Interview with Daniel Major, President and CEO, GoviEx Uranium Inc. (TSX-V: GXU; OTCQB: GVXXF): Focused on Becoming a Significant Uranium Producer

|

By Allen Alper Jr., President, Metals News Inc.

on 4/10/2019

GoviEx Uranium Inc. (TSX-V: GXU; OTCQB: GVXXF) is a junior exploration company, focused on becoming a significant uranium producer through the continued exploration and development of its mine, permitted and construction-ready Madaouela Project in Niger, permitted construction-ready Mutanga project in Zambia, and the Falea project in Mali. At PDAC 2019, we learned from Daniel Major, President and CEO of GoviEx Uranium, that in 2018, the company was able to remove an $8.2 million debt, at a big discount, signed up the feasibility study contractors, and have been working on improving the project and reducing the costs. Plans for 2019 include carrying out the feasibility study, incorporating the solar hybrid power supply to reduce risks and costs associated with the project, working on financing and talking with potential off-takers.

Al Alper: This is Allen Alper Jr., President of Metals News, here at PDAC 2019, interviewing Daniel Major, who is President and CEO of GoviEx Uranium. Could you tell us a little bit about your background?

Daniel Major: Absolutely Allen. So I'm a mining engineer from the Camborne School of Mines. I started in the uranium industry back in 1987 working for Rio Tinto at the Rossing Uranium Mine in Namibia. Subsequently I’ve worked in the platinum industry, I've worked for myself doing mine consulting design, I've worked seven years as an equity analyst, both in South Africa and the UK. I've worked in Russia in the ferro-molybdenum business and the timber business, I've worked in South America in manganese and gold, and I've done gold mining in Canada and Peru. And now I'm back in uranium again in Niger and Zambia this time.

Al Alper: That’s an amazingly extensive background! Excellent! Could you give our readers/investors an update on what's been going on since the last time we interviewed? Also for the benefit of the thousands of new readers/investors, who have joined us since our last interview, could you give us an overview of your Company?

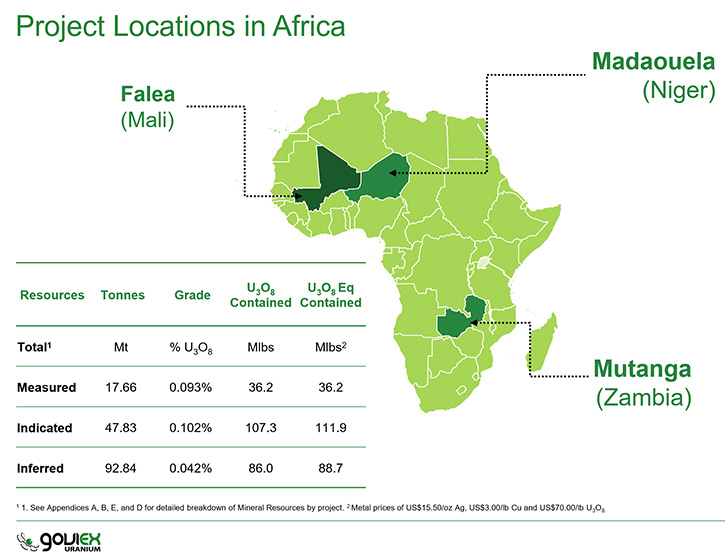

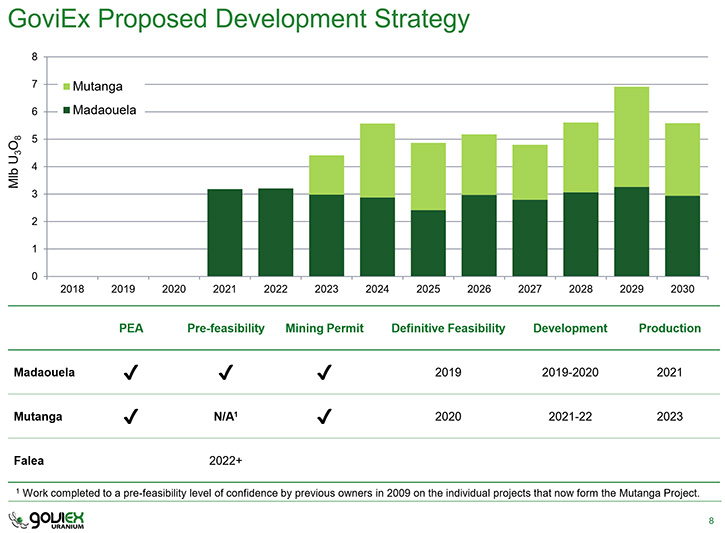

Daniel Major: GoviEx is a uranium-focused company. It's focused on Africa and has a very large mineral resource, with a lot of exploration upside. We have three main projects. The first one is Madaouela in Niger, it's a mine permitted project, ready for construction. We have Mutanga in Zambia, equally so, it's permitted ready for construction. And then we have the Falea project in Mali.

