Justin Cochrane, CEO, Carbon Streaming Corp. (NEO: NETZ, OTCQB: OFSTF, FSE: M2Q), A Unique ESG Principled Company, Offering Investors Exposure to Carbon Credits, a Key Instrument, Used by Both Governments and Corporations, to Achieve their Carbon Neutral and Net-Zero Climate Goals

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 5/18/2022

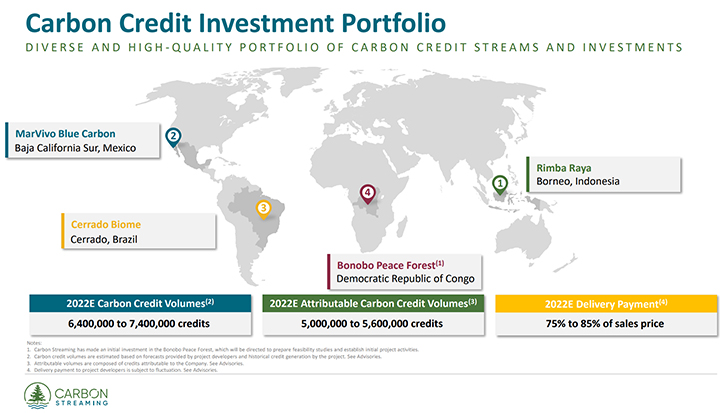

We spoke with Justin Cochrane, who was CEO and Director of Carbon Streaming Corporation (NEO: NETZ, OTCQB: OFSTF, FSE: M2Q). Carbon Streaming is an ESG principled company, offering investors exposure to carbon credits, a key instrument used by both governments and corporations to achieve their carbon neutral and net-zero climate goals. Carbon Streaming invests in high-integrity carbon credit projects that use the money for environmental and community causes, like investments in clean power and clean water and education, wildlife protection, medical help. This develops carbon credits and Carbon Streaming Corporations get the right to market and monetize those credits, for the life of the project. The Company's portfolio includes; the Rimba Raya project in Borneo, the MarVivo Blue Carbon Conservation Project in Baja, Mexico, the Cerrado Biome Project in Brazil, the Bonobo Conservation Initiative, in the Democratic Republic of Congo and the Restoration Bioproducts Project in Virginia, U.S.

Educational opportunities are provided in the form of scholarships, as well as the creation of libraries and community centers.

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Justin Cochrane, who was CEO and Director of Carbon Streaming Corporation. Justin, could you give our readers/investors an overview of your Company, what your goals are, and also what differentiates your Company from others?

Justin Cochrane:

