Fortune Minerals Ltd. (TSX: FT) (OTCQB: FTMDF): Developing the advanced IOCG class NICO Deposit in the Northwest Territories and a Refinery in Southern Canada to Produce Cobalt, Gold, Bismuth and Copper: Interview with Robin Goad, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 6/2/2020

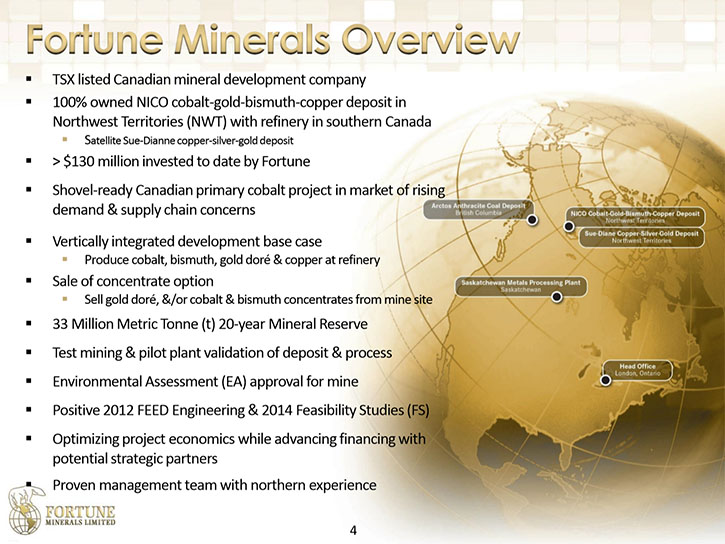

Fortune Minerals Limited (TSX: FT) (OTCQB: FTMDF) is a Canadian mining company focused on developing the advanced iron oxide copper-gold (IOCG class) NICO Project, which is comprised of a proposed mine and concentrator, up in the Northwest Territories, and a refinery in Southern Canada to produce cobalt, gold, bismuth and copper. We learned from Robin Goad, President and CEO of Fortune Minerals, that they are busy optimizing the project, based on the 2014 feasibility study development strategy, using current costs, up-to-date metal prices and currency exchange estimates, as well as some improvements to the project it has identified. We learned from Mr. Goad that Fortune Minerals is developing NICO as a vertically integrated project, and is involved in discussions with both the Canadian and US governments for potential funding for it, based on their Joint Action Plan for Critical Mineral supply. Cobalt and Bismuth are both identified on the US Critical Minerals List – having essential uses in essential manufacturing and defense industries, cannot be substituted by other minerals and their supply chains are threatened by geographic concentration of production and/or geopolitical risks. The NICO Deposit also contains more than one million ounces of gold as a countercyclical and liquid co-product.

Fortune Minerals Limited

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Robin Goad, who is President and CEO of Fortune Minerals, Limited. Robin, could you give our readers/investors an overview of your Company?

Robin Goad:Fortune Minerals Limited is a TSX listed company. We're involved in the minerals industry and our primary asset is called the NICO Project, a development asset, which is comprised of a proposed mine and concentrator, up in the Northwest Territories, and a refinery in Southern Canada, producing cobalt, gold, bismuth and copper. This is a very advanced project. We've spent more than $135 million to date. We have received environmental assessment approval for the facilities in the Northwest Territories and we also have a positive feasibility study, which was completed in 2014 for a contemplated transaction, with a large Chinese state-owned enterprise. This transaction did not proceed and we have re-engaged with other potential strategic partners. So, we are now primarily focused on updating that feasibility study, using current costs, up-to-date metal prices and currency exchange estimates, as well as some improvements we've identified for the project.

Dr. Allen Alper: That sounds very good. Could you tell our readers/investors a little bit more about the NICO Project?

