Seamus Cornelius, Executive Chairman of Danakali Limited (ASX: DNK, LSE: DNK) Discusses the Best Undeveloped SOP Project in the World, Capable of Producing a Million Tons of SOP for 200 Years

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/14/2021

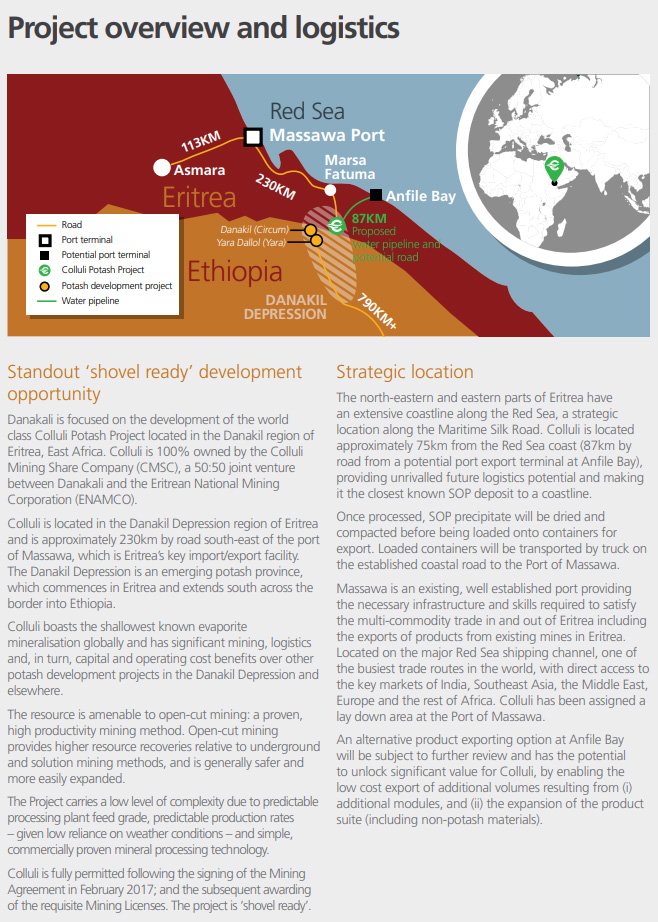

We spoke with Seamus Cornelius, who is Executive Chairman of Danakali Limited (ASX: DNK, LSE: DNK). Danakali is focused on their Colluli Sulphate of Potash (SOP) project, located in Eritrea, East Africa, about 75 km from the Red Sea coast, making it one of the most accessible potash deposits globally. The resource is amenable to open pit, which is safer that underground mining, and allows for higher recoveries. It allows for low energy input, high potassium yield conversion to SOP, using commercially proven technology. The salts at Colluli are in solid form, which reduces infrastructure costs as well as the time required to achieve full production capacity. SOP carries a substantial price premium, relative to the more common potash type, MOP.

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Seamus Cornelius, who is Executive Chairman of the Danakali, Ltd. Seamus, could you give our readers/investors an overview of your Company and what differentiates your Company from others? Also Mark Riseley, Head of Corporate Development, Danakali, Ltd. will be participating in the interview.

Seamus Cornelius:

The Company is Danakali Limited. We’re on the ASX and we're developing the Colluli Potash Project in Eritrea. We are at the very northern end of the Danakil Basin. What distinguishes us from other Companies is actually the project, Colluli Potash. Everything that's special about us is directly related to the fact that Colluli Potash, as a deposit, as a source of raw material for the making of sulfate of potash (SOP) is truly unique.

I know in the industry, a lot of people talk about that all the time, but Colluli Potash is unique. It’s the largest, the highest grade, the shallowest, the closest to a port. Therefore, I would say it is the best undeveloped SOP project in the world. It's capable of producing a million tons of SOP for 200 years. To put it in context, a million tons of Colluli Potash is about 15% of the world's annual demand. It is a massive, exceptional, unique deposit. That's what makes Danakali unique.

