Rockridge Resources Ltd. (TSX-V: ROCK, OTCQB: RRRLF, Frankfurt: RR0): Focused on Two Main projects, in World-Class Mining Camps, with Proven Geologic Potential: Interview with Grant Ewing, CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 1/23/2020

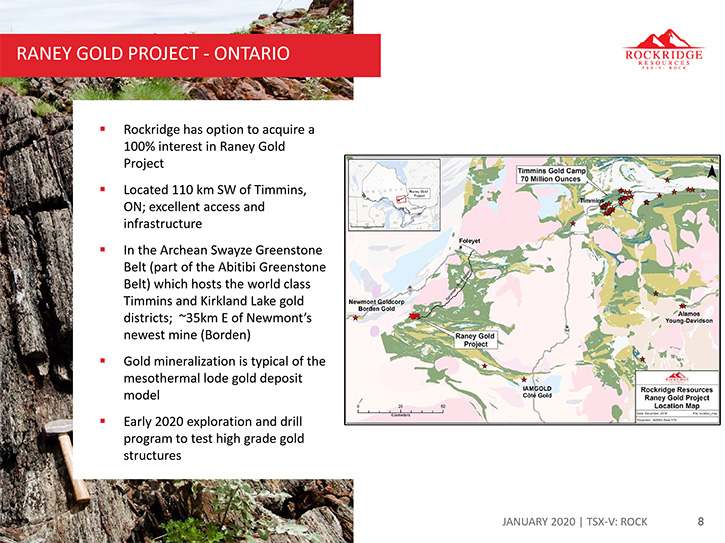

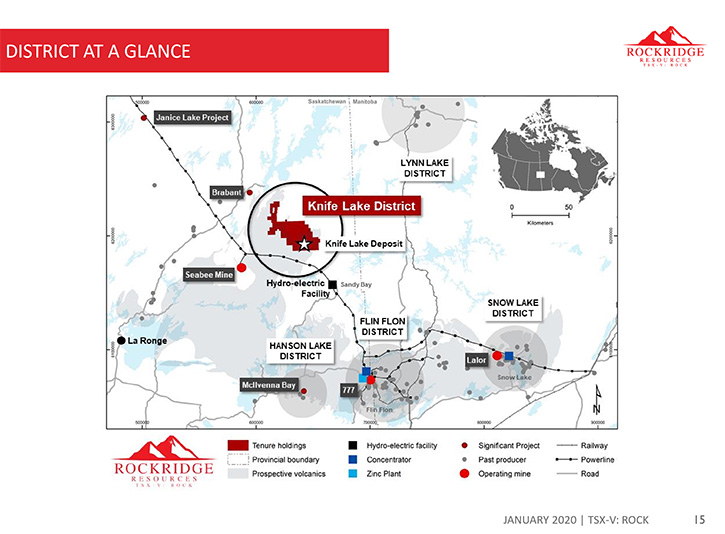

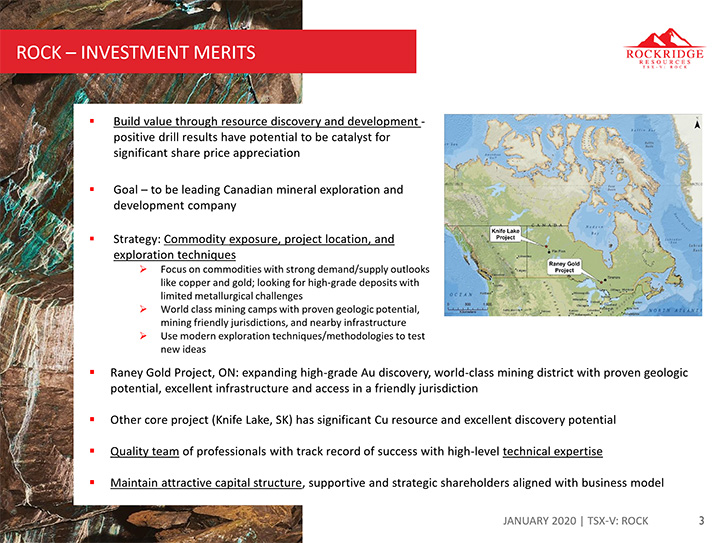

We learned from Grant Ewing, CEO of Rockridge Resources Ltd. (TSX-V: ROCK, OTCQB: RRRLF, Frankfurt: RR0), that they are focused on two main projects, located in world-class mining camps, with proven geologic potential. The Company's high-grade Raney Gold exploration project, in Ontario, is located in an area with excellent access and infrastructure in the same greenstone belt that hosts the world class Timmins and Kirkland Lake lode gold mining camps. The Company’s other core asset is a near-surface copper-cobalt-gold-silver-zinc VMS deposit, called Knife Lake Project, located in Saskatchewan, which is ranked as the #3 mining jurisdiction in the world by the Fraser Institute. According to Mr. Ewing, this deposit is open along strike and at depth and holds excellent potential for additional discoveries. The Company is well financed for 2020 and is about to embark on an early drilling program at the Raney Gold project, in mid-February through April, followed by summer exploration work at their Knife Lake copper project.

