Glenn Mullan, Chairman and CEO, Golden Valley Mines and Royalties Ltd. (TSXV: GZZ; OTC QX: GLVMF) Discusses its Outstanding Performance Growing Assets, with Partner-Funded Option/Joint Ventures and Subsidiaries: Abitibi Royalties, Val-d’Or Mining Corp. and International Prospect Ventures

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/12/2021

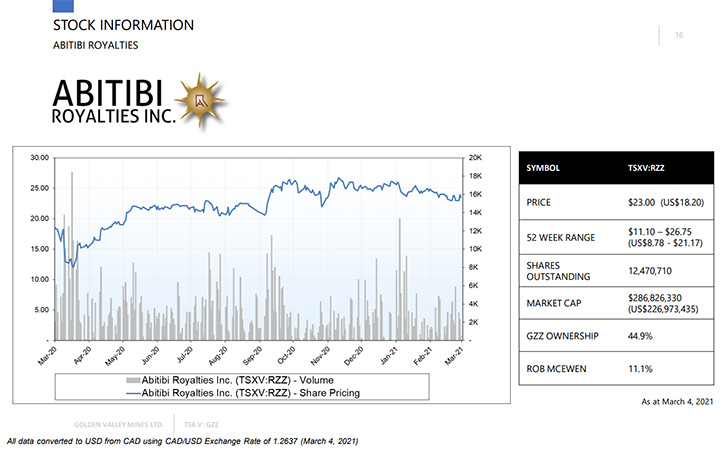

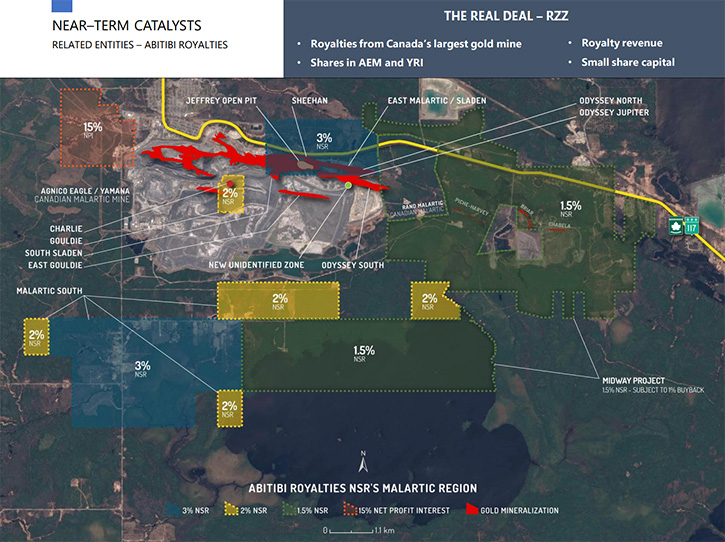

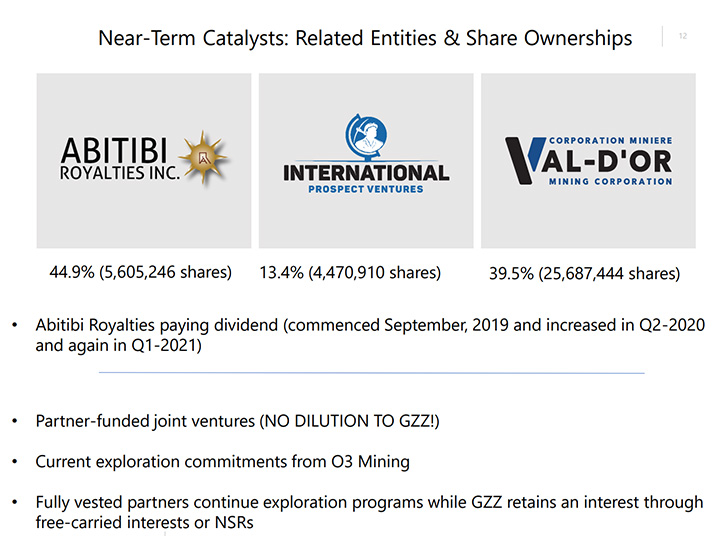

We spoke with Glenn Mullan, Chairman and CEO of Golden Valley Mines and Royalties Ltd. (TSXV: GZZ), a Canadian project generator that grows its current assets, by way of partner-funded option/joint ventures and through three of its own subsidiaries: Abitibi Royalties (TSX-V: RZZ), Val-d’Or Mining Corporation (TSX-V: VZZ), and International Prospect Ventures (TSX-V: IZZ). This allows Golden Valley to minimize dilution of its share capital. According to Mr. Mullan, the Company's shareholders have enjoyed great prosperity, benefiting from the state of the mining industry in northern Quebec. Particularly, thanks to the exceptional performance of Abitibi Royalties, which holds various royalties at the Canadian Malartic Gold Mine - the largest gold mine in North America.

Golden Valley Mines and Royalties Ltd.

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Glenn Mullan, Chairman and CEO of Golden Valley Mines and Royalties. Glenn, I know it’s been a very exciting year, since we spoke a year ago. Could you tell our readers/investors what differentiates your Company from others, also give them a taste of the portfolios you have of some of the joint venture projects?

Glenn Mullan:

I'm always appreciative of the opportunity to tell a little bit about what makes Golden Valley Mines and Royalties different. In one word, I would say the difference is lack of share dilution. We certainly try hard to minimize dilution of our share capital. Going back over a decade, I think there's only been one dilutive circumstance, Directors exercising their own stock options that were about to expire.

Why would Directors want to exercise their stock options? Why would Directors feel that their ownership should increase? Because the largest group of shareholders are the Directors, the Board of Directors. That's been true for the past decade, in fact the past 20 years right from our origin, but definitely the past few years. In the last five years, the Board of Directors has doubled their ownership. I think that's important for any investor or prospective investor to know, and we're quite proud of that.

What are the likely factors that will stimulate further interest? Golden Valley is very different because we don't dilute. We don't raise money, and then raise more money, dilute and dilute and dilute. We don't do that. What we do is use our own subsidiaries, three of them. We have three Companies that were formed from Golden Valley Mines a decade ago in 2011. We did a plan of arrangement, as it was called, on the TSX-V, our home stock exchange in Canada.