Al Alper: So tell me about what's been going on in 2018?

Daniel Major: 2018, we did a couple major things. The first one was to clean up our balance sheet. We removed a large debt, it was about $8.2 million worth of debt that was owed to the Toshiba Corporation. We bought that out at $4.5 million, a big discount. On the back of that, because the metal prices started to improve towards the end of the year we signed up the feasibility study contractors. And what we've been focused on since then is what can we do to improve the project, reduce the costs, both operating and capital costs so that we reduce the incentive price of uranium that's needed to start this project.

Al Alper: So what are your plans for 2019?

Daniel Major: Well it's really to carry on that work on the feasibility study. Currently we are very focused on the metallurgical plant, as that’s where our biggest capital is and the biggest operating costs. There's a lot of technology that's changed since we did the pre-feasibility study. We're looking at its application in the current projects and how that could improve the existing economics. That includes things like solar hybrid, where we've appointed a group called Windiga Energy to do an analysis of solar hybrid for us, to reduce our risks on power supply coming through to the project.

We're also working with the lending banks. We just started to work with the off-takers. So this year's going to be all about what it requires to get a project off the ground. So the news flow will be focused on getting the project going.

Al Alper: And tell us again what your resources are?

Daniel Major: About 230 million pounds U3O8, the majority of which is at Madaouela, 138 million pounds. There're 60 million pounds at Mutanga and about 30 million pounds at Falea. All of those have a lot of exploration upside because we turned the draw rigs off in 2013. We just basically felt at that time that with the uranium price falling there was no real point in adding to what are already large resource bases. They're big enough. Madaouela has a 21 year mine life and Mutanga an 11 year mine life, so why make it bigger at this time?

Al Alper: I've been hearing a lot of good predictions about uranium. What’s your take in that?

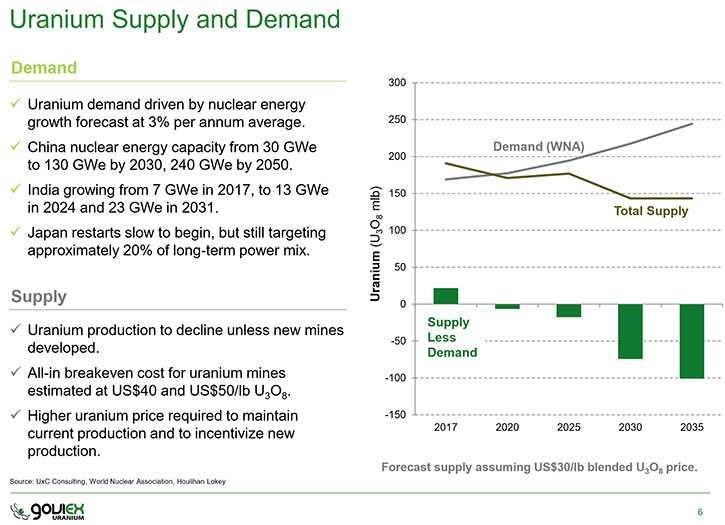

Daniel Major: I would agree on the positivity. Not just my optimism. I think the key thing is nuclear generation is now back to pre-Fukushima levels. You're looking at a reactor build rate that's the fastest that we've had in the last 25 years and accelerating. On the other side of it you had major supply cuts coming through that put the market into deficit. You had inventory draw-down, particularly by the investment funds, pulling it into inventory, and secondary sales have declined as well. So I think during this year you're going to see that all of those impacts feed into that market in a positive way, and we will see the uranium price steadily climbing throughout the year.

Al Alper: So stronger demand and weakening supply.

Daniel Major: Exactly right. All the things you need.

Al Alper: Tell us a little bit more about your Management Team.

