Rambler Metals and Mining Plc (AIM: RMM): Resource Endowment of 1 Billion Lbs. of Copper in a Proven Mining Jurisdiction, Newfoundland, and Labrador; Dr. Toby Bradbury, President and CEO Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/7/2022

We spoke with Dr. Toby Bradbury, who is President and CEO of Rambler Metals and Mining plc (AIM: RMM), a mining and development Company that brought its first mine into commercial production, in November 2012. Rambler has 100% ownership of the Ming Copper-Gold Mine, together with a fully operational base and precious metals processing plant and year-round bulk storage and shipping facility; all located on the Baie Verte Peninsula, Newfoundland and Labrador, Canada. Rambler’s focus is to regain its production profile, at 1,350 metric tonnes per day and at a target grade of 2% Cu and evaluate expansion opportunities from that base. Along with the Ming Mine, Rambler also owns 100% of the former producing Little Deer Complex.

Rambler Metals and Mining plc

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Dr. Toby Bradbury, who is President and CEO of Rambler Metals and Mining. Toby, could you give our readers/investors an overview of your Company and what differentiates it from others?

Dr. Toby Bradbury: Rambler Metals Mining is a London, AIM listed, copper-gold mining company. We were historically listed on the TSX Junior Exchange. That is something which we are considering again, as we grow the business to reflect its true potential, because all of our operations and projects are Canadian based. We currently have one active mining operation, at the Ming Mine, on the Baie Verte Peninsula on the island of Newfoundland. It is effectively a residential mine, which is supported by several small communities in that area, where most of our employees come from. We employ in excess of 200 people, and we are a significant contributor to the local economy.

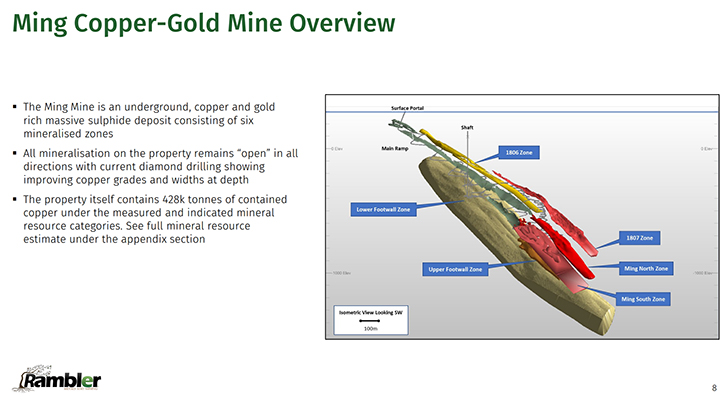

Mining goes back over 100 years in this area and it's a very rich part of Canada, from a mineralization point of view. It's been largely under-explored and has become a hot area now for exploration. The Ming Mine is a volcanogenic massive sulfide (“VMS”) type ore body. I'm not a geologist, I'm a mining engineer, but what I do understand is that this type of deposit originates from the center of the earth, in terms of a volcanic or magma type extrusion. For that reason, it has the potential to go very deep indeed.

We are mining currently from around 500 meters level downwards and we have drilled the identified ore zones down to 1500 meters below surface. We currently have, in the resource statement, more than 400,000 tons of copper metal, using a 1% copper cut off, to give a 1.8% average grade. In global terms, this is a world class asset. It is a high-grade asset. When you add to that the attributes of being in Canada, particularly being in Newfoundland, our close proximity to the coast (it's easy for us to get our product to the market) and it's actually an active mining operation, this makes for an attractive investment proposition.

The mine operated historically until 1982. It closed down and it was reopened in 2012. This was prior to my involvement. Although money was brought into the Company, it was largely undercapitalized for an extended period. It's very difficult for a mining operation to show its true colors, if it does not actually get the investment that it needs. What we have done, over the last two years, while I have been involved, is the specific reason why I was brought in, to get the mine established as a sustainable producing asset. We have kept ourselves pretty much below the radar, until just recently.

May 2022 was the first time we have attended a conference, during my tenure. We were at the Mining Indaba, in South Africa, and we attended PDAC, in June in Toronto. We are now seriously starting to ramp up the profile and the story behind the Company, because the asset is largely unrecognized and the true value of what it might be is not well understood. We have been reporting to the market, on our progressive operational improvements, because the further we go down the road, the more confident we become in our success.

We have been building up the Team, in terms of competencies. It is a project that I got hitched up with, because in a 40-year career, it is the single best geological deposit that I have been involved with. It just needed to see the true light of day, as it were.