Rockridge Resources

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Grant Ewing, CEO of Rockridge Resources Ltd. Grant, could you give our readers/investors an overview of your Company?

Grant Ewing: Certainly, Al. Rockridge Resources is a relatively new public company. We're focused on exploration and development of projects in world-class mining camps, with proven geologic potential. Both of our target jurisdictions are mining friendly jurisdictions. We have projects in Saskatchewan, Canada and Ontario, Canada.

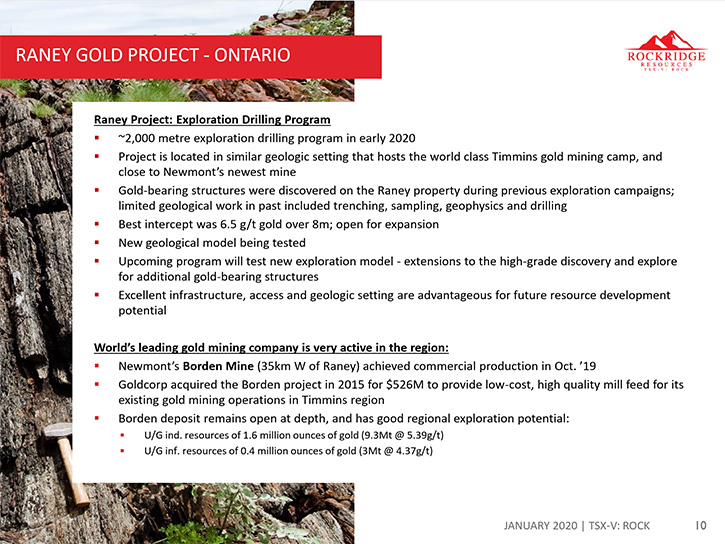

In Ontario, we have our core gold project called the Raney Gold Project and there we're expanding a high grade gold discovery. This gold project is located in the Timmins gold district, a district well known for its world-class discoveries. We're following up on a high-grade gold intercept of 6.5g/t over 8 metres that is open for expansion along trend and down plunge. The project has excellent access and infrastructure, and is approximately a 1.5-hour drive southwest of Timmins.

