Ascot Resources Ltd. (TSX.V:AOT, OTCQX:AOTVF): Interview with Derek White, President and CEO

|

By Allen Alper Jr., President, Metals News Inc.

on 4/4/2019

Ascot Resources Ltd. (TSX.V: AOT, OTCQX:AOTVF) is a gold and silver focused exploration company, with a portfolio of advanced and grassroots projects in the Golden Triangle region of British Columbia. The company’s flagship Premier project is a near-term, high-grade advanced exploration project, with large upside potential. We learned from Derek White, President and CEO of Ascot, that in early January they announced a deal to acquire IDM Mining, with its feasibility-ready, shovel-ready high-grade Red Mountain project. According to Mr. White, the deal places Ascot in the top 7% of the world in gold grade, which is critical for lowering operation costs. According to Mr. White, the main reason investors should look forward to Ascot/IDM merger is the critical mass - a pathway to 200,000-plus a year for 10 years of high-grade low-cost production.

Allen Alper Jr: This is Allen Alper Jr., President of Metals News, here at PDAC 2019, interviewing Derek White, President and CEO of Ascot. He's going to take us through a presentation about what's new and exciting with Ascot Resources.

Derek White: Thanks very much Allen, we appreciate the opportunity to share our progress with you and your readers/investors. We'll just walk you through our presentation and show you what our value proposition really is. In November of 2017, we joined the company with the vision of restarting a mine to be able to produce 200,000 ounces a year for a minimum of 10 years. The way we wanted to go about that was utilizing the existing infrastructure that was invested in this area, historically.

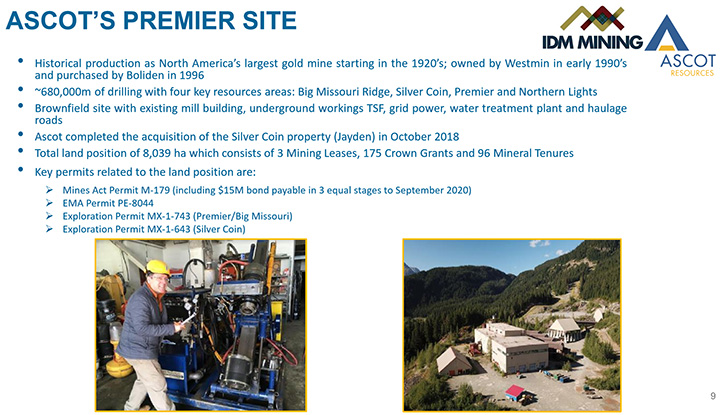

When we went up there and we had a look at this, we had a mill, an underground mine, a tailings dam, a road, a power plant, all the things that we needed to have. What we were missing was the 10 million tons of high-grade ore that we needed to put through that. In the first quarter of 2018, we went on a bit of a quest to get that high-grade ore. Historically there were a lot of drills in this area, so we went through the historical database and in April of 2018 we put out our first three million tons of about seven gold grams per tonne material.

Then shortly after that, in the fall of 2018, we were able to add another six million tons by additional drilling that we did, and also the acquisition of a company called Jayden Resources, which was a nearby mine called Silver Coin that fed this mill back in the 1990s. By the end of the fall we had gone from nothing to nine million tons of about seven and a half gold grams material, which was almost enough to feed this mill for 10 years.

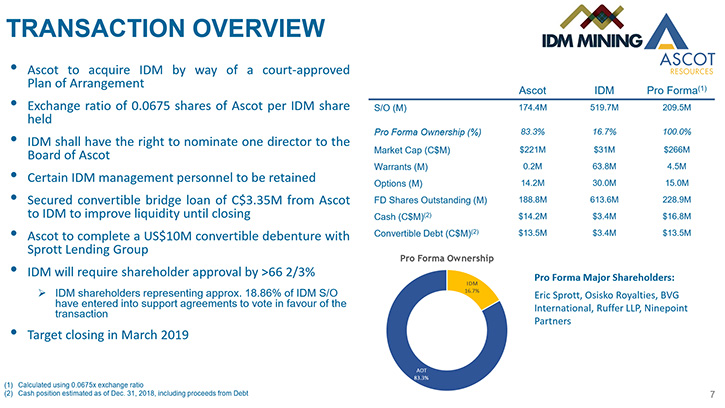

Our drilling was cheaper and easier because of road access, and we were able to accomplish a lot very, very quickly. Post the IDM transaction, about half of the Resources will be measured or indicated resources, and the other half inferred. Across the valley from us was a feasibility-ready, shovel-ready project called Red Mountain from IDM. We really wanted to build one mining company in Stewart, and they were willing to make a deal with us. They would add another three million tons of measured and indicated material.