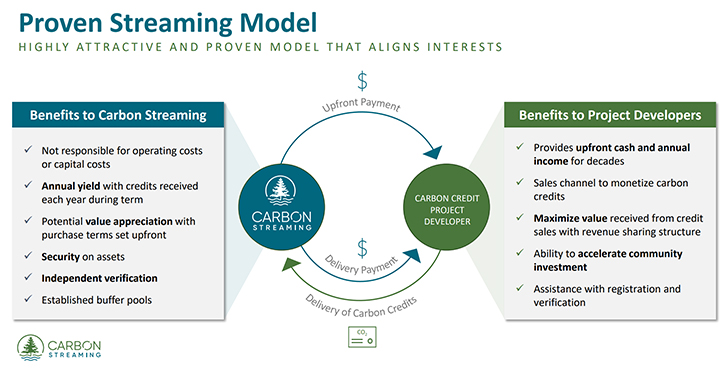

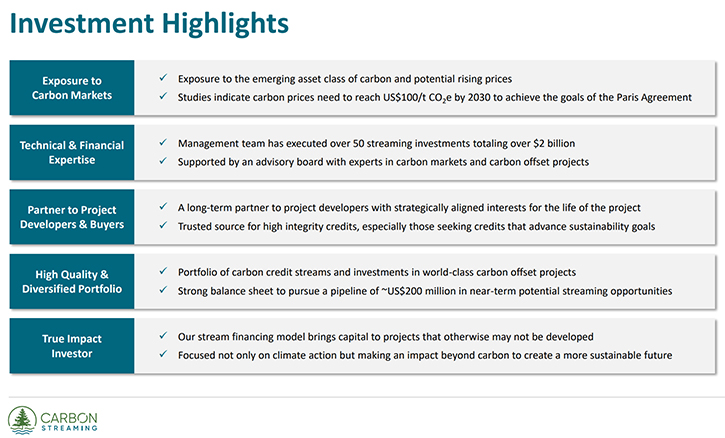

Just a quick background on Carbon Streaming and what we do, we are using the streaming and royalty financing model, from the mining and energy space, and applying it to a new asset class, in carbon credits. We launched this Company about two and a half years ago. We were the first publicly listed company of this kind in Canada and hopefully the first publicly listed company in the U.S., once the NASDQ listing is approved. By investing capital through carbon credit streaming arrangements, we bring capital to carbon project developers around the world, who are building projects to help fight climate change.

We firmly believe that trillions of dollars of investment are needed every year, for the next several decades and capital markets are going to have to play a meaningful role, in providing that capital, to help fight climate change. We believe the royalty and streaming model, while not the only model, is certainly one of the most efficient models to provide capital to these project developers, around the world. And so, we've gone all out.

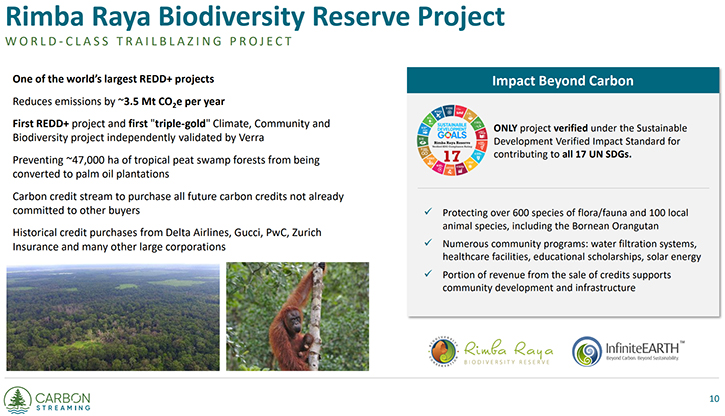

We've already acquired a world class portfolio of flagship assets that are going to provide the Company, with carbon credits and cash flow, for decades to come. We've done that by using streaming models. The best live example would be the Rimba Raya project, in Borneo, Indonesia. We have entered into a U.S. $45 million stream agreement and strategic alliance.

What does that mean? It means that we have provided and upfront payment to help support the project and includes paying a portion of the proceeds, from the sale of carbon credits, to fund continued operations. The project is using those funds to expand community initiatives, protect the local Bornean Orangutan, invest in a floating medical clinic that floats on the eastern border of this property and hits the three communities. Also, to invests in clean power and clean water and education. They're using this money to help fight climate change and improve the lives of the local community and protect biodiversity at the same time. It’s a wonderful project.

In exchange for our investment, Carbon Streaming gets the right to market and monetize those credits, for the life of the project. The existing life of the project, right now, is another 20 years and there may be a life beyond that 20-year period. But for at least the next 20 years, we get to monetize about 3 million carbon credits per year, from that project. Then we take a small revenue share, the bulk of the revenue is invested back into the project again, on an annual basis. But Carbon Streaming earns its return by keeping a share of the revenue, as we sell these carbon credits.

Dr. Allen Alper:

Who do you sell the carbon credits to and how does that work?

Justin Cochrane:

That's an excellent question. The buyers of these carbon credits, and Rimba Raya is an example, that's a project that's been around for ten years, that tends to be large corporate buyers. A hundred or more companies have been buying credits from Rimba Raya, for the past ten years, including Delta Airlines, Gucci, Volkswagen, Zurich Insurance Group, PwC, all of those companies. We have a large Rolodex now of buyers that have supported that project and we believe will continue to support it, in the years and decades ahead.