Dr. Allen Alper:

That sound’s excellent. It’s great to have such a large resource, in such an excellent location, that's safe and sound. I noticed you received a reward for safety. Could you tell us a little bit about that?

Dr. Toby Bradbury:

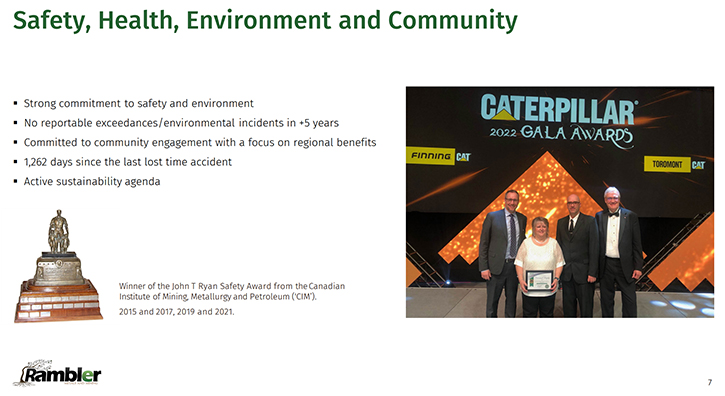

The John T. Ryan Award for 2021, for the safest underground mining operation in Canada, was received in May this year. That is quite an accolade and we're very proud of that. The Company has now actually operated for three consecutive years - we are in the fourth year now, of operating without any serious injuries. We always touch wood when we say that because you cannot take these things for granted. But it is actually a case of continuously putting initiatives in place, to help people improve safety behavior. Our excellent safety statistics are the end result.

What we want to do, is manage the way in which people behave in their workplace, make sure they're always working safely, have safe systems of work, safe equipment and are all properly trained in their tasks. You can never take your foot off the pedal, as far as that is concerned. It is a constant area of attention. But, the most important thing is, that for all the individuals that work in our mine, they come to work and return at the end of the day, as safe and sound as they were at the beginning. We are grateful for the efforts that all of our employees and contractors make, because they’re the people that have actually achieved this.

Dr. Allen Alper:

I notice that one of your focuses is Mine Operation Improvement, could you say a few words about that?

Dr. Toby Bradbury:

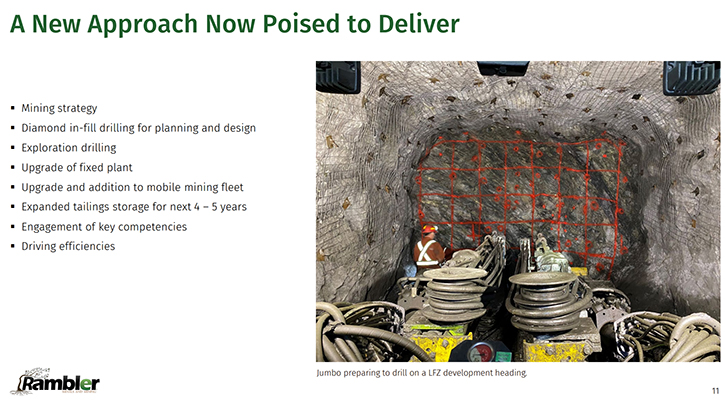

I have been very fortunate to be in the mining industry for my 40-year career and I have actually spent quite a lot of time in a contracting capacity. Essentially, being a service provider, where our business makes its margin, based on how efficient we can be. That kind of mindset, that discipline, is part of what I carry around with me. When I came to look at the Ming Mine, it just struck me that there were some inefficiencies there, that could be addressed and fixed. That's what we're in the process of doing. The bottom line is that this is a cultural change. We are not really changing so much, around the technological side of what's going on in the mine. It’s the way we actually manage the activities, with the people at the mine site, bringing them along for the ride.

It does mean that we are bringing in, in some cases, some special skills, if they do not exist locally. I did mention, we are a residential mine, which is fantastic. We have a mine life that is, most likely, in excess of 20 years and to have a mine that supports a community, or a number of communities, where people can live and raise their families, without having to work remotely, or fly in and fly out, is a fantastic position to be in. There are not that many mines that can actually provide that sort of lifestyle.

Dr. Allen Alper:

Well, that's excellent. Toby, could you say a few words about the importance of copper and the growing market?

Dr. Toby Bradbury:

Sure. I personally have always been a copper fan. Copper is known as a bell-weather metal, because it's a material that is used in absolutely everything, and that has always been the case. We use copper in piping for plumbing and electrical wiring for houses and buildings. What's become far more prevalent today is the need to move to renewable energy and away from internal combustion engines.