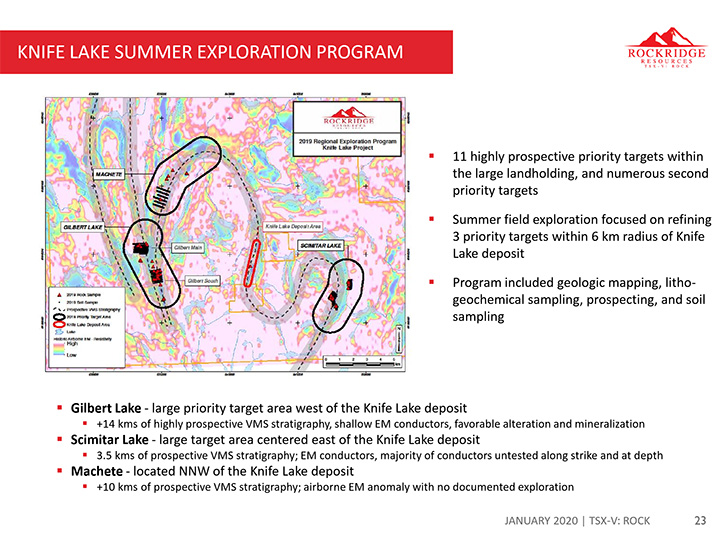

Our other core asset is a copper dominated project, located in Saskatchewan, Canada. It's a VMS project located in the Northwest extent of the Flin Flon-Snow Lake base metals belt. We see excellent potential to discover additional projects near the existing copper asset, and regionally on our extensive landholding.

Dr. Allen Alper: That sounds very good. Could you tell our readers/investors about your team and your Capital Structure?

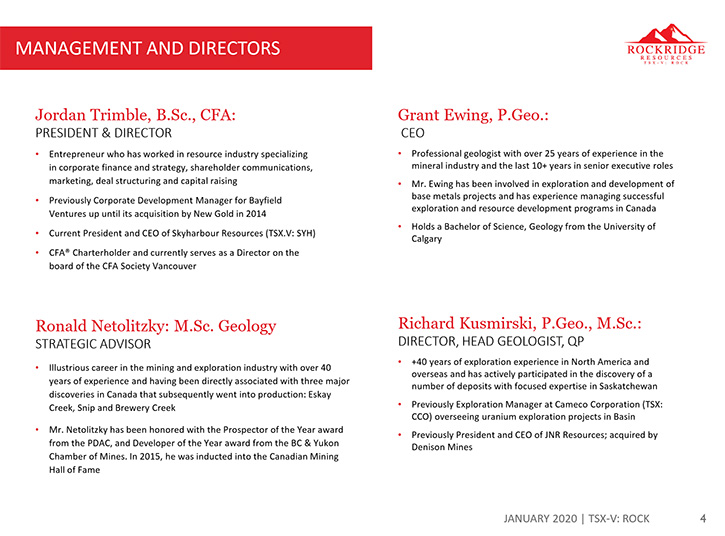

Grant Ewing:Rockridge has a quality team of professionals involved with the Company. I've had extensive experience as CEO of other junior companies. Overall our Management team, Board of Directors and strategic advisors bring extensive capital markets, M&A, financing and marketing experience to the Company, as well as very strong technical skills.

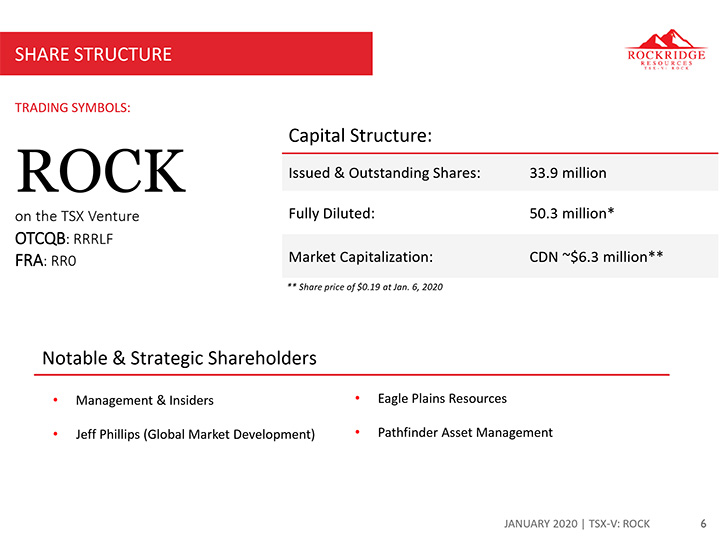

Rockridge is a relatively new public company. We have approximately 34 million shares outstanding, a market cap. of approximately $7 million Canadian, and a strong supportive shareholder base aligned with our corporate strategy. Management and Directors hold over 10% of the stock and another 20% of the stock is held by strategic investors.

