McKinsey Lyon, VP, External Affairs, and Chris Fogg, IR Manager, Perpetua Resources Corp. (Nasdaq: PPTA, TSX: PPTA) Discuss Redeveloping One the Largest, High- Grade, Low-Cost Gold Projects in the USA

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/20/2022

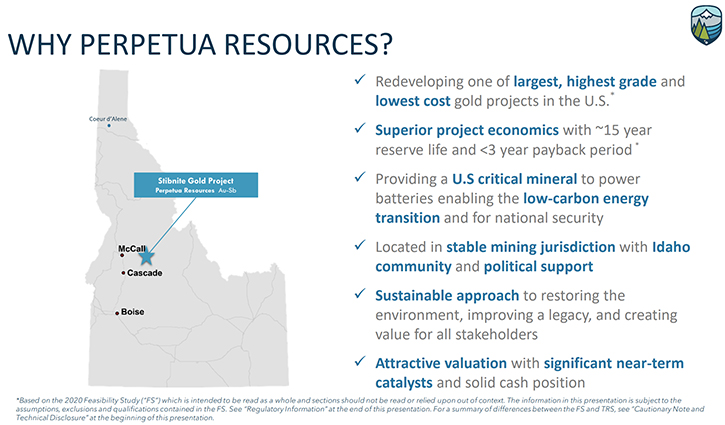

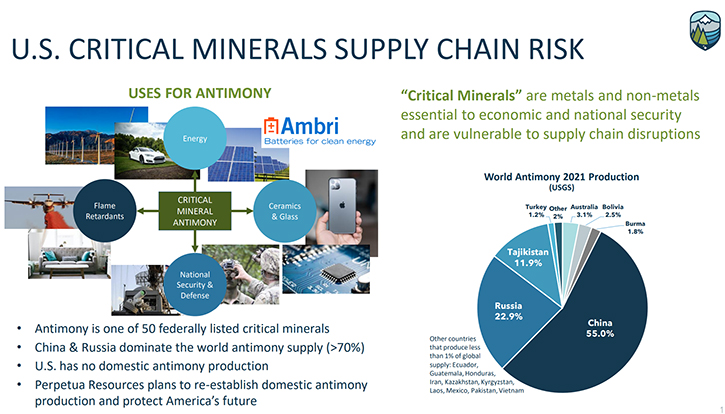

We spoke with McKinsey Lyon, VP of External Affairs, and with Chris Fogg, Investor Relations Manager, of Perpetua Resources Corp. (Nasdaq: PPTA, TSX: PPTA). Perpetua Resources, through its wholly owned subsidiaries, is focused on the exploration, site restoration and redevelopment of gold-antimony-silver deposits in the Stibnite-Yellow Pine district, of central Idaho. They are encompassed by the Stibnite Gold Project. The Project is one of the highest-grade, low-cost, open pit gold deposits, in the United States and is designed to apply a modern, responsible approach to restore an abandoned mine site and produce both gold and the only mined source of antimony in the United States. Perpetua will have significant leverage to higher gold prices, and a valuable antimony by-product credit of $70/oz, over life of mine. Antimony is one of 50, federally listed, critical minerals, used in National Security and Defense, in batteries for clean energy, flame retardants, solar panels, glass and ceramics. The U.S. has no domestic mined antimony production. Perpetua Resources plans to re-establish domestic antimony production and help protect America’s future.

Perpetua Resources Corp.

Dr. Allen Alper: This is Dr. Allen Alper, Editor in chief of Metals News, talking with McKinsey Lyon VP of external affairs, and also, Chris Fogg, Investor Relations Manager of Perpetua Resources. I wonder, McKinsey, maybe you could start and give us an overview of the Company and what differentiates your Company from others.

McKinsey Lyon: Well, thank you, Allen, I appreciate this opportunity. As you mentioned, I'm the Vice President of External Affairs for Perpetua Resources. Our offices are here in Idaho, in Boise and Donnelly, and the Stibnite mining district.