Both of these require a large amount of copper, from the point of view of transmission and copper windings in electric motors. In terms of vehicles, the drive motors typically need 50 to 80 kilograms of copper. As we make this transition to cleaner energy, that adds up to a substantial increase in demand.

Increased demand for copper should improve pricing, especially based on a constrained supply side. The world's supply of copper is not growing at the pace at which the demand is growing. Even where there are new mines, there are very few that are operating that have the opportunity to open up and produce, at a high grade, as we do. We could average a grade at 1.8% over a life of mine. There are mines, being opened up today, at the cost of billions of dollars and they are mining not even 0.5% copper. We're in a very privileged position because of the quality of the asset we have.

Dr. Allen Alper:

Well, that's excellent! Toby, could you tell our readers/investors, a little bit more about yourself, your Team, and your Board?

Dr. Toby Bradbury:

I am a mining engineer. I have been in the industry working for over 40 years, in a range of different commodities and countries. This helped me build broad experience, with a strong network. By way of example, I have one colleague, one of our Vice Presidents, with whom I worked in Tanzania, who is moving to Canada, with his family.

We are bringing people into Canada from overseas, where we cannot attract people from within the country. We have applied for and been successful in becoming a designated employer for immigration purposes, which puts us in a fortunate position.

Using this program, we have just brought in a new General Manager, who effectively started early this year. He is an underground mining engineer, with specific experience in leading mining operations and in the mining methods that Rambler employs. One of the main reasons, why I was keen to get a mining engineer into the role of GM, is that the success of the project is very much hinged around the success of the underground mine. The metallurgy in the mill is relatively straightforward. We have a fantastic copper recovery with our ore. We get around 95% to 97% recovery of copper, which is an outstanding result.

We have just brought in a Chief Financial Officer as well, who has come in from overseas, a very well qualified and experienced lady. What is really important for me, is that our Operating Team are residents of Newfoundland. To be able to attract top caliber people to come and live in Newfoundland is great and this in turn helps us attract others into the Company.

Then we have two long-standing executives, who have been with the Company, each of them for over 10 years. They are covering the corporate secretary and the mineral resource management aspects of the business.

We have a VP of Human Resources, who has been with us for four years. On our Executive Team, we have two women, and we are a diverse group: the seven of us.

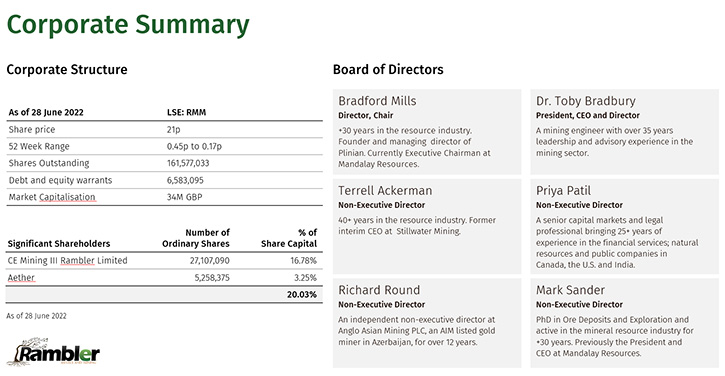

On the Board, we have three Directors that have been in office since 2016. They are associated with a private equity group that has a significant shareholding in the Company. They have a great deal of success, in recognizing undervalued assets and getting them turned around and operating. We have two independent Directors, who started last year. Priya Patil, who originally was from India and is now Canadian, living in Toronto. The Chairman of our Audit Committee, Richard Round, is British, based in the UK, and then myself. We currently make up the six Directors.

Dr. Allen Alper:

Well that sounds like an excellent, well-balanced Board and Team. It sounds like you have real depth of operating experience. That's excellent! Could you tell our readers/investors, a little bit more about your share and capital structure?

Dr. Toby Bradbury:

We have currently around 160 million shares on issue. The Company is vastly undervalued. One of the reasons for that is that the history of performance, of the Company, hasn't been there. So, right now, while we are building up the credibility of the Company, we are also working hard to increase awareness, in the market. I expect that the value of the business will be transformed, in the coming months and years.

