Opus One Resources Inc. (TSX-V: OOR): discovering high-quality gold and base metals deposits, in the Abitibi Greenstone Belt, Quebec and Ontario; Interview with Louis Morin, CEO and Pierre O'Dowd, Chief Geologist

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/3/2020

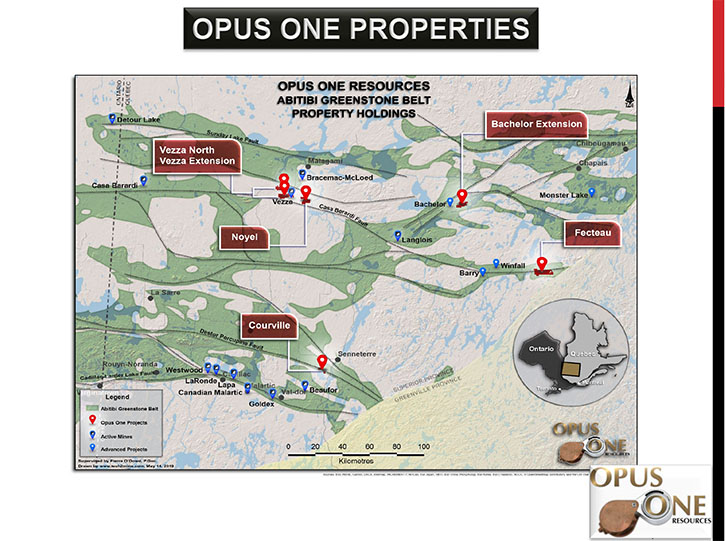

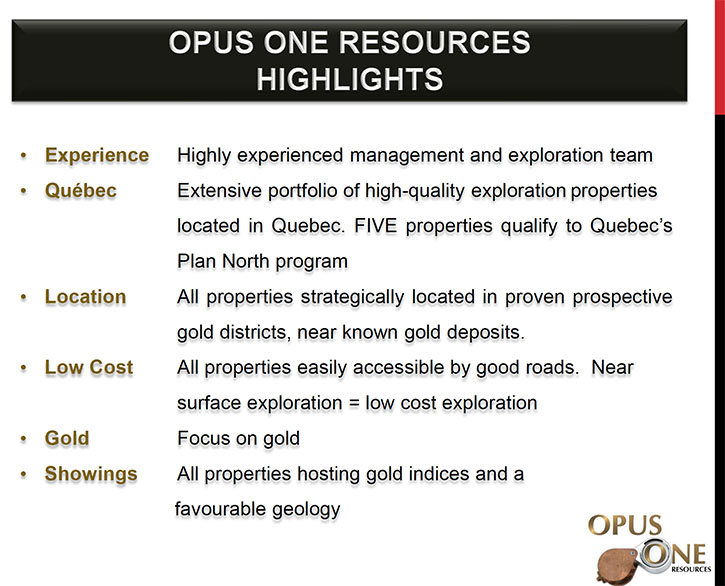

Opus One Resources Inc. (TSX-V: OOR) is focused on discovering high-quality gold and base metals deposits, in the Abitibi Greenstone Belt, north-western Quebec and north-eastern Ontario – one of the most prolific gold mining areas in the world. Opus One holds assets in Val-d’Or, Matagami and Chibougamau areas. We learned from Louis Morin, CEO and Director, and Pierre O'Dowd, Chief Geologist, of Opus One Resources that their properties are all located in areas easily accessible by good road networks, which translates into significant savings in exploration costs. Every property has gold showings, with multiple near surface targets. The Company is currently focused on two areas, which include three properties in Casa-Berardi Break and an earn-in opportunity at the Fecteau project, located in the Windfall district.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Louis Morin, CEO and Director, and also Pierre O'Dowd, Chief Geologist, of Opus One Resources. Louis, could you give us an overview of your Company? What differentiates it, why it's important, and the highlights of the Company?

Louis Morin: The management of our Company has broad experience, both in financial markets and mining exploration. In the past, we have been successful at identifying possible deposits that have been bought-out by major companies. As a small exploration company, our expertise is exploration. Our goal is to find something that will be attractive to a major, as we did in the past on several occasions. We are now concentrating in the Quebec Province on easily accessible areas. All our properties are easily accessible on good road networks, which translates into significant savings in exploration costs, while all our properties are located in active exploration or mining camps and all our properties have gold showings. Maybe you have something else to add, Pierre?