Dr. Allen Alper:

That sounds excellent. Could you tell our readers/investors a little bit more about the project?

Seamus Cornelius:

We discovered the project in 2009. It was known that there would be potash salts in the Danakil Basin, from previous work, dating back to before the Second World War, when it was part of an Italian colony. There was small-scale potash, salt mining, going on there. The Danakil Basin itself has been known as the source of salt for thousands of years. People still take salt out of the Danakil. But what makes this project special is its size and its grade. I've already mentioned 200 years, at a million tons a year, of SOP production.

The grade of our product, K2O, sitting in the ground is 12% on average. If you want to compare that to something else in the industry that other people are talking about, these brine type of deposits, those deposits are always under 1%. And some of them in Australia, are 0.3%, 0.6%, 0.7%. In any mining or natural resource extraction project, the saying is “The Grade is King.” We have 20 to 40 times higher grade than anyone else and it's already sitting there in solid salt form.

This is really important because people often get confused by the idea that extracting potassium salts for fertilizer from a brine is easy. It's actually not. There's no evidence to suggest that it's easy. All there is, is marketing spin to suggest that it's easy, but all of the evidence tells you it's not. Whereas in our case, the evaporation has already happened. So, we will be digging it up, in an open pit mine, with surface miners, this is the salt that we will process into the SOP.

We're doing it in a joint venture, with ENAMCO, which is the Eritrean National Mining Corporation. We're in a 50/50 joint venture, with them. We're very happy about that, they are very good partners for us. As we go forward, and I'm not talking about 200 years from now, I'm talking about the next 10 or 20 years. It's really important that when you have a natural resource project, the people most closely connected to the project are the people in the country where the project is and the people who use the product, which in our case that is a very high-grade fertilizer, can see the direct benefit from the project.

Being in a 50/50 joint venture with the Eritrean National Mining Corporation, helps us deliver on some of those aspects. The other key thing that we often hear about now is ESG. This is become a big topic. Fortunately for us, our partners and the government of Eritrea are 100% behind the idea that not only is Colluli today the best deposit in the ground, when it's developed, it needs to be the best, most profitable and most important SOP project in the world. Our product, our fertilizer will change agriculture across Africa and in the Middle East. So, it's fundamentally important. It's not a normal project.

Mark Riseley:

Seamus, how about talking about the jurisdiction, which is something worth talking about.

Dr. Allen Alper:

That sounds great, yes.

Seamus Cornelius:

