Darcy Marud, CEO & President, Western Exploration Inc. (TSXV: WEX, OTCQX: WEXPF) Discusses their Growing Nevada-focused Gold-Silver Exploration Company with the Support of Agnico Eagle

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/8/2022

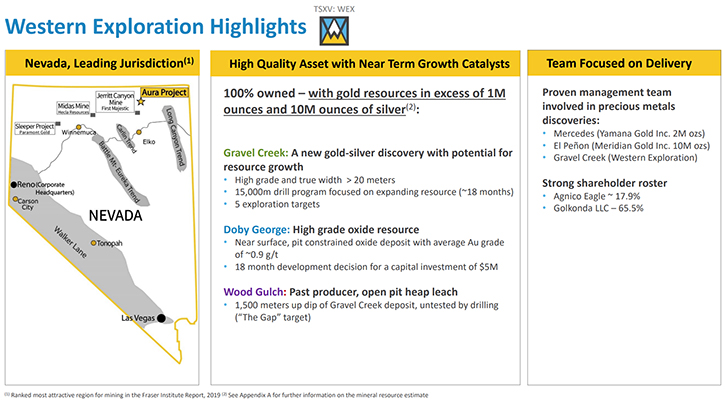

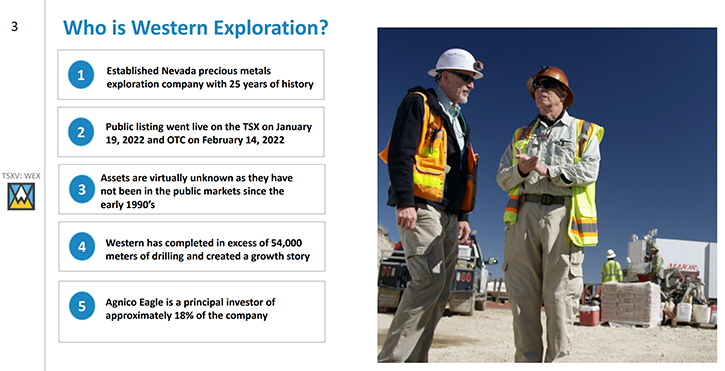

We spoke with Darcy Marud, CEO, President, and Director of Western Exploration Inc. (TSXV: WEX, OTCQX: WEXPF), an established, Nevada-focused, precious metals exploration company, with 25 years of history, aiming to be a premier gold and silver development company, in North America. The Company's principal asset is the 100% owned Aura gold-silver project, located in Elko County, Nevada, approximately 120 kilometers north of the city of Elko, Nevada. Aura has three high quality deposits, with near term growth catalysts, and with gold resources, in excess of 1M ounces, plus 10M ounces of silver. Agnico Eagle is a principal investor of approximately 18% of the Company.

Western Exploration Inc.

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief and Metals News talking with Darcy Marud, CEO, President, and Director of Western Exploration. Darcy, could you give our readers/investors an overview of your Company and what differentiates it from others?

Darcy Marud: Western Exploration is a new Company to the public markets. It was listed on the Toronto Stock Exchange, under the symbol WEX, in January of this year. We followed up with a listing on the OTC, in February of this year, and that's WEXPF. On the public side, it's a very new Company, but it does have a very long history, as a private company, working in Nevada. It was originally formed, in the late 90s, by several gentlemen, here in Reno that realized the potential for exploration and discovery on private lands, that were held by a large oil company in Nevada.

Since that time, we've put together an impressive portfolio of projects, the principal asset of which is called our Aura Project, in northeast Nevada. It's about an hour and ten-minute drive, north of Elko, on a paved highway. That is the asset that we're focused on right now. I think what differentiates us from other companies is having that long history of 25 years, where we've completed over 50,000 meters of drilling on that asset. We've advanced three different deposits to a resource stage.

Those deposits are Gravel Creek, Wood Gulch, and Doby George, all within one large contiguous claim block. I think the differentiating factor, for us, is that history, but also that we have a project, with three resource bases on it, all of which can be expanded. I think that gives us a lot of optionality for exploration and discovery.

Dr. Allen Alper:

That sounds great. That's sounds like you're in the right area and you have a background of exploration and data. Maybe you could tell us a little bit more about your resource and a little bit more about the three key projects.