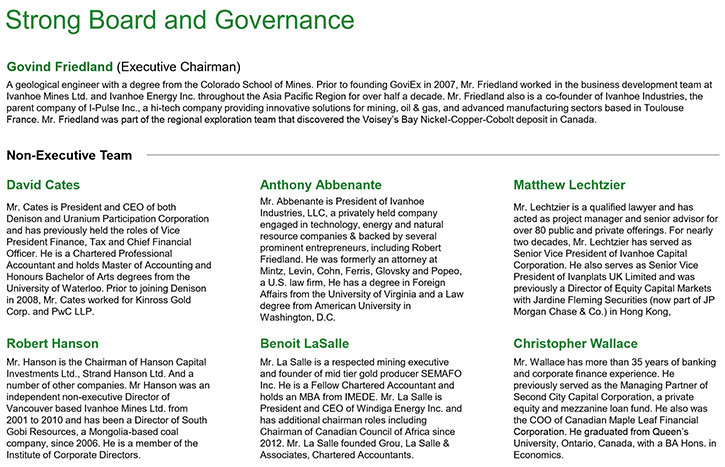

Daniel Major: My management team is relatively small at the moment. We keep it small on purpose because of where we are on the project team. I've given you my background, my chief geologist has a long history in the uranium industry, did some time both as an exploration geologist and as a mine geologist. He’s also worked in the iron ore industry. We have a very strong metallurgical consultant with our group as well, which is very important as to how we focus on the projects. He actually has built his own mine personally as well, in copper, so it brings a lot of mine-building experience into play for us. Good Board, we have Govind Friedland, as the Chairman of the Board of course, and we have people like Benoit La Salle, from SEMAFO, who brings a ton of experience on West Africa. So very useful Management and Board Team.

Al Alper: Really excellent people! What do you see as the biggest challenges that you have right now and what are you doing to address those?

Daniel Major: The biggest challenges are predominantly technical challenges, where we stand today, which is all about getting the cost of that project down, both in operating and capital costs. So I see that being the single biggest challenge, because after that you can define your debt equity strategy. The better you can make the project the bigger the debt you can put on it, and less equity. So really that's the total focus of where the management is at the moment.

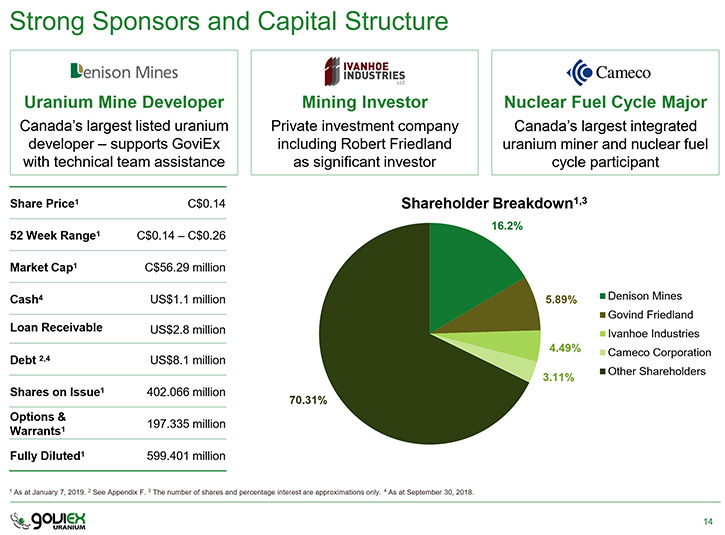

Al Alper: Tell us a bit about your share structure.

Daniel Major: We have some major shareholders, Cameco, Denison and Ivanhoe Industries. They're holding about 30%. The rest is pretty well split between retail and equity. There are about 400 million shares on issue.

Al Alper: Management interest?

Daniel Major: Management interest, all total, is about 12%.

Al Alper: So you have skin in the game.

Daniel Major: We all have skin in the game. I share with investors that the key driver for myself is - I want to build the mine and do the transaction that makes shareholders money. As an engineer, that's what really incentivizes you as well, that desire to construct.

Al Alper: Exciting! What are the main reasons you think investors should be looking at GoviEx?

Daniel Major: Well obviously the first thing you have to look at is do you believe in the uranium market? If you believe in the uranium market, all uranium shares will go up. The difference is we're permitted, so we have that potential to go from being a developer to being a producer, and that comes with a natural re-rate. Producers are rated much higher than developers and so we're one of the few that can actually do that. Because we're so advanced with the permit, that's going to be what drives us through.

Al Alper: To sum it up you have a great management team, good location, good resource, fully permitted, ready to go, and the market will recognize you for that when you go into production.

Daniel Major: Exactly correct.

Al Alper: Okay. So is there anything else you'd like to add?

Daniel Major: Just to thank you for interviewing GoviEx for Metals News.

Al Alper: Thank you. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.goviex.com/

Govind Friedland, Executive Chairman

Daniel Major, Chief Executive Officer

+1 604-681-5529

info@goviex.com

|

|