Paramount Gold Nevada Corp. (NYSE American: PZG): Interview with John Seaberg, Executive Chairman

|

By Allen Alper Jr., President, Metals News Inc.

on 4/9/2019

Paramount Gold Nevada Corp. (NYSE American: PZG) owns 100% of the Grassy Mountain Gold Project, which consists of approximately 11,000 acres, located on private and BLM land in Malheur County, Oregon. The project contains a gold-silver deposit (100% located on private land) for which results of a positive PFS have been released in 2018 and key permitting milestones accomplished. At PDAC2019, we learned from John Seaberg, Executive Chairman of Paramount Gold Nevada, that recently they acquired the Frost Project 12 miles away from the Grassy Mountain. Plans for 2019 include completing the permitting process for the Grassy Mountain, which is going to be a small, but very profitable operation and will have tremendous economic impact on the local communities of Vale and Ontario that are very supportive of the project.

John Seaberg, Executive Chairman of Paramount Gold Nevada at PDAC 2019

Grassy Mountain

Allen Alper Jr: This is Allen Alper Jr., President of Metals News, here at PDAC 2019, interviewing John Seaberg, who is the Executive Chairman of Paramount Gold Nevada.

Could you tell Metals News and our readers/investors a bit about your background? Then we'll talk more about Paramount and do a recap of what you've been doing in 2018 and we'll go forward from there.

John Seaberg: Sure, great Allen. I appreciate the opportunity to tell the Paramount story to Metals News and your readers/investors. I'm the newest member of the executive team. I joined as Executive Chairman in June of last year. I have over 25 years of experience in the metals and mining sector, most of that was with Newmont Mining Corporation, where I served in corporate development as well as Investor Relations. Then, more recently I spent several years at Klondex Mines and joined this team in June of last year. I’m excited about the opportunity. It's a great Company. We have an exceptional and very experienced Management Team supported by a Board of Directors who bring a wide array of skills to the table. Equally important, I really like the assets here in the U.S., the Grassy Mountain Project in Eastern Oregon and our Sleeper Mine in Nevada.

Allen Alper Jr: Could you give our readers/investors an update on what's been going on since the last time we interviewed? Also for the benefit of the thousands of new readers/investors, who have joined us since our last interview with Paramount, could you give us an overview of your Company? Just a quick summary of what you've been doing in 2018.