Dr. Allen Alper:

Well, that sounds great! Could you explain further, how the Carbon Credit Investment Program improves climate change and decreases the carbon footprint?

Justin Cochrane:

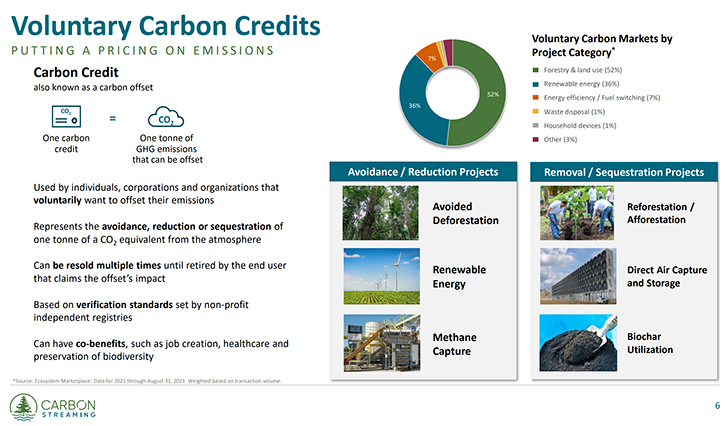

The goal of these carbon offset projects, these voluntary carbon projects, is to do a couple of things. The first is to avoid emissions that were otherwise planned. So, as an example, to end deforestation, to put a price on trees, to make the trees more valuable standing than they are dead. And so, we're funding projects that are reducing deforestation. The second is sequester and absorb carbon from the atmosphere. An example would be a reforestation project or a biochar project.

Dr. Allen Alper:

That’s fantastic! That’s really fantastic!

Justin Cochrane:

As an industry, deforestation is about the same size emitter, as the global airline industry or the global shipping industry. But it's not only that big, it's nine times the size of those industries. Ending deforestation is absolutely critical. These projects support the development of renewable energy projects, solar, wind, geothermal projects, in developing countries, around the world. They help develop technologies to pull carbon directly out of the atmosphere and store that carbon underground in permanent storage there.

These projects are absolutely vital to reducing emissions. And then they are also going to be used to support reforesting previously raised and deforested lands. So big investments and big commitments, around the world, to reforesting, reforesting the world. And you need to be able to put a value and a price on carbon and carbon credits, critical to that financing equation.

Dr. Allen Alper:

That sounds excellent! Could you tell us a little bit more about your portfolio?

Justin Cochrane:

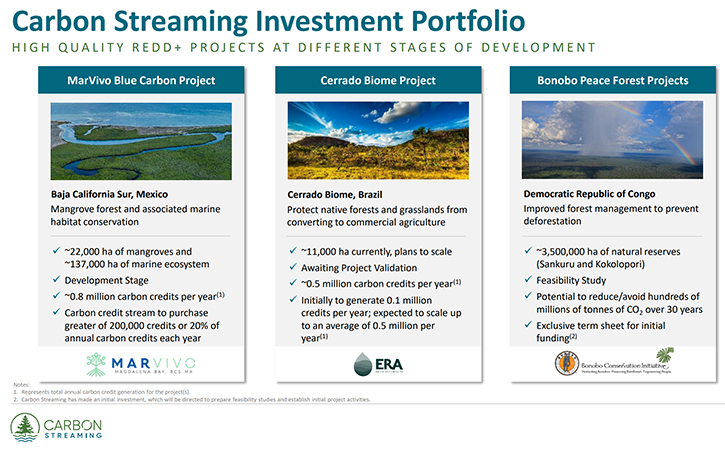

Alongside Rimba Raya, we have also invested in a blue carbon project, called MarVivo in Baja, Mexico. MarVivo is a blue carbon project. Blue meaning water, because it's actually a Mangrove Conservation project in Baja, California that is protecting 22,000 hectares of mangroves and 137,000 hectares of its marine ecosystem that surrounds the mangroves. So, very critical project that's being developed right now, as we speak, and expecting to issue credits next year.