On that exchange, we spun out three Companies, Abitibi Royalties, RZZ on the TSX-V. Val-d’Or Mining Corporation, VZZ on the TSX-V and International Prospect Ventures, IZZ on the TSX-V. We call ourselves the Zed Zed Group. We have been quite successful by most points of reference. We've been able to avoid the dilution that besets, and in fact is a common factor in most of the mining industry.

Two of our Companies are project generators, break rocks, form joint ventures, look for gold and base metals and other strategic metals in various environments, locales, geographies. One of them is a royalties holder, a pure royalties holder, holding a royalty in the largest gold mine in North America. That is what has permitted our shareholders to enjoy a very good period of time and what has obviously been so challenging for so many people with Coronavirus, lockdowns, shutdowns and various constraints, imposed on so many so far around the world. We've been so lucky with Golden Valley Mines and Royalties and Abitibi Royalties that we've enjoyed great prosperity, namely just benefiting from the state of the mining industry in northern Quebec and a favourable climate for precious metals.

Dr. Allen Alper:

Oh, that sounds excellent. Could you tell our readers/investors your primary goals for 2021 going into 2022?

Glenn Mullan:

Well, we'll stay focused on the Royalties aspect. Abitibi Royalties has done particularly well, over the past few years. Not very many junior mining companies traded over $10 a share, let alone $20 a share. Abitibi closed at $22.96 Canadian on Friday afternoon. What underlies that? Well, that's the royalty at the Canadian Malartic Gold Mine, which covers many of the new zones, being developed by Agnico-Eagle and Yamana Gold. The new zones that they're developing, for underground production, and on which they've already confirmed a $1.7 seven billion Canadian capital investment program, for the current year. They're spending all of that money sinking a shaft and are driving two ramps. We believe that most of that is within our main royalty property, Abitibi Royalties. Originally that was Golden Valley Mines that had staked and owned the property.

For strategic reasons, back then in 2009 or so, we had reasons to be concerned that there could be a hostile transaction. We made the decision to spin out, to take that asset and put it into a dedicated, listed public Company, controlled by Golden Valley Mines. In other words, if anybody wishes to do any transaction with the royalties’ Company, they have to go through the front door, which is Golden Valley Mines for Abitibi Royalties.