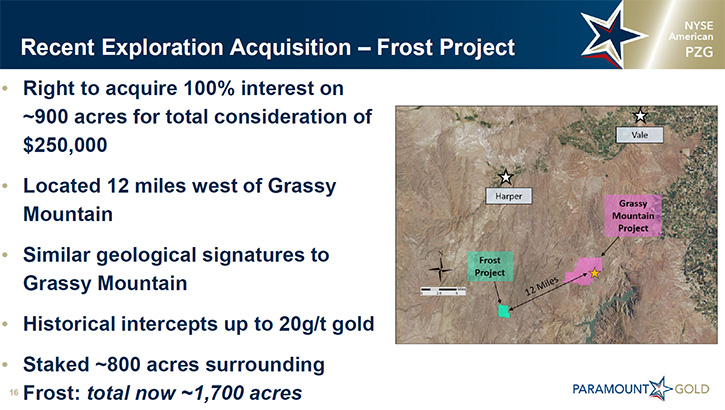

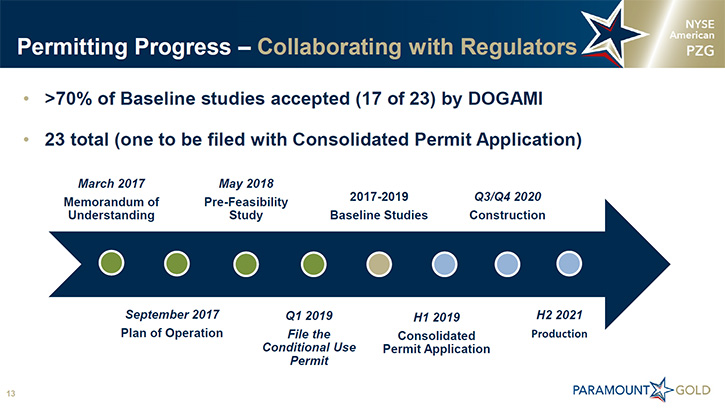

John Seaberg: Several milestones were achieved in 2018. I think the most important of which was completing our PFS, Preliminary Feasibility Study, at Grassy Mountain. We did that in May of last year. The permitting process is in full force. We had several baseline studies that were accepted by the Department of Geology and Mineral Industries, whom are the Oregon State Regulators that are overseeing the permitting process. We have 18 of 23 baseline reports filed and accepted and the remaining are under review. The final baseline data report will be filed mid this year as part of our consolidated permit application. We completed a small equity raise in July of last year and put some money in the bank. We exploited our first mover advantage in the state, expanding our land holdings by 1,700 acres in Eastern Oregon with the acquisition of the Frost Project, which is only 12 miles from our Grassy Mountain Project. Payments for Frost will total $250,000 spread out over four years. Our team is excited about the prospects at Frost as there are several geologic similarities to Grassy and very interesting high grade historical drill intercepts grading up to 20 grams per ton. Its close proximity to Grassy Mountain makes it a viable trucking distance to the Grassy Mountain complex. It was a very exciting year in 2018 and we have continued the momentum into 2019 as well.

Allen Alper Jr: So what are your plans for 2019?

John Seaberg: 2019 is another pivotal year for the Company on a couple of fronts. We have to complete the permitting process and when I say complete, I’m referring to the work that we have to do prior to submitting the Consolidated Permit Application to the State which is expected in mid-2019. We recently filed the Conditional Use Permit with the county in which we'll be operating - Malheur County. With respect to the county permit, there is meeting scheduled at the end of this month, March 28th, where there is a public hearing to review the permit. We expect the permit to be reviewed and accepted in very short order. We believe, this will really start to give the project a higher profile and people will realize that we're actually going to file the state and federal permit applications and it'll be the only permit ever filed for a chemical mine in the State of Oregon.

We have extremely strong support with the local communities around the project in both Vale and Ontario. Both of those are small towns in Oregon right around our project, from which we'll source most of our labor. We've already had public meetings in each one of those communities and they're eager to get this project underway due to the potential economic impact that it will have.

Following the County permitting process we plan to file the Consolidated Permit Application with the state mid this year, and that is important because it starts the clock ticking from the regulator's standpoint. They will then have an obligation to review under certain milestones. The federal process under the BLM will also commence following the National Environmental Policy Act. Then it gets very interesting.

Allen Alper Jr: So tell me a little more about the project. What do you see there?

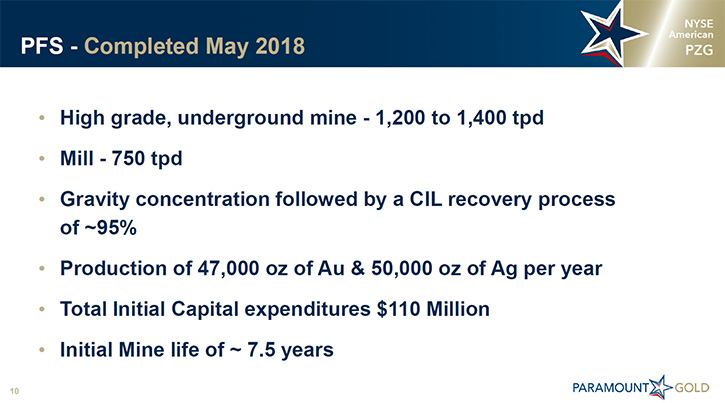

John Seaberg: Grassy Mountain is designed to be a really simple, but very profitable high grade underground operation driven. The PFS scenario assumes total production of 362,000 ounces or approximately 50,000 ounces of gold and silver per year over a seven and a half year mine life with an average ore grade of ore of 7.23 grams per ton. The mining process is straight forward with a 750 ton per day mill and a recovery process that begins with gravity concentration followed by a carbon in leach process that will yield approximately 95% recoveries. The initial development capital is approximately 110 million dollars. So it's a modest size, not massive production, but very profitable. At $1,300 dollar gold we have a 28% IRR in the PFS and approximately 90 million dollars after tax NPV. So it's a great profitable mine that can withstand lower metal prices, which we believe is important given the volatile metals environment. To recap, it is low cost and high grade with excellent recoveries.

Allen Alper Jr: Now has that been fully explored out or will you be able to expand the mine life past seven and a half years?

John Seaberg: That's a great question. No, we have a lot of exploration potential in the land package that we control. It's approximately ten thousand acres. We have a small exploration program that will complete when the weather clears in the spring of this year. That is another event that's going to happen in 2019. All of the exploration opportunities are within trucking distance to Grassy Mountain, which means any additional mineralization that we discover will extend mine life and we won't have to build another mill.

Allen Alper Jr: Very good! Tell us a bit about your share structure and where you're trading.

