Aztec Minerals Corp. (AZT: TSX-V, OTCQB: AZZTF): Discovering Exceptional Mineral Deposits in North America; Interview with Bradford Cooke, Chairman

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 5/25/2020

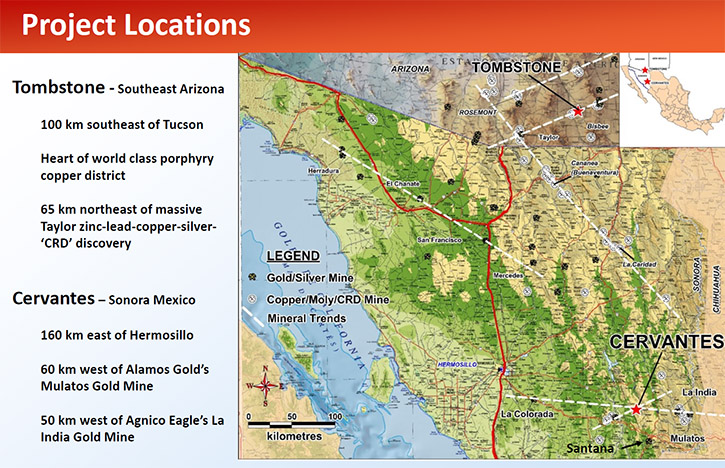

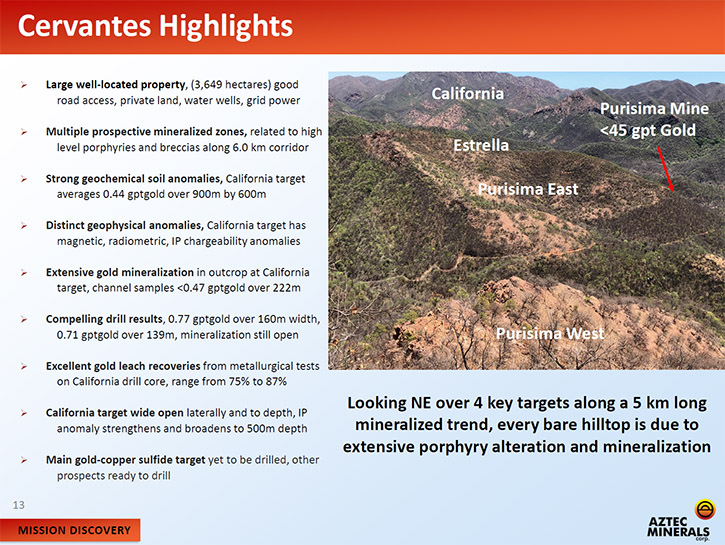

Aztec Minerals Corp. (AZT: TSX-V, OTCQB: AZZTF) is a mineral exploration company, focused on the discovery of exceptional mineral deposits in North America. We learned from Bradford Cooke, Chairman of Aztec Minerals, that they are focused on new discoveries at their Cervantes porphyry gold-copper property in Sonora, Mexico, as well as their Tombstone project, located in Southeast Arizona, approximately 65 km northeast of the massive new Taylor zinc-lead-copper-silver ‘CRD’ discovery.

View of outcropping porphyry gold mineralization at the California prospect on the Cervantes property

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Bradford Cook, who is Chairman of Aztec Minerals. Brad, could you give our readers/investors an overview of Aztec Minerals?

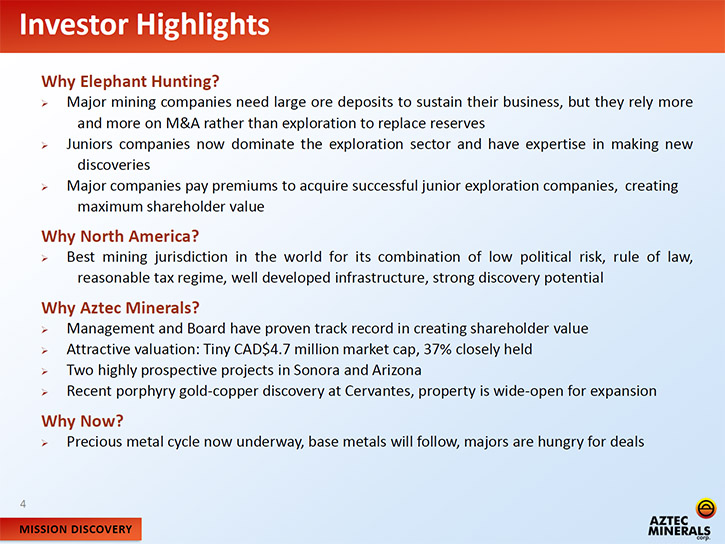

Bradford Cooke: Yes. Thanks very much, Dr. Alper, for letting us introduce Aztec to your readers/investors. Aztec is a relatively new company. It only came to the market through an initial public offering in May of 2017, so just under three years old. We have a great Board of Directors and Management team populated by serially successful geologists, a tight share structure, ready access to financing and two world class projects.

