Altech Chemicals Limited (ASX: ATC, FRA: A3Y): Becoming One of the World's Leading Suppliers of 99.99% (4N) High Purity Alumina (HPA); Interview with Iggy Tan, Managing Director

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 6/10/2020

Fraunhofer Institute confirms 99.99% (4N) high purity alumina (Al2O3), is critical for Lithium battery safety and performance. Test work shows there is sodium contamination from low grade alumina and boehmite in lithium-ion battery applications. There is up to an 80-fold increase of sodium levels, in contrast, there is minimum sodium leaching for 4N alumina (99.99%). Sodium contamination causes serious battery safety risks, performance and durability problems. Fraunhofer Institute demonstrates that minimum quality industry standards for alumina coated separators are needed.

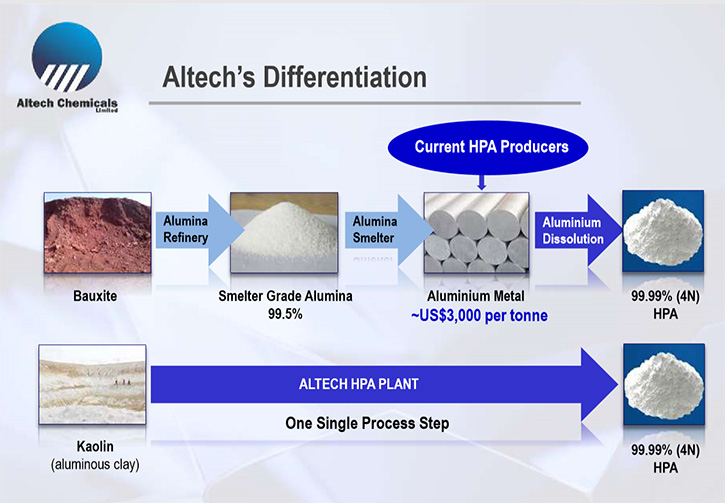

Altech Chemicals Limited (ASX: ATC, FRA: A3Y) is aiming to become one of the world's leading suppliers of 99.99% (4N) high purity alumina (Al2O3), through the construction and operation of a 4,500tpa, high-purity alumina (HPA), processing plant at Johor, Malaysia. Feedstock for the plant will be sourced from the Company’s 100%-owned, kaolin deposit, at Meckering, Western Australia and shipped to Malaysia. We learned from Iggy Tan, who is Managing Director of Altech Chemicals, that high-purity alumina is a high-value, high-margin and highly-demanded product, required for the production of synthetic sapphire used in lithium ion batteries and LEDs. According to Mr. Tan, Altech Chemicals utilizes a disruptive technology that uses low-impurity kaolin stock, instead of the expensive aluminum metal, to create high-purity alumina at a third of the costs, with much lower CO2 footprint and energy consumption.

Altech Chemicals Limited

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Iggy Tan, who's Managing Director of Altech Chemicals. Could you give our readers/investors an overview of your Company and what differentiates your Company from others?

Iggy Tan:Altech Chemicals is an Australian listed Company. We have a vision of building a four and a half thousand ton per annum, high-purity alumina plant, high-purity as in 99.99%. Commonly referred to as 4N alumina. We are building this plant because of the demand for 4N alumina, which is used in the LED industry to make synthetic sapphire wafers, used as a substrate for LEDs. High purity alumina is also used in lithium ion batteries. High purity alumina is applied onto the separators that are within a lithium ion battery to ensure battery integrity and longer life. As the energy density of batteries increases, the operating temperature of the batteries are getting hotter and hotter, as a consequence the separators, which traditionally have been only polyethylene or polypropylene tend to shrink. When they shrink, they allow the anode and cathodes to contact. And that's where you get a battery short-circuit and thermal runaway. To combat this, most separators now have an alumina coating or ceramic coating applied to the separator sheet to protect the battery.

Our Company is using disruptive technology - as currently high-purity alumina is produced from aluminum metal. Companies like Sumitomo, Sasol, Nippon Light, et cetera, buy alumina metal, they dissolve it in alcohol and hydrolyze it and calcine it back to alumina. The process is called the alkoxide process.

Now that process is obviously expensive because you're using an expensive feedstock, like aluminum metal. Our technology on the other hand uses kaolin as the feedstock. So instead of having to purchase expensive alumina metal, we own a high quality deposit of kaolin deposit in Australia, which is where we get our feedstock – the cost of this is quite low. The Altech process uses hydrochloric acid to dissolve the alumina in the kaolin ore to produce high-purity alumina. Because we don't use aluminum metal, our process is disruptive. It is much cheaper. We use less carbon in our manufacturing footprint and we use less energy. So this is a disruptive process, just to meet the demands of both the LED and the lithium-ion battery industry.

