Paul Lock, Chairman and Managing Director, Pan Asia Metals (ASX: PAM) Discusses Being a Battery and Critical Metals Explorer, Developer and Producer, with Lithium and Tungsten Projects in Southeast Asia, Thailand

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 12/3/2021

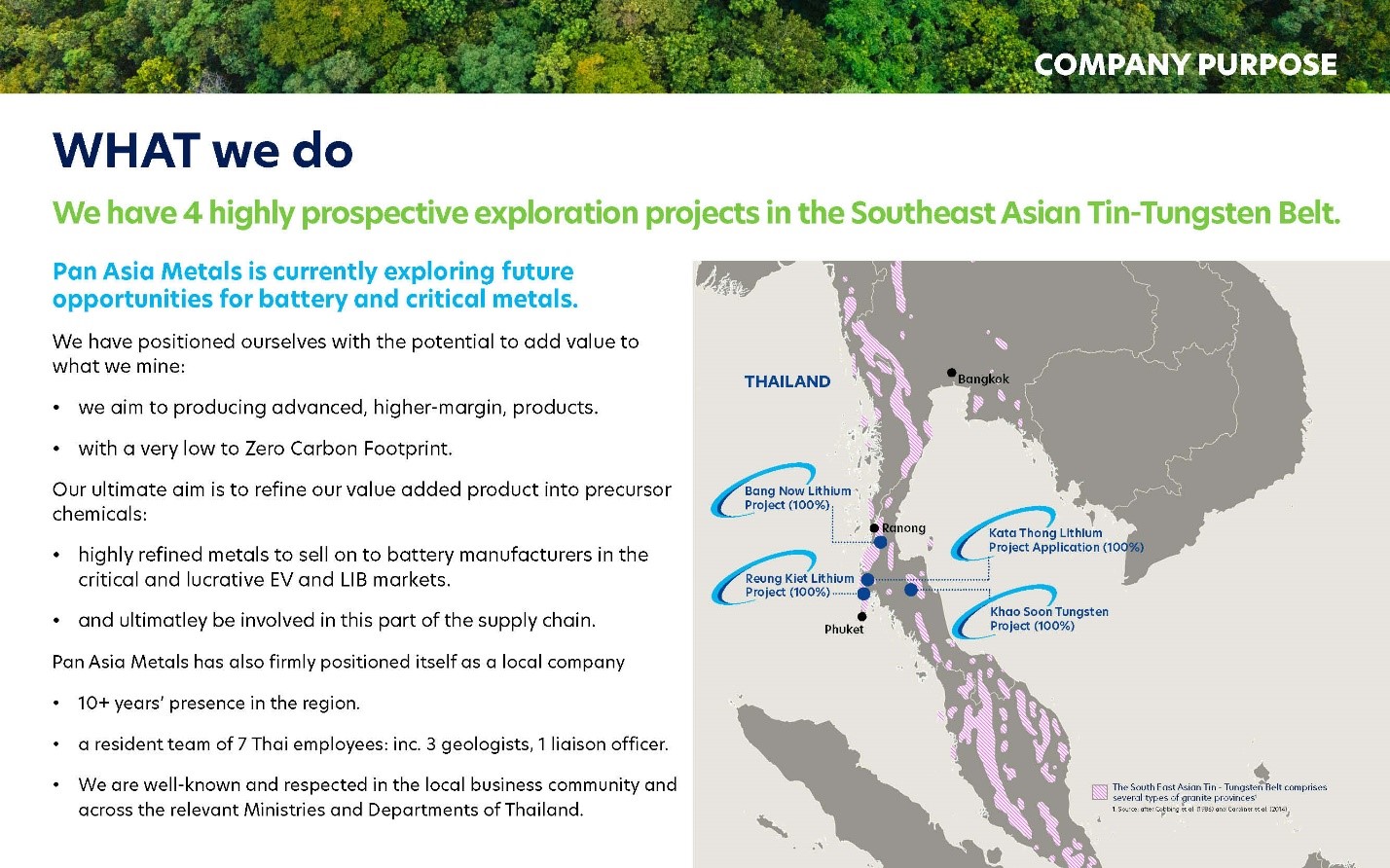

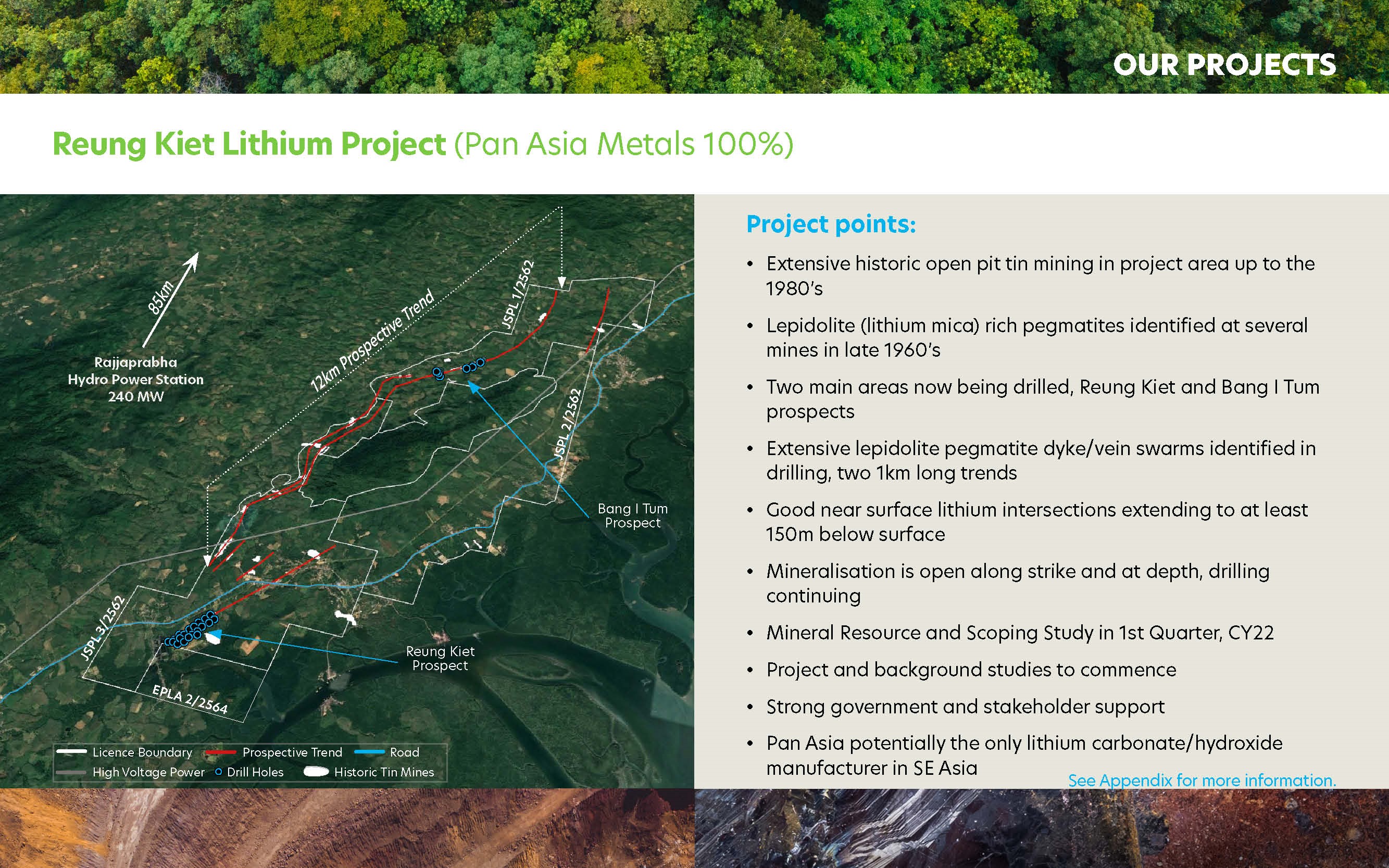

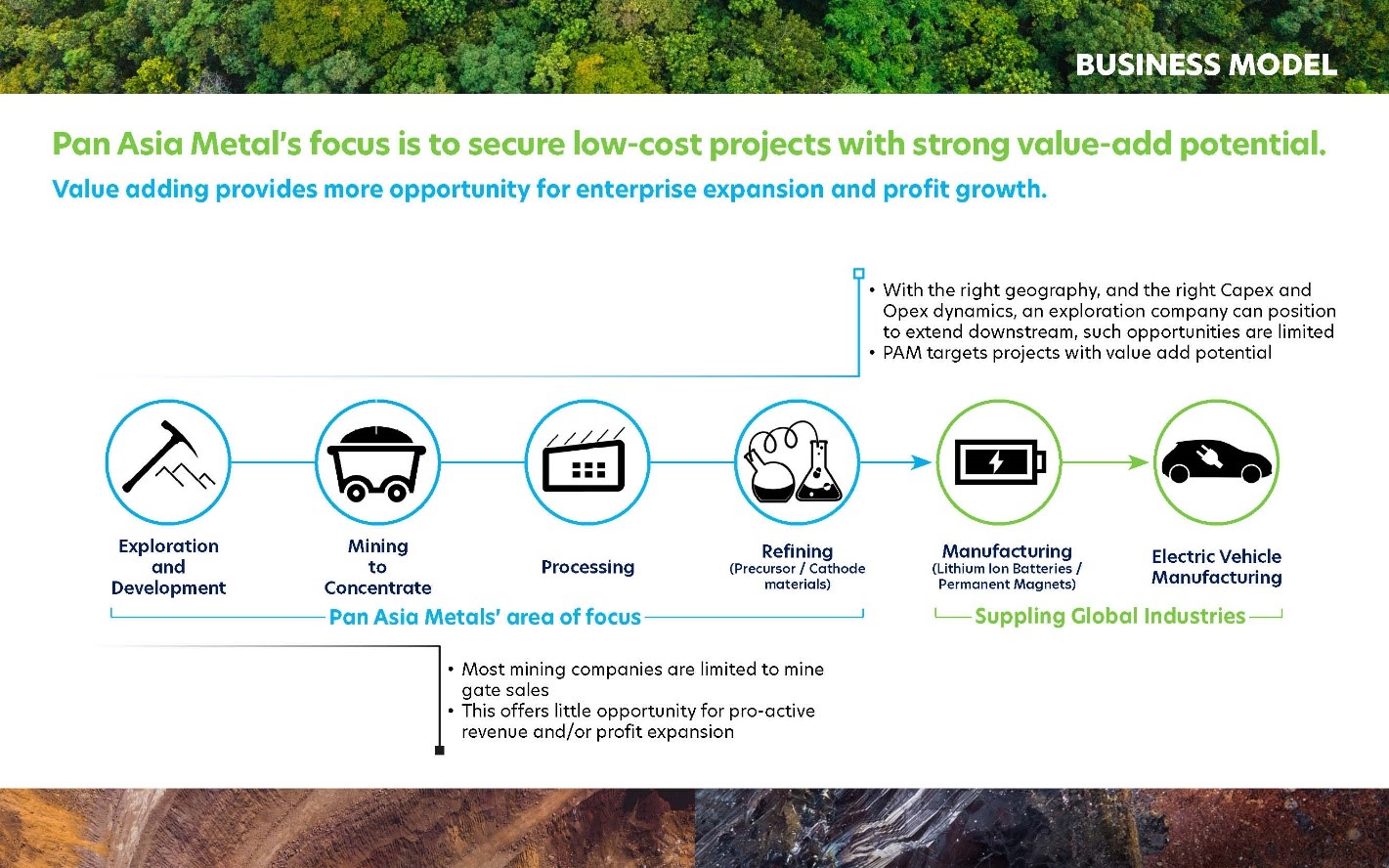

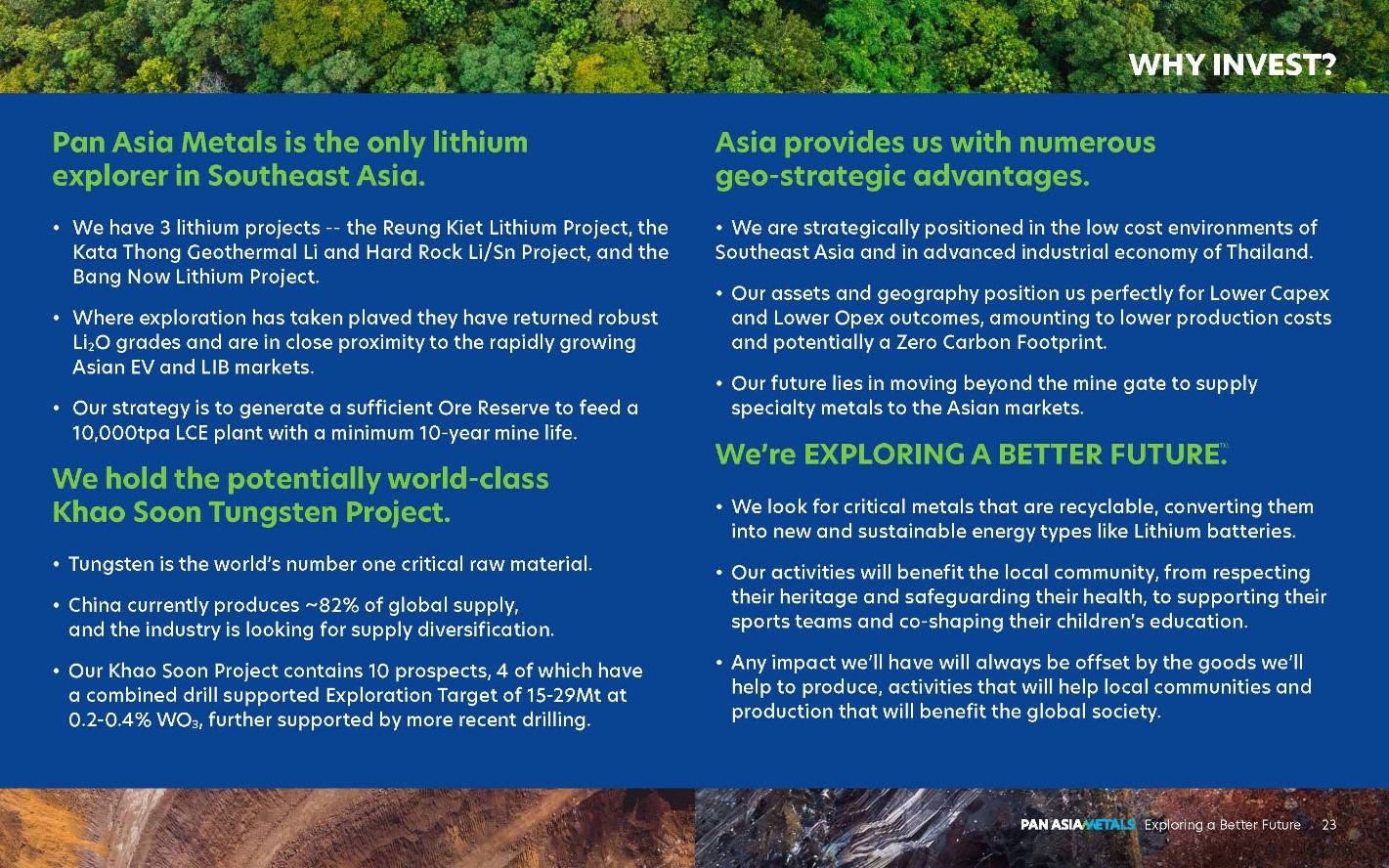

We spoke with Paul Lock, Chairman and Managing Director, Pan Asia Metals (ASX:PAM). Pan Asia Metals is a battery and critical metals explorer and developer, with a strategy of developing downstream, value-added opportunities, situated in low-cost environments, proximal to end market users. Pan Asia Metals owns lithium and tungsten projects, in the Southeast Asian Tin-Tungsten Belt, in Thailand. The Company's flagship project is the 100% owned Reung Kiet Lithium project, located about 70km north-east of Phuket, in the Phang Nga province, in southern Thailand. PAM's objective