To date, we have focused primarily on exploring our core asset in Sonora, Mexico, the Cervantes project. Our geological mapping, geochemical sampling and geophysical surveying led to drilling a new discovery at the California prospect, one of seven drill-ready porphyry targets on the Cervantes property. It's a classic porphyry gold-copper system, and all 14 drill holes intersected oxidized gold mineralization starting at surface, for example, 0.77 grams per tonne (gpt) gold over 160 meters (m) including 1.0 gpt gold over 80 m in hole 18CER010. The discovery is wide open in all directions for expansion through additional drilling. We own a 65% interest in Cervantes, in a joint venture with Kootenay Silver and we are currently finalizing our JV agreement before planning the next phase of drilling.

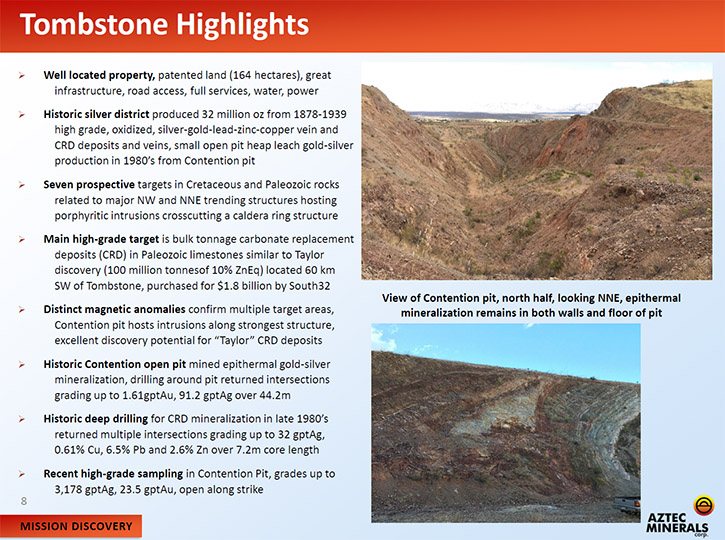

We've since acquired a second prospective project, which fits our elephant hunting strategy. It's the historic Tombstone silver district, an hour's drive southeast of Tucson, Arizona. And if you know your Western lore, this was the home of the shootout at the O.K. Corral, with Marshal Wyatt Earp, Doc Holiday, and the Clanton gang. Tombstone was a real high-grade silver mining district from 1878 until 1939, when all the mines closed due to WW2. Over 32 million ounces of silver were produced from a series of high-grade silver veins and we now hold an option to acquire 75% interest in the original patented claims.

The main target at Tombstone is NOT the low-grade leftovers in the old mines. Instead, we recognize very strong geological similarities at Tombstone to a fabulous new discovery in the last four years in Arizona, called the Taylor discovery by Arizona Mining. It ultimately turned into a world class polymetallic, massive sulfide CRD discovery of zinc, lead, copper, silver and gold, in the order of a hundred million tons grading 10% zinc equivalent. Arizona Mining stock went from CAD$0.25 to CAD$6.20 and their shareholders accepted a friendly takeover bid from South 32 for almost CAD$2 billion.

Tombstone has a very similar geological setting, it is located only 40 miles away from the Taylor discovery, with the same geology as the Taylor discovery, and we know from historic drilling on our property that below the old mines, we also have polymetallic massive sulfide CRD mineralization and a shot at a world class discovery. So not one, but two projects in the asset portfolio, Cervantes and Tombstone, that we think have elephant potential.

Dr. Allen Alper: Well, that sounds excellent. Could you tell our readers/investors your primary goals for 2020, going into 2021?

Bradford Cooke: Our goals in 2020 are to convey more systematically, to the market, our strategy of elephant hunting, and our prolific results on both projects, raise some financing, then get back to drilling discoveries. I've touched on the initial successful discovery at Cervantes, but we also have some great historic drill results from 30 years ago at Tombstone that support an aggressive drill program in the second half of this year to go after the elephant potential. There are actually two elephant-type targets at Tombstone, deeper Taylor-type CRD massive sulfides and shallower epithermal bulk tonnage gold-silver mineralization around the largest historic structure at the Contention mine.

Historic drilling around the Contention open pit 30 years ago returned results such as 1.6 gpt gold and 91 gpt silver over 44.2 m of epithermal mineralization in the west pit wall, and 9% zinc-lead, 0.6% copper and 32 gpt silver over 7.2 m of CRD massive sulfide mineralization below the north pit floor. So that's the plan for this year. Focus in the second half on drilling two targets at Tombstone.