We also have invested in an amazing project in Brazil, called the Cerrado Biome Project. This is a project in the grasslands next to the Amazon Rainforest in Brazil. And it saw its highest rates of deforestation in the last 15 years. Our partner ERA is protecting these grasslands and developing a carbon project, where landowners can come in and participate in this incredible project. They're actually expecting to issue their first series of credits imminently. Hopefully sometime very soon.

Then we have also invested in two very large projects in the Democratic Republic of the Congo. In the DRC, we have two projects in partnership with the Bonobo Conservation Initiative. The Bonobo is human's closest ape relative, quite an amazing, amazing species. And this Bonobo Conservation Initiative is developing two very large carbon projects that will not only protect the land, where these Bonobos live, but also prevent this land from further deforestation. The Congo rainforest, being the second largest emitter of carbon, on an annual basis, from deforestation, so it is absolutely critical to protect that Congolese Rainforest.

Dr. Allen Alper:

Oh, that sounds excellent. Could you also talk about your delivering, beyond carbon advancing, the U.N. Sustainable Development Goals, through impact investing?

Justin Cochrane:

One of the things we love so much about this business is these projects. Going back to Rimba Raya, not only do they help eliminate deforestation and help reduce global emissions, they are also very much investing beyond just climate. They're investing in the local communities, they're investing in protecting biodiversity. They’re empowering people. They are providing education and health care and investing in women-led businesses. So, gender equality, protecting life on land and on water.

These projects can have amazing impacts, beyond just the climate impact, beyond the carbon impact. And so, “Carbon Streaming”, as an organization, has an investment policy that says we will invest in projects that help fight climate change. But they also have to go beyond just fighting climate change and do one other positive thing for the world. Whether that is education or gender equality or health care or preserving life and water. As a policy, investments have to go beyond just carbon. And that's a key part of our investment policy. It's also a key part of what institutional investors, who are focused on sustainability and ESG principles, are looking for.

Dr. Allen Alper:

Well, that's fantastic. Could you tell us a little bit about your robust pipeline of streaming opportunities?

Justin Cochrane:

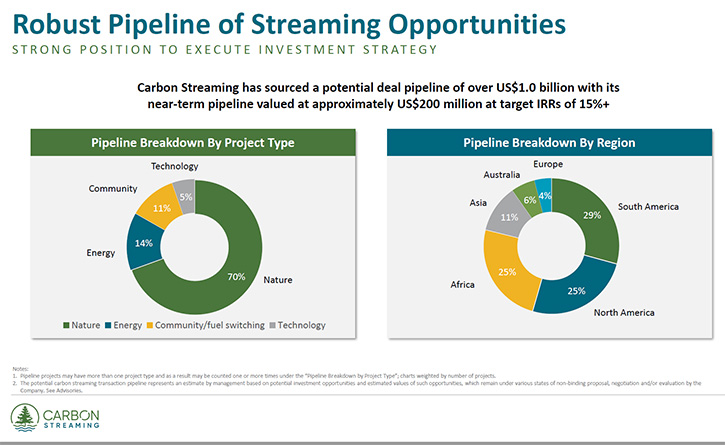

The investment pipeline now exceeds over $1,000,000,000 in size. We have over $200 million of that pipeline that we consider near term. We are very enthusiastic and excited about what the next six months have in store for the Company. It has been a little bit slower to for us to execute new investment opportunities and bring them into the Company. That's because of the level of diligence and consulting work and negotiations that we undertake, as we execute these streams.

But we are very enthusiastic about what the future has in store. And for us, we are sitting on over $100 million in cash, on our balance sheet, and we believe that positions us exceptionally well, relative to our peers in this industry, to continue to grow and diversify our pipeline, as we execute on our growth objectives, as a Company.

Dr. Allen Alper:

That sounds excellent. Could you tell us a little bit about the demand drivers and catalysts for a voluntary carbon market?

