Abitibi Royalties Inc. (TSX-V: RZZ, OTC-Nasdaq: ATBYF): Building Portfolio of Royalties and First Dividend Payment Scheduled; Interview with Ian Ball, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/29/2019

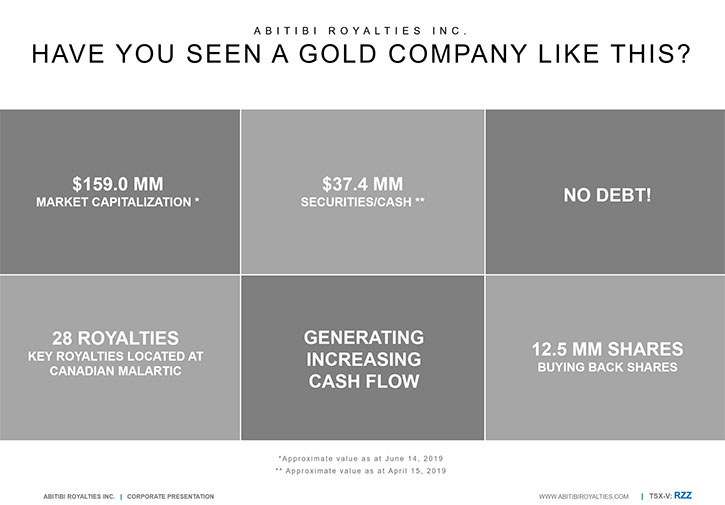

Abitibi Royalties Inc. (TSX-V: RZZ, OTC-Nasdaq: ATBYF) owns various royalty interests at the Canadian Malartic Mine near Val-d’Or Québec. We learned from Ian Ball, who is President and CEO of Abitibi Royalties, that one of the most important things about the Company is that it is debt free and, at any given day, $40 to $45 million of its value is in securities and cash on the balance sheet. The Company has been buying back shares for three years, and its first dividend payment is scheduled for the end of September. According to Mr. Ball, Abitibi Royalties is beginning to generate cashflow that is expected to grow. The main catalysts will be the exploration efforts at the Canadian Malartic Mine, as well as the technical study on the underground expansion there, which is expected to be delivered during the first quarter of 2020. In addition, the Company is building a portfolio of royalties on early stage properties, near producing mines.

The Canadian Malartic Mine

Dr Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Ian Ball, who is President and CEO of Abitibi Royalties. Well, Ian, you've had a fantastic market. A fantastic year with your Abitibi Royalties, and have done extremely well in a market that hasn't been all that exciting for the mining business. I wonder if you could give our readers/investors an overview of Abitibi Royalties and also tell them what differentiates Abitibi Royalties from other mining investments.

Ian Ball: When you look at our peer group in terms of size, 150 million market cap companies, what stands out to me, in terms of the fundamentals, is that approximately, on any given day, $40 to $45 million of our value is in securities and cash on the balance sheet, and we're debt free. We're buying back our shares constantly, that's been ongoing now for three years.