We are in the process of permitting the Stibnite Gold Project, which stands out as a truly unique opportunity. First, the project is designed to restore environmental conditions at an abandoned mine site. Additionally, the project is positioned to be one of the highest grade, open-pit gold mines in the nation, as well as the sole domestically mined source of the critical mineral antimony. Antimony is essential for national security and the clean energy future. And our approach to responsible US production has led to strong community relationships and support.

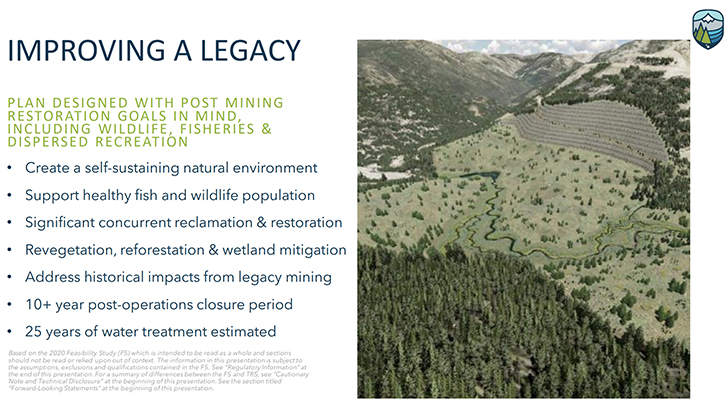

McKinsey Lyon: The historic Stibnite mining district has seen over 100 years of mining activity. Most of which occurred during WWII and the Korean War, a time when there were few environmental standard regulations or requirements on how to mine or how to leave it when you were done. As a result, the site was left with some pretty severe environmental legacies, including 10 and a half million tons of legacy waste and tailings that degrade water quality today. And, the East Fork, South Fork of the Salmon River flows through into an abandoned mining pit, which has blocked Salmon migration to the headwaters of the East Fork South Fork Salmon River for over 80 years.

And so, it's a site that needs help. Modern, responsible mining redevelopment offers a feasible opportunity to clean up the site and see the site restored.

McKinsey Lyon:

The project has one of the largest resources in the world of the critical mineral antimony, not owned by the Chinese or their interests. Antimony is critical for our daily lives, our national security, and our clean energy future. Antimony is used in a variety of energy, technology, and defense products, ranging from fire retardants to semiconductors and solar panels. And it's also important for an emerging technology, developed by a company called Ambri, with whom we entered into a supply agreement last year. Ambri’s liquid metal battery is a grid level, storage battery system, developed to hold renewable energy, like wind and solar, so that it can be accessible to the energy grid on-demand. Storage batteries are the missing piece of technology to decarbonize our grids.

Ambri’s Liquid Metal Battery technology is really interesting, in that it relies on two things, antimony, and calcium, and for many compelling reasons it is a technology that will be critical for a low-carbon future. So, with this resource of antimony, we have an opportunity to play a role in the clean energy transition.

McKinsey Lyon: And then, the final thing about the project, that I think helps us stand out, is our approach. We're a young Company. We've been at this for just about 10 years. We started with the vision that not only could we use modern redevelopment to help restore this abandoned mine site and produce the minerals that we need, like antimony and gold, in a responsible and secure way, but that we could also do so, bringing benefits to our community. That approach has helped us earn a strong social license and guided how we engage with our communities.

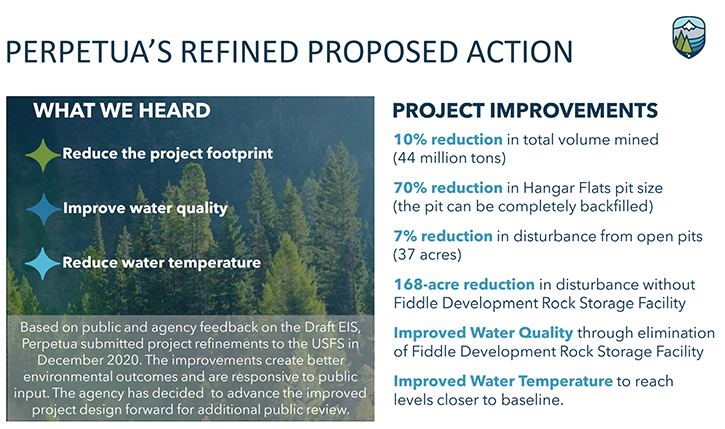

McKinsey Lyon: The project is currently in NEPA review for approval, and we anticipate some milestones in that process later this year, including the release by the U.S. Forest Service of a supplemental draft EIS that will review the Company’s preferred action for mine development.

