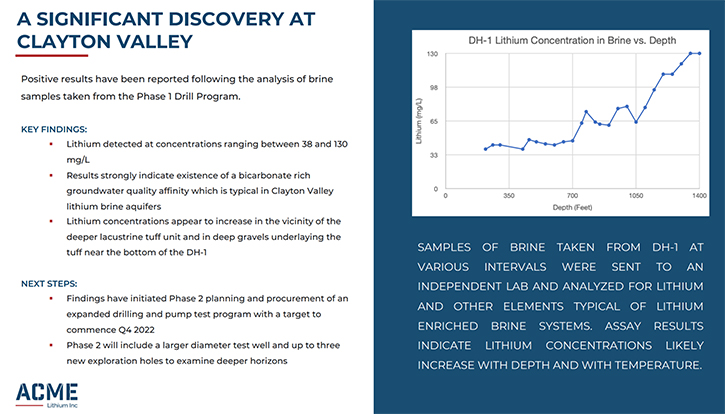

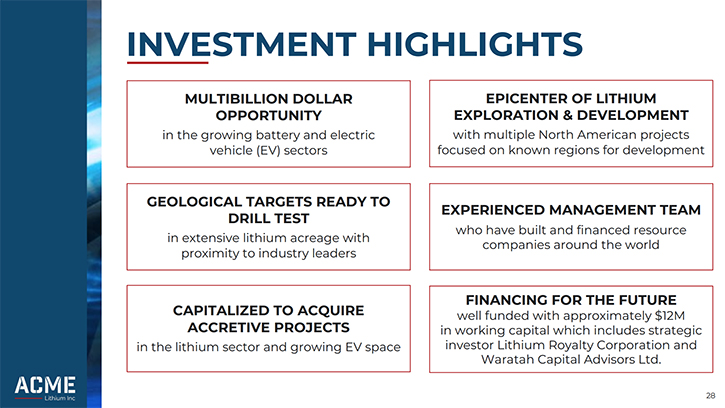

We spoke with Stephen Hanson, who is Founder, President, and CEO of ACME Lithium Inc. (CSE: ACME, OTCQX: ACLHF), a lithium exploration company, with a world class portfolio of projects, located in the United States and Canada. ACME has acquired, or is under option to acquire, a 100-per-cent interest in projects, located in Clayton Valley and Fish Lake Valley, Esmeralda County, Nevada, and at Cat-Euclid and Shatford Lakes, in southeastern Manitoba. On August 17, ACME announced a significant new lithium discovery, at their Clayton Valley lithium brine project, in Esmeralda County, Nevada. This new discovery has initiated planning of Phase 2, of the drilling program. ACME Lithium is well positioned, in the growing battery and electric vehicle (EV) sectors.

Drilling at Clayton Valley, Nevada

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Stephen Hanson, Founder, President and CEO of ACME Lithium, Inc. Steve, could you give our readers/investors an overview of your Company and how you tie in, with the electric electrification revolution?

Stephen Hanson:

Absolutely. We have a world class portfolio of projects, located in the United States, specifically Nevada, and Canada, in Manitoba. I founded this Company on the belief that a number of macro themes are taking place, in that we absolutely are in a crisis today, when it comes to a domestic supply of battery metals and in particular lithium. There are only two locations in North America, where lithium is currently being produced. One being Clayton Valley, Nevada, on the New York Stock Exchange-listed Albemarle’s Silver Peak site, where they've been producing since 1966. It is the only place, where lithium is produced in the United States, currently.

We are their neighbor, directly and contiguous to the northwest, and we've announced in July, a brand-new lithium brine discovery. What is of particular concern, at a domestic level, is that most of the lithium is produced in only a handful of countries, around the world. Approximately 95% of the lithium, extracted in the world, comes from a handful of countries, which include China, Australia, Chile and Argentina and there is a very small amount of lithium that is produced in the United States and Canada.

