Dr Allen Alper Interviews Glenn Mullan, Chairman of the Board, President, and Chief Executive Officer, Golden Valley Mines (TSX-V: GZZ)

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/23/2020

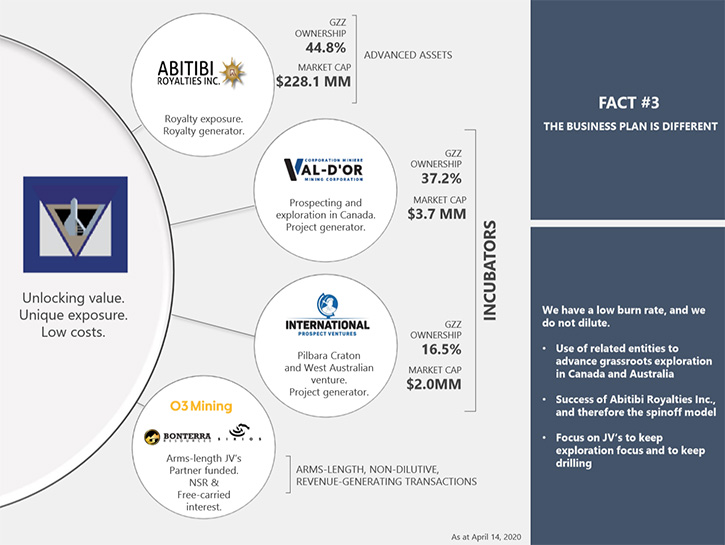

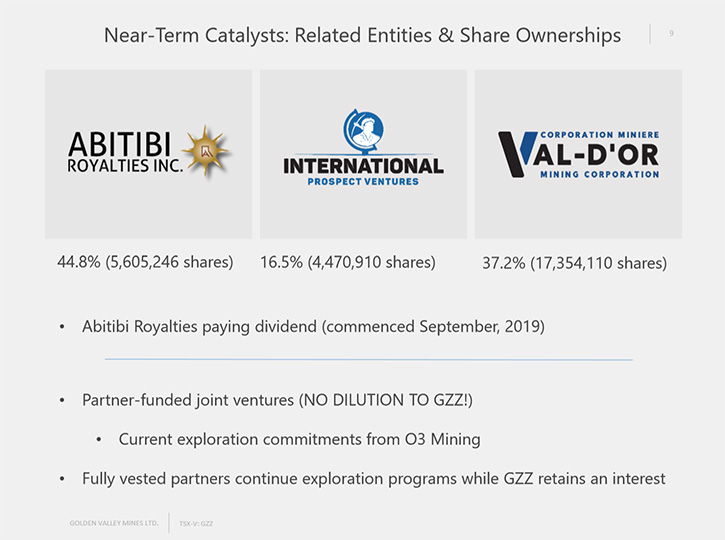

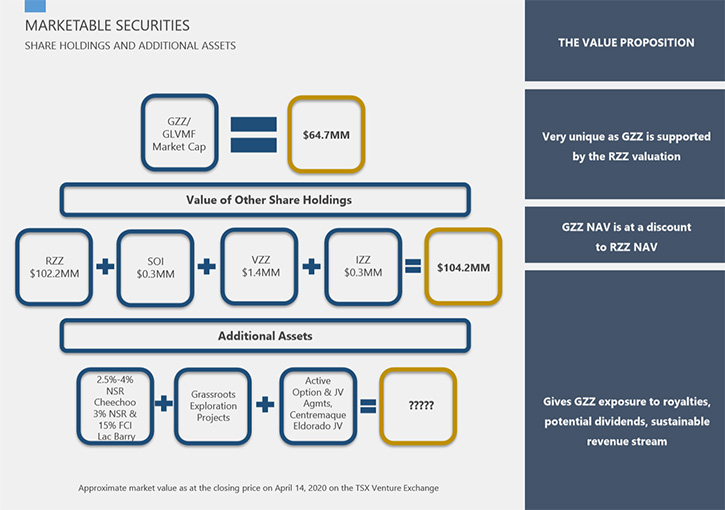

We spoke with Golden Valley Mines’ (TSX-V:GZZ) Chairman of the Board, President, and Chief Executive Officer, Glenn Mullan. Golden Valley Mines is a junior exploration company that has shares of Abitibi Royalties, Val-d’Or Mining Corporation, and International Prospect Ventures. They also have Joint Ventured with many companies that have left Golden Valley with Net Smelter Return (NSR) Royalties or a free carried interest (FCI) in the venture. They own 44.8% of Abitibi Royalties which is worth more than Golden Valley's entire market capitalization. Abitibi Royalties’ main NSR comes from Canadian Malartic Gold Mine, which was originally staked by Golden Valley. Val-d’Or Mining Corporation focuses on prospect generation and grassroots early-stage exploration in both northeastern Ontario and northwestern Quebec. International Prospect Ventures owns 1 gold property in Ontario and eight gold properties in Australia, with exciting potential in Australia covering 255,000 acres in Western Australia in the Pilbara Craton. They have a lot of skin in the game and are getting approval for a share consolidation targeted for the July – August time frame. Golden Valley is a sound company with a very successful and unique business model. Look for exciting news from them and their holdings.

Glenn Mullan, Chairman of the Board, President, and Chief Executive Officer, Golden Valley Mines

Golden Valley Mines

Dr. Allen Alper: Glenn, could you update our readers/investors and give them an overview of your Company. And also, what differentiates Golden Mines, LTD from other companies.

Glenn Mullan: Our business plan is quite unique. I'm not aware of any other listed company that follows the same strategy as Golden Valley Mines, LTD.Golden Valley is described by some of our shareholders as a holding company, because it holds shares of other public companies that it spun out of itself and listed on the TSXV exchange in 2011. We took a look at our best assets and quickly decided we could be at risk via a hostile takeover (HTO), and we wanted to find a model or a strategy that would make it very difficult for anybody else to acquire our assets, or companies, through conventional means, namely on the public market. We took our best properties at that time and spun each of them into a listed company that could be controlled by Golden Valley through its equity holdings in each. One of them is a royalties company called Abitibi Royalties, and as things have turned out, it now owns a royalty in the eastern section of the largest gold mine in North America, which is Canadian Malartic Gold Mine.