Pierre O'Dowd: Most of our projects have targets that are near surface. We're not dealing with projects that have targets at the kilometer depth. We're working from surface, zero to maybe 400 meters right now. So it translates again into low cost exploration.

Dr. Allen Alper: Well, that sounds very good. Pierre, could you tell me a little bit more about the main projects, where they're located and what makes them significant, and also the general geology of the area?

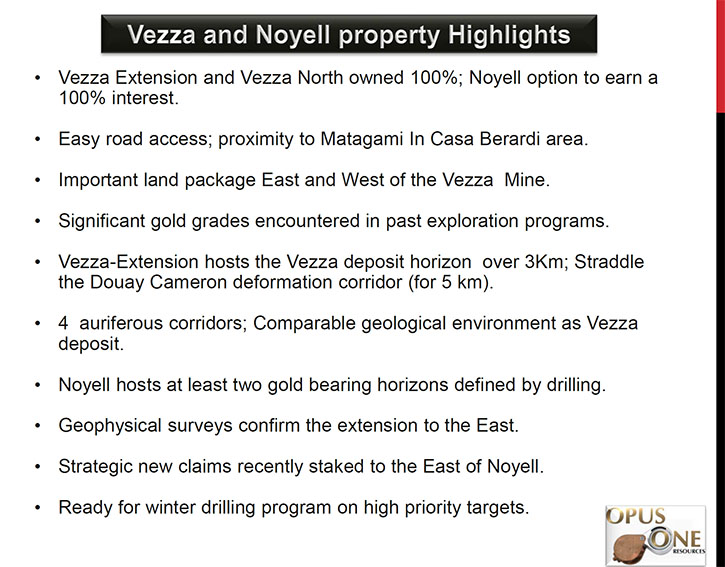

Pierre O'Dowd: Right now, we are concentrating on two areas of interest. The first area of interest is the Casa-Berardi Break. We have three properties called Vezza Extension, Vezza North, and Noyell, which are located directly adjacent to the west and to the east of the former producer Vezza Mine, a mine that just shut down a few months ago. We control 25 kilometers of strike that have the favorable structure, which is significant. There is a big area play that we can manage in that particular area. This is what we call a winter project because this area is mostly swampy. It does not have outcrop. It's difficult to work there during the summer time. But, during the winter those properties are easy to access and to drill. This project is at the drilling stage. We have done the geophysics and some drilling this winter, before we were forced to shut down because of COVID-19. So this is our gold project along the Casa-Berardi Break, 25 kilometers south of Matagami. It's very close to Matagami.

Our second area of interest is located in the Windfall district. We have a project called Fecteau. We can earn 100% into this project. Fecteau is located like 25 kilometers east of the Osisko Mining Windfall discovery. This is an area that has seen little exploration in the past because of lack of accessibility. We recently have a very good road access from a recent forestry roads network. Five years ago there was no access to our property, so there's been a limited amount of exploration there. We think it's more like our summer project because there's still a lot of ground work to do and we have a lot of outcrop on this project. There's no swamp in that area and there's a lot of rock exposure, so we have not completed the surface work over there. We started to do a geology sampling, till sampling and we got good results.

Dr. Allen Alper: That sounds very good. Could you tell us a little bit more about the details of what you've found so far? What makes it interesting?

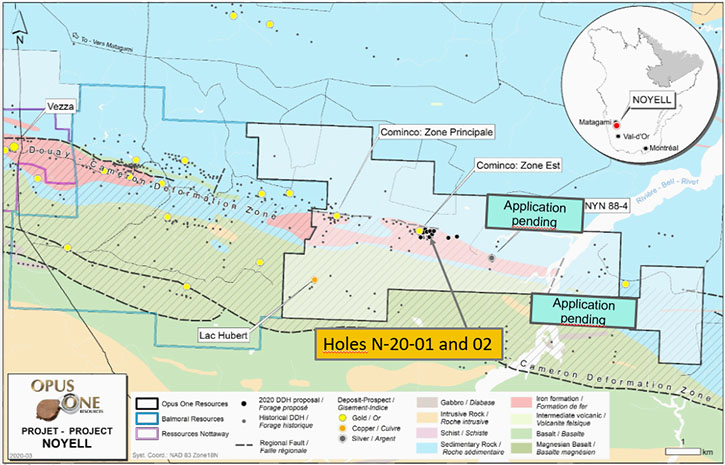

Pierre O'Dowd: Let's start with Noyell, because this is our winter project. The Noyell Property is found within the Douay-Cameron deformation corridor (just south of the interpreted Casa Berardi Break) which hosts the Douay deposit, 35 km to the west of the property, and the Vezza Mine (past production approximately 800,000 tons @ 4,5 gpt Au), located 8 km to the west of Noyell, but just directly east of the Vezza Mine. This project is located within the Tai bi sediments. Also, the Break is in that particular area just south of Matagami.