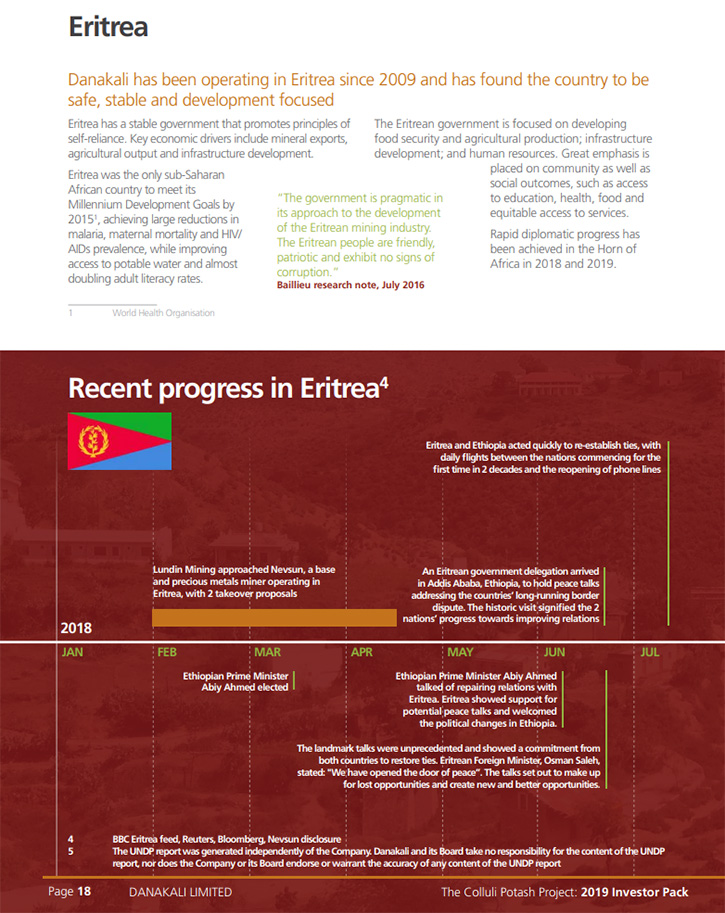

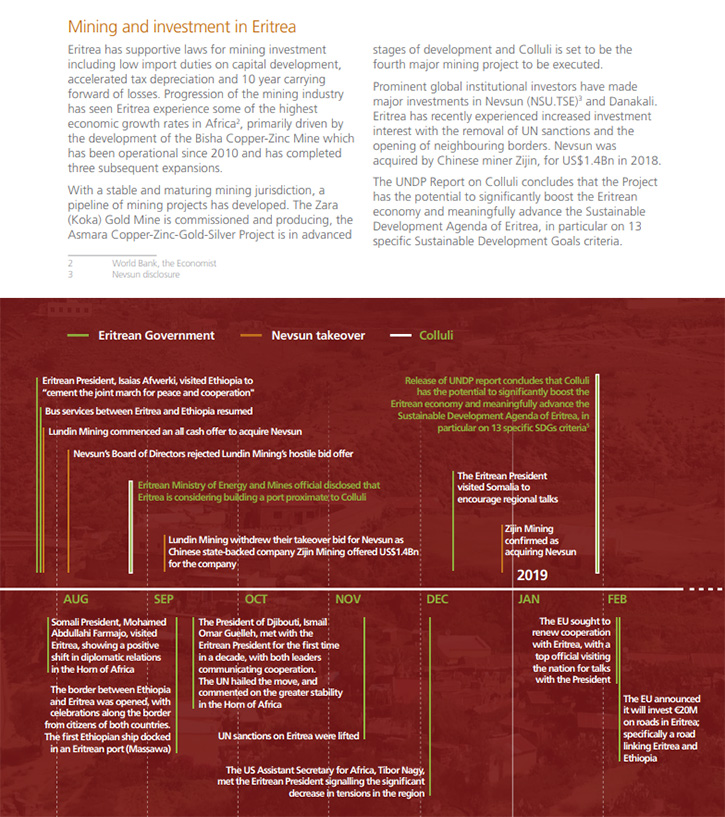

I mentioned we're in Eritrea. Eritrea is not a well-known jurisdiction, and I would emphasize the difference between being not well known or not well understood and how that impacts project risk. Lack of knowledge has no impact whatsoever on risk. The thing that happens in Eritrea is that there have been only three mining projects, developed in Eritrea, up to this point. Colluli will be the fourth. If you look at the facts, those three projects have been developed very, very successfully.

There is only a history of success, in Eritrea, when it comes to foreign investment in mining projects. The first project was Bisha, that was owned by Nevsun. They developed it in a joint venture, with an ENAMCO. They took it from Greenfields, all the way through to what it is today, which is a very large-scale copper zinc mine. But it started its life as a gold mine. So, it's a polymetallic deposit. Nevsun was able to develop that. They we're able to take out their profit. They were able to pay dividends to all of their foreign shareholders.

Then ultimately, the foreign-listed company, which was Nevsun, listed in Canada, was taken over by a major Chinese corporation for $1.4 billion U.S. So very successful! And it still operates today, that mine is still going on. The next project was the Zara Mine, that was taken over by another Chinese corporation for US$70m, right at the point where Danakali is now, interestingly enough. Which is after all the studies have been done and right at the point when you're starting the mine development. Another very successful outcome!