That one has worked out very well and Golden Valley continues to be the controlling shareholder in Abitibi Royalties, owning 44.8% directly. Similarly, we took our best nickel assets, back then in 2011, and we spun them into a company that was focused on nickel, which proved to be a very difficult strategy. Nickel was very difficult to finance from 2011 through last year. Ultimately, we changed the name on that one to Val-d’Or Mining Corporation, and we've rebranded it as the local prospect generator, focusing on the Abitibi Greenstone Belt in Quebec and Ontario, Canada. Essentially, Val-d’Or Mining Corp is doing what Golden Valley used to do, namely prospect generation and grassroots exploration. We stake properties, we do the early exploration, we try to find partners, we form joint ventures. We use the joint venture funding to do all of the drill programs to minimize dilution to our capital structure.

The third one that was spun out was originally a uranium proposition. That too proved to be very difficult to finance between 2011 and recent times. So, we changed the name to International Prospect Ventures Ltd. with Golden Valley as the largest shareholder and International Prospect Ventures Ltd. does prospect generation and grassroots exploration in Australia. It is now the only part of our group that is currently working outside Canada. There's a separate component as well, where we have joint ventures with arms-length 3rd parties, other mining companies, who are earning interests in our properties.

Golden Valley's been around 20 years. Some of our joint ventures go back quite far in time. Some of our partners are still conducting exploration on Golden Valley's properties to earn their interest. Our joint venture terms tend to be unique as well. At least I'm not aware of anybody else who does transactions like we do. For instance, the vesting only happens after the last dollar is spent. We don't do the conventional type deals, where the company spends X dollars and earns an interest and then spends more and earns more interest. We don't do that. They have to spend all of the funds required for the vesting to be triggered. And that's usually where the end result is that we're left with a free carried interest (FCI) or a NSR or both.