I've worked in the past on the Noyell project, in 2006, 2007. In those years we did a little drilling program and identified spectacular showings, gold showings, related to IP anomalies. There's no exposure of it. There are 20 meters of overburden. So everything is done with geophysics and drilling in that particular area. In 2007 we came up with pretty decent results, actually quite spectacular. The company I was with, we acquired more ground to the east. In 2011 we did an IP survey to the east and we saw that the mineralized area that we drilled could be extended towards the east for approximately a 1.5 kilometers, just using that fabulous IP anomaly that corresponded directly to the mineralized zone.

That area has never been drilled. The last hole I drilled was like 50 meters from the boundary of the property. The area to the east didn't belong to the company. No one ever drilled there yet. We have this fabulous IP anomaly oriented directly east of the showing that we got in 2007 and it has never been drilled. And that's beautiful. So we decided this year to acquire that area and to extend our staking in that area. I knew the IP anomaly was quite interesting, and it went all the way to the eastern end of the property. In the last two years we acquired much more ground to the east when that ground became available for staking.

Therefore, we staked kilometers of strike which is in the favorable structure. We carried on an IP and mag survey on the portion of that ground this February. We got the extension of the IP anomaly that was already known since 2011. We got that same anomaly to the east for another additional 1.6 kilometers in that area that have never been drilled. This IP anomaly is quite consistent, with what we see in the core.

I will describe to you a typical mineralize zone that we got this year. We drilled two holes this year, one was the deepest hole ever drilled there. And we got two zones, Zone One, Zone Two. They're parallel. They're south dipping, pretty steeply, 75 degrees south dipping. They are meters wide, about six, seven, eight meters per zone. These zones are quite spectacular, quartz injected with a quite significant amount of sulfides, mostly purified pyrite, arsenopyrite, and a little bit of zinc and a little bit of sphalerite, which is typical of the gold mineralization at the Berardi Mine.

In our first hole this year, we have two zones like that. We have some preliminary results, but everything's been stopped due to COVID19, in March. These zones are quite extensive and they are absolutely never barren. There's not one single barren hole. Obviously, we're not talking about the ore grade all of the time, we're talking one gram, two grams, three grams ...

Therefore we have this gold bearing horizon there, which in this corridor of mineralization, we can have one, two, or three different mineralized horizons and these are never barren. Right now we're looking for the source. Where it develops into a significant body. We have the mineralization. We're looking for vectors that will lead us towards where this thing developed and becomes an ore body that can be mineable. This is what we are doing right now. We know we're right on the right place. We showed our information to numerous highly experienced geologists and they all say the same things. This project is a no brainer. You just drill it until you find a deposit. This is what we intended to do on Noyell, up until when we got stopped at mid-March by the government.

Dr. Allen Alper: That sounds very promising.

Pierre O'Dowd: Actually this is very exciting! I can tell you that we saw the rock that has all the ingredients. Does it carry gold? I don't know yet, but it has all the ingredients. And this is metrics wide. This is what's really interesting. This was several meters wide. True width of five, six meters wide? And it's just a matter of getting more tonnage of that stuff if it carries gold.

Dr. Allen Alper: Well that sounds very exciting!

Pierre O'Dowd: We know there will be gold, but is there enough gold to make it economic? This is what we do not know. But we know there will be gold. There's always gold over there in that environment. We're so close to the Vezza Mine that we know we can develop another deposit, probably bigger. On our side we have kilometers and kilometers of that favorable horizon.

Dr. Allen Alper: That sounds excellent. Maybe you could tell us a little bit about your background and your team.