Darcy Marud:

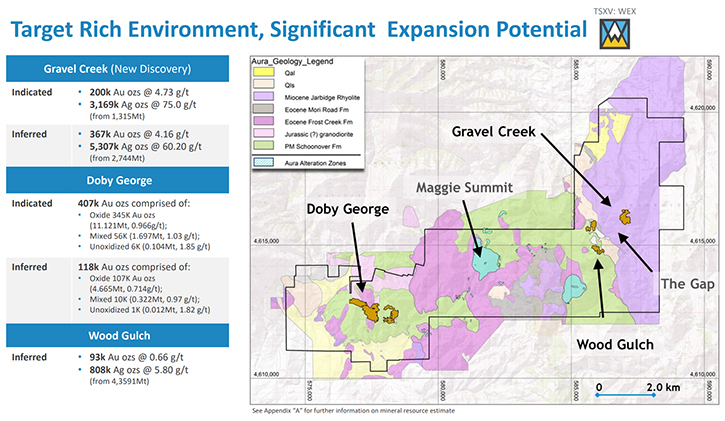

The total resource, right now, is about 1.3 million to 1.4 million gold equivalent ounces. As we said earlier, there are three different resource areas. The largest resource we have is a new discovery that was made by the Company in 2013, it's called Gravel Creek. It was a discovery made by taking the geology that was known at the time and extending it into an area that had been previously undrilled. The first hole made the discovery.

At Gravel Creek, we have about 700,000 ounces of gold, at an average grade of just north of five grams per ton gold, but also about 10 million ounces of silver, with a grade of silver, that's about 70 grams per ton silver, so two ounces silver.

Immediately to the west of Gravel Creek, is the Wood Gulch mine. It was mined by Homestake, in the late 80s to 1991, when they closed it. We have a resource there of about 110,000 ounces of gold equivalent, of which the majority is gold, about 96,000 ounces of gold, the rest is silver. It was that deposit, when they looked at the geology, that convinced them to drill the discovery hole at Gravel Creek. We're currently working on a program, where we think those two deposits may connect to make one large deposit, with Wood Gulch at the surface and Gravel Creek down deeper.

Last but not least is the Doby George deposit, which is the farthest west on our claim block. There we have about 525,000 ounces. It is different from Wood Gulch and Gravel Creek in that it is oxide. It's over a gram per ton at surface, so it has over 800 drill holes in it. That resource is very well defined and we're currently starting a drill program, within the next 10 days, at Doby George, to do additional metallurgical work that we think we can use to then take that deposit, very quickly, to a pre-feasibility study.

Dr. Allen Alper:

That sounds excellent. Could you elaborate a little bit more on your plans for this year?

Darcy Marud:

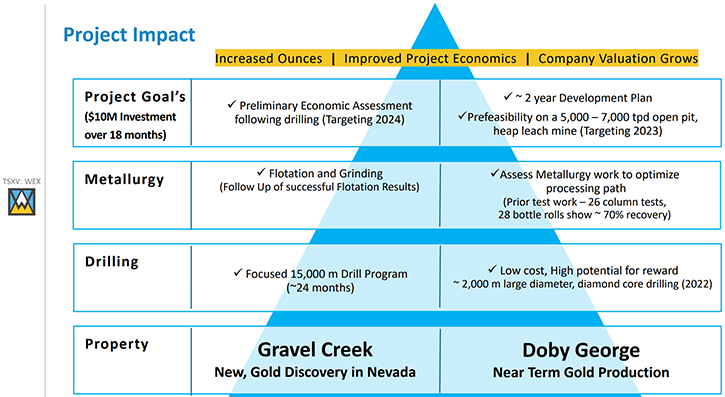

The majority of the drilling will be done at Doby, George, this year. We just think, that with a limited drill campaign, about 2,000 meters, that's very focused on areas that are currently, within the resource boundaries and just outside them, that we can get that additional metallurgical work to a pre-feasibility level of study. We think that that will demonstrate an economic operation, open pit, heap leach, in northeast Nevada that would be around a gram per ton. We think that would be the quickest return to our shareholders, of creating value for the Company.

Next year, the focus will shift to Gravel Creek and Wood Gulch. The Gravel Creek deposit is sulfide. It's deeper, so it requires a little bit more of a financial commitment, to the drilling. But, long-term the risk to reward there is much higher than Doby George, because of the grade and that it's a new discovery, we really don't know yet how big that deposit will get.

We're doing additional surface geology geophysics at that Wood Gulch and Gravel Creek deposit this year, as well as a new 3D geologic model. That will be used to drive the drill program that will either commence late this year or starting next year at Gravel Creek and Wood Gulch.

Dr. Allen Alper:

Well, it sounds like this will be exciting time for your shareholders and stakeholders.

Darcy Marud:

I think so. As a private company, we did a lot of good work, but people really didn't get to see what we were doing. Obviously, as a private company, we're not putting out any news. I think the news flow that will come out, most importantly, will have significant impact for the Company, proving up the development potential at Doby George. But I think it's really the first time that our shareholders and our stakeholders will be able to see what Doby George is all about, as far as grade and the continuity of that grade goes.