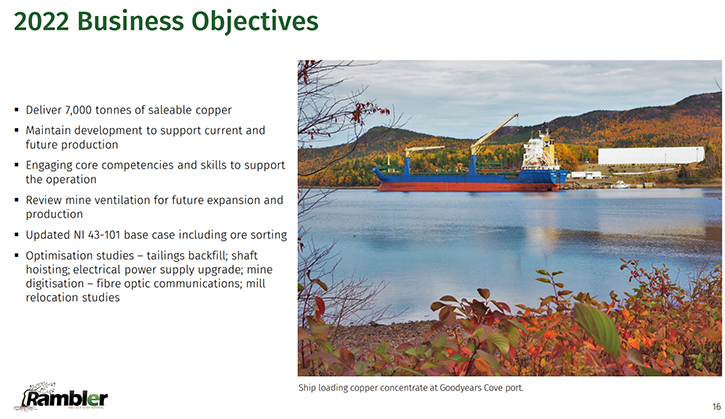

We are solely listed on the AIM market, of the London Stock Exchange. We do have some significant capital projects that can help take the Company to the next level. We currently have a base plan that will produce around 10,000 tons of copper per year. We can implement strategies that will reduce our carbon footprint and increase the scale and economics of the operation.

Bear in mind, that I said we have over a 20-year mine life. There is a lot of opportunity to upscale this mine, based on the resources that we know. It may still have a 20-year mine life, even as a bigger operation, as we have flexibility to reduce our cutoff grade, which would increase the amount of material that we can mine economically, from underground. With these environmental and growth projects, we may be looking to access capital. The first phase may be to incorporate ore sorting.

There are feasibility studies to be done, but just to get into your investors’ minds the type of opportunities that may be there. We may look to raise some of that capital through the markets in Canada as well as in the UK, where we are listed right now. I should emphasize that we are comfortable with our capital structure for the current operations. Any future capital requirements would be for expansion opportunities only.

Dr. Allen Alper:

Well, that sounds like an excellent opportunity to grow the Company and increase revenue and profits. So that's excellent!

Dr. Toby Bradbury:

It really is! It is an undervalued, world class asset, and we're starting to show the true value of what we have! It is very exciting!

Dr. Allen Alper:

It sounds like this year and next will be very exciting times for your shareholders and stakeholders.

Dr. Toby Bradbury:

It definitely will be! We are enjoying the ride.

Dr. Allen Alper:

Well, that's excellent! Toby, I wonder if you could summarize and highlight the primary reasons our readers/investors should consider investing in Rambler?

Dr. Toby Bradbury:

The first is the quality of the mineral resource, and not just the resource as we know it today, but what the resource may be, based on further exploration. There is a lot of potential for us to enhance and to grow the mineral resource and we have specific targets in mind.

Secondly, the opportunity for upscaling, from where the operation is right now. We are more than a pilot operation, currently producing an annualized 8,000 tons of copper, which provides a cash generative base plan. There is no reason to think that this mine cannot be double or triple that and still have a 20-year mine life.

Thirdly, our jurisdiction in Newfoundland, Canada is not only stable and supportive of mining, but also provides us with a platform to reduce carbon emissions, with a move to renewable energy, as our grid power supply is 100% hydro generated electricity.

This is a proven operation in an excellent jurisdiction, with both resource and production expansion opportunities, committed to achieving optimal sustainability objectives, as a copper (critical mineral) producer.

Dr. Allen Alper:

Well, it sounds like those are very compelling reasons for our readers/investors to consider investing in Rambler. You have a great resource, it’s copper, something for which there is a great need. The demand is growing very rapidly and you’re in a great location, you’re putting together a great Team, and you have the opportunity of growing your resource and your production and you are proving your results. It sounds like you have everything going for you. Toby, is there anything else you'd like to add?

Dr. Toby Bradbury:

The one area, which we are still working on, very hard, right now and we will get the information together, in the next few weeks, is to give a really strong indication of where we think the Company is, from an economic point of view. As hard as we have been working on improving the performance, in the underground, we are actually working on improving our management accounting arrangements, so we have better financial information to make decisions on.

This is part of what we have been fixing up this year, since our new CFO came in. But this is going to become a very profitable mine and we are doing this for money. There are no two ways about it. We are just in the process of proving what this asset actually is. It is not just good! It is much better even than people think!

Dr. Allen Alper:

Well, it sounds excellent! It sounds like a great opportunity for your shareholders and stakeholders and future investors. We’ll publish your press releases, as they come out, so our readers/investors can follow your progress.

https://www.ramblermines.com/

Toby Bradbury

President and CEO

Rambler Metals & Mining Plc

Tel No: +1 (709) 800 1929

Fax No: +1 (709) 800 1921

|

|