Dr. Allen Alper: That's great. Could you tell our readers/investors a little bit more about your property and more about your production plans in Malaysia and also in Germany?

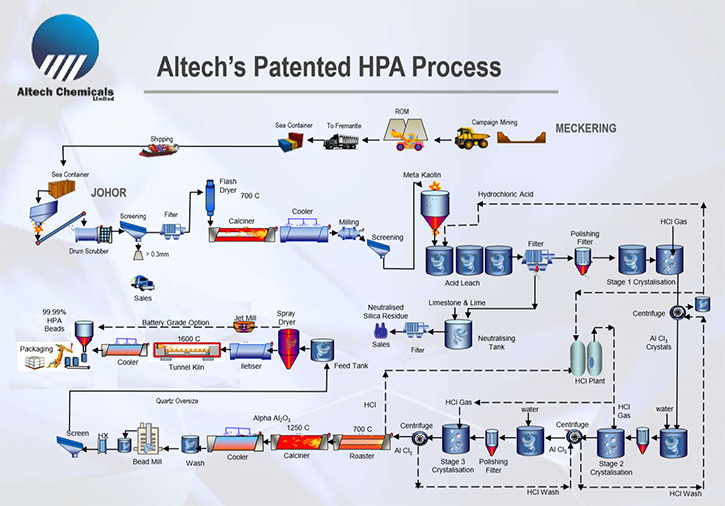

Iggy Tan: The chemical process that we will use to produce our HPA is well established. The Swiss came out with the chemistry in the early 1900s and Alcoa and the US government did a lot of work in the 1980s on the process. There wasn't much demand for high purity alumina in the eighties because there weren't any LEDs around or lithium ion batteries. So the technology and knowledge essentially just set there.

However, because of increased demand from these two growing sectors, companies like us are looking at building more HPA capacity.

The production process involves hydrochloric acid simply dissolving the kaolin to form aluminum chloride in solution. Next, we filter out all the silica and then crystallize the aluminum chloride out of solution and we recrystallize it to purify that material. We then heat it up to 1,280 degrees Celsius and grab some oxygen and it forms alumina. But the beauty of the process is that the hydrochloric acid as a gas is recycled. So we are able to clean that acid up and recycle it back into the process. Since the main reactants for the process can we recycled and reused, the cost of production is further reduced.

The kaolin deposit we have in Australia has 250 years of mine life, and we've elected to build the downstream process, not in Australia, but in Johor Malaysia, on the bottom end of Malaysia, right across from Singapore. We decided to build it there because of lower operating costs, a great location and established infrastructure.

The 4 Hectare HPA site is in a big industrial chemical park, with a large number of foreign companies already established there. And by building it Malaysia, we have access to lower cost raw materials. For example, hydrochloric acid, that'd be $350 tonne in Australia. In Malaysia it's only about $120 tonne, electricity's a third and labor is also a third of the cost compared to Australia. The other important thing is that we get a five to 10 year tax free window, for building the plant there, from the Malaysian government. So, no profits tax for nearly 10 years. Those are some of the reasons why we chose Malaysia. The cost of our HPA production, we estimate it to be half to a third compared to the cost of producing HPA via the current process, because we don't have to purchase aluminum metal as the feedstock, Hydrochloric acid is recycled, and we own the kaolin feedstock – it's our deposit, we just have the cost of extraction.

We also emit 46% less greenhouse gas per ton of high purity alumina compared to the current process. We use 41% less energy per ton of HPA, we have a 10 year offtake deal with Mitsubishi to buy our product. Then they will sell it to their customers in Asia and so on. Construction of the HPA plant will be by a German company, SMS group. We have signed a lump-sum, turnkey contract with SMS group, in which they will guarantee the throughput, the quality, et cetera. So they have taken the risk on all the guarantees and because it is a lump sum turnkey contract, they also take the risk on any capital cost blowouts.