To that extent, I think we've been quite successful. Abitibi’s share price has continued to appreciate for each of the past seven years. Our liquidity has actually improved. We now trade half of our daily volume in the United States, since we were listed on the OTC QX market. We're looking at a larger market awareness program, we're looking at a senior listing in the U.S. as well and continuing to work through those discussions. The short of it is Abitibi Royalties owns a royalty in the largest gold mine in North America and Golden Valley Mines is the controlling shareholder, so they've both done very well.

Dr. Allen Alper:

That's fantastic. I know. I looked at some of your charts, comparing Abitibi Royalties, Golden Valley, compared to other companies, and you've done extremely well compared to them, over the years, in the marketplace.

Glenn Mullan:

Yeah, we've done well over a two-year timeline, five-year timeline and actually even a 10-year timeline, which most companies don't track. We've done well compared to gold peers. We've done well compared to base metals peers. We've actually been the best performer, even including, when we track ourselves to royalties, peers. That includes the biggest and the best in the industry, including Franco-Nevada, Altius Minerals, Sandstorm, Osisko, to name but a few. We're quite proud of those metrics and very sensitive to the underlying factors.

Dr. Allen Alper:

Well, outstanding results! And you and your whole Team could be very proud of what you've accomplished, that’s excellent. Now, I know one of your royalties is doing work in Australia, could you say something about that?

Glenn Mullan:

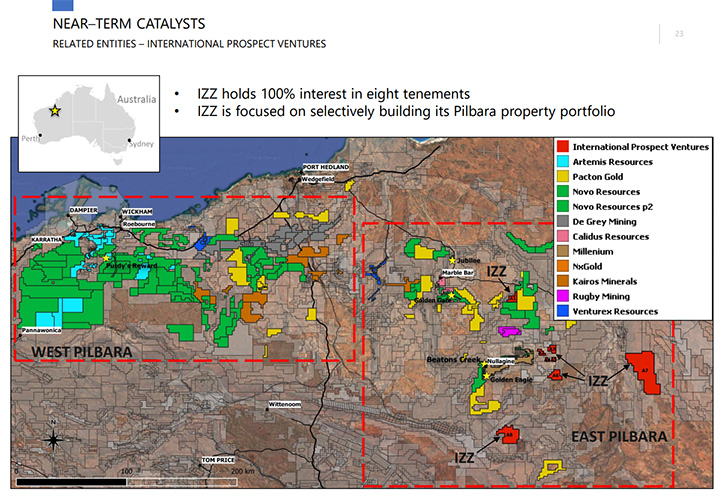

Yeah, one of our prospect generators, one of the subsidiaries that we spun out in 2011, is called International Prospect Ventures. It works exclusively in Western Australia and the simple reason for that is currency. So back in the day, we were very aggressive and happy to be working in Central and South America, Africa, various locales, Canada, U.S. The currencies started to disconnect. U.S. currency has done extremely well, which is a bit of a problem for a Canadian based, junior mining company. As a result, we have focused on working in places where the Canadian currency has some strength, and Australia would be one of the few places on the planet where one equals one for a Canadian.

We've been working in Western Australia, the Pilbara Craton, as it's called. It's important because South Africa is generally known as the greatest producer of gold in world history. Previously and currently over 1.6 billion ounces produced. A geologist from Vancouver, B.C., came up with the concept that there was a very interesting package of rocks in Western Australia that were not just analogous, but what he thought directly comparable to the package at the Kaapvaal Craton, in South Africa. His name is Dr. Quinton Hennigh from Novo Resources.

I thought they were onto a very interesting geological strategy by looking at this package. The strategy, the geochronology, the methodology, the stratigraphy were all quite attractive and virtually analogous, between Western Australia and South Africa. Because of plate tectonics, that's a leap of faith to make. But we're working in there. We have eight different properties, covering 255,000 acres. It's very early days, very early-stage work for International Prospect Ventures. Golden Valley is the largest shareholder of that Company and we're quite enthusiastic about what we've done and what we're doing to date.