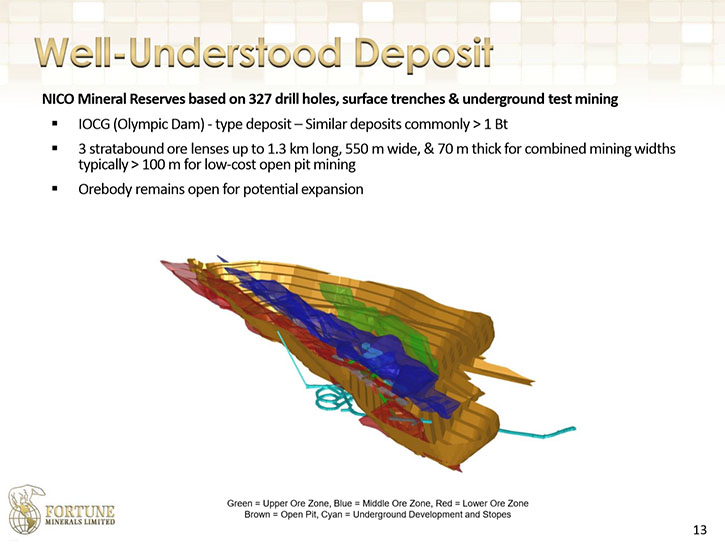

Robin Goad: Sure. Let's talk about the metals that are contained in the deposit. There are 33 million tonnes of ores in the Mineral Reserves containing recoverable cobalt, gold, bismuth and copper. There're more than a million ounces of gold, which, in itself, would be an economic target, considering the grade is more than a gram per tonne, in a primarily open-pit Mineral Reserve. It also contains 12% of the bismuth reserves in the world, even though this is only the third most important metal in the deposit, by projected revenues. There's quite a bit of copper in the system, however, in the deposit itself, it's only a relatively minor by-product. The NICO deposit is an IOCG, which stands for iron oxide copper gold. This deposit class contains some of the biggest deposits in the world, including Olympic Dam in South Australia, the Carajás Mine deposits in Brazil, as well as the Candelaria and related deposits in Chile. Commonly, these deposits are well over a billion metric tonnes.

In addition to NICO, we also have a satellite deposit called Sue-Dianne, which is a small copper deposit of about 10 million tonnes, but there're tremendous opportunities to identify more mineralization, through targets that have already been identified, as well as just being this kind of deposit. As already stated, they are typically very large deposits and occur in clusters of multiple deposits.

Dr. Allen Alper: That sounds very good. Could you tell our readers/investors about your plans for 2020, going into 2021?

Robin Goad: This is a vertically integrated project, which contains two critical minerals identified by the United States, European Union and Canada, as metals that have essential manufacturing and defense industrial applications, can't be easily substituted, with other minerals, and their supply chains are threatened because of geopolitical risks or geographic concentration of production. So both cobalt and bismuth are identified on these critical minerals lists. With more than a million ounces of gold as a co-product, all of these metals have significant investor interest. They also have interest from governments concerned about risks to the supply chains for essential industries and are refocusing policies to encourage and enable more North American production.

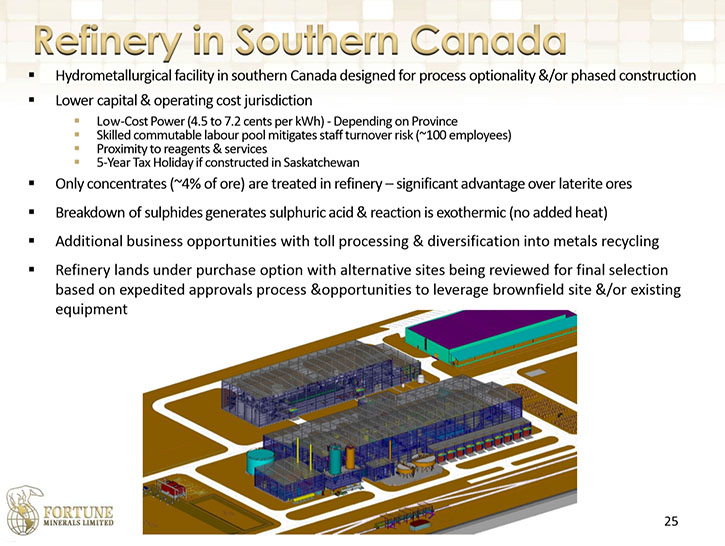

We're involved in discussions with both the Canadian and US governments, for potential funding for this project. One of the challenges, with technology minerals like ours, is that the processing facilities that are typically developed for base metals projects are not configured to be able to recover the metals efficiently that are in our deposit. So it must be vertically integrated, meaning it has to have not only a mine and a concentrator, but also a refinery associated with the development. That makes the capital costs fairly high for these kinds of projects. Fortune is therefore now focused on optimizing the project to reduce capital costs and accelerating access to higher grade ores, earlier in the mine life, to be in a better position to service debt.