So that's how we create NSR’s and free carried interests (FCI) in what were originally our own grassroots properties. So, all in all, between the listed companies that we formed and spun out, each of which are now listed on the TSXV venture exchange on the one hand, and the arms-length joint ventures on the other, with very unique vesting terms, I'm really not aware of any other public mining company, or private for that matter, with a strategy similar to ours.

Dr. Allen Alper: That sounds excellent. I think that gives our readers/investors a very good understanding and overview of your Company. Could you give us a little more detail and highlights on some of these companies you're invested in.

Glenn Mullan: Beginning with the anchor asset, Abitibi Royalties, which clearly dwarfs the others using the market valuations. The ticker symbol in Canada is RZZ on the TSX Venture, and ABTYF on NASDAQ, it was listed with a market cap in 2011 of about $3 million. It's grown to over 275 million at the current time. Not many junior mining companies trade at valuations over $20 per share and not many of them sustain that for a period of years, but Golden Valley enjoys its controlling ownership of 44.8% of Abitibi Royalties. I guess that's a long winded way of saying the shares that we own in Abitibi Royalties are actually worth more than Golden Valley's entire market capitalization, at this time. That asset has become quite significant for us. Abitibi Royalties owns NSRs in the Canadian Malartic Gold Mine, specifically the east side of the project, which contains all of the new zones, being developed for underground production.

Those zones include all of, or portions of the Odyssey North zone, Odyssey South zone and East Malartic, or at least a good portion of it. Same also for the Nori zone because the boundary cuts right through that. So pretty much everything that's part of the Canadian Malartic Gold Mine on the East side of the open pit was originally the property that belonged to Golden Valley. It was Golden Valley that staked it and then spun it out into Abitibi Royalties. Abitibi Royalties is now trading at over $20 a share Canadian. It listed on NASDAQ about 2 years ago, and that's been an important factor as well. Separate from that, we've continued to complement our core strategy at Abitibi Royalties by acquiring another 10 or so NSRs in the Malartic Quebec area.

So that's the area where our focus asset is, where the Canadian Malartic Gold Mine is, and we've acquired, I think it's nine or 10 other NSRs that are clustered in that same area, mostly held by other junior mining companies that were seeking financing. We provided some of that capital to them in return for creating NSRs. And that's important for us because it extends our reach from just the single focus at the Canadian Malartic mine for another 25 - 30 kilometers farther west to the Agnico Eagle Laronde Mine area.

That has worked very well for us. That's our core business, the royalties in Northwestern Quebec, and that has also worked very well for Golden Valley, given that the shares that we own in that Company are now worth more than our entire market cap. The other two companies are also each worth a word. I guess my day job, if I have to describe it as such, would actually be running Val-d’Or Mining Corporation, which does the prospect generation and grassroots early stage exploration in both northeastern Ontario and northwestern Quebec.

It really operates the way a prospector operates. We stake claims, meaning we typically own a hundred percent interest on Day-1 because we acquire them directly from the government. We do the early stage exploration, line cutting, geophysics, geology, mapping, prospecting, sampling, sometimes geochemical work and then we try to find partners to fund the more expensive drilling part.