is to continue drilling, with the aim of reporting a JORC-compliant Mineral Resource, early next year, that will be used as part of a scoping study that plans to consider initial production of up to 10,000 tpa of LCE and associated by-products.

Pan Asia Metals

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Paul Lock, who is Chairman and Managing Director of Pan Asia Metals. Paul, could you tell our readers/investors about your two major projects; lithium and tungsten resources in Thailand?

Paul Lock: Thanks Allen, good to be talking with you. Pan Asia Metals is all about Exploring a Better Future™. We have three lithium projects and one tungsten project. The Reung Kiet Lithium Project is our primary project, where we are currently drilling to deliver a Mineral Resource, in accordance with JORC 2012 early next year. We expect that'll be ready by the end of January, early February, to be followed closely by a Scoping Study.

Our objective, at Reung Kiet, is to build a sufficient Mineral Resource to supply a 10,000 ton per annum lithium chemical plant, for a minimum of 10 years. We will follow through with a Preliminary Feasibility Study and then Definitive Feasibility Study. In parallel, we'll continue to drill some other prospects to expand the Mineral Resource. We are yet to decide whether to produce battery grade lithium carbonate or lithium hydroxide, battery formulas are a moving feast, and this decision will likely come down to partner preferences and specific regional requirements.

We also have the Khao Soon Tungsten Project, which we've held since 2014. Our license has just renewed. This would be one of the larger and most prospective tungsten projects, in the global peer group. We have over 10 kilometers of strike and we have drilled four of 10 target prospects, producing a drill-supported, exploration target of 15 to 29 million tons, at 0.2 to 0.4% WO3. This is all shallow drilling, down to about a hundred meters and the results, thus far, suggest an open pitiable style deposit.

We have started some metallurgical test work. On the back of this work, we plan infill drilling, with the aim of delivering an augural Mineral Resource in accordance with JORC 2012. The key to this project is the historic Khao Soon Tungsten Mine, available information suggests an average head grade of 2 to 4% WO3. Mining was only to about 100 meters in depth, and uncoordinated. Government geophysics suggest that the mineralisation is the result of breccia pipes, emanating from a granite intrusion, about 1 km below surface, so Khao Soon has the potential to be one of the richest and most interesting tungsten projects, in the global peer group. But at the moment our key objective is the Reung Kiet Lithium Project.

Dr. Allen Alper: Well, that sounds exciting. Could you tell our readers/investors, your primary goals, going into 2022?

Paul Lock: First and foremost, our primary goal is to deliver a Mineral Resource at Reung Kiet, followed by a Scoping Study first quarter 2022. We expect to deliver a Preliminary Feasibility Study in late 2022.