The third one is the Asmara Project, which is a copper project. It's, as its name suggests, very close to Asmara, which is the capital of Eritrea, up on the highlands there. And it also was taken over at the same stage where we are now for US$60-65m. So, nothing but success! In addition to those projects, there have been dozens and dozens of mining exploration projects that have been foreign invested, foreign development. They haven't turned into economically viable deposits, but that's totally normal in mining. If you look at some of the various rating agencies around the world, to talk about ease of doing business and a mining jurisdiction, Eritrea ranks very, very well because it is a very good jurisdiction.

The regulations are clear, there is zero corruption there and that is a really important point, given that Eritrea is in Africa. People often associate those two things. To associate that with Eritrea is completely wrong. The rules are clear, the rules are transparent. And I think most importantly, the same rules apply to everybody. There are no special deals in Eritrea, no project gets treatment that another project does not get. So, the rules are the rules and that's how they get applied. You don't get tax holidays; you don't get special breaks. The rules apply clearly and transparently.

If I can just talk about ENAMCO very briefly. What people really don't appreciate is that because ENAMCO is the dedicated partner for all foreign invested exploration and mining projects, they are a very experienced set of mining executives, a Team of people who have been through dozens of exploration projects. They've had a small number of them turn into development projects, so they've been through the development. They've had a small number of those turned into operating mines, which have usually started with open pit and then either being planned to go underground or starting to go underground.

They've been through offshore acquisitions; they've been through onshore acquisitions. They’re experienced purely objectively. It would stack up against pretty much any other mining executive Team around the world, because ENAMCO has been through it dozens of times; every phase of what you would expect from mining exploration, all the way through the corporate transaction. They were a tremendous partner for us, really helpful. We couldn't be happier. The only thing that would make us happier is if we had all the funds we need to commence the development of the project immediately, tomorrow. That's the only thing that would make me happier.

Mark Riseley:

Can you talk a bit about the market potential and proximity to markets, plus also the use of SOP versus MOP?

Seamus Cornelius:

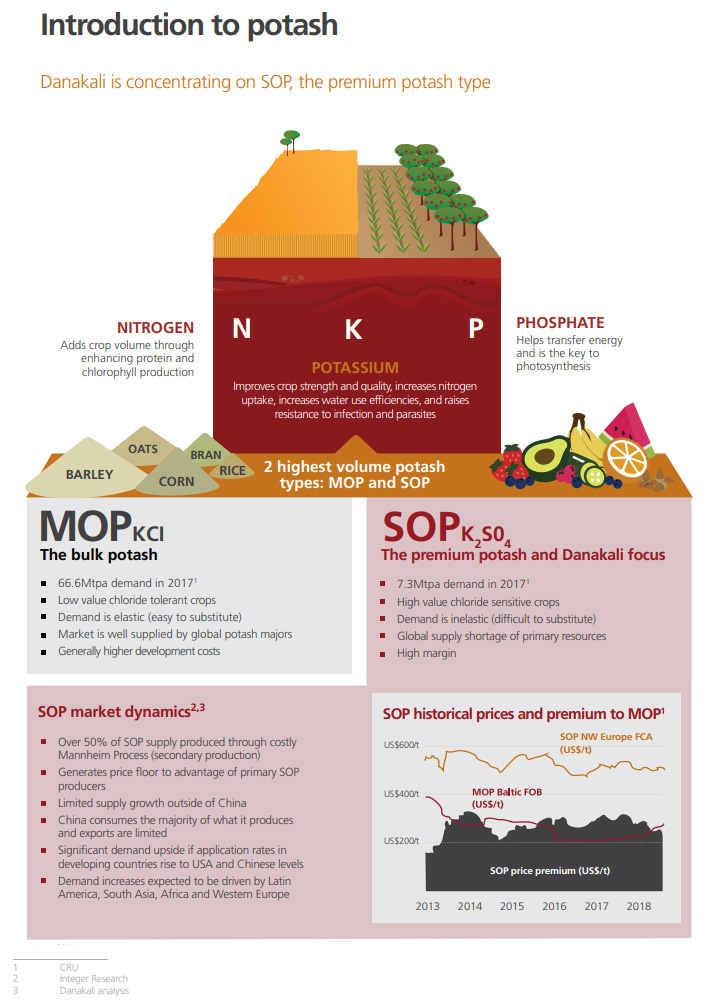

SOP is a kind of potash, it’s called Sulfate of potash, the chemical formula is K2SO4. Clearly, you can see there's no chloride, there are no Cls. Most people, when they think of potash, think of MOP, which is Muriate of potash and the chemical formula for that is KCL. What plants want is the K, potassium. You can apply that either directly as a KCL or K2SO4 project or you can mix it into an NPK or other type of blended or formulated product.

SOP, because it has sulfur, along with the potassium, and no chloride, it's particular use is on very high-value crops: citrus fruits, not berries, potatoes, coffee, tea. Pretty much anything where the taste of the product really, really matters. In order to get the K, the potassium, to the plant, you use SOP. On the contrary, MOP, KCL goes on the broadacre crops. The most obvious one is wheat, right? Nobody eats raw wheat. You process the wheat, and you turn it into flour and then turn it into other things, so the taste doesn't matter.

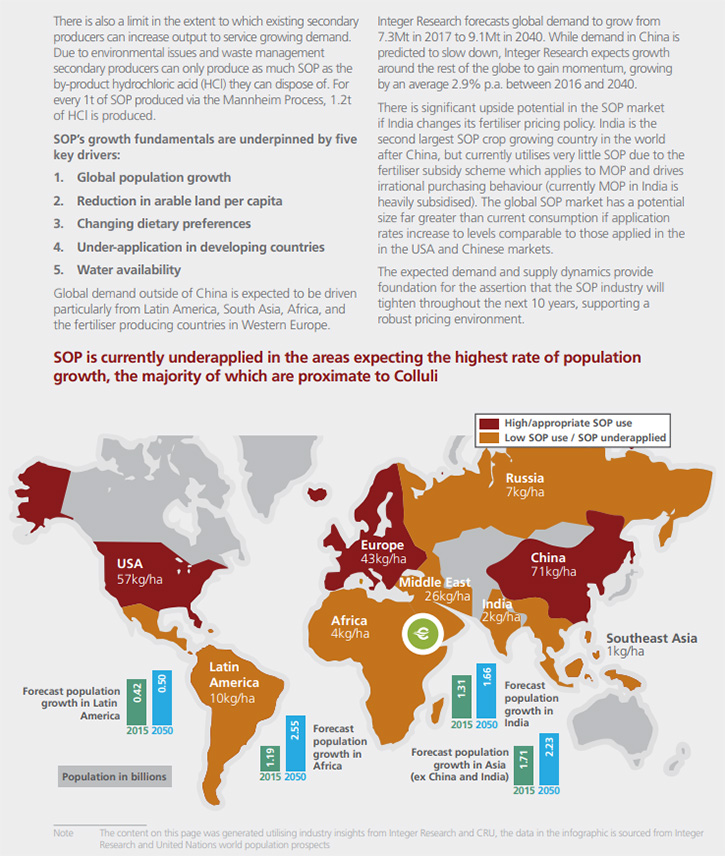

As it happens, wheat is one of the plants that can tolerate the chloride. So, farmers use MOP as opposed to SOP. The really interesting thing about SOP, within the broader fertilizer space, is this fertilizer is more than a population story. It is an economic development story. Within that broad population story, SOP has a special place, because of the products that it is used on, the products that people want to eat, when there's not just population, but there’s economic growth. Or people have spending power that extends beyond what is just the power that you need to fill your belly.

The best example of this is China. If you look at China, 30 years ago, they had extremely low usage rates for SOP and they had about the same population that they have today. Today, China is the biggest user of SOP and their usage rates are the highest in the world. The reason is not because the population has changed. It's because the food that the population wants to eat has changed, along with the massive economic growth that we've seen in China.