In 2020 we have already improved the Mineral Resource model. We constrained the ore zone boundaries to reduce modelling dilution. We also extended the ore zones to surface where the deposit is known to outcrop, to reduce waste truck stripping in early years of the mine life. We have also re-optimized the open pit shell, based on the Mineral Resource model and updated information. The development plan also includes contribution of ores in the early years, with higher margin, gold-rich underground ores to accelerate cash flows and we have now redesigned the underground stopes. A new mine plan and schedule is currently in progress, with a focus on early access to these higher margin materials and a stockpiling strategy to defer process of lower margin ores.

Previous development plans had focused on the Company building its own independent hydrometallurgical facility, but we have identified at least three brownfield sites, some of which are potential collaborations, with other large mining companies. The brownfield sites have existing facilities that could reduce the capital cost for the refinery.

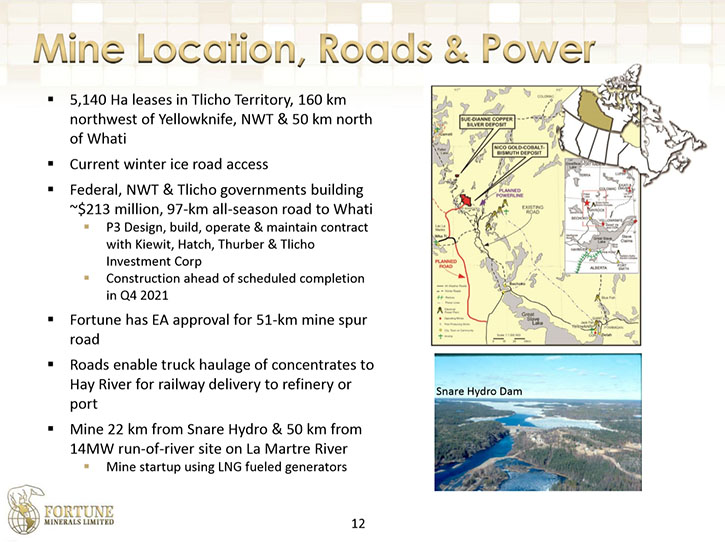

Another optimization is the all-weather road being constructed into the area of our deposit by the Canadian and Northwest Territories governments. This is a $200 million all-season road, which will be developed to within 50 kilometers of our site and we plan to build a spur road to connect the NICO mine to the highway. The road is ahead of schedule and will now allow the Company to construct the NICO mine, using all-weather road access as opposed to winter ice roads. That will reduce the capital cost for the project and also reduce the risks associated with winter road construction.

So we have a number of opportunities that we're pursuing. There are also some that are technical, related to either equipment specifications to reduce capital, or improvements to the process flow sheet to be able to either reduce capital or achieve higher metal recoveries. These are all being considered before we enter into commissioning an updated Technical Report, which will be used for project financing.

Dr. Allen Alper: That sounds very good. Could you highlight the chief applications for some of your key metals that you will be recovering?

Robin Goad: Sure. Under normal metal price scenarios, cobalt would be the dominant metal in the deposit by projected revenues. Cobalt is an essential metal that's used in not only aerospace alloys, but it's also a key ingredient in most lithium ion battery chemistries. Battery materials are attracting significant investor interest, right now, because of the transition in the automotive industry from internal combustion engines to electric vehicles. The success of this transition is dependent on high-performance rechargeable batteries that balance energy density (range), power, recharge time, safety and cost. Most lithium ion batteries contain cobalt, particularly NMC and NCA cathode chemistries, which are the dominant batteries used in electric cars. Portable electronic devices also use lithium ion batteries that are typically LCO or lithium cobalt oxide. Batteries currently are responsible for close to 60% of total cobalt consumption. That is expected to increase significantly as we get greater adoption of electric cars. In addition, cobalt is used in magnets, high strength cutting tools and cemented carbides, pigments, catalysts and it is a source of vitamin B12.

