Max Tuesley, Managing Director, Culpeo Minerals Ltd (ASX:CPO) Discusses their New Copper Exploration and Development Company, with High-Grade Copper Systems, in the Coastal Cordillera Region of Chile

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 12/11/2021

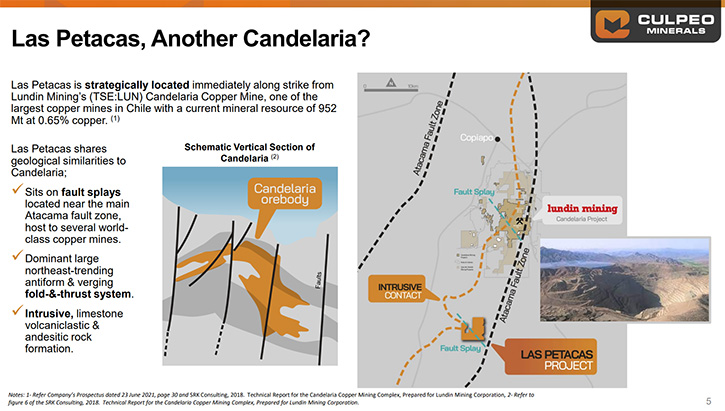

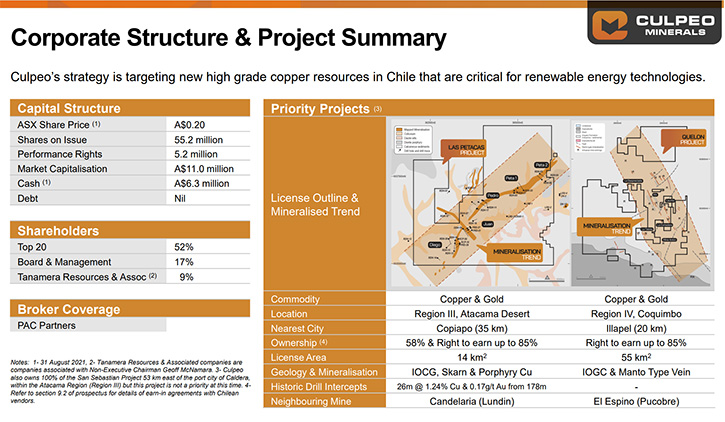

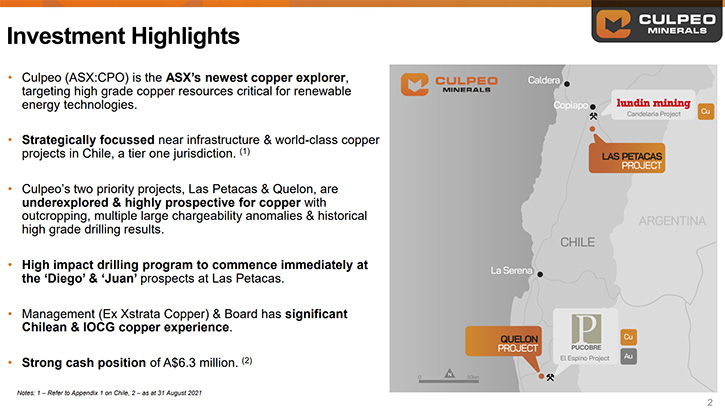

We spoke with Max Tuesley, who is Managing Director of Culpeo Minerals Limited (ASX:CPO), a new copper exploration and development company, with high-grade copper systems in the coastal Cordillera region of Chile. The Company’s flagship is the Las Petacas Project, located in the Atacama Fault System, near the world class Candelaria Mine, which is about a billion tons at 0.8% copper equivalents. The second project is an early-stage exploration project, called Quelon, located 240km north of Santiago. Near-term plans include geophysical work at Las Petacas and at Quelon, as well as drilling targets at Las Petacas, with first results expected in two weeks. Culpeo Minerals is expecting to be drilling at Quelon, as soon as early next year. The Company's San Sebastian Project is located about 30km east of the port city of Caldera, within Region III of Chile, close to the coast in the vicinity of an operating port and near a regional mining center, with three copper toll treatment facilities. According to Mr. Tuesley, Culpeo Minerals plans to drill first holes at San Sebastian, in the middle of next year.

Culpeo Minerals Limited

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Max Tuesley, Managing Director of Culpeo Minerals. Max, could you give our readers/investors an overview of your Company, and tell them what differentiates your Company from others and a little bit about your great copper projects in Chile.