If you look at the next 10, 20, 30 years, where is the population going to grow and where is our economic growth going to happen? Everyone points to Africa; everyone points to India and that region. And where is Colluli located? Right there in Eritrea on the Red Sea, perfectly located to serve the fertilizer needs, food needs of entire Africa, India and the Middle East across that region. Which, as it happens, is where population growth and economic growth are going to be focused. So, it could not be in a better location than where it is today.

Mark Riseley:

In terms of sustainable competitive advantage, how do we rate on the cost curve? And can you describe some of those competitors and where we sit relative to them.

Seamus Cornelius:

You want to be in the bottom left-hand corner, which is a low-cost producer. Everyone talks about bottom quartile. Colluli fits squarely in the bottom corner, at the very bottom of the cost curve, which means they are the lowest cost producer. It does that even at what we call the startup scale, which is Module I and Module II. I mentioned 200 years of production, at a million tons a year, we’re in the bottom quartile of the cost curve, even when we're producing half that amount, which is what we'll produce when we're in Module I.

It's untouchable because it's deep in that bottom quartile at the very bottom left corner, even when it does not have the benefits of economies of scale. As soon as we start to scale up, it goes down on the cost curve, even further into that bottom left-hand corner, where no one can touch it. The good thing is, all of the competitors, who produce the same product as we do are in our time zone and I count our time zone as being Europe, Africa, the Mediterranean Middle East. All of the producers in that area are very high-cost producers, who produce at a cost of over US$400, sometimes up towards US$450 a ton.

Our on the ship cost, all in cost, at the beginning, when we're at a very small scale is $250. So, it's massively lower and it's only going to go lower, as we get the benefits of economies of scale. Being in that position and being a natural producer, with a zero-carbon footprint, as we can do, means that those guys, who are high-cost producers, with a heavy environmental footprint can't compete with us and their days are numbered once Colluli comes online.

Dr. Allen Alper:

That sounds excellent. Could you tell our readers/investors a little bit about the capital structure?

Seamus Cornelius:

We’re an ASX listed company, public company, we have one class of shares. We have approximately 370 million shares on issue. Our market cap today is about $170 million. We have zero debt, only $200 million U.S. of debt, properly documented as project finance debt, for the development of the project. That comes from two banks, both of them being very significant banks, based in Africa. One of them is Africa Finance Corporation, the other one is Africa Export Import Bank. Both of those are policy banks, so they're not purely commercial banks. They are policy banks, who see part of their policy mission to be development of African assets, infrastructure and the improvement of the livelihoods of people in Africa.

We're really happy to have those two banks, as our senior lenders. Each of them has agreed to put up $100 million US so far. We haven't drawn down on that money yet, but we will be in a position to draw down on that, shortly after we commence the full-scale development. What else can I say about the capital structure beyond that? We are currently listed on the LSE, in addition to being listed on the ASX, but we are delisting from the LSE soon.

As it turns out, we've realized that it's just not a good position for us to be listed on both exchanges. We don't get any extra benefit from being listed on the LSE and we do get a lot of additional cost and compliance, which we don't need. Part of our approach, as we move into development and production, is to be as lean a production operation as we can be. So, there's not going to be any wasted spending, on things that don't help us achieve our key objectives. That's why we've decided to delist from the LSE, but keep our listing on the ASX, and also on several German exchanges.

Dr. Allen Alper:

That sounds good. Could you tell our readers/investors the primary reasons they should consider investing in Danakali Limited?

Seamus Cornelius:

Well, I think the primary reason for everybody to buy shares is that they want to make money. The other key thing that I think is really important for us is that we're undervalued now. The value of our asset is not properly reflected in our share price. I think there are two main drivers for that. One is that we are not fully funded yet and so people will apply a small discount for that. The other one is that people do not understand enough about Eritrea. Anybody who is interested in making money, who believes that fertilizer in particular SOP is going to have a very bright future, as I do, should look at Danakali, should look at Colluli.