If we move over to bismuth, of which we have 12% of the global reserves, its principal use is in the automotive industry. It's used to make the little black dots on the perimeter of the windshield of your car, which are called frits. Those frits protect the seal of glass panels in automobiles from being degraded by UV radiation as well as changing temperatures, because bismuth is one of the very few metals, which expands when cooled. This enables alloys and compounds to be dimensionally stable – also important in casting. Some car brands are also electroplated in a bath containing bismuth as an anti-corrosion coating. It is also used in medicines like Pepto-Bismol because it has anti-bacterial properties and is scientifically proven to be non-toxic and environmentally safe.

But the great opportunity in bismuth, right now, is in products that previously contained lead, which is toxic and harmful to the environment. So potable drinking water sources, particularly in the United States, European Union and Canada, have mandated that any wetted surface of drinking water sources must not contain lead. Therefore lead pipes are outlawed, the solders used to fuse copper tubing must be lead-free and the brasses typically used for plumbing fixtures must also contain no lead. The European Union has also banned the use of lead in consumer products like electronics. Bismuth is also replacing lead in free machining steels and aluminum, ceramic glazes, paint pigments and some glasses. An interesting new technology is also lead replacement in perovskite solar panels, where demand could grow in renewable energy. It really has quite a promising future, but the price has been depressed over the last few years, primarily because there was a large inventory of metal held by the Fanya Exchange in China which went bankrupt. The inventory has now been purchased by a large minor metal and bismuth processor. This coupled with the closure of a number of small mines in China and a Vietnamese tungsten producer ceasing to produce by-product bismuth concentrates, is bringing stability back to the market. Prices are anticipated by industry players to recover above the cost of production of between US$4 and US$5/pound as the market transitions into balance.

Having 1 million ounces of gold is obviously a very attractive feature of the NICO Project. It also makes NICO stand out relative to other planned cobalt projects because gold is typically countercyclical and will mitigate price volatility in the markets for Fortune’s other metals. Gold is also receiving significant investor interest, with the volatility in our capital markets and also because of the unprecedented response by governments globally to stimulate economies during the Covid-19 crisis.

Dr. Allen Alper: That sounds very good. Could you tell our readers/investors a little bit about your background and your Team?

Robin Goad: I am the President and CEO and a founder of the Company. I have a Master's degree in Geology and Geochemistry and more than 40 years of experience in the mining and exploration business. I previously worked for Noranda and Teck, but also as a consultant to the junior mining industry and some mid-tier producers. I started Fortune in the late 1980s to pursue opportunities in mineral development with a focus on Canada’s North. We've been involved in a number of projects, but we have continually advanced NICO from an in-house discovery and are focused on its near-term development.

Our Chairman is a Founding Director and former CFO of IAMGOLD. Our CFO was previously the CFO of De Beers Canada as well as BHP-Billiton Diamonds. And our COO, Glen Koropchuk, was responsible for the construction of the Gahcho Kue diamond mine for De Beers when he was the COO of the Canadian subsidiary. He has a long history of working within Anglo American.

We have a couple of directors related to our largest shareholder, “Procon Group”, which is a Canadian mining contracting company that was planned to be the development partner for the NICO Project in 2014. Our Vice President of Environment and Regulatory Affairs has also had a long history of permitting mines in the Northwest Territories. This included two of the diamond mines as well as our project. He is an aquatic scientist that has also been involved in permitting other mining projects in other jurisdictions in Canada. So we have quite a lot of expertise in upper management, as well as some good engineering skill sets within the Company. We're looking forward to developing the NICO Project and transitioning the Company into commercial operations.

Dr. Allen Alper: Oh, it sounds like you have a very strong team and you have a great background. Your Chairman and your other members have great backgrounds. Could you tell our readers/investors a little bit about your share structure?