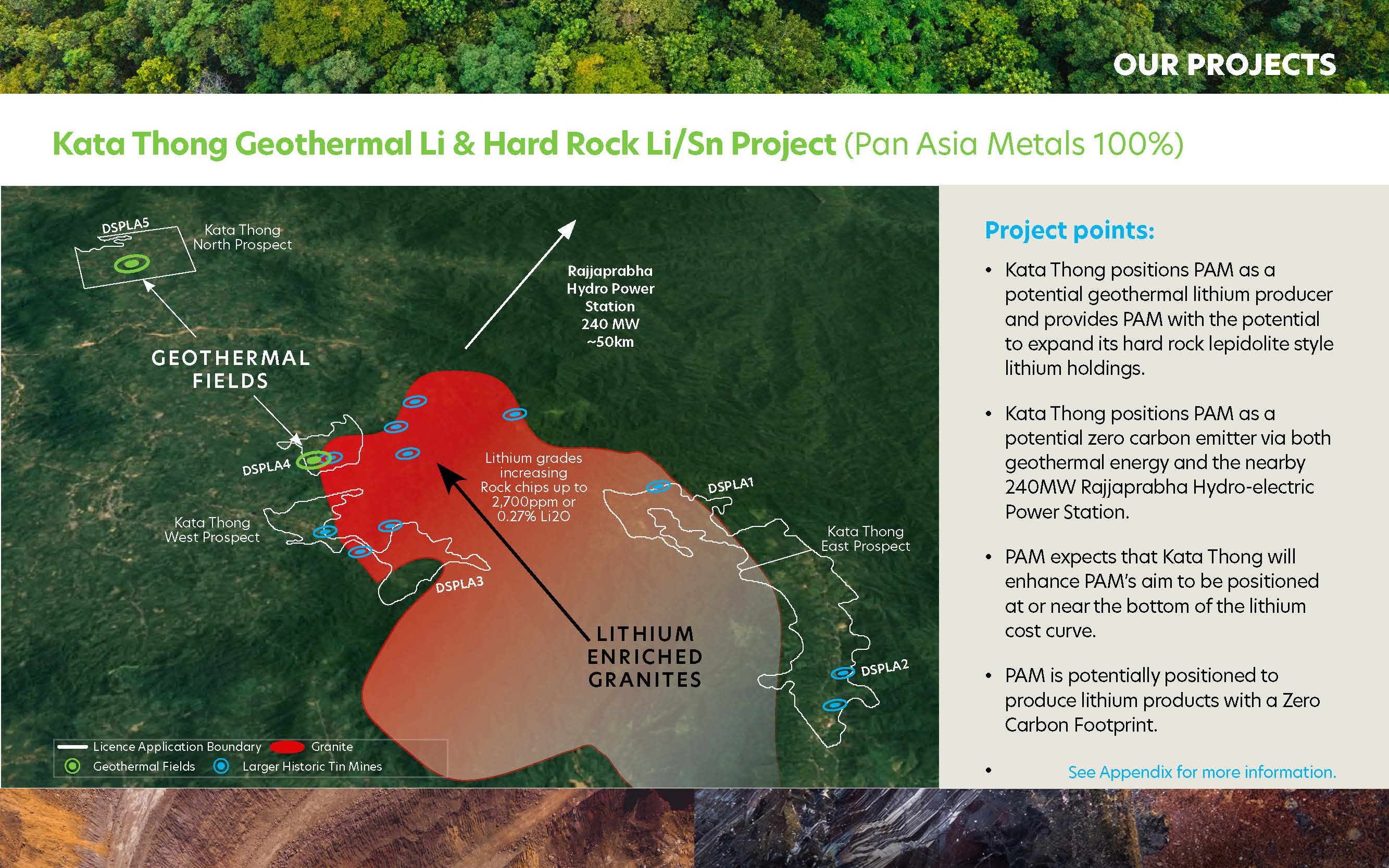

Further to this, we recently announced the Kata Thong Lithium Project, which is located to the north of Reung Kiet. It is a hard rock lithium project, and we expect secondary tin. There are a lot of old tin mining areas, in the application area, although our target is lithium.

Also, we have two geothermal fields in the application area. Four of the five application areas surround a granite intrusion, with rock chips up to 0.27% Li2O. We are targeting the pegmatites in and around the granite. One of the geothermal fields, in the application area, abuts the granite, which is quite exciting. We are looking for hard rock lithium and we have the potential for geothermal lithium.

Dr. Allen Alper: Oh, that sounds excellent! Paul, could you tell us a little bit about yourself and your Team?