Dr. Allen Alper:

Well, that sounds excellent. Darcy, could you tell our readers/investors, a little bit about yourself, your Management Team, and your Board?

Darcy Marud:

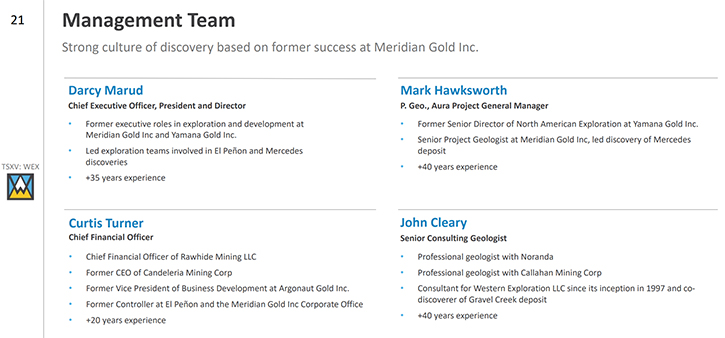

I joined the Company, Western Exploration in 2018. I'm a geologist by training. I've been in the industry for 40 years. I was very fortunate, in my career, to work with some high profile, very professional organizations. I started in the 80s with Homestake Mining in Canada and ended up traveling to South America with Homestake. It was when I was living in Chile that I met the Management Team for Meridian Gold and I joined Meridian in 1994 as an exploration geologist, right at the time that El Peñón was being drilled out for the first time.

I spent a lot of time at El Peñón, through its discovery days and right through its construction and production. I ultimately ended up being VP of Exploration, for Meridian in 2004, and when Yamana bought Meridian in 2007, I continued on in the role of Exploration VP, until 2014, when I became Executive VP at Yamana.

I left them in 2017 and then came to work, with Western Exploration, in 2018. The decision to leave Yamana was really about that stage in my career. I wanted to spend more time, focused on an asset, that I think had a lot of potential, but be closer to home, with a little bit less traveling in my life. That was the decision I made, to join the organization in 2018.

Dr. Allen Alper:

You have an excellent background.

Darcy Marud:

Thank you. I'm fortunate that I have worked with very good people and high-quality organizations, through that time. Through working with high quality people like that, we just become better people and better geologists. I'm very fortunate to have done that in my career.

Dr. Allen Alper:

That's great!

Darcy Marud:

Then we added a VP of Exploration here, to the organization in 2019. It's a gentleman that I've worked with, over about 20 years, at both Meridian and Yamana. His name is Mark Hawksworth. He's been a very successful exploration geologist, during the 40 years that he's been in the industry. His most recent role was Director of North American Exploration for Yamana. He and I have worked together before, in Meridian as well, where he was the key person behind the discovery of the Mercedes Mine in Sonora.

On top of that, we have two professionals, geologists that have worked, with the Company, since the late 90s. So, we have a combination of people that know Nevada very well and know the project very well, with some new blood that has come out of some major companies in the industry. I think it's a good mix of people that know the project, but people that have come in as well, that know the industry very well, and what it takes to take a project from discovery right through to development and ultimately construction. We have a very strong Team.

Our CFO, I've worked with him in the past as well, Curtis Turner. He was the controller at the El Peñón mine, in Chile, where I first met him. He's also held senior C-suite roles, with Argonaut, where he was VP of Business Development and Corporate Development. He was the CEO of Candelaria Mining and most recently the CEO of Rawhide Mining, which is a private mining Company here in Nevada.

I think it's a Team that has a lot of experience working together, but also a lot of experience in the industry and a variety of different roles, which I think is going to be very important, as we move Western from being strictly an exploration company, into potentially a development company as well.

Dr. Allen Alper:

Well, you have a very impressive Team, Darcy.

Darcy Marud:

Thank you, Al.

Dr. Allen Alper:

Could you tell me a little bit about your Board?