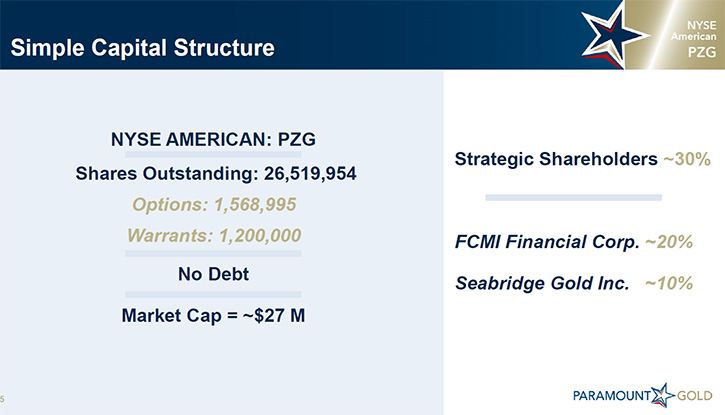

John Seaberg: We're U.S. focused. Our assets are in the U.S. and we're only traded and listed in the U.S. on the New York Stock Exchange American under the symbol PZG. We have a very tight capital structure. I think we're very conservative as far as issuing stock. If you look at most of our peer group, companies our size have significantly more shares outstanding. We only have 26.5 million shares outstanding and we have zero debt. We are trading at about $1.00 per share giving us a market cap of about 26 million. When we issue stock, we try to improve per share metrics for our shareholders so not to dilute them unnecessarily.

Allen Alper Jr: Excellent. Could you tell us a little bit about the Management investment?

John Seaberg: As far as ownership?

Allen Alper Jr: Yes ownership.

John Seaberg: Management plus Directors own approximately 4%. Management is incentivized alongside its stockholders, to advance their assets as the vesting criteria of employee stock options are related to stock price performance and key permitting milestones of Grassy Mountain. Our largest stockholders are FCMI Financial and Seabridge Gold, who own approximately 30 percent and both are long term focused investors in the gold sector.

Allen Alper Jr: What do you see as the biggest challenges you're facing and what are you doing to address those?

John Seaberg: The biggest challenges are obviously the macro environment that we're in and we're starting to see some strength in the gold price although it keeps giving us a head fake and then retreats. But I think in the near term and even longer term, we're going to see stronger metal prices. That should hopefully bring some of the inflows back into our sector and the equity market should hopefully return. More specifically to the Company, I think it's really overcoming the perception that you can't get a permit in Oregon. Grassy Mountain is a great project. Technically it is very low risk. It's been studied for over three decades by many different companies including Newmont in the early to mid-90s. We just have to complete the permitting process. We're pioneers in Oregon, with respect to the permitting process, because it hasn't been tried or tested. But the rules and regulations have been around since 1991. They're very standard, straight forward, transparent and they're time based. Meaning, if we do our work, and when we submit our applications and it is deemed complete by the state, then we should get our final permits within one year of filing that application.

So it's a very efficient process and we're testing it now. That's one of the challenges that we're overcoming with continuous meetings with investors, potential investors, and our existing shareholders, is that perception of Oregon. We're in Eastern Oregon, which is very different from the Western part of the state. Eastern Oregon is exactly like Northern Nevada, very desert like and nothing but sagebrush. Actually it's a perfect place to build this mine.

Allen Alper Jr: So is the concern environmental impact and then what would you be doing to minimize that?

John Seaberg: Well, that's why we chose to go underground. We actually have a total resource at Grassy Mountain, of over a million ounces at 1.2 grams per ton and it is near surface. So it looks like it could be an open pit, but we don't want to do that. We want to focus on the high grade core of the mine so we can mitigate the risk of volatile gold prices but we also want to have a small footprint on the land. Having the first mine in Oregon, we think that's a prudent approach and it should help with the permitting process. We know that we need to earn our social license every single day. This could be a game changer for the State of Oregon, welcoming mining into that state and we don't want to mess it up. We want to be a success story in that state, because I think that's going to be helpful and positive for our entire industry. There are enough environmental examples of what not to do in our industry and we actually want to be a poster child for how to do it correctly.

Allen Alper Jr: What do you think are the main reasons that investors should be looking at Paramount Gold Nevada?