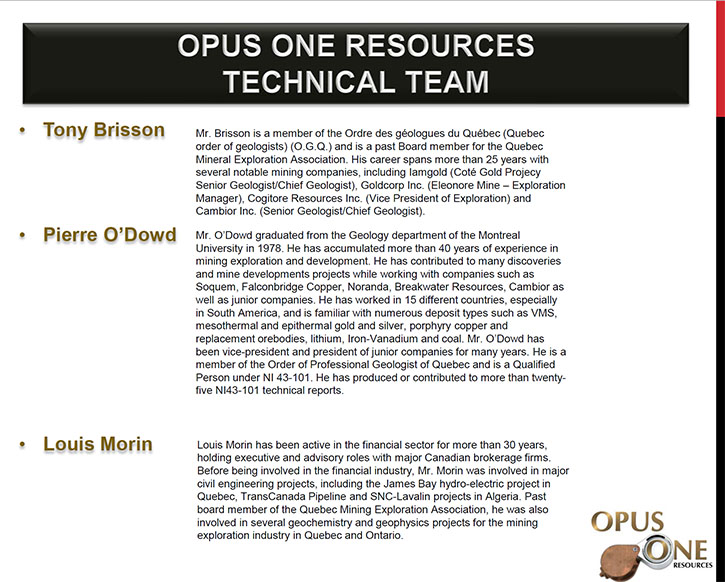

Louis Morin: I myself have been involved, for 33 years, in the financial markets. I've been helping companies to raise money successfully. Prior to this experience, I worked on several exploration projects as a technician in geophysics or geochemistry and I also worked on civil engineering projects, like road construction in James Bay, conception, building and optimization of processing plants in James Bay and more. So I have broad field experience, along with broad financial experience. Several companies I was involved with ended up with takeovers. One Company that is quite well known is Viceroy Exploration, which used to be Trillion Resources that I was involved with since the beginning. The Company was revamped after the financial meltdown in 2000. I was involved with Ronald Netolitzky, Pat Downey and those guys, rebuilding the Company, putting back together valuable assets and building value for shareholders. Viceroy Exploration ended up as a takeover by Yamana Gold in 2006. Pierre O’Dowd and I were involved in developing La Luna silver project, in Mexico, that has been subsequently acquired by First Majestic.

Dr. Allen Alper: That sounds excellent. Could you tell us a little bit about the other members of the Team and Board?

Louis Morin: On our Team, we have Tony Brisson, a geologist that works part time for us because we're a small Company. We can't afford full time people right now. Tony has broad experience with major companies. He was the Chief Geologist on Cote project for IAMGOLD recently. He was the mine geologist at the Eleonore gold mine for Goldcorp, he has been with Goldcorp and other majors for several years. Pierre O’Dowd also has excellent, broad experience, which he can tell you about.

Pierre O'Dowd: I graduated from the Polytechnic school in Montreal in '78. I've been working in exploration ever since. Worldwide, I actually have worked in approximately 15 different countries. I started my career with Falconbridge Copper. Then I was 12 years, with the Falconbridge-Noranda group, before they became Glencore. And so I worked in the B2B and then with Noranda. I was shipped to South America, spent a number of years in Chile, looking for porphyry, and more gold. In '95 I came back to Canada, became a career consulting geologist. I work on a number of discoveries, initially on base metals, and then on gold later in my career. With Louis, we've developed an interesting project in 2005, six, seven, in Mexico on the Real de Catorce's (La Luna) silver deposit that was eventually bought by First Majestic. So a lot of experience everywhere, but mostly South America and Canada. I've worked on gold, base metals, on iron deposits and lithium, and coal in Columbia. I've done a lot of work in Columbia and Peru and Chile.

Dr. Allen Alper: It sounds like you both have very strong backgrounds. And Louis, could you tell us a bit about your Chairman of the Board, Michael Kinley's background and position?

Louis Morin: Our Chairman, Michael Kinley's an accountant. He is our CFO. He has been CFO for different public companies. The reason why he is President is if I'm away, he has the authorization to sign official papers, in the event I could not be able to do it myself. Very conservative man, very careful and meticulous.

Dr. Allen Alper: Very good.

Louis Morin: The two other guys, Tony Croll and Patrick Fernet are business men that are providing general guidance for the Company. The day to day business is carried out by myself, Pierre, Mike and Tony.