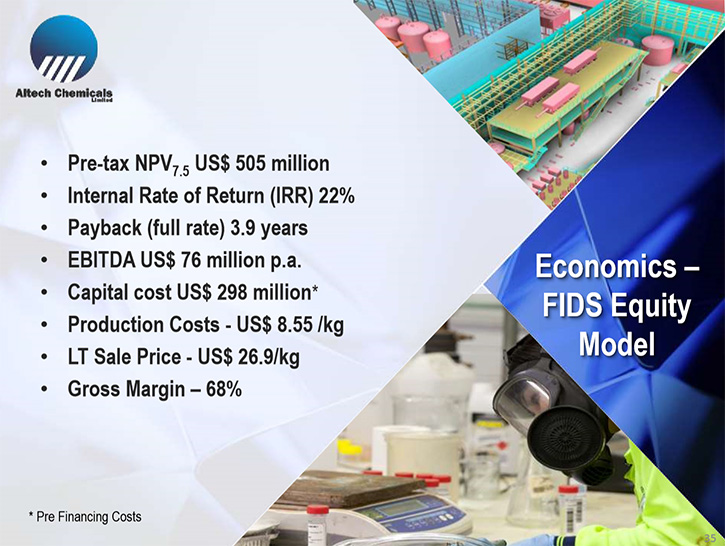

The economics of the project are very strong. The NPV for the project is nearly half a billion US dollars. At its full rate, the EBITDA is around 76 million US per annum. The cost of production is only $8.55 a kilo. The product currently can sell from $25 to $40 a kilo. The margin is high. We're in the middle of the funding process. We have debt from a German bank called KfW IPEX-Bank for 190 million US. We have a Macquarie Bank looking at a mezzanine debt of 90 million. But rather than wait for the debt funding to complete, we also raised about 40 million in the last two and a half years, and we've commenced the HPA plant construction process which is running in parallel to the funding process. The reason for that is it, it takes out the risk of a greenfield site.

By starting the construction, we’ve had to have permits and environmental approvals and construction approvals, which has all been obtained. Now we're in the second stage of construction. We've leveled the site and built infrastructure. We've built a large workshop and substation and so on. We are continuing to advance the site, while the funding process is finalized.

Altech Chemicals Limited

Maybe I can talk to you about the latest release on some of the work we did, with the German Institute.

Dr. Allen Alper: Excellent!

Iggy Tan: We did the work with the Fraunhofer Institute of Ceramic Technologies and Systems in Germany. They specialize in lithium ion battery research, but more specifically, they specialize in battery separator technology. We commissioned the work because more and more separator manufacturers are trying to use cheaper and lower grade alumina in their separators, of course, that's what always happens. People are trying to get away with lower grade materials to reduce their costs. Now, some of these manufacturers are using 3N alumina or even boehmite in their separators.

We think this is a problem for future lithium batteries, so we commissioned research from the Fraunhofer Institute and they exposed the different grades of alumina to the battery electrolyte. This test work shows that because the lower grade material has sodium, sodium is leaching into the electrolyte, something like an 80 fold increase of sodium in the electronic from 0.5 PPM to two 40 PPM. We also see a 20 fold increase in sodium from the use of boehmite. Sodium is a big problem in batteries because it can reduce battery discharge capacity adversely, affecting the reactivity of the lithium ions within the battery. It also promotes dendrite growth and lithium plating on the anode. Sodium is generally a big, no, no for batteries.

This latest research is really very important for the future of lithium batteries. As a Company, we are calling on a minimum quality standard for the alumina in the separators. Now the cost of using a higher purity material is minimal. The cost of the alumina in the total EV is only $200. So, the difference between a lower cost alumina versus a high-cost alumina in an EV is very minimal, but the problem is that it potentially can be catastrophic.

Dr. Allen Alper: Well, that sounds excellent. It sounds like you have a product that's very important for the life of the battery and the cost of the battery, compared to total costs and total usage. It would be extremely important to use the high-purity alumina instead of ones that will contaminate the system.

It really sounds like you're on the cutting edge of the technology. You'll have a great product, great technology, a great resource, and a great partner with Mitsubishi. You are a great off-taker with Mitsubishi. It sounds like you'll have many wonderful things going for you and your Company.

Iggy Tan: Like all project development, it takes time and effort, and there are always many, many things to deal with. Funding is not easy in this climate.

Dr. Allen Alper: Well, one thing that was interesting, I know where your plant is going in Malaysia. Osram has an LED Chip plant there. I was a Vice President of Osram Sylvania, where we made critical materials for their lighting division. Could you give our readers/investors a little more information about your background and the Board?