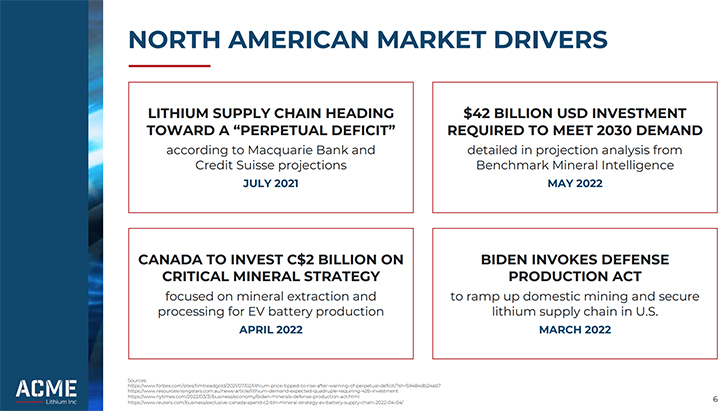

What is happening now, and partly due to the EV revolution, is a massive demand for lithium, domestically, in North America, driven by our daily use of cell phones, tablets, laptops, power tools and now hybrid and EV vehicles and also in grid storage. Battery storage for energy is very important, as we seek alternative uses, and our needs for the storage of energy.

This has created a number of themes recently, as we've seen lithium, as a commodity, skyrocket globally, almost 500% in price in the last 12 months, because of this exponential demand that's being created, as our needs change, as a global community. In fact, the US government, at a federal level, coming out of the Energy Department and backed by President Biden, for the very first time, the Defense Production Act was invoked, this past spring, where it has been stated that we are in a crisis.

We absolutely, in the U.S. and in Canada, need to secure these critical minerals, in a steady supply. In Canada, Prime Minister Trudeau has promised, recently, to invest up to $2 billion in critical mineral developments. We're seeing a groundswell, a tailwind that's coming into the industry, by all stakeholders. We're seeing movements from the technology companies to the auto manufacturers to the large miners to the processors and to the financial community, putting energy and capital, and knowledge, into this industry, to ensure that we have a domestic supply for the long term.

ACME’s vision and goal, with four projects, located in North America, is ultimately to be a supplier to this domestic industry that has massive growth potential. So, we're very excited, as a young Company, to advance what we believe is one of the best portfolios of projects, in North America. We have our flagship project, which is in Clayton Valley, Nevada. We are rapidly advancing our Phase 2 exploration plan. We're planning, in the fourth quarter of 2022, to drill our first test well, based on that discovery and multiple exploration holes that will step out from this initial discovery. So very exciting catalysts, coming up in Clayton Valley, for us.

We are in good shape, obviously, to advance those, and we are right now working on the permitting and procurement of services and crews to be able to execute on that work, in the fourth quarter of 2022. To the west, over the foothills from Clayton Valley, is an area called Fish Lake Valley, where we have a project, with actually boots on the ground. We're actively exploring and advancing that project. What's interesting about Fish Lake Valley, and our project there, is that we are a neighbor to a company that is in late-stage feasibility, of their lithium project, an Australian company, called Ioneer.

This summer, Ford, Panasonic and Toyota have all signed offtake agreements with Ioneer, a billion and a half dollars Australian company, to advance their project, as they head into feasibility. Again, we're the neighbor to the west and we're advancing our exploration, our projects. Even though we're a neighbor, doesn't mean necessarily that we're going to have success. But it's a very good address for us to have and it certainly has excellent potential. We have a very good grade of lithium from surface sampling, and we'll continue to explore this project, over the course of the remainder of the third quarter and into the fourth quarter of 2022.

I'll make a drilling decision on Fish Lake Valley, sometime later in 2022, and we're hopeful that we can be drilling that project sometime in 2023. Moving on to Canada. We have two very interesting projects in southeastern Manitoba. There's a long history of exploration, for a number of minerals, in this region. What is particularly interesting is that the only lithium production in Canada is located at the Tanco Mine. We are their southern neighbor. The Tanco Mine was bought by a large Chinese company, Sinomine, a number of years ago. It's in active production.