Dr. Allen Alper: Oh, that sounds great. Could you give us a little more detail about your background and some of your Board members?

Grant Ewing: I'm a geologist by training. The last 10 plus years I've held senior management positions with a few different exploration mining companies. Prior to Rockridge, I was the CEO of Kiska Metals, a project royalty generator company with projects primarily in North America, but some international assets as well. We developed a successful royalty generation business model, which led to the acquisition of Kiska in 2018 by AuRico Metals. I continued with AuRico Metals, and about 10 months later, AuRico was acquired by Centerra Gold for approximately $300 million in a cash transaction. So that was a nice event for Kiska shareholders.

Prior to that, I was the CEO of Acadian Mining, which was focused on exploration and development of gold assets in Nova Scotia, Canada. We successfully built up two gold assets, which led to the acquisition of the Company by an international group. Shortly after that, the assets of Acadian were acquired by Atlantic Gold and these assets now form part of Atlantic Gold's mine development portfolio. Recently, Atlantic Gold was acquired by an Australian company for several hundred million dollars. So overall, I have extensive M&A experience and a strong technical background.

The rest of our Board and Management have extensive experience in this business. We cover all aspects necessary for a successful exploration company with extensive M&A, capital markets, and strong technical skills on our Board.

Dr. Allen Alper: That sounds very good and very balanced. You have an excellent background, so that's great. Could you elaborate a bit on your plans for 2020?

Grant Ewing: Certainly. We completed a financing late last year, so we're well financed for 2020. Our initial focus will be a drilling program at our gold project in Ontario, the Raney Gold Project. We expect to mobilize a drill in the middle of February for an approximate 2,000-meter drill program, involving seven to 10 drill holes. We'll follow up on a drill intercept of six and a half grams per ton over eight meters that was drilled by the previous operator about 10 years ago. That intercept was never followed up due to the price of gold at $900 an ounce in those days, and the fact that winter conditions were required to position the drill for testing the target zone.

So fast forward ahead to today. We're going to mobilize in February to test this high-grade intercept and look to expand it along strike and depth. We've conducted a thorough review of historic data and produced a revised geologic model that shows both expanded strike and dip potential to the high-grade zone. This is due to the view that the structure has a steep south dip orientation versus the historical model which envisioned a steeply north dipping structure. If our new interpretation is correct, that opens up the strike and dip potential considerably, and also provides better continuity of the historic intercepts.

So that'll be our first activity in 2020, the program will be conducted through February, March and April. Then we plan to follow up on our copper project in Saskatchewan, Canada. There we have the option to earn a 100% interest in the Knife Lake Project, where a significant copper resource that has been identified, and we have a large land holding with excellent exploration potential to discover other VMS deposits. We're excited to get going on that project in the summer months, so we'll have active copper and gold exploration programs through 2020.

Dr. Allen Alper: That sounds excellent. It's nice to have copper and gold to be exploring for in a safe region.

Grant Ewing: There you go, we agree.

Dr. Allen Alper: What would you tell our readers/investors are the primary reasons to consider investing in Rockridge?

Grant Ewing:Rockridge has only 34 million shares outstanding, so we have a nice tight capital structure. Management have significant shareholdings, and we have a group of strategic investors aligned with our business model. We're focused on new discovery at our highly prospective projects, and of course new discoveries have the potential to be significant share price appreciation catalysts. Overall were well financed and positioned for an active 2020, so I think that leads to a great investment opportunity with Rockridge.

Dr. Allen Alper: That sounds excellent. Is there anything else you'd like to add?

Grant Ewing: Thank you for interviewing Rockridge Resources for Metals News.

Dr. Allen Alper: You are very welcome. It sounds like you are doing all the right things. I enjoyed speaking with you.

http://www.rockridgeresourcesltd.com/

Grant Ewing, CEO

Jordan Trimble, President

Simon Dyakowski, Corporate Development

Rockridge Resources Ltd.

Telephone: 604-687-3376

Toll Free: 800-567-8181

Facsimile: 604-687-3119

Email: info@rockridgeresourcesltd.com

|

|