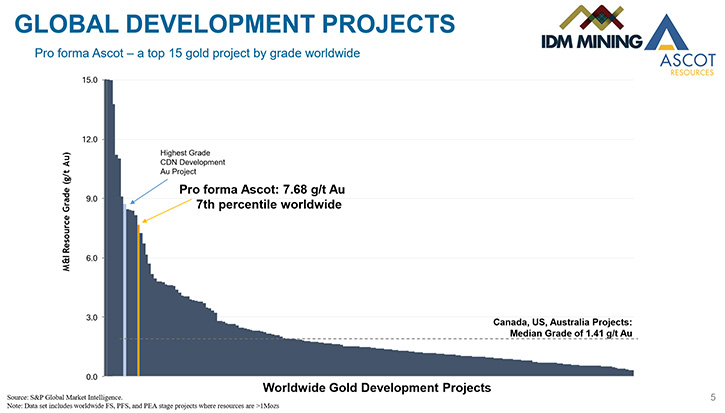

By January of this year, we announced the deal to acquire them and put the whole thing together. We're now in the top 7% of the world in gold grade, which is very helpful in terms of keeping our operating costs at a low level.

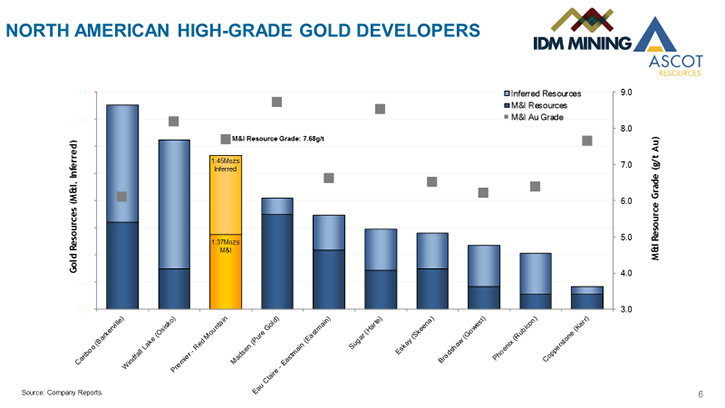

Derek White: When we started at the end of 2017, we had no high-grade resources. These are all the gold development projects in Canada on the chart below. The dark color represents M&I, the light color represents inferred, the gray bar represents grade. We've now become probably the third largest gold junior development project in Canada in less than a year. The closest to us is the Windfall Project by Osisko. We're approximately the same grade and we actually have more M&I and they have a little more tonnage.

For us, in a very, very short period of time, we were able to amass that critical volume of material. Now we're working on taking that material into an engineering plan and putting that through a feasibility study and doing the work for the regulator, so we can reactivate our mining permit again and start production. The first step in that is to close our IDM deal, which the shareholders are expected to vote on March 20th.

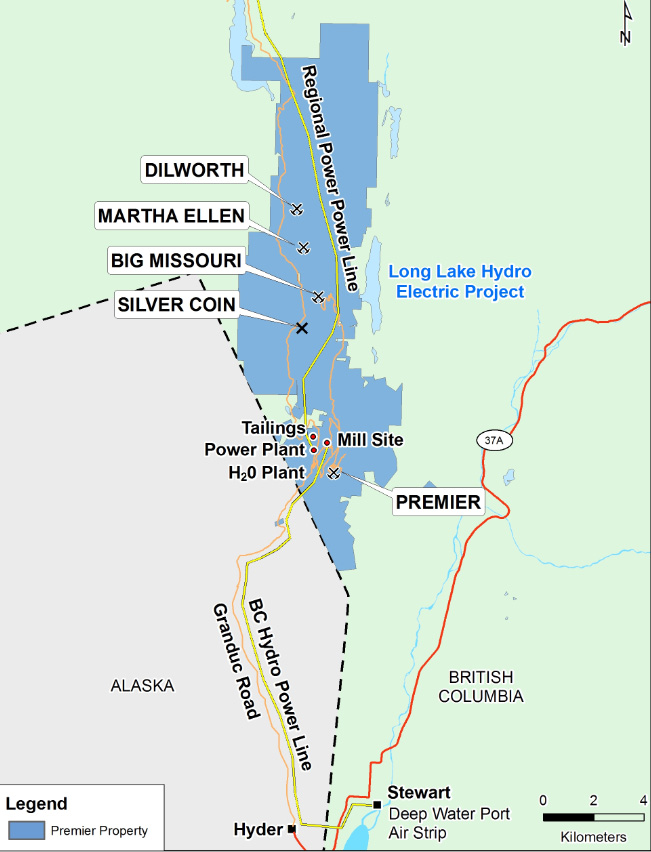

For any of your readers/investors, if you're IDM shareholders, this is the critical mass that you need to be relevant to larger mining companies. I think the proforma Company provides critical mass that makes it an attractive target for future mining or also for a potential takeover target. Why? Because the Company has infrastructure, and high grade and lots of exploration potential and is about a 20-minute drive from Stewart. We have a lot of the infrastructure in the southern part of our property and we have the option to mine from effectively four areas in two key locations, one area near the mill (“Premier”) and another area about five- six kilometers away (“Big Missouri Ridge”)