Dr. Allen Alper:

Sounds very exciting. Could you tell us what's happening with the Val-d’Or partner?

Glenn Mullan:

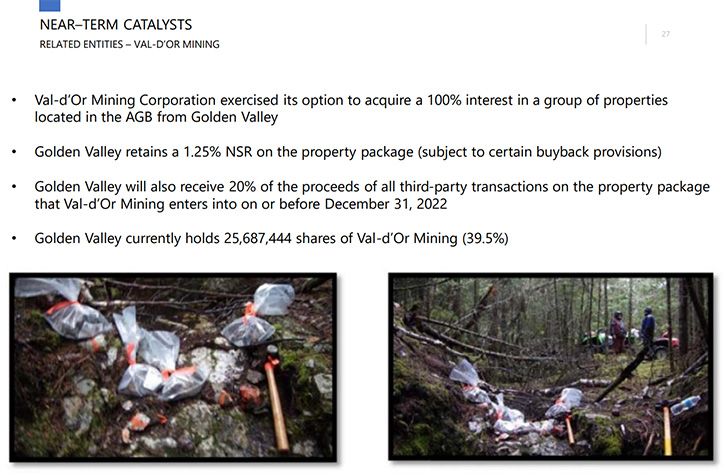

Val-d’Or Mining Corp. is 38% owned by Golden Valley Mines, and that's the Company, in which we break rocks, do joint ventures, test ideas, acquire properties and move through the whole cycle of exploration. Right now, Val-d’Or Mining Corporation is working on over 50 different projects in Quebec and Ontario. That has always been our backyard and it's also where our royalties continue to be held, with the royalties company. Val-d’Or Mining Corporation is a Company, in which we're looking for another exploration success. I'm proud to say that the largest group of shareholders is our own Golden Valley Mines and our own Board. Not for everybody given grassroots exploration is extremely high-risk, but it certainly is for explorers and that's what we like to do.

Dr. Allen Alper:

That sounds exciting. Could you tell our readers/investors the primary reasons they should consider investing in Golden Valley Mines and Royalties Ltd.?

Glenn Mullan:

Well, the main reason would be that most mining companies are subject to constant and relentless dilution. Golden Valley Mines and Royalties is quite different, we don't dilute. That's one reason. The second reason would be our main holding, our anchor asset is Abitibi Royalties. That's the Company that owns royalties on the Canadian Malartic gold mine, where $1.7 billion Cdn. is being expended right now as we speak, sinking a shaft to 1600-metres and driving two ramps. A lot of the catalysts that will influence Golden Valley, will surely come from Abitibi Royalties, over the next few months, including imminently, as Agnico and Yamana deliver their quarterly updates.

Separate from that, Golden Valley continues to have direct exploration exposure, through International Prospect Ventures, in Australia and Val-d’Or Mining Corp. We break rocks, we chip samples, we option properties, we drill holes, we form joint ventures. We do all of that fun stuff in our prospect generators and Golden Valley Mines is the main shareholder of all of those Companies. I think those are all valid reasons for shareholders to look at Golden Valley.

Dr. Allen Alper:

Those are very compelling reasons for our readers/investors to consider investing in Golden Valley Mines and Royalties. Glenn, is there anything else you’d like to add?

Glenn Mullan:

Just that any prospective share owners have a lot of opportunities. There are over 2,000 mining companies in Canada. Over 2,500 mining companies between London, England, Australia and Canada. Shareholders have nothing but opportunities and choices. I would encourage anyone to take a good look at Golden Valley and consider that we try our hardest to avoid dilution. Dilution is the one thing that ends up being the kiss of death for most mining companies. Consider that in your search and I'm sure you'll be well rewarded.

Dr. Allen Alper:

It sounds outstanding. It's a great business model, it's almost unique in the industry. Because the industry is constantly needing money for drilling and so it's hard to keep going without diluting. I must say, I am very impressed with what you have done by not diluting! That’s fantastic!

https://gvmroyalties.com/

Glenn J. Mullan

Chairman, President, and CEO

Golden Valley Mines Ltd.

2864, chemin Sullivan

Val-d’Or, Québec J9P 0B9

Telephone: 819.824.2808 ext. 204

Email: glenn.mullan@goldenvalleymines.com

|

|