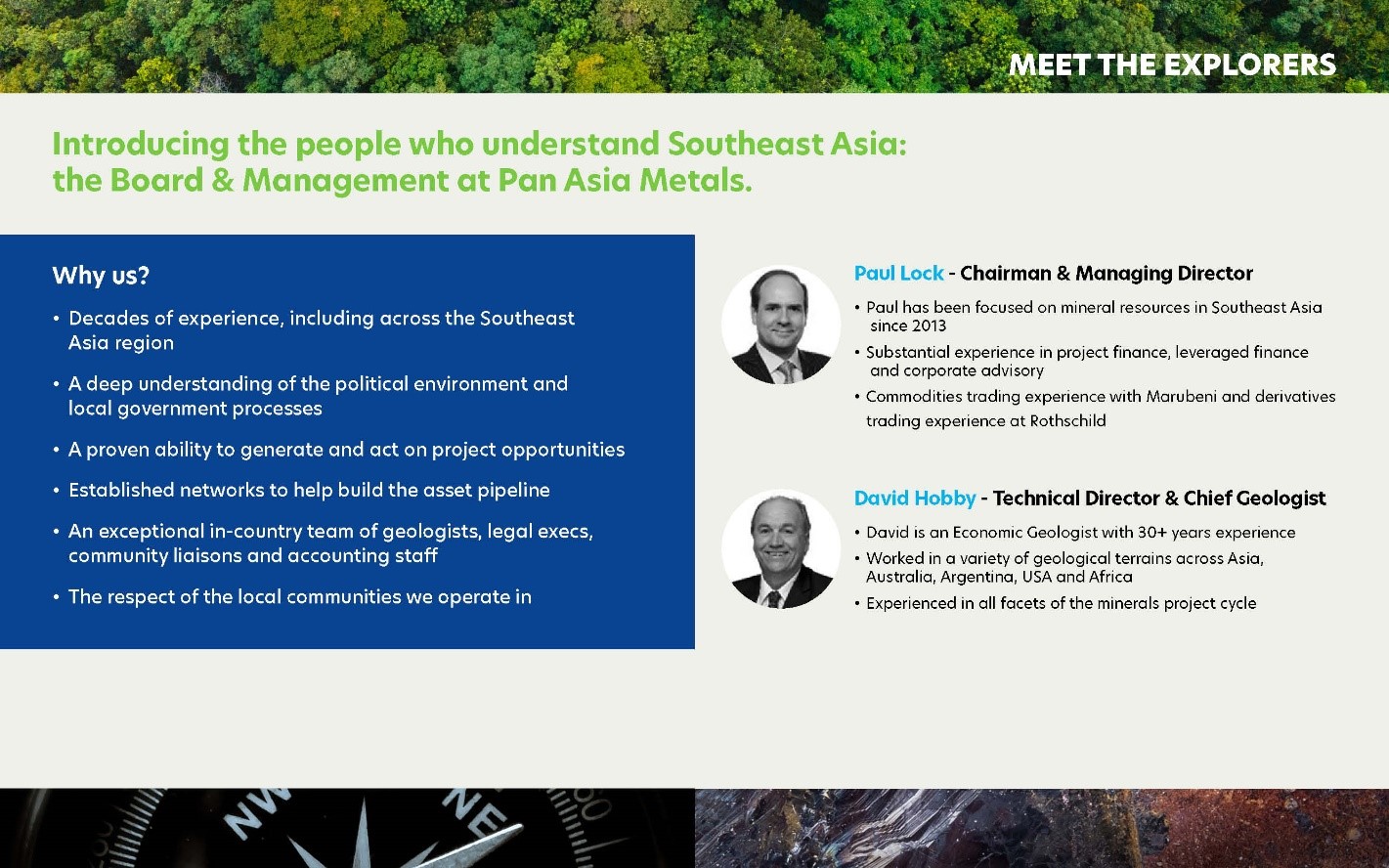

Paul Lock: David Hobby, the Technical Director & Chief Geologist and I have been working in Southeast Asia since late 2012. We've been a Team during that time, and we've been primarily focused on the Southeast Asian tin tungsten belt. It's a very rich granite belt, which extends from southern Myanmar through peninsula Thailand and peninsula Malaysia to the Tin Islands in Indonesia. This belt contained two of the largest tin producing regions in the world, Perak in Malaysia and PhangNga in Thailand. Our projects are located in PhangNga and to the north, we are targeting lithium in this belt. We have been working on this belt for over eight years, as well as elsewhere in Asia.

In addition to the assets in our portfolio, we expect to bring additional opportunities. We're a tight-knit Team with a Thai workforce, our head office is in Bangkok. We have three Thai geologists and accompanying field staff. As a result, we're very close to our communities. Even though we're targeting an initial 10,000-ton lithium chemical plant, using ore from Reung Kiet, we want to expand to 20,000 tons of lithium chemical production, per year, in SE Asia and we hope to bring in additional assets, which would allow us to move that to 40,000 tons. These are aspirational targets, but we know the region very well. We think we can achieve this.