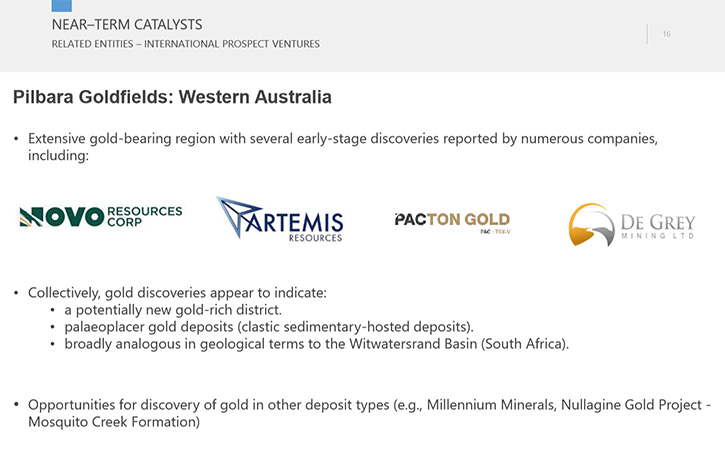

And that's essentially the same business plan we're also using in Australia, with International Prospect Ventures. It also acquired 100% interest in its eight properties, or as they call them in Australia, tenements. We have 100% of eight tenements that cover 255,000 acres in Western Australia in the Pilbara Craton, looking for gold in a paleo-conglomerate host. We do the same strategy, early stage exploration, self-funded by the Company, while we try to find joint venture partners to fund the more expensive parts, including drilling, bulk sampling and so on.

Dr. Allen Alper: Oh, that sounds great. Could you give us the highlights of what's happening in Australia? That's a rather gold rich region you're in, an outstanding region!

Glenn Mullan: I'm quite enthusiastic about this area in Western Australia, called the Pilbara Craton. Without going into deep geology, I think most of our investors and even those who are just generally interested or at least familiar with the fact that Africa as a continent, snugly fit into South America several billion years ago. The same can be said for Western Australia fitting quite snugly into what is now South Africa. So those continents were in fact joined at the hip 3.7 billion years ago.

And that's of interest to us because South Africa is the primary source of gold production in the world. The only place that's produced more than a billion ounces, specifically 1.6 billion ounces. And that's significant because number two would be this area in northern Quebec and Ontario, which is 200 million ounces. As for South Africa’s gold production, there's really been nothing else ever found quite like it.

Reading about the results from several companies, reporting coarse-grained gold nuggets, many thousands of nuggets being found in the last two years really made my heart skip a beat. And when I started looking at the geology, the geochronology, the date and age of the rocks, the stratigraphy, the lithology, the different rock units and their mode of mineral occurrences, I was quite intrigued with the similarities between what's now called the Kaapvaal Craton in the Witwatersrand, South Africa and the Pilbara Craton, as it's called, in Western Australia. And it wasn't hard to convince myself that they're analogous enough, they're similar enough that there's an easy story for investors to see, in that if prospectors are actually recovering coarse grained nuggets from Western Australia, there's a very good chance that there's a significant motherlode, or origin yet to be discovered. So that work has all been clustered pretty much in the last 24 months.

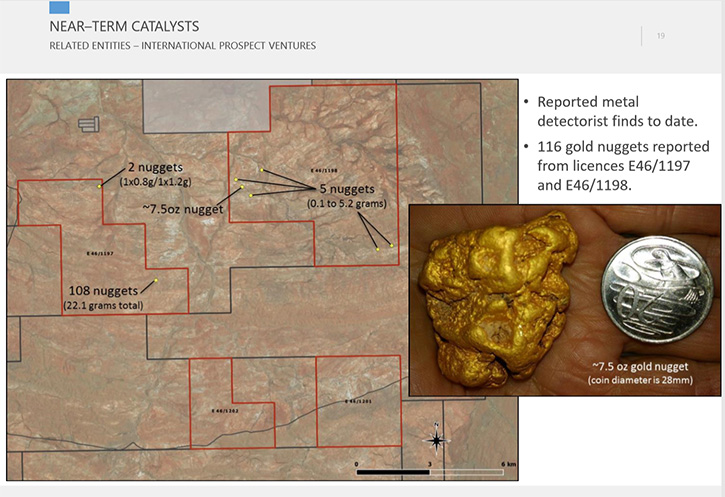

And most of the previous work in Western Australia was really focused on iron mines. That's the area where the largest iron mines in Australia are also located. That's not our game. We're specifically focused on the potential for gold and trying to find the source of those many nuggets. I'm quite intrigued by that for another reason. They have an exploration permitting process in Australia that allows independent prospectors, by simply buying a license, and it's very cheap, it's about 15 Australian dollars, by buying that license and filling out a form called an S40E, Section 40 E, they have permission to go on to tenements, even though they may be owned by another Company as long as they report their findings and the locations by GPS.