Over the last two years we’ve work directly, with regulatory agencies, to improve the project design, based on public and agency feedback, on the 2020 Draft EIS. The improved environmental outcomes are something that we're really excited about. I think we're going to see a project that really shows our vision coming to life, that through modern mineral redevelopment, we can improve water quality, at this abandoned mine site. We can see an uplift in habitat, whether that be river habitat or wetlands habitat, and we can truly leave the place better than we found it, while producing the minerals that are critical for our country. So, it's a very exciting time for the Company, as we near that milestone and the release of the Forest Service, next step in the NEPA process.

Dr. Allen Alper: That's truly excellent, a project where we're doing something socially, to benefit the environment. And at the same time, it has commercial benefit too, for your shareholders and stakeholders. So that's truly excellent, in that you have two great elements that you are working with, gold and antimony, which are critical, so that's fantastic.

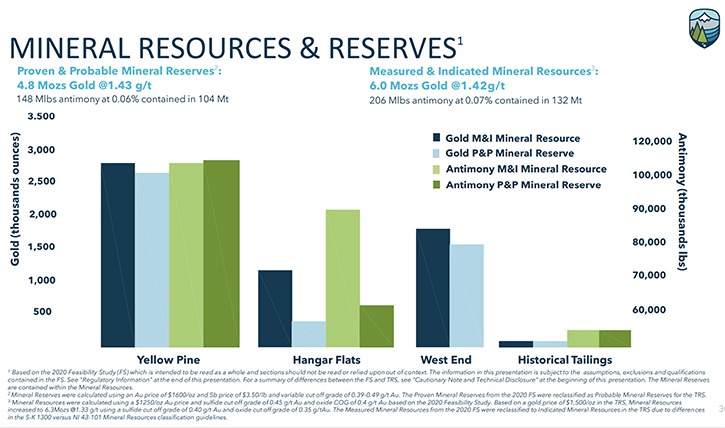

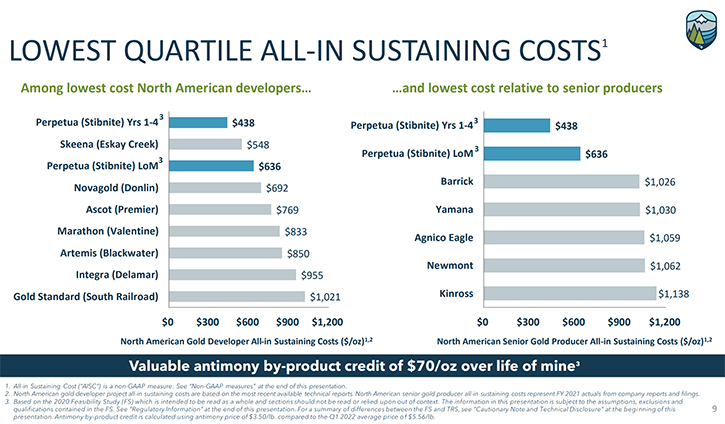

Chris Fogg: Yes, absolutely and I think McKinsey covered a lot of the key points. There are just a couple things I would add. First, our project is one of the largest gold reserves in the United States, with 4.8 million ounces of Gold Reserves. Another thing that makes us unique is the low-cost basis of our project. Over the life of the mine, all-in sustaining costs will average less than $650 per ounce of gold, and in the first four years of production it will be less than $450 per ounce.