Dr. Allen Alper: Well, that sounds excellent. Could you tell our readers/investors a little bit about why lithium and tungsten and tin are so important?

Paul Lock: Well, from our perspective, we're aiming for projects, which will allow us to move past the mine gate and value add. With both our lithium and tungsten projects, that's a deliverable. We think we can achieve this without a huge CapEx spend. Moving past the mine gate and producing a metal, or a chemical, means APT from our tungsten project and either lithium carbonate or hydroxide from our lithium projects. Why do we want to do this? For lithium, this approach gives Pan Asia exposure to the CAM market, the cathode active material market. If we're producing CAMs we are then positioned for opportunities, which will allow us to move further downstream.

This also applies to tungsten and APT. We want exposure to the tungsten chemical market. If we're producing APT, then we can achieve this. This opportunity is not available to many projects. One of the key reasons we can is that we are in Southeast Asia, we're in a low-cost operating environment, which is essential. So, with all of our projects, we need to see the likelihood of being positioned in the lower third or quarter of the cost curve. Also being in Asia and in Southeast Asia, we are proximal to key industrial centers. All of our inputs are nearby for processing, and we are right in the middle of our markets.

In fact, we have the only lithium projects in Southeast Asia. In Thailand, we sit in between the emerging Indian market for batteries and EVs, the emerging Thai market for batteries and EVs and the established east Asia market, China, Korea, Japan, and Taiwan for batteries and EVs. So, we are right in the thick of our market and I think that positions us better than most lithium companies globally.

Dr. Allen Alper: Well, that's excellent. It's excellent to be in such a great position, located in such a great area.

Dr. Allen Alper: Could you tell our readers/investors a little bit about your share and capital structure. I could see that you and your Management Team have a lot of investment in your Company, and it's excellent to see the Management Team aligned with shareholders.