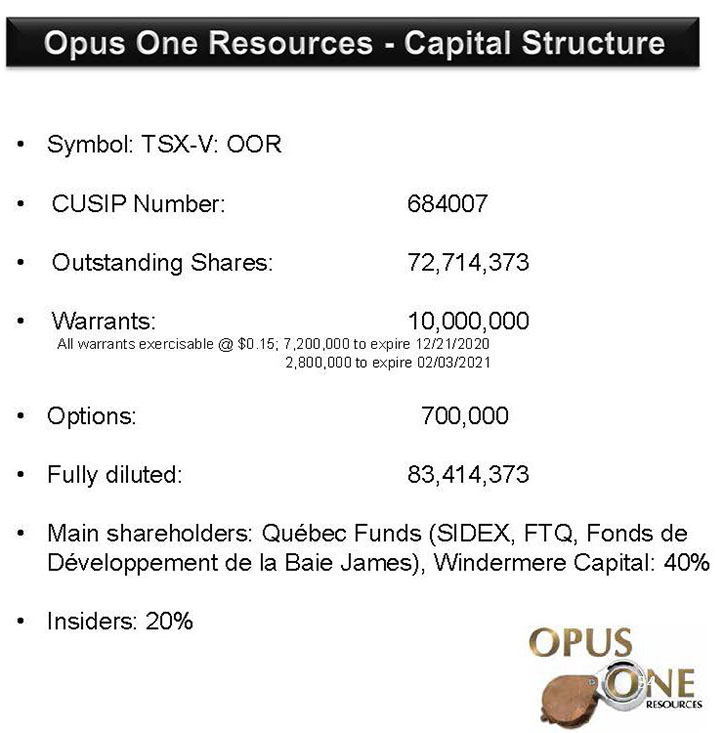

Dr. Allen Alper: That sounds very good. Could you tell our readers/investors a little bit about your capital structure?

Louis Morin: We now have 73 million shares issued. Those shares are almost 50% institutionally owned. We have Toronto funds that have provided us working capital, and we also have support from the Quebec James Bay Development, FTQ and Sidex funds. Out of our six properties, five qualify for the Quebec North Plan. For investors investing in flow through shares in our Company, they get a better credit. Whenever we use hard cash for exploration, the Company itself gets a better tax return. We get in excess of 35% tax return because we work above north of the 49th parallel.

Dr. Allen Alper: That is really great. Excellent! Could you tell our readers/investors the primary reasons they should consider investing in Opus One Resources?

Louis Morin: We have a good track record for finding economical deposits and selling them back for very good profits. So we have good experience at creating value for shareholders. We are convinced that within our several projects, we will be successful in the near future in creating such value for our shareholders.

Pierre O'Dowd: All our properties are really strategically located and there's no moose pasture land in our portfolio. We don't want that kind of land. We really concentrate on the promising and favorable districts, we want the good ingredients. We want the rocks, we want the values, and we want the structures. We concentrate on areas that have high potential. On the other hand, we concentrate on areas that have been neglected in the past because of lack of road access. We work on projects that have new access by road.

Therefore our targets are near surface, so we really focus on low cost exploration. We don't want to go very deep into the James Bay and be forced to pay $500 per meter of drilling. It's very important that we stay in favorable ground that is low cost for exploration, easy access, near surface exploration. The last hole we drilled reached 400 meters. 400 meters for exploration is not deep. If this hole returns spectacular values, we'll go deeper. Obviously. But right now our holes are shallow holes, and we get good results with them.

Dr. Allen Alper: That sounds very good.

Louis Morin: Also if you go farther up North you have to deal with the North Premium, which translates into 1: much higher exploration costs, 2: you need much bigger or much richer deposits to become economical. In the regions, where we are working, we are not in remote areas. We are located near infrastructures and most of our people are not far from home and return home every night, after they're done with their jobs.

Pierre O'Dowd: Exactly. We don't have to deal with extreme costs, which is something quite significant, where we work, we don’t need to discover a world class deposit to be successful. Vezza Mine, which operated for a number of years, is not a world class deposit. This when you think that in James Bay, even a deposit like the Eleonore mine won't make it, incredibly, because the costs over there are so high. We don't want to deal with that.

Dr. Allen Alper: Well that sounds very good. Talking with both of you, I think you have a very promising exploration program in a great area. Have a great day, both of you. When this COVID crisis is over, you should be able to start up, and it looks like gold is getting stronger and stronger. So it should be very good. President Trump is determined for the economy to rebound strongly after COVID is conquered.

Louis Morin: You have more experience than I, Dr. Alper, but my reading of this situation right now should translate into much better, much higher gold prices. I'm very excited to be involved with gold at this time.

Dr. Allen Alper: Yeah, I think that's very promising. I think everyone is predicting that gold prices will get extremely high this year.

Louis Morin: Yep. It’s about time to see a recovery, especially in the junior mining market that has been beaten down and driven out of favor for the last nine years.

Dr. Allen Alper: I agree. I enjoyed talking with both of you. Thank you.

Louis Morin: Very nice of you. Thank you for interviewing Opus One Resources for Metals News.

Pierre O'Dowd: Thank you very much, Dr. Alper.

Dr. Allen Alper: We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.opusoneresources.com/en/

Louis Morin, CEO & Director

T (514) 591-3988

Info@OpusOneResources.com

|

|