Justin Cochrane:

The demand drivers are a couple of fold. First one being the regulatory pressure that companies are now seeing. The SEC, just a couple of weeks ago, announced a proposal to require public companies to disclose their emission levels. That's an outstanding development for us and will drive a significant increase in demand for carbon credits. At the same time, we have shareholder pressure that is pushing companies to be more engaged, in reducing emissions and helping to fight climate change. We now have the shareholder actions undertaken from individuals and asset Managers to ensure the companies are taking an active role in helping to fight climate change.

And, of course, we see technology gaps to achieve a goal of net zero by 2050. That's almost three decades away and there's going to need to be a lot of innovation and new investments to get us towards net zero. Between now and then, we believe there's going to be significant demand from corporations, around the world, to offset those emissions that they can't reduce overnight. The Paris Agreement commitment and government commitments to reduce emissions will all lead to a significant growth in this industry.

Dr. Allen Alper:

Well, that sounds excellent. Could you tell us a little bit about the carbon prices and the carbon market?

Justin Cochrane:

When we look at carbon prices, on average, in the voluntary carbon market, there are around $10 a credit today. When we look at what is needed to achieve net zero by 2050, most people believe that price needs to be above $75 a credit, and I certainly share that view. So, we see a price that needs to go much higher and a price that's going to be regulated to go higher to meet Paris Agreement commitments. I love this commodity for that fact alone. We see the need for carbon removal technologies and direct air carbon capture and to make those projects economic, we need a much higher carbon price. We certainly believe, that over the next several years, we'll start to see that.

Dr. Allen Alper:

That sounds excellent. Could you tell our readers/ investors, a little bit about yourself, your Team, the Board and your advisors?

Justin Cochrane: Y

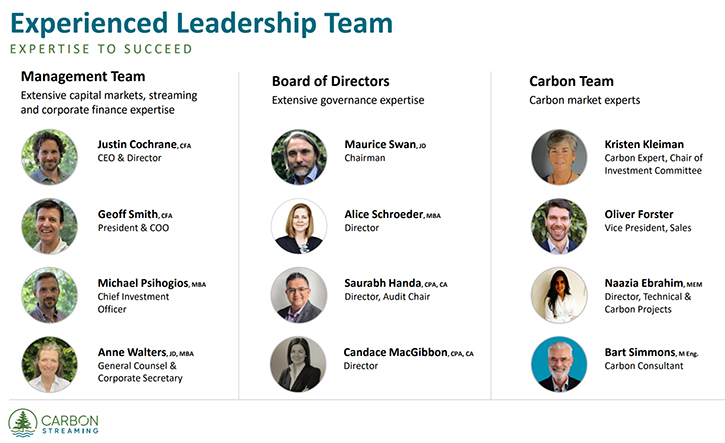

I'm the founder and CEO. My expertise spans the royalty and streaming business model, for over 15 years now I've raised and invested billions of dollars in this sector. I've surrounded myself, with an amazing Team. We have Mike Psihogios, our Chief Investment Officer, now running a Team of eight full-time individuals, who are focused on sourcing, negotiating, and executing on new investment opportunities. We've heavily invested in the investment Team.

Geoff Smith, who's alongside me, is our President and COO. An amazing former banker for Scotia, also focused on the royalty and streaming business. He joined us, back in October, and we couldn't be more excited to have him on the Team. Anne Walters is our General Counsel, who joined us in the middle of last year, and has been an amazing addition, in helping us navigate and negotiate contracts and develop sales contracts as well.

On the Board of Directors, we recently added Alice Schroeder, a former Wall Street Research analyst, in the insurance industry. She wrote Snowball, the Warren Buffett Biography. She brings a wealth of Board experience and she's been a tremendous addition to an already very diverse and very capable Board of Directors.

Then a Carbon Team that sits alongside us, we just added Oliver Forster to head up our Sales efforts, as we are expecting the delivery of upwards of 7 million carbon credits, delivered to us later this year. Oliver, along with many other consultants and employees make up our carbon Team of experts, who help us review and analyze and do due diligence on projects, as we are looking to make our investments around the world.