Max Tuesley:

We're a reasonably new company, listed on the ASX in Australia. We listed on the 10th of September. So we've been operational now for just over a couple of months. We're a copper-focused Company, as you mentioned, with projects in Chile. Our manifesto is to explore the coastal belt of Chile, as opposed to the Andes. We believe there are a lot of opportunities in the coastal belt for medium size, higher grade copper deposits. Probably more akin to the IOCG style, than the porphyry copper deposits that you normally find in the Andes.

We like the coastal belt because it has a lot of infrastructure. It’s close to the coast, so you have opportunities there for desalinization of water. If you need water for your processing plants, electrical power is usually close by. We believe it's fairly underexplored. Chile historically has been the playground for the major mining companies, who have focused on the Andes and on the porphyry coppers. We believe that the moderate sized copper ore body, that the coastal belt is prospective for, has been overlooked by a lot of these majors, and that's why we're here.

There are not that many copper-focused companies on the ASX, so that's the sort of niche that we bring to the ASX, people looking to get into high-grade copper and people looking to get into Chile. We have three projects in Chile. We have our flagship project, Petacas, which is about 30 kilometers south of Copiapo City, 20 kilometers south of the large Lundin mining operation, Candelaria, and has about a billion tons at 0.8% copper equivalents.

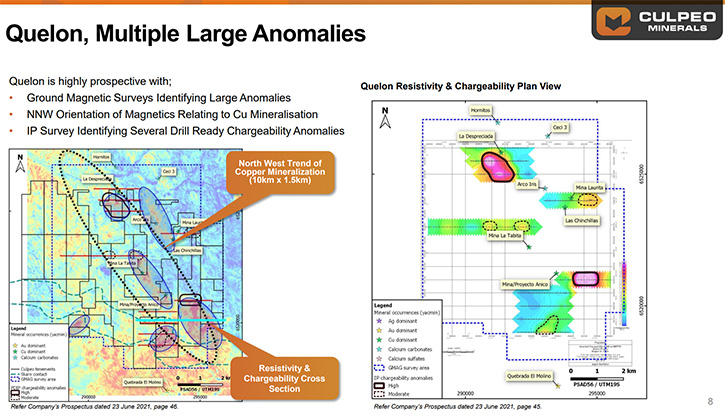

Our second project, Quelon, is a little bit farther to the South. It's about halfway back to Santiago, just south of the town of La Serena. That project is also very prospective for IOCG style deposits. Our third project is a smaller project, called San Sebastian, which is centered over an old mining claim. So, it was an old operational underground mine, quite high-grade. That project's north of Copiapo, not far from the coastal town of Caldera. So, those are our three projects.

Dr. Allen Alper:

That sounds excellent, sounds like you have some very great projects, with excellent potential, in a great region. Could you tell our readers /investors a little bit about your plans for the rest of 2021 and going into 2022?

Max Tuesley:

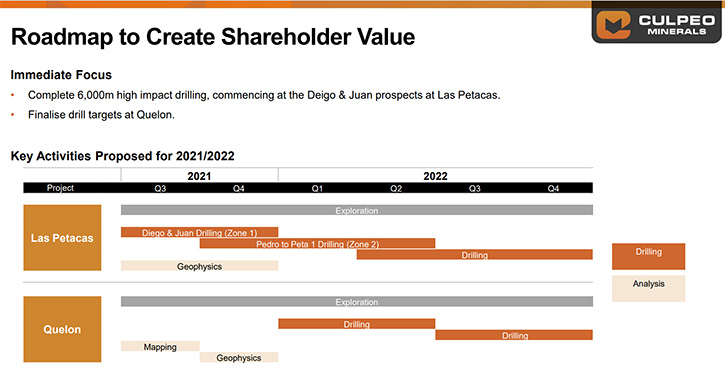

With Petacas, that project had been previously explored by a couple of other companies, so there had been some drilling done. Quite a lot of significant intercepts there, but not a lot of infill and not a lot of taking it to the next step. That's where we saw the opportunity, mineralization over a strike length of six kilometers. We've already mobilized a drill rig to that project. We're drilling at Las Petacas now. We've sent the first lot of samples away for assays and we hope to get those results back in the next couple of weeks. We're also doing an extensional geophysical survey there.

We recently announced the results of the Gradient Array IP Survey, there at Las Petacas, which identified some additional significant targets there. We're following up that Gradient Array IP Survey, with some Dipole-Dipole IP, which enables us to see a little bit deeper into the rock and using all of that data to help us position the next lot of drill holes. In the next couple of weeks, we should see some results coming back from the assays.

We will also see some results coming back from the geophysics at Las Petacas. With Quelon, we hope to be there by the end of the year, doing some geophysics. There have been previous IP done at Quelon and it was pretty spotty in the positioning of the IP. The results were very, very exciting, but they didn't follow that up with a second survey. We're going in there and we're going to do quite a bit more IP and then if the targets are there, we will be mobilizing the drill rig there.