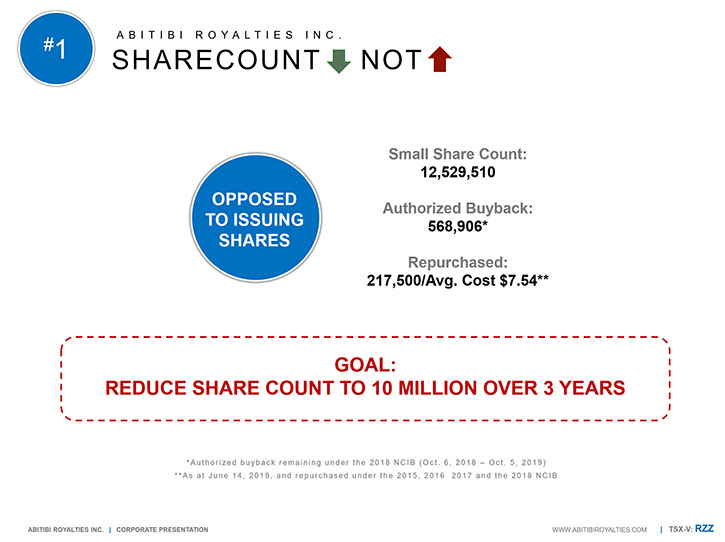

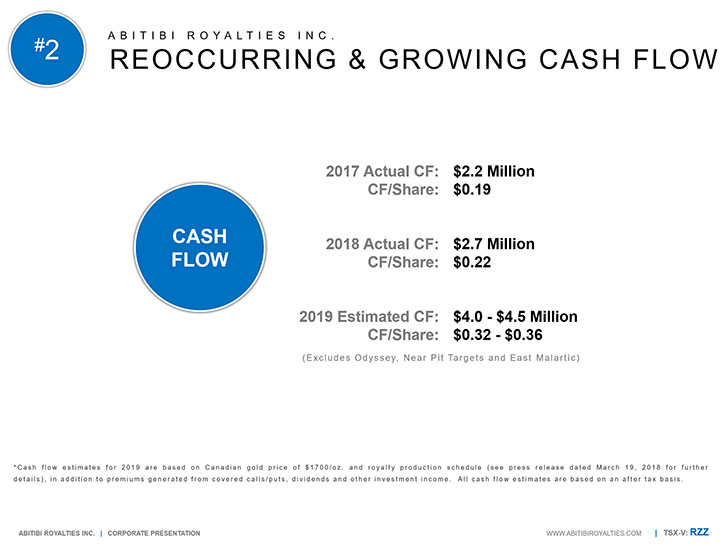

As you mentioned, we are just starting to pay a dividend. The first dividend payment will occur at the end of September, on an annual basis. It is 12 cents a share. We're at the early stages of our cashflow generation, so we expect that our cashflow, in coming years will grow. We don't put up any of the capital for that growth. We have the smallest share float of any company in the mining sector, who has a market cap in excess of $100 million.

We have 12.5 million shares outstanding and at the end of September we will have no forms of equity compensation or warrants outstanding. So the outstanding shares will equal the fully diluted shares. All this is being driven by the key royalty at Canadian Malartic, which is the largest gold mine in Canada. So you have a great asset, with a company that is shareholder-friendly.

Dr Allen Alper: That sounds exciting. That's really great. Could you tell our readers/investors a bit more about the outlook for Abitibi Royalties and what your plans are in the future?

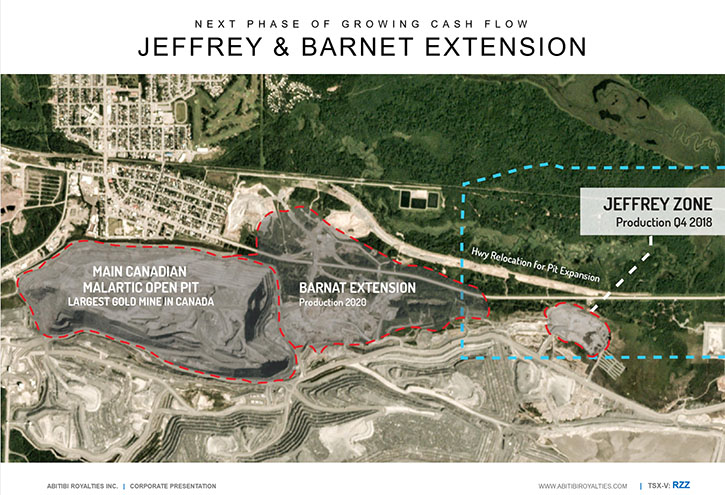

Ian Ball: A couple of things. One, we're seeing a lot of activity at the royalties at Canadian Malartic. Exploration is continuing at that site to extend the underground deposits that are connected to the main open pit. So that's first off.

Second, the operators are conducting a technical study on the underground and the results of that are expected to be delivered during the first quarter of 2020. If the results of that are positive, the operators have suggested that they would begin construction of the underground and that the underground ore would be fed to the existing Malartic mill by 2021. We are also seeing exploration programs being carried out on several other royalties that we've been able to acquire over the past five years.