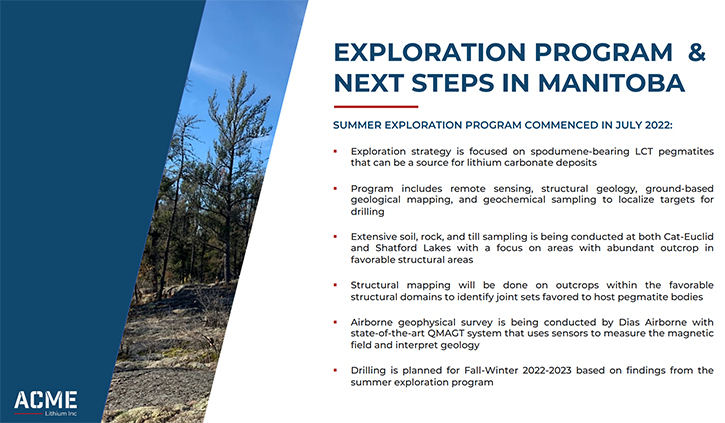

We are in the midst of a major summer exploration program there, which includes geological work, sampling, airborne geophysics. We've had multiple crews there, over the course of the summer, leading to a significant drill program in Manitoba, targeting sometime in the fourth quarter of 2022 this fall and first quarter 2023, subject to permitting and availability of equipment and crews. We're very busy and we're very excited about the prospects of our Company.

Part of what we've been able to do, as a young company, is to attract strategic investment from some very savvy and smart investors, around the world, including some top institutions that invest in lithium. We have about $11.3 million cash in the bank, so we have enough capital to meet our exploration requirements, for the remainder of 2022. We're in very good shape, as a company, and excited to deliver on these catalysts through Fy2022 into early 2023.

Dr. Allen Alper:

That's excellent. Could you tell us a little bit more about yourself and your Management Team and Board?

Stephen Hanson:

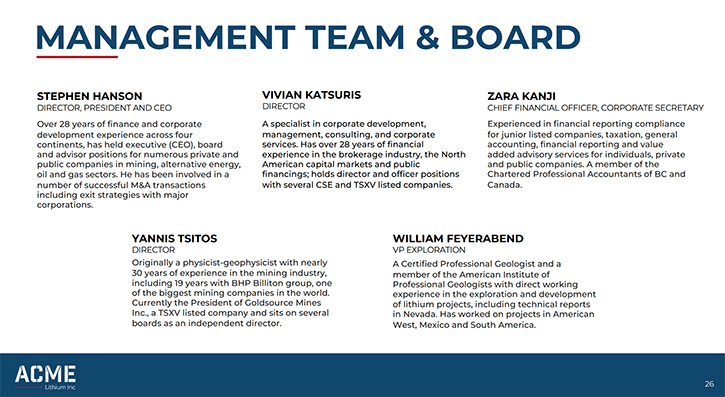

I have spent almost 30 years in resource developments and related industries. I've worked on all continents, around the world, from Mongolia to Argentina to Africa to Mexico, and throughout the United States and Canada. I've been involved in a number of strategic investments by large companies, in projects, in which I've been actively involved. I've been involved in some M&A activity as well. I've been CEO of a number of Companies. I’ve sat on Boards, as well as being an advisor to Boards and have been involved in actively developing and de-risking projects, over the course of my career.

This is a very interesting Company that I've founded. We've had our running shoes on. We've been very busy in our first year and a half in business. We've accomplished a lot, in a very short period of time, and we'll continue to do that. My goal, as CEO, as I work for our shareholders and our investors, is to continue to deliver on these milestones and hopefully have some major catalysts, over the next year or so.

Dr. Allen Alper:

That sounds great! Great experience, great background! Could you tell us a little bit about some of the other members of the Team and Board?

Stephen Hanson:

One of our key Board Members is Yannis Tsitos, he was with BHP for 19 years, was involved in over 300 transactions and he's been involved, with a number of junior companies, at the CEO and Board level. He’s an advisor of mine and a very important Board Member.