By all means, look at other projects that are in the SOP space. But go back to basics. Look at where the deposit is located? What is the grade of the deposit? How big is the deposit? How easy is it to mine? Where are the customers? In every single instance the only logical choice is to say, okay, I need to buy Danakali shares. That's the only logical outcome. Anything else is not based on logic.

Mark Riseley:

Seamus, can you talk about the expansion options, the social impact, and Carbon Neutral goals of Colluli?

Seamus Cornelius:

For 200 years, we’ve produced a million tons a year. Our startup module is 472,000 tons. If you did simple math, we could do that for over 400 years. Even at our startup scale level, we are still in the very bottom left-hand corner of the cost scale, so it's only going to get better. Expansion is based on the fact that it is the easiest deposit in the world, because it's a very large flat lying, close to surface, close to the coast, close to a port deposit, which can be mined in an open pit, with surface miners.

The product that we will displace initially, is produced in expensive polluting factories in Europe. The customers that want our product are right on our doorstep. So those are the macro-reasons. If you look at where we are also, Danakil is extremely hot and dry and has good wind, but also, it's a known source of geothermal energy. We will start Module I and then very quickly move to a completely renewable energy source, which is most likely to be geothermal for the base, with some wind and some solar.

But it depends, right? Both of those technologies, solar and wind, are advancing and improving rapidly, as are battery technologies. For us to move to a completely renewable energy source, for our operation, is not dependent on us using geothermal energy. Although, if you look at the science today, that is probably the best baseload source of energy you can have. But who knows, in two, three, five years’ time, solar and wind might do that for us. So, we don't need to rely on the government developing the geothermal energy, even though that is part of their plan.

From the zero-carbon perspective, I think that's important, but we're not there yet, although we can, and we will go there. But the other key thing, people should be aware of, is water. The availability of water is going to be a major issue for the future. One of the challenges, with agriculture, is that agriculture is widely regarded as one of the leading causes of the waste of water.

One of the ways that people waste water is when they apply the wrong potassium fertilizer. The simple answer, without going deep into it, is that SOP is the right potassium fertilizer because it has no chloride in it and therefore you do not need to waste water to flush the chloride out of the soil. Most plants do not want chloride. Some can tolerate it. If you put chloride on the soil, you're basically throwing salt on the soil and every agricultural region in the world, whether it's the mid-west of America or the wheat belt of Western Australia, saltification of the soil is a key challenge.

One of the contributors to that problem is the use of potassium chloride. It's the chloride that's the problem. If you replace that, where you can, with SOP, you're reducing the waste of water as well. So, there are no negatives. There is absolutely no downside to the development of Colluli, either economically or socially and in a much broader ESG sense.

Dr. Allen Alper:

Well, that sounds excellent. That's really terrific. It's great to have a project that will feed the world, has the right salt, the right course, the right Team, and the right location. Those are amazing factors going for the Company and for serving humanity.

Seamus Cornelius:

I'm not going to hide from the fact that we want to make a profit, we want to make money, we want to pay dividends to our shareholders. That's all true. But we can do all of that, because of what's in the ground, and improve the livelihoods of millions of people and reduce the wastage of water, improve agricultural yields and provide people with the economic benefit that comes from not being a subsistence farmer anymore.

You're shifting into having surplus and you start to grow cash crops. You start to sell the cash crops and industries build off the back of that. Then it's transformational. At the same time, it gets rid of some of those higher cost, high pollution, factory-based production methods, which only exist today because Colluli is not yet in production. Once Colluli goes into production, there is no reason for those high-cost, high pollution factories to exist. Absolutely no reason.

Dr. Allen Alper:

It is an outstanding potash project! Great resource! A great Team with great partners!

We’ll publish your press releases as they come out, so our readers/investors can follow your progress.

https://www.danakali.com.au/

Seamus Cornelius

Executive Chairman

+61 8 6266 8368

|

|