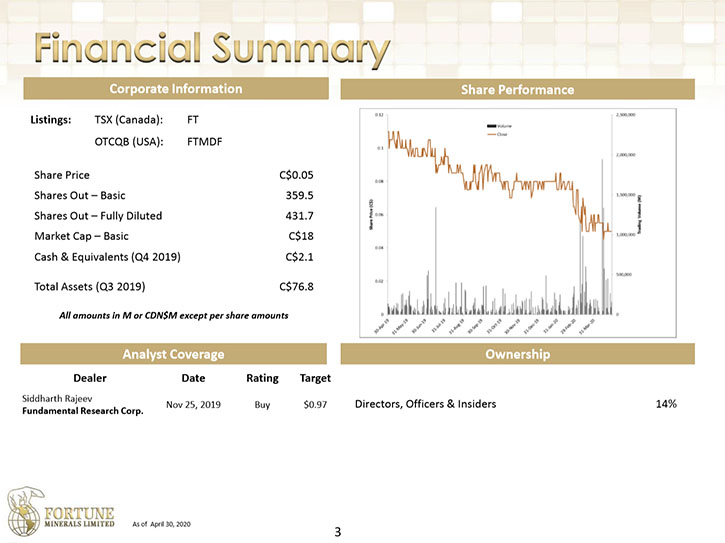

Robin Goad: We have 359 million shares outstanding and we trade on the Toronto Stock Exchange under the symbol FT. Our shares also trade in US dollars on the OTCQB, under the symbol FTMDF.

Dr. Allen Alper: Could you tell our readers/investors the primary reasons they should consider investing in Fortune Minerals?

Robin Goad: Sure. I think that's based on primarily two issues. First, we are a very advanced project and the market value of the Company currently is understating the investment that we've made in our projects as well as the net present value of our projects in feasibility study assessments.

Second, we have metals that are attracting a lot of investor interest right now, being critical minerals and gold. Even though there's been a long history of work on the projects, historically, investors were not very focused on metals like cobalt or other technology metals. Today's a lot different. Technology has become very important in our day-to-day lives and metals like cobalt are going to have a very strong future, particularly as an energy metal needed to make batteries in the transformation to electric mobility.

Having more than a million ounces of gold in our mineral reserves is also very attractive. Gold is currently trading at $1,700 per ounce. There are projections from very reputable sources, including the Bank of America, which are projecting gold to trade up to $3,000 per ounce. While I'm not sure what targets people should be using for the gold price, but generally speaking, most investors feel that there's going to be additional price movement and having 1 million ounces of gold in the Mineral Reserves already identified, and a project that has already been determined to be economic at lower metal prices, would make this project particularly attractive as metal prices improve.

Fortune is at the project development stage, and historically, resource companies increase in value, when they transition into construction. That is a very good time to be investing. There's a long history of other resource projects achieving share price appreciation during speculation and discovery. Then, after the hard work is really done on making a project economic through a feasibility study and development. We've gone through an environmental assessment and we're now looking at project financing to develop the NICO Project, and that is always a very good time to invest in the resource industry, with a much lower risk.

Dr. Allen Alper: Oh, those sound like very good reasons for our readers/investors to consider investing in Fortune Minerals. Is there anything else you'd like to add, Robin?

Robin Goad: Although we're certainly going through some difficult times with the COVID-19 pandemic, confidence seems to be being coming back into the capital markets. Large gold companies have already shown a very good, strong reaction to higher prices and this is going to transition down market into smaller companies like Fortune. We have the people, the project, and the investment in infrastructure that is a strong demonstration of government support for our asset. And I think we're very well positioned to be able to make a good return on the amount of work and investment that's already been made to date on this project.

Dr. Allen Alper: That sounds excellent! I enjoyed talking with you again, Robin. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

Robin Goad: Thank you very much. It's good to talk with you, too, Allen.

https://www.fortuneminerals.com

Troy Nazarewicz

Investor Relations Manager

info@fortuneminerals.com

Tel.: (519) 858-8188

|

|