Bill Feyerabend is our exploration geologist, who helps oversee technical work at our US based projects. He's been active in lithium, in the southwestern United States, for close to ten years. He's written a number of 43-101s and again has a long career, in particular in the southwestern United States, over 35 years, working in the industry.

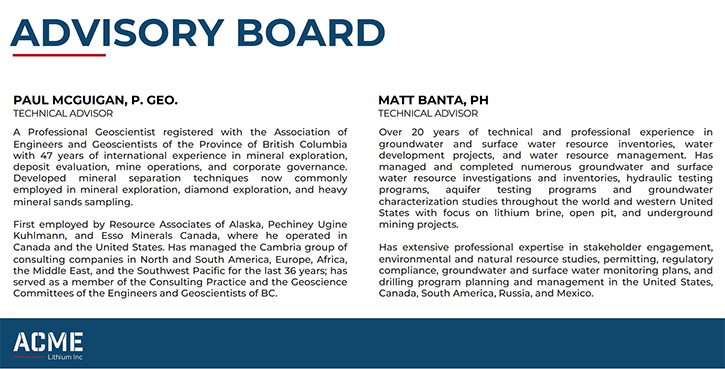

GeoXplor, is our working partner at Clayton Valley and has been overseeing our operations at Clayton Valley. They are veterans in their field of activity, working in lithium and Nevada for over a decade. A couple of my key advisors are Matt Banta, as a hydrogeologist, and an expert in understanding brine and aquifers. He has been involved in a number of lithium projects, in the southwestern United States. He has been very active in overseeing our drill program, in Clayton Valley. Paul McGuigan is an advisor of mine, as well, who runs Cambria Geosciences. He's a veteran around the world, working the globe on dozens of projects. He's a sampling expert, he's been on Boards of industry and has spearheaded exploration programs, dozens of them, on all four continents around the world. We have a very good Team, working with a number of experts in their field. This is why we're able to meet these milestones and advance our projects effectively, on time and on budget.

Dr. Allen Alper:

It sounds like you have a very strong Management Team, Board and Advisors, so that's excellent! Steve, could you tell us a little bit more about your share and capital structure?

Stephen Hanson:

We're traded on the CSE, under the symbol ACME and were traded in the United States, under the symbol ACLHF. We have just a little more than 51 million shares outstanding and we're currently trading at about $0.86 US. We have about a $46 million U.S. market cap.

Dr. Allen Alper:

That’s very good. Steve, could you tell our readers/investors the primary reasons they should consider investing in ACME Lithium, Inc.

Stephen Hanson:

Well, I believe that investors, who follow the green economy and believe that our world is changing, those that follow the electric vehicle companies and technology companies should be invested in these core supply chain businesses. We all utilize, as consumers, cell phones, laptops and ultimately hybrid and electric vehicles. Ford is investing close to $20 billion in their EV division. General Motor’s goal is to have 50% of their vehicles EV. California has just announced that all new vehicle sales will be EV in 2035.

We're in a changing world and I think all investors should have some exposure to this dynamic industry and ultimately the success of this dynamic change that's going on, this evolution that's going on. The success of this is going to be about supply chain. Can we access core materials that are going to build this industry and meet these long-term targets? It's estimated that we need tens of billions of dollars of investments in battery minerals to meet this growing demand. And obviously, lithium is the core commodity that is the basis of those battery metals.

We're well financed, we have world class projects, probably one of the best portfolios in North America. We have a great Management Team and we've now made a discovery in Clayton Valley, which is the epicenter of lithium development, in the United States, and we're advancing our other projects, aggressively, over the next year. I believe the timing is very good and my goal here is to continue to deliver on behalf of our shareholders.

Dr. Allen Alper:

Those are very compelling reason for our readers/investors to consider investing in the ACME Lithium, Inc. Steve, is there anything else you'd like to add?

Stephen Hanson:

Thank you for your time today. I look forward to your investors following us over the coming months. Again, we are really excited about the months ahead.

Dr. Allen Alper:

That sounds great!

We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://acmelithium.com/

Steve Hanson

Chief Executive Officer, President and Director

Telephone: (604) 564-9045

info@acmelithium.com

|

|