We use that process to encourage the prospectors to sweep our properties, looking for those nuggets. Last year they found nearly 200 nuggets on our eight properties, including one that came in at a pretty impressive 7.5 ounces per ton shaped more or less like a golf ball, a pretty big nugget. I've never seen anything like that anywhere else in the world. Our properties in Australia are quite exciting. They were staked because of the general geology and because we liked the story and the potential for something substantial to be found over time. But now it's not a story just about good geology. We know now that there are many gold nuggets that are being recovered by these independent prospectors, including the pretty nice sized 7 ½ ounce one. I have very high expectations for the next few years for our properties in Western Australia.

Dr. Allen Alper: That sounds exciting. Sounds like that's a great opportunity and also a great time for exploration and anticipation. Could you tell our readers/investors a little bit about Golden Valley Mines share and capital structure?

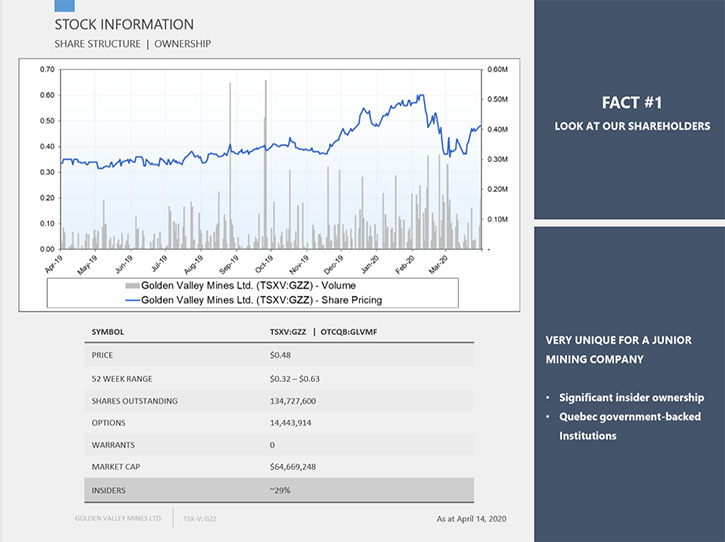

Glenn Mullan: Actually it's an opportune time to talk about that because our annual meeting was on June 26th and one of the resolutions that was approved at that meeting is a share consolidation, which is imminent. We've submitted and filed all of the particulars, with the TSX Venture Exchange and anticipate it will be done by the end of July, subject to the regulatory approval. We think the consolidation is important for a different reason. We currently have just over 135 million shares issued and outstanding. We're 20 years old. We haven't had any significant dilution over the last five or six years. The general thinking was, we were already on the OTC QB market for the past two years and recently graduated to the higher level platform they call the OTC QX.

We're now on OTC QX “Best Market” and the ticker symbol there is GLVMF for foreign. That's worked very well because over the last month, since we graduated, nearly 50% of our daily volume is coming from the United States now. That's a brand new market for us and brand new shareholder demographics. And the thinking behind the share consolidation was that it would facilitate some other possible listing opportunities. We are going through discussions, both in the US and Europe with senior exchanges looking at possibilities. That's what really drove the share consolidation idea.

Of the 135 million shares issued, the largest group of shareholders are the Board of Directors and Management. We, the Board of directors, own 30% of the 135 million shares. And that's important because, in a brand new company that might not be so impressive, but in a 20 year old company where those numbers have increased for each of the last five years, it's clear that our insiders think they know something and, well, I hope they do, but I think that really shows that the Board has been very strong supporters of our strategic plan and the Quebec Government, through its own financial institutions, including the largest pension fund in Canada, out of Montreal called the Caisse de Depot from Quebec. The Quebec funds collectively own 10% of Golden Valley.