Dundee Precious Metals has a discovery, just north of Canadian Malartic. They just finished a 5,000 meter drill program there and we have a 2% royalty. Pacton Gold is around Great Bear Resources’ new high-grade gold discovery, in the Hinge Zone, at its Dixie Project in the Red Lake District of Ontario. Pacton Gold just raised money. They're drilling a 10,000 meter drill program and we have a 1% NSR there.

We're starting to see a number of the non-core royalties have bits of activity, but the key driver is Malarctic. We're still looking for opportunities to expand our royalty portfolio. We've been looking to expand our footprint, within the broader Abitibi region (Quebec /Ontario). We are always looking out for another producing royalty. Our main royalty began production in December, but we like to add another one to the portfolio. It is just a matter of jurisdiction and a matter of price.

Dr Allen Alper: Excellent! Excellent! Could you tell our readers/investors a bit about what differentiates royalty companies from mining companies?

Ian Ball: Generally, if royalty companies have a producing asset, they have free cash flow. They don't have to keep reinvesting it back into exploration or development. That's one of the big differences, the cashflow is free. Royalty companies do not have to put it back into sustaining development.

The second is that you don't tend to have the same risk profile. Costs blow out, things of that nature that can really disrupt a mining company. On the flip side, in the short term, if gold prices go up, a mining company’s margins will tend to expand much faster than a royalty company. Although over long periods of time, we've found that the mining companies’ margins will tend to erode due to people having their hand out asking for more money, whether it is employees or communities, but mining companies’ margins have a lot more initial leverage.

Dr Allen Alper: That explains why royalty companies make a very profitable investment. Can you tell our constantly growing number of readers/investors about your background and that of your Management Team and Board?

Ian Ball: I've been at Abitibi for the past five years. When I joined the Company, I agreed that I would put all of my salary and any cash bonuses back into the Company. I've been doing that now for the past five years to show investors that I'm just as invested, if not more invested than anybody else in the Company.

Prior to joining Abitibi, I was with McEwen Mining, where I was President, heading up operations for the construction team as well as exploration. I was there for the bulk of my career. I started at Goldcorp back in 2004. Glen Mullen, who's the Chairman of the Company was, until recently, the President of PDAC. He was the Founder of Abitibi Royalties in 2011 and he is also the Founder and CEO of Golden Valley Mines, our largest shareholder. He was also CEO of Canadian Royalties’ that discovered another mine in northern Quebec. It is still in operation and was purchased by a Chinese entity.

Dr Allen Alper: Yes. Thank you. Could you, tell our readers/investors the primary reasons they should consider investing in Abitibi Royalties?

Ian Ball: You're going to get exposure to exploration and that's obviously the key driver for almost any mining company. The difference is that we don't require any funds, and so we don't have to worry about share dilution. You're getting this exposure, without the risk of having the ability to raise money at a high cost. So that's the first reason.

The second is the development and the future cash flows. Our royalty at Malartic started in December of last year. We've seen it build in 2019. You are now getting a yield of 1% on your shares through the dividend policy. We're expecting these cash flows to increase, once the underground portion of the royalty comes into production. From there, you're looking at a very shareholder friendly Company. We have a very small shareholder count. We're buying back the shares. I'm investing all of my compensation back into the Company. From that standpoint, I don't think you're going to find a company of our size with better fundamentals, or a company that's friendlier toward its shareholders.

Dr Allen Alper: Sounds like excellent reasons to consider investing in Abitibi Royalties! Ian, is there anything else you'd like to add?

Ian Ball: I think that that touches most of the bases. Thank you for interviewing Abitibi Royalties Inc. for Metals News.

Dr Allen Alper: I appreciate you sharing your insights with us. We’ll publish your press releases as they come out so our readers/investors/investors can follow your progress.

https://www.abitibiroyalties.com/

Ian Ball President and CEO

Tel.: 1-888-392-3857

Email: info@abitibiroyalties.com

|

|