That's been a big change over the last 12 months, as we've really built up the Team and I couldn't be more excited about the quality of the individuals that we've been able to attract and very excited about the capacity that they now add, to really make this a successful business, for decades to come.

Dr. Allen Alper:

That’s excellent! Sounds like you have an extremely well-balanced Team, a source for funds, a source for knowledge of the capital markets, of the industry, it sounds so well balanced and so well experienced.

Justin Cochrane:

Yeah. I couldn't be more thrilled about the Team and very excited about what that means for the Company and how it positions us to succeed in the coming quarters.

Dr. Allen Alper:

Could you tell us a little bit about your capital structure?

Justin Cochrane:

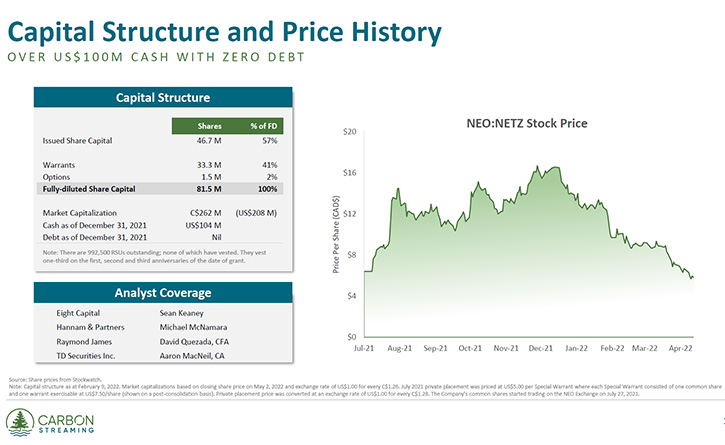

We have about 47 million shares outstanding and a share price of around $5 to $6 a share. We do have a number of outstanding warrants that are also publicly listed. All of this is traded on the NEO Exchange, under the symbol NETZ for Net Zero. We are sitting on over $100 million US, in cash, and so over $2 US in cash per share and very excited about the investment portfolio and our ability to build and diversify our suite of investments. We've seen some share price declines, in the last couple of months and we fully intend on reversing that, as we get some new investments under our belt.

Dr. Allen Alper:

That sounds very good. Could you tell our readers/investors the primary reasons they should consider investing in Carbon Streaming?

Justin Cochrane:

Yeah, a couple of key reasons. Investors should be looking at carbon as a new asset class that is highly uncorrelated, with other assets in their portfolio, whether energy or mining or consumer discretionary or other assets. This is an asset portfolio. This is an asset that's focused on climate change and climate change is not going anywhere. We encourage investors to think about carbon, as an asset class.

Following that, of course, Carbon Streaming, we have a first mover advantage. We believe we've acquired the best portfolio of assets, in the industry, by far. We also believe we have the best Team and the balance sheet to continue executing on our growth and our vision here, of building a diversified portfolio of projects and supporting climate projects, around the world. We have a world class Team that's going to make that happen. Looking at us today, it's a fantastic entry point for new investors. We are very, very excited about what the future has in store.

Dr. Allen Alper:

That sounds excellent. You are in a new frontier that's helping the environment and getting investors to be part of combating climate change and improving the world for everyone. So, that's excellent!

Justin Cochrane:

Thank you very much for that, Dr. Alper.

Dr. Allen Alper:

Is there anything else you'd like to add?

Justin Cochrane:

The only other key point is, as people who have followed our news will know, we have been pursuing a U.S. listing on the NASDAQ and while we're still subject to final regulatory approvals, we are hopeful that we can get that finalized here, in the coming months, and very excited to list on the U.S. Exchange and open ourselves up to a new suite of investors.

Dr. Allen Alper:

Sounds exciting! Really great! We’ll publish your press releases as they come out, so our readers/investors can follow your progress.

http://www.carbonstreaming.com/

Justin Cochrane, Chief Executive Officer

Tel: 647.846.7765

info@carbonstreaming.com

|

|