We hope to have that happening by end of the year, but it may be early next year for the actual drilling. We're using a multi-pronged approach to both these projects, geophysics, geochemistry and obviously doing the drill program as well. Over the next six months, once we get all the results of the geophysics, we will be drilling in both of those projects. And probably going up the San Sebastian, middle of next year, to drill some holes into that project as well.

Dr. Allen Alper:

It sounds like it's going to be a very exciting time for your shareholders and stakeholders, in the months ahead, as you get more and more results that will be very interesting.

Max Tuesley:

Yeah, absolutely, we should have a lot of good news flow coming. What we like about these projects is that all of the projects have outcropping copper mineralization there, substantially underexplored. They're also in areas of proven discoveries. I think we've been lucky to pick up these projects, in the areas that they do fit in.

Dr. Allen Alper:

It sounds excellent. Max, I noticed that you have great experience, and your Team and your Board have a proven track record. I wonder if you could tell our readers/investors a little bit about yourself, your Team and your Board.

Max Tuesley:

I'm a geologist, who originally cut my teeth in Australia. I've spent the last 15 years working internationally, with a focus on copper and gold. I've spent a lot of time in the Philippines, Mongolia and Northern Africa in Sudan. This was an opportunity for me to use those geological skills that I've acquired, particularly with the focus on copper, both IOCG and porphyry style. That was why I became involved in the project, when I saw the potential of the tenements that we do have, I was pretty excited to join the group.

The other Directors are a mixture of geologists and mining engineers, plus obviously our lawyers, who sit on the Board, as the joint secretaries. The other Directors have had quite a lot of experience in Chile. So, they've built up an in-country network, which has enabled us to see a lot of projects that have come across the table, that maybe are not exposed to other organizations.

I think we've been lucky, in that respect, that we have that in-country experience. We've been able to look at projects first and make a decision on the quality of those projects. So, we do see a lot of projects, but we really only focus on the ones that meet our criteria, which is known mineralization, in areas of very high prospect activity and areas of infrastructure, and located in that coastal belt.

Dr. Allen Alper:

Sounds excellent! Could you tell our readers/investors a little bit about your share and capital structure?

Max Tuesley:

When we did the capital raise, we raised $6 million on the ASX. We still have about $5.5 million left. Obviously, we had a few expenses coming out of the IPO. Those shares are fairly tightly held by early investors that have come into the pre-IPO and also the Directors and Management. With that $6 million raise, we had 30 million shares listed at the IPO. Plus, there were some previous shares, on the market, from early investors. We have about 56 million shares on the market, tightly held.

Thirty percent of those shares are in escrow, so not a lot of shares out there trading. So that's pretty good. We're not seeing the fluctuation in shares that some of these guys that are a bit more diluted do see. It gives us a market capitalization of about 11 to 12 million. We believe that's pretty good value for people looking to get into a copper-focused company, with projects in Chile.

Dr. Allen Alper:

It sounds great that Management and the Board have skin in the game and are invested in the Company.

Max Tuesley:

Yes, absolutely. Management is very supportive of the projects and pretty keen to progress these projects into the resource definition stage and hopefully into the feasibility stage, if the resources are there.

Dr. Allen Alper:

Well, that sounds excellent. Max, could you tell our readers/investors the primary reasons they should consider investing in Culpeo Minerals?

Max Tuesley:

We believe we offer investors a chance to get into that copper exploration sphere. Chile is the number one copper producer in the world. It's a very good Country in which to do exploration. They're very understanding of mining and exploration, because it's such a large part of their economy. If you're going to explore for copper, I think Chile's a good place to be. We're definitely copper-focused, particularly on the ASX, there aren’t that many companies that are actually focused on copper. Given the fact that we've hit the ground running, we're already drilling our projects, advanced enough to have these walk-up drill targets. I think investors are going to see quite a lot of news flow coming out, in the next 6 to 12 months. We intend to bring some pretty interesting results to the table.

Dr. Allen Alper:

That sounds excellent. Max, is there anything else you'd like to add?

Max Tuesley:

I appreciate the interview with you today. I'll be very happy if people take the opportunity to invest in Culpeo. I’d like to see some new investors come on to the shareholding list. Obviously, we intend to make the most of it over here in Chile.

Dr. Allen Alper:

Sounds excellent! We’ll publish your press releases as they come out, so our readers/investors can follow your progress.

https://www.culpeominerals.com.au/

Max Tuesley

Managing Director

E: max.tuesley@culpeominerals.com.au

P: +61 (08) 9322 1587

|

|