Between the Board and the Quebec funds, we're at 40% and it doesn't take very many more names of shareholders to take it well north of 50%. So there's a small group that I'll call my “lunch club”. Those are the people that have more than a million shares of Golden Valley, all bought in the secondary market. They're mostly retail investors and they're scattered throughout the United States and Canada, Vancouver, Toronto, Montreal, LA, New York city, and a couple of places in Florida. About 7 or 8 of these retail shareholders collectively have about 20% of Golden Valley. It's a very interesting and different capital structure because we haven't financed the conventional way that most public mining companies do through brokerage firms. It's been pretty much all provided by friends, family, and the Board of Directors, and that's how they became our largest shareholders.

Dr. Allen Alper: That sounds excellent. It's great to see a Company that the Board and Management team have such great confidence and is willing to have so much skin in the game. So that's really great. Shows you all have great confidence in what's happening in your Company.

Glenn Mullan: Yeah, we've had a few good endorsements. We, Golden Valley, have performed very well. The share price has performed very well, compared to both the price of gold and the TSX Venture index. The TSXV actually has an index for all public companies listed there and we've performed much better than that over the past five years. We've also performed much better than the price of gold over the same time period. And I think most of your readers/investors probably know the price of gold has done pretty well in the past 12 months itself, up nearly 30% and Golden Valley has done much better than that over the past one, two and five years. I know that we're up over 80% this year, up 130% over the past two years and over nearly 500% over the past five years. So those are somewhat progressive metrics and I'm looking for that to continue.

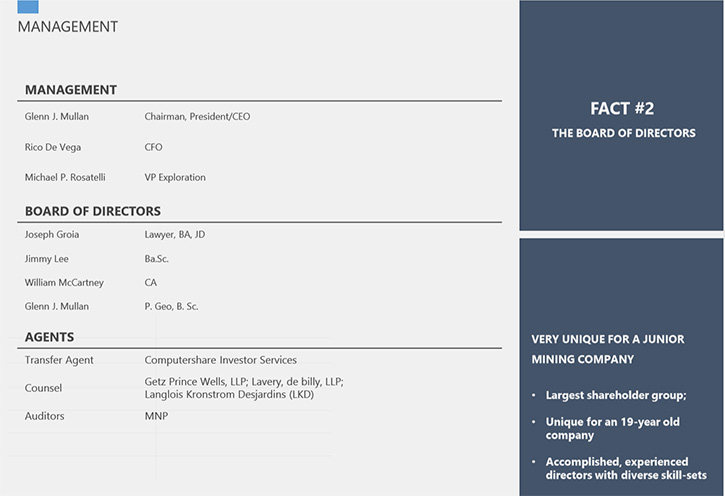

Dr. Allen Alper: It really sounds excellent. Glen, I know you have an outstanding background. For our readers/investors, could you touch on the highlights of your background and some of the members of your Team?

Glenn Mullan: Thank you for that. I guess I would describe myself as a traditional prospector. I do have a degree in geology from the Department of Earth Science at Concordia University, in Montreal, graduating in 1992. In any event, I had always worked for myself, and worked as an independent prospector for the first 20 years. It was a brokerage firm that came up with the idea to take my private prospecting company to the public market through an IPO in 1999. And that became a Company by the name of Canadian Royalties Inc, which was listed originally on the old Alberta Stock Exchange (ASE), if any of your investors have good memories. And it quickly graduated from the Alberta Exchange to the CDNX as the combined exchange became known, and then to what became the TSX Venture Exchange currently. Within a few years of its listing, it graduated onto the most senior stock exchange in Canada, the Toronto Stock Exchange (TSE as it was then known) and our market cap grew to about a half-billion rather quickly. It reached over $486-million, and ultimately led to a hostile takeover and I lost the Company to a Chinese metals company focused on nickel.

The reason the share price and market cap moved so quickly is we actually discovered a set of nickel, copper, platinum group deposits in northern Quebec. And well, that was a credible endorsement of sorts, but the hostile takeover changed things significantly. That mine still operates under the name Canadian Royalties Inc. although it's now owned by Jilin Jien Nickel Industry Co., Ltd. from northern China. That was also a good lesson in business for myself because I was the Founder and the largest shareholder through the entire time and I lost my Company in a hostile takeover.