Chris Fogg: Part of the reason that it is so low cost is because of the relatively cheap and clean hydro power that we can tap into, off the Idaho power grid. And then, as McKinsey alluded to, we're currently trading at a very attractive valuation. So, we think this is a great entry point for new investors. Our stock price, right now, is trading at only 11% of our project’s net asset value, compared to our peers, which are trading at 3 to 4 times higher multiples. And so, with significant near-term catalysts, we think that our stock will naturally re-rate, as we get through some of those.

Dr. Allen Alper: Well, that's excellent! That sounds like a great opportunity for our readers and investors. And I noticed too, that your Company is a very ESG conscious Company, could you say a few words about that?

McKinsey Lyon: Absolutely. Our ESG approach started in the first years of the Company, in recognition that if we were going to redevelop this abandoned mining site, we had to do so responsibly. And to us, that meant taking on site restoration, to leave it better than it is today, doing right by our communities and having both transparent and accountable business practices that are governed by our Board.

ESG has made up the fabric of who we are as a Company, and how we have implemented the development of this project. Most recently, we launched a sustainability roadmap that lays out 13 specific goals and commitments that the Company is making, as we bring the project into development, things like a commitment to annually report our greenhouse gas emissions, commitments to systems of transparency and accountability, with the public, so that the public will always have access to our Team and information around the project, as well as the ability to communicate and weigh in directly with us, on project development.

McKinsey Lyon: And it's these goals that we see as the tip of the spear, on where mining in America is going. Over the last few years, it seems clear that the American people understand and now demand domestic production. We understand that there are significant security, economic, and environmental consequences to not producing the minerals we need here in America. And now the conversation is shifting to how we are going to do so responsibly?

McKinsey Lyon: Perpetua is poised to lead the way, on what responsible US mining will look like. For us, that means taking responsibility for the environment, to not only restore this abandoned mining site, but also to provide environmental benefits and to meet or exceed environmental standards, wherever possible. It means recognizing that we are an important part of a supply chain for clean energy products and recognizing ourselves as a part of that supply chain. As a result, we’ve partnered with Ambri, out of a commitment to prioritize how and where our products are used. So, there are a lot of really exciting components to the project, when it comes to ESG.

Dr. Allen Alper: That sounds great! Do you have anything else to add on that subject Chris?

Chris Fogg: Just that, our sustainability goals align with the United Nations sustainable development goals, and that they are designed to be in alignment with those goals to provide wider benefits for society’s biggest challenges.

Dr. Allen Alper: That sounds excellent!

McKinsey Lyon: Absolutely! Allen, we included the UN sustainable development goals, in our roadmap, out of recognition that we have a role to play in this global pursuit of a more sustainable future.

Dr. Allen Alper: Well, that’s excellent. I noticed, in looking at your website, how committed your Company is to Idaho, and the community and the people of Idaho. That’s excellent!

McKinsey Lyon: It’s the reason we have such a strong Team. For so many of us, within the Company, this is our home. And when we talk about mining projects, this is one that has earned the respect of people who live here, enough so that we’ve collected a great Team of people that want to be a part of it.

Dr. Allen Alper: That’s excellent! McKinsey and Chris, could you tell our readers/investors a little bit about your background and also the background of your Team and Board?

Chris Fogg: Absolutely. I joined Perpetua, in early March of this year, as Investor Relations Manager. I have been in the mining industry and in the gold mining industry, in particular, for quite a while now. I was previously with Newmont Corporation, headquartered in Denver, where I held several roles in Finance, including Investor Relations, Treasury and Corporate Development. McKinsey, I’ll kick it over to you to introduce yourself to go through your background and then I’ll go through the Board.

McKinsey Lyon: I’ve had the pleasure of working on behalf of this project, since 2011. I’m an Idaho native and cut my teeth at a public affairs firm. When I started to work for this Company, the question we were trying to answer was, how do we implement this project, in such a way that we will earn the respect and the trust of our local communities? So, my work here really started with, how do we communicate? How do we build systems for transparency and accountability, with our communities? And how do we make sure that also extends into our culture as a Company?