Dr. Allen Alper: Well, that sounds great. Could you tell our readers/investors a little bit more about your capital structure?

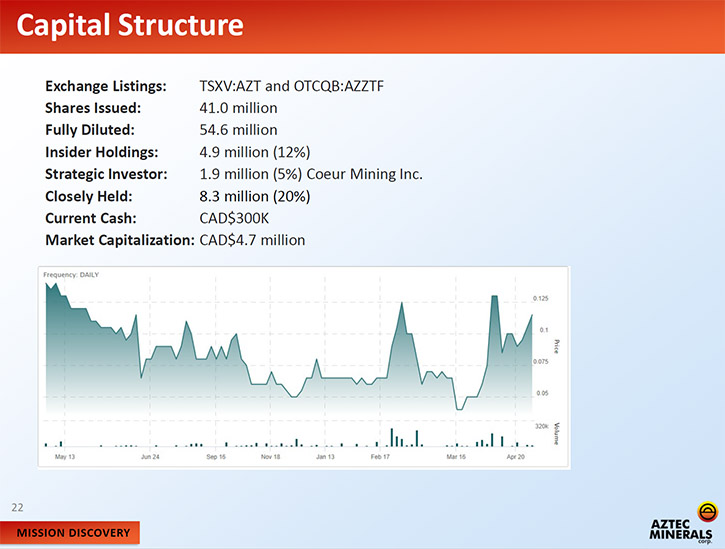

Bradford Cooke: There are about 41 million shares issued, mostly issued at higher than current share prices. The stock did an IPO in 2017 at 35 cents, traded up to 45 cents, then hit hard times for two years and is just now starting to rebound. If we drilled our Cervantes results today, I think the market would recognize deep value in our current share price, and the same thing for the historic drill results at Tombstone. They would be considered high-quality drill holes. So, as we get out and retell this story, we think there's some real upside. Market capitalization today is only eight million Canadian.

Dr. Allen Alper: Well, that sounds like an excellent opportunity for investors. Could you tell our readers/investors the primary reasons they should consider investing in Aztec Minerals?

Bradford Cooke: The value proposition for Aztec is threefold. Focusing on the Tombstone project this year, we're going to drill two world class targets, both of which already have historic discovery drill holes in them: shallower, open pit, bulk tonnage epithermal gold-silver mineralization around the Contention pit, and deeper, underground, massive sulfide CRD Taylor-type mineralization below the Contention pit. Turning our attention to the Cervantes project later this year, we've literally just scratched the surface on what looks like a significant gold-copper porphyry system at Cervantes, with seven separate targets ready for drilling. These are the ways we can create value for our stockholders.

Dr. Allen Alper: Well, that sounds excellent. Sounds like a great opportunity for our readers/investors to consider. By the way, could you tell our readers and investors about your background and the background of your team?

Bradford Cooke: The rule of thumb for investing in any small company is management, management, management. When you look at our Board, we have three world-class discovers as directors. Mark Rebagliati won the Prospector of the Year award in Canada for his multiple porphyry discoveries with the Hunter Dickinson Group. Pat Varas made a major copper-iron discovery in Chile and his Company, Far West ultimately was sold to Capstone. As the Founder and the Chairman of the Board, I founded and run a mining company, Endeavor Silver. I am a professional geologist and the secret sauce of Endeavour’s success has been making multiple new silver-gold discoveries in Mexico. Our CEO and Chief Geologist, Joey Wilkens, is a porphyry copper-gold expert, who spent almost 20 years working with Kennecott. So our shareholders are in very good hands when it comes to doing exploration and focusing on discovery.

Dr. Allen Alper: Well, you all have a great background and a very strong Board and Team. Is there anything else you'd like to add?

Bradford Cooke: At this time, with the entire world recovering from both the virus pandemic and the market panic of March, we've had a nice bounce in global equities in April and it is now time to start looking at which sectors typically outperform following a market crash. Gold is usually first and it's not only recovered all of what it lost in the March panic, it's making new highs almost monthly. Base metals are also going to make a big come back, as we see a massive restart of the global economy, and the need for basic materials.

Let's talk about silver, which is a key component of the Tombstone discovery formula because it is a famous historic silver district. Silver right now is lagging gold because it has a strong industrial component. But as we restart the global economy, more and more silver is going to be needed for industrial uses. More importantly, as we look forward, silver is a green metal. You can't have solar power without silver. You can't have electric cars without silver. I think our targets at Tombstone play into not only the gold silver investment thesis, but also the base metals investment thesis. This is a great time to be in the exploration and mining business!

Dr. Allen Alper: That sounds great, an excellent opportunity for investors! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

http://aztecminerals.com/

Joey Wilkins, President and CEO or Bradford Cooke, Chairman

Tel: (604) 685-9770

Fax: (604) 685-9744

Email: joey@aztecminerals.com

|

|