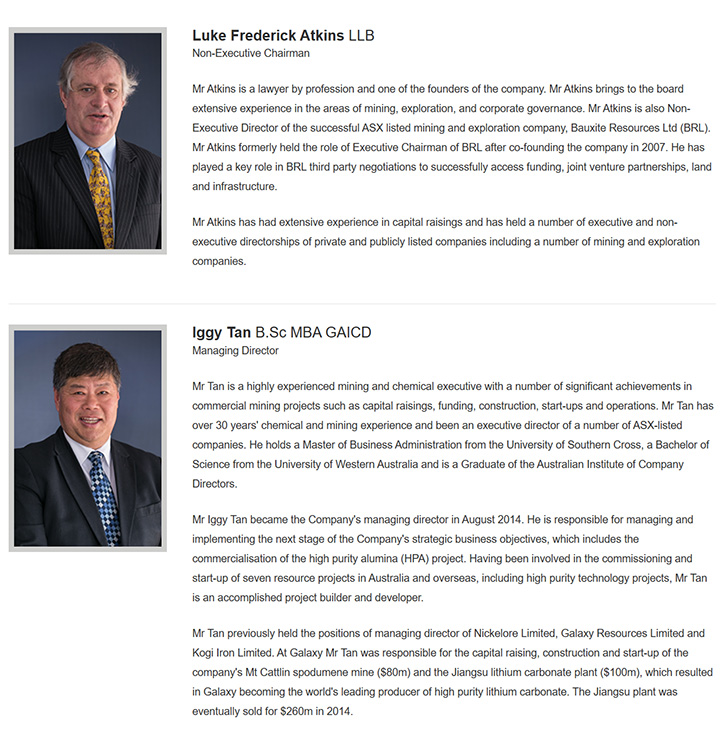

Iggy Tan: I specialize in project development and establishment. I was a founder of Galaxy Resources and I built the lithium carbonate project for Galaxy. We built the Mt Cattlin mine in Australia and the lithium carbonate plant in China. So we were one of the first to establish a new lithium supply in the industry. And there were many attempts, but most were unsuccessful. Privately built in China, this is the largest high quality lithium carbonate plant in the world. The Board has a mix of experience from a lawyer to industry people that are involved in the alumina industry. So we have the credentials to build a new chemical company.

Dr. Allen Alper: It sounds like you have a great background. Looking at your presentation, with your company here, you have a strong Board and Technical Team, et cetera. That's very good. Could you tell our readers a little bit more about your capital structure?

Iggy Tan: So the Company has around 780 million shares on issue, a market cap around a hundred million. We’ve dropped since going through the COVID-19 period. We have three major shareholders. One is a Malaysian group called Melewar. The other one is the SMS group, our major contractor. The third one is Deutsche Balaton of Germany. We focus a lot of our fundraising in Europe because of the link with the German bank KfW IPEX-Bank and SMS group and now Deutsche Balaton. So we've been very focused on the future. If the demand is, as we predict and more HPA production needs to come online, we see building the next plant in Europe, focused on building battery science because of the EV industry.

In Europe, there is a push for vehicle manufacturers to build EVs because of the European EU legislation of 95 grams of CO2 per kilometer. And in order to achieve that, car manufacturers like VW have to have half their fleet as EVs. So there's a big push to EVs in Europe and hence there's a big push for battery production. So we think our long term future will be in Europe as well.

Dr. Allen Alper: Well, that sounds excellent. Sounds like you're well prepared to supply the European market with high-purity alumina.

Iggy Tan: Yeah.

Dr. Allen Alper: Could you summarize the primary reasons our readers/investors should consider investing in the Altech Chemicals Limited?

Iggy Tan: In summary, the growth of this sector, the high purity alumina sector has very exciting growth driven by LEDs. As you know, LEDs use 1/6th the amount of electricity of conventional lighting, and are sweeping the world. It's the lighting of the future. The other sector that's driving the growth is the lithium-ion battery industry. The growth of lithium-ion batteries is driven by electric vehicles, renewable energy storage, and so on. Our Company's disruptive technology will produce HPA at a third of the cost, with a much lower CO2 footprint and energy consumption. So the prospects are very good. We have the technology and we're in the process of building the plant. We're halfway through the funding process, but we will complete the funding and build that plant. The economics are very strong. The net present value of the project is half a billion US, so there are strong economics, and more importantly, the product that we're going to produce is going to be essential.

Dr. Allen Alper: Very exciting! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.altechchemicals.com/

Iggy Tan

Managing Director

Altech Chemicals Limited

Tel: +61 8 6168 1555

Email: info@altechchemicals.com

|

|