Darcy Marud:

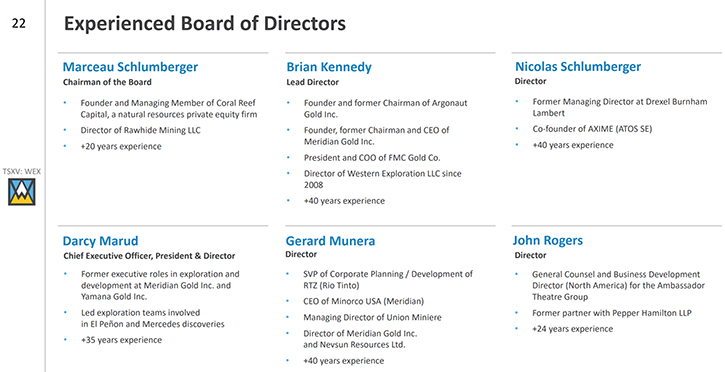

The Board is a good mix of people that have been there, and seen it, and done it, in this industry. Two of our Board Members, Brian Kennedy and Gerard Munera, have formed a number of public mining companies, listed on the TSX and the New York Stock Exchange, as well. Brian Kennedy was the CEO of Meridian Gold, when I was there, and he was the Founder and Chairman of Argonaut Gold, when it was first founded, with Pete Dougherty, back in the day. He's been involved in industry and is very well known in the mining industry in Toronto and around the world, as a matter of fact, given the success at Meridian and Argonaut.

Gerard Munera was on the Board of Nevsun. He's been on the Board of a number of French companies, and he is a well-known executive, as well, in the steel making industry, here in Nevada. He's had a family company that he's recently sold. Those two gentlemen have a lot of experience, operating publicly traded resource companies. On the other side, we have Marceau Schlumberger and his father, Nick Schlumberger, who came into Western, as a private enterprise, in 2013. They both come from the private equity side of the business and were very key to Western being able to raise over $30 million U.S., between 2013 and 2018, which was the money that was used to take the discovery of Gravel Creek, successfully, to the resource we have today. John Rogers is also on our Board. John is a lawyer in New York.

I think we have a very strong Board that's been well known, in the public space, in mining companies in the past, mixed with people that have come from the public finance side, and also legal representation, on the Board. So, I think it's a Board that knows the Company and has been around the Company, since at least 2013, but at the same time has a vast amount of experience, not only running public companies, but forming them as well.

Dr. Allen Alper:

That's excellent. Sounds like it's great to have a group that could support the Company financially and help get you funds to move your way.

Darcy Marud:

I think it's very important, as well, to mention that the Management Board owns about 4% of the Company, right now. But that 4% ownership is not through options or share issuances, it's through actual money that's been put into the Company over time. Everybody has put their own capital into the Company, so we're all vested in the success of the Company, going forward.

Dr. Allen Alper:

It's great to see that Management and the Board have skin in the game, that's great!

Darcy Marud:

I think it has to be that way. I think it really speaks to the belief in the project we have and the Team that we have, when you see Management and Board willing to support it. Especially, when times are tough and we know that this industry is cyclical at that point, there's going to be a time when it's difficult to raise capital and you need to know that there's strong Management and Board support, behind the Company.

Dr. Allen Alper:

That's excellent! Darcy, could you tell our readers/investors a little bit about more about your share and capital structure?

Darcy Marud:

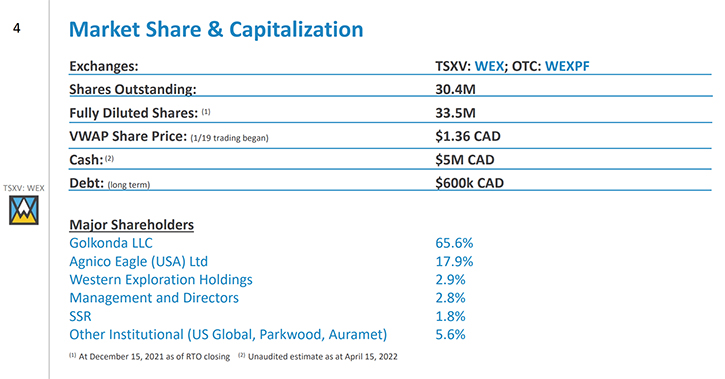

Currently we have about 33.6 million shares outstanding. It's very tightly held. The group that came into the Company in 2013 when it was private, Golkonda, LLC is a private equity group, out of New York. They own about 65% of the Company, but within that LLC that Golconda, there are about 70 different high-net-worth individuals and family offices in that. It's represented on our shareholder registry as one group, but it's actually 70 people, within that syndicate that are shareholders of the Company.

The second largest shareholder is Agnico Eagle, owning about 18% of the Company. We're very fortunate to have such a high-quality partner as Agnico. I know the Agnico Team very well, from my time at Yamana, I was the co-chair of the Malartic Operating Committee, working hand in hand, with the Agnico team. It's a pleasure for me to continue to work with Agnico, in a different enterprise, but they bring a lot of technical expertise to the Company as well. They do sit on a technical committee with us, so they're involved in a lot of the exploration and advancement of the asset as well as other shareholders.

Dr. Allen Alper:

That’s definitely a great Company.