That wasn't a very good feeling. That is exactly why we took a good look at Golden Valley and said, is there any risk of that happening again to us? Because the only thing worse than losing one company in a hostile takeover would be if you were the idiot that lost a second company in a hostile takeover and we didn't want that to happen. We quickly identified the Malartic area properties, where the Canadian Malartic Gold Mine is, as the focus assets, and we convinced ourselves there was a very high probability that something similar would transpire unless we took preventive measures.

That's when we came up with the idea to spin out our best assets, the listed companies that were controlled by Golden Valley, so that any future transactions would have to come in through the front door. That's been successful. Abitibi has grown very quickly and progressively from a $3 million market cap to $275 million right now. It's trading pretty much at its all-time high as we speak. That's quite exciting. We are in discussions with various parties and we'll continue to advance that Company's interests. Between Canadian Royalties, Abitibi Royalties and Golden Valley, I think you see some common themes, namely, that they are very prospector-driven. We're not averse to grassroots early stage opportunities. In fact, pursuing those is exactly what's created all of the value within our group and our shareholders have been pretty well rewarded over time. I'm looking forward to continuing this for many, many more decades, if possible.

Dr. Allen Alper: Sounds excellent. Could you tell our readers/investors the primary reasons they should consider investing in Golden Valley Mines?

Glenn Mullan: There are a number of reasons. Our business model is really focused on no debt and minimal dilution. So the only dilution that we've incurred has been the Directors exercising their own stock options. We haven't done a dilutive financing in more than five years, and we have no plans to do one anytime soon. We receive dividends, not many junior mining companies receive dividends. We receive our dividend from our own subsidiary, Abitibi Royalties. The dividend payment is greater than our annual budget and burn rate. Not many junior mining companies actually enjoy an increasing cash position without dilution. I think that's an important consideration.

We graduated only a month ago onto the OTC QX, and now have half our daily volume coming from the United States. That's a very recent phenomenon and that's one that's causing us to look at other senior listing opportunities.

Another one would be that we're not only focused on gold. We're exploring for gold and base metals. Historically we've also explored for industrial minerals, including uranium. We've looked for diamonds in West Africa. We've explored in South America. We've looked at many opportunities across the continent of Africa and Central America. But at this time the only places we're working are Australia, and Quebec and Ontario.

And if your readers/investors are familiar with a “think tank” that operates out of Vancouver, called the Fraser Institute, then they would be aware that Quebec, Ontario, and Western Australia rank in the top 10 of all global jurisdictions. So that's a key part of our strategy. Staying focused in safe jurisdictions, in places where we think we can get our maximum bang for our buck. Also to look at all commodities, not just gold, but gold definitely represents the bulk of our property portfolio and the opportunities right now. I think those are all good reasons to look at Golden Valley.

Dr. Allen Alper: Sounds like very, very compelling reasons for our readers/investors to consider investing in Golden Valley Mines. Glen, is there anything else you'd like to add?

Glenn Mullan: We really are prospectors. As soon as we get a property, we do the basic grassroots prospecting; small ground-based exploration programs consisting of grid cutting, geophysics, geology and geochemistry. We then try to find joint venture partners. We try to find partners with financial capacity to do the more expensive drilling and bulk sampling. That's where the dilution usually impacts the capital structure and I'd rather have my partners have to do that heavy lifting than have it done to my shareholders. As the work progresses, funded through our partners, some of the transactions conclude with vesting, leaving Golden Valley with NSRs and free carried interests (FCI) that it has created in its own formerly grassroots properties.

All in all, it is a pretty unique strategy. I am just not aware of a peer group of other people doing the same. I would encourage anyone that's interested to do their own due diligence. Take a good look at us and I'm always happy to answer questions.

Dr. Allen Alper: That sounds excellent! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.goldenvalleymines.com/

Glenn J. Mullan

Chairman, President, and CEO

Golden Valley Mines Ltd.

152, chemin de la Mine École

Val-d’Or, Québec J9P 7B

Telephone: 819.824.2808 ext. 204

Email: glenn.mullan@goldenvalleymines.com

|

|