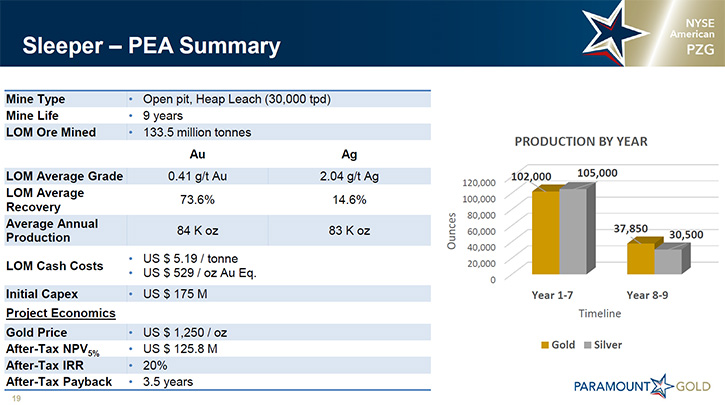

John Seaberg: I believe if you look at the combined value of our assets: the PFS at Grassy Mountain, which has an after tax NPV of 90 million dollars at $1,300 dollar gold; and the Sleeper Mine that has a completed PEA at 1,250 gold has an NPV of $125 million. We have yet to discuss our Sleeper Mine, which I do want to touch on, but it has a four million plus ounce deposit in Nevada and I would submit we're getting zero value for that in our share price. That said, I think we're cheap and trading at a significant discount. We truly are, but I think we're making significant progress with permitting Grassy Mountain and it's a great time to get into our stock. We have very supportive shareholders. We have zero debt on our balance sheet and we're exploring opportunities on how to unlock value at the Sleeper Mine in Nevada. Right now our primary focus is on advancing Grassy Mountain. One of our goals is to advance Sleeper as well and take advantage of stronger gold prices, which I believe is forthcoming. The other thing I want to mention about Sleeper is that it has scale. It is four million ounces today but it's also a 40,000 acre land package in a very good gold rich district. We're going to wake Sleeper up with the goal of advancing both projects simultaneously to accelerate unlocking that value for our shareholders.

Allen Alper Jr: So tell me more about your Sleeper project.

John Seaberg: Sleeper has a rich history as it was high grade, open pit producer from 1986 to 1996 with a head grade of over 7.0 g/t gold. Today, we have over four million ounces of mineralized material. Sleeper and Grassy Mountain are almost mirror opposites of one another. Grassy is a smaller modest size project with high grade and Sleeper is a relatively lower grade project, but it's big and has scale given its 40,000 acre land package. Our PEA envisions an open pit, heap leach scenario only considering about a million ounces of the four million as only the higher grade oxide and mixed material will be processes. The PEA is extremely lucrative at $1,250 gold with an NPV of $125 million which is driven by an extremely low strip ratio, recoveries of approximately 75% and a quick payback period. Further to the upside at Sleeper given the scale of the project which I mentioned, the Company has done some work in the past reviewing the recoveries of the sulphides using various methods with modest success. That is one avenue we are discussing turning our attention to that could add significant value to the project. Recall, there are over 4 million ounces here and the PEA only considers a fraction of them.

Allen Alper Jr: Is there anything else you'd like to add?

John Seaberg: I appreciate the opportunity to tell the story to Metals News and your readers/investors. I'm excited. I'm very passionate about Grassy Mountain and I'm also very passionate about Sleeper. It's a very good strategic asset for us in Nevada. I'm going to repeat that again because it is arguably the best gold jurisdiction in the world, and we're going to look at opportunities to unlock value at Sleeper as well. Right now it's waiting until we get more advanced at Grassy Mountain, but with more capital then we'll start advancing both projects simultaneously.

Allen Alper Jr: You mentioned that you're really very tight in doing everything possible to minimize the dilution of stock. How do you see financing going with minimal dilution?

John Seaberg: Sure. There are other options to raise capital in this market and we're having these discussions, with other corporates. For example, we would entertain selling the silver stream at Grassy Mountain, which, as mentioned, will produce 50,000 ounces of silver a year. We've had some interest from companies looking to take in a stream on that project. The royalty companies are always a source of capital and more so when the equity markets aren't as strong as they could be. To clarify, I didn't say we wouldn't dilute because the equity markets are a great way to raise capital. However we strengthen our balance sheet, we aim to take the dollars raised and improve the value for our shareholders on a per share basis. So when we issue stock and raise capital, we put that money into the projects, into the ground, and hopefully that creates value for our shareholders.

Allen Alper Jr: Now would you limit those raises to existing shareholders?

John Seaberg: Absolutely not, our shareholders are very supportive and they've participated in every financing that we've done pro rata, not to dilute their ownership. That said, we want to get some new names on our shareholder registry. We think it's important to have additional endorsements. We know our existing shareholders believe in management and believe in the projects. So getting new money into the name is important for us.

Allen Alper Jr: Very wise! Very well thought out! I’m impressed with what you are doing and the opportunities you are pursuing. Thank you very much for a very interesting interview. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

John Seaberg: Thank you.

http://www.paramountnevada.com/

Glen Van Treek, President, CEO and Director

Christos Theodossiou, Director of Corporate Communications

866-481-2233

Twitter: @ParamountNV

|

|