I consulted for about five years, and then came in-house in 2017. And it’s a phenomenal Team to be a part of, 67% of our Management Team are female. Laurel Sayer, our CEO came from a career of conservation and natural resource policy and Jessica Largent, who joined the Company about a year ago, just moved up to take the role of CFO. I’d like to say that we are quite literally changing the face of mining, through this Team. And not just the experiences that we bring to the table, but also the approach on how we choose, on a daily basis, to bring this project to life.

Chris Fogg: We have a very experienced and diverse Board, including eight Directors and our CEO, Laurel Sayer. Marcelo Kim, a Partner at Paulson & Co., which is our largest shareholder, has been a director since 2016 and became Chairman of the Board in 2020 and brings significant finance and capital markets experience. Our lead independent Director is Chris Robison, who has over 42 years of experience in the mining industry, in operations and projects and is a former fortune 500 executive. Bob Dean has over 25 years of experience, investing in private and public companies and Chairs the Audit Committee. David Deisley has over 30 years of experience, in the mining industry, with an extensive track record in project permitting, corporate affairs, legal governance, and mergers and acquisitions. Jeff Malmen is currently Senior Vice President of public affairs of IDACORP, an electricity holding Company and Idaho Power, a regulated electric power utility, where he has worked since 2007. Chris Papagianis is a partner at Paulson & Co. and serves as Chair of the Compensation Committee. Mr. Papagianis, together with Alex Sternhell and our newest Director, Laura Dove, brings significant political and government affairs experience. Ms. Dove previously served as Senior Director of the Ford Motor Company and before that as the US Senate's secretary for the majority, an elected officer of the Senate from 2013 to 2020.

Dr. Allen Alper: A very impressive, diverse Board and a very experienced, knowledgeable, and diverse Team, so that sounds excellent. Could you talk a little bit more about your share and capital structure?

Chris Fogg: As I mentioned, Paulson & Co. owns about 39.3% of our stock. Sun Valley Gold owns about 8.2%, followed by B. Riley at 4.3%. And we recently announced that value-oriented investor, Kopernik became a new shareholder. Overall, we have issued outstanding shares of about 63 million shares. On a fully diluted basis, we have about 66 million shares outstanding and an estimated cash balance of $40 million. We are well capitalized to continue advancing the permitting process, and we have no debt.

Dr. Allen Alper: That sounds excellent. Could you to tell our readers/investors the primary reasons for them to consider investing in Perpetua Resources?

Chris Fogg: Absolutely. Number one, we are redeveloping one of the largest, high-grade, and low-cost gold projects in the United States. Our project has superior economics, with a 15-year reserve life and less than a three-year payback period. We're providing a U.S. critical mineral, in the form of antimony, as a by-product of our gold production, to power batteries that enable the low carbon energy transition and is important for national security. Our project is located in a stable mining jurisdiction, with significant Idaho community and also political support. Very importantly, we are using a sustainable approach to restoring the environment, improving the mining legacy, and creating value for all stakeholders, not just our shareholders. And again, we have a very attractive valuation, with significant near-term catalysts and a solid cash position. We're trading at only 11% of our project’s net asset value.

Dr. Allen Alper: I enjoyed talking with you, I'm very impressed with your Company, and I'm glad I have the opportunity to bring it to our readers/investors. I'm looking forward to continuing our relationship because I think you have a great Company. I love it that you'll have both a great resource, both gold and antimony and you're doing something excellent for the environment, improving it, improving the condition. And I think that's fantastic. I like the idea that one of these days, the Salmon won't be blocked anymore. That'll be fantastic.

McKinsey Lyon: You know, Allen, it's a project that we're all really proud of. And so, it's great to hear that others find it compelling. It's exciting to see an American mineral opportunity bring value to our communities, bring value to the environment, and bring value to our shareholders. So, thank you.

Dr. Allen Alper: You are welcome. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://perpetuaresources.com/

Chris Fogg

Investor Relations Manager

chris.fogg@perpetuacorp.us

Info@perpetuacorp.us

Mckinsey Lyon

Vice President External Affairs

media@perpetua.us

|

|