Darcy Marud:

Yeah. What I like about Agnico, as well, is that they're very supportive of the Company, not only from the financial perspective, but from the technical perspective as well. If we come across an issue, whether it be metallurgical exploration, they are a wealth of information that we can always tap into and they're happy to provide that kind of support to us as well.

SSR Mining is also a shareholder of the Company, they own about 1.3% of the Company. They acquired that interest through a transaction, we completed with them, in 2019, where we sold a small piece of land, we had around the Marigold mine. In addition to that, we have several institutional investors, Parkwood, U.S. Global, Auramet, who own about 4% of the Company as well and came into that shareholder roster when we did the private placement back in October of 2021.

Dr. Allen Alper:

Well, it's great to have such great support, of a group that could help you move the project forward, and stay with you when times are hard, and support you.

Darcy Marud:

To date, Agnico, any time we've done a capital raise, has always contributed at least their pro-rata to that raise. I can't speak for Agnico, I hope they continue to do that going forward, and I suspect they will. But they're that kind of partner, that are there when you need them.

Dr. Allen Alper:

Excellent. Darcy, I wonder if you could summarize and highlight the primary reasons our readers/investors should consider investing in Western Exploration.

Darcy Marud:

First and foremost is the quality of the asset that we have here, in one of the highest quality mining jurisdictions in the world. Our project, the Aura Project, is located only about an hour and 10 minutes north of Elko, driving on a paved highway. Access to the project is only about three kilometers, so two miles off that paved highway, to access our project. We have water rights that we can use for exploration and potentially for development going forward.

A power line runs right next to the project, only about five kilometers away. I think infrastructure wise; our project is second to none. Everything that we need, for a successful exploration and development program, is there. We do have permits, with the Forest Service until 2029, so we have a long runway for exploration, before we need to permit the project again.

I think the second is that we do have a very high-quality resource, already identified on the project, and not only one but three, they're all expandable by drilling. Now that we are a public Company and we've raised that initial capital for Doby George, I think you'll see an acceleration of our exploration plans, on the project. Our goal, within the next 24 months, is to have a pre-feasibility study completed on Doby George, where we can demonstrate a high quality, high margin, open pit heap leach mine, in Nevada. In 24 months, at Gravel Creek, we will have a PEA, where we can demonstrate what a potential underground mine, at the combined Wood Gulch gravel creek deposit would look like.

Third, is the quality of the Team. This is a Team that's been very successful, in the past, discovering deposits, taking them through that development stage and ultimately being there while they go into production as well. I would say that El Peñón, in Chile and the Mercedes Mine, in Sonora, Mexico are two examples of what the Teams have been involved in.

I think those are the three principal reasons investors should look at. I think Western is early in the game, right now, as a public Company, with a high-quality asset. As we get exploration going and we start to deliver results, which should happen within the next month to three months, we'll be drilling and delivering drill results and ultimately updates on metallurgy for Doby George. I think people will come to appreciate how close Doby George is, to being a development decision and how much potential exists on the property as a whole, especially at Gravel Creek, to make a significant new discovery, here in northern Nevada.

Dr. Allen Alper:

Well Darcy, those are very compelling reasons for our readers/investors to consider investing in Western Exploration. You have a great Team, a great Board, you’re in a great location, with proven resources and with great potential to expand. Those are all excellent reasons to consider investing in Western Exploration.

Darcy Marud:

In the junior space, right now, the market valuations of Companies are not probably where they should be, or where they have been recently. And we all understand the reasons for that. So, I think, with the quality of the asset and Team we have at Western, the valuation of the Company, right now, is very attractive to future value accretion.

Dr. Allen Alper:

That's very important to point out. Since this business is cyclic, it looks like this might be one of the good times to invest in the mining sector. Particularly as inflation continues, and seems to be out of control.

Darcy Marud:

Yeah, I agree with you. I think we're seeing some unfortunate pressure on the junior mining stocks, for no fault of their own, but that creates opportunities for the people that want to seize those opportunities.

Dr. Allen Alper:

Darcy, is there anything else you'd like to add?

Darcy Marud:

No. I just really want to thank you for this opportunity. I'll encourage people to check out our story, at our website, westernexploration.com. Nicole Cowles is our Director of Investor Relations, we're always available to talk to anybody about the Company, about our Team, about what we're doing. We encourage people to check out our website and if they need to get a hold of us, we'd be happy to talk to them as well.

Dr. Allen Alper:

That’s excellent! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://westernexploration.com/

Nichole Cowles

Investor Relations

Phone: 775-240-4172

Email: nicholecowles@westernexploration.com

|

|