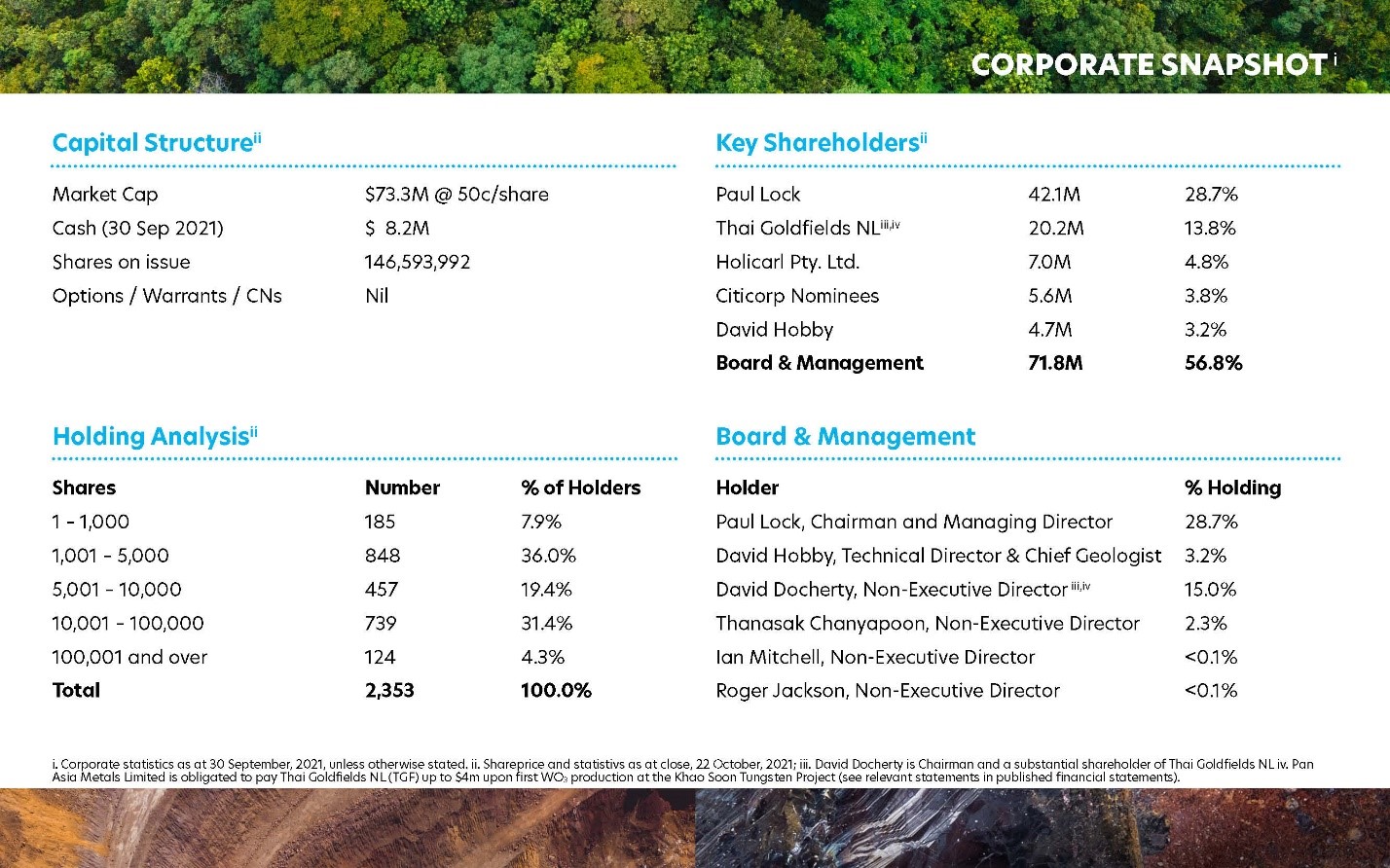

Paul Lock: David Hobby and I, when we started this, we purposely kept the Company private, for as long as possible, because most of the dilution happens at the front end of a project, particularly if you have a couple of bad turns during exploration. So, we wore that risk ourselves. And once we'd completed drilling, that's when we went to the capital markets. We are focused on having a very clean capital structure, there are no options or warrants, just shares.

We have about 147 million shares on issue, but no options or warrants. And we want to keep it that way because what we find is that once you start issuing options and warrants, then for every capital raising thereafter, everyone wants the same, and fair enough. But if we can avoid this and keep our capital structure tight, then it’s going to be to the benefit of all shareholders.

The Directors have just under 50% of the share capital. We are in escrow until October 2022. But our objective is to build a Company. We're not here lining our pockets with big salaries and bonus share and option arrangements. We're completely aligned with shareholders, and we think we can build a great company, which will deliver value for all stakeholders.

Dr. Allen Alper: Oh, that sounds excellent! Paul, could you tell our readers/investors, the primary reasons they should consider investing in Pan Asia Metals?

Paul Lock: Well, when an investor looks at an exploration or development company, I think the first consideration should be where that company sits, or where it can potentially sit, on the cost curve - because at the end of the day, it's your cost structure that will drive your funding options. Investors should be looking for companies, with projects, which have the potential to be in the lower third or quarter of the cost curve, these projects have greater potential to be banked, all else being equal.

There are some fantastic projects out there, which sell a concentrate. Our differentiator is that we have the potential to move past the mine gate, into lithium chemicals. This is essentially set in stone and as a result we have the potential to move past lithium chemicals and into CAMs. What generally happens is that the hurdles into a concentrate project are fairly low, and as the market heats up, it is the concentrate market which tends to get swamped first, when you're further downstream your margins tend to be better protected. So, investors should look at this closely.

A third point is that we're completely aligned with investors. We're all facing the same direction. Investors can take comfort in the fact that every time we do something that involves share dilution, we want to make sure that the dilution results in some sort of value accretive outcome, whether it’s the process route we choose, an acquisition or some other purchase. So, shareholders have the comfort that every time we do something wrong, it hurts us just as much as it hurts them.

Dr. Allen Alper: That sounds excellent. Paul, is there anything else you'd like to add?

Paul Lock: I think I've covered most of the points, but one important point is that Thailand, where we operate, is a low cost advanced industrial economy and is the fourth largest auto producer in Asia and the largest in Southeast Asia. Thailand has a comprehensive EV and LIB policy. The Thai government wants to retain its leadership position in auto production in Asia. And the way to achieve this is to encourage EV and LIB battery production.

Thailand is offering EV and LIB companies a range of incentives, including lengthy tax incentives, tax exemptions on imported machinery and so on. Mercedes, BMW and Toyota are some of the auto manufacturers already producing PHEVs and EVs in Thailand. Toyota recently moved its Prius battery recycling facility from Belgium to Thailand, which suggests that they're getting pretty serious about battery production in Thailand. So, it is an emerging EV market.

Just recently, one of the big-listed companies in Thailand, PTT, announced a JV with Foxconn, the Taiwanese Company, which manufactures Apple’s iPhone in China. They are investing up to 1 billion dollars each into the JV and they’re planning to produce Foxconn’s EV platform in Thailand. Honda has also announced that it is considering an LIB battery plant in Thailand and there are plenty of other large-scale initiatives on foot. As an emerging lithium chemical producer, we are positioned perfectly to take advantage of what's happening in this market.

Dr. Allen Alper:

A very compelling reason for our readers/investors to consider investing in Pan Asia Metals! That's excellent! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://panasiametals.com/

Paul Lock

Pan Asian Metals Limited

Managing Director

paul.lock@panasiametals.com

|

|