Also, we will look at the opportunity and various options for Red Mountain, including moving ore between the projects. Red Mountain is about 20 kilometers as the crow flies and about 50 kilometers by road, because we have to go down and around a mountain range. The general rule of thumb in mining is 20 cents a ton kilometer for moving ore back and forth, which gives us about a 150-kilometer radius around this mill. We obviously want to get this deal done, but we see a lot of other opportunities to utilize this infrastructure to increase our resources in the future through our own exploration, but also a number of the other players that are around us.

I'm just going to go quickly through some history of the site to give your readers/investors a little more background. In the 1920s to the 1950, Premier was one of the largest gold mines in North America and owned by the Guggenheim family. At the Big Missouri ridge, another mine was built in the 1940s and then in the 1990s another mine was built by Westmin Resources, including the mill which stands today and the Silver Coin Mine. This was bought by the Swedish company, Boliden AB, in 1990s and then by Ascot in 2018. Ascot also acquired Jayden Resources and consolidated this Big Missouri ridge. Generally, the gold at Big Missouri is located from 0 to 50 meters or 160 to 180 meters or about 240 meters down along this ridge. This is connected by a five- six-kilometer haul road roughly three miles to the mill.

The second area, Premier, that we want to mine, actually in the beginning, is right next to our mill. This has about three million tons of high-grade, about 200 meters from the mill. We have 70 kilometers of underground, or roughly 45 miles of underground workings already de-watered and ventilated here. That gives us a huge advantage over construction of a new mine.

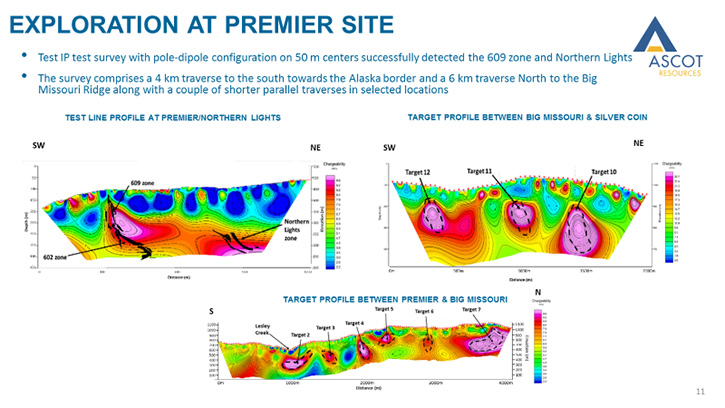

Derek White: We're really just utilizing what we inherited, about 30% of the landmass here. One of the things we noticed, in our first year working here, was a lot of pyrite associated with the gold, which is conducive to a geophysical method called induced polarization, with the high gold and pyrite content showing up very well.

Because we can go underground, we've laid a geophysics line over the underground areas and you can see the gold structures that show up in the induced polarization. We said this works so well, why don't we put a whole pile of induced polarization lines all around, so last fall we did. We identified a number of targets which we hope to drill in 2019

In the southern portion of our project we have about 14 or 15 world class targets, right now, for exploration. It's between Premier and Big Missouri, above haul road, up and between Big Missouri and Silver Coin. We also have a number of exploration targets on the IDM side, and we see significant upside potential here a well.

The rational, for the IDM deal, was that they have a deposit with likely 800,000 to a million ounces that had a Feasibility Study and environmental permit, with a lot of synergy value with our location. We believe, a new operation at Red Mountain will cost at least $150 million to build, and we felt we could save in true synergy value over $100 million, simply by the synergies, but this requires further study.

We want to update people on our two other assets. We own a gravel mine about 50 miles south of us. As many readers may know, there's a shortage of gravel in California right now. A similar mine to this sold for $300 million in November of 2017, and we've hired a group out of New York that is going to be working on selling this asset, hopefully to construction groups in California, because it's about $7 a ton cheaper to take gravel from the coast of British Columbia, by boat down to California than it is to truck it inside California.

Finally we have a large copper porphyry asset, which gets no value in our share price. We're looking at restructuring that and spinning those shares out to the shareholders in a combined copper vehicle, which will highlight some of the value that our shareholders aren't getting right now.

We'll just talk a little bit about the deal. The proforma company would have around 200 million shares outstanding. The IDM shareholders would end up with about 16.7% and the existing Ascot shareholders about 83.3%. We've loaned about three and a half million dollars to IDM. We'll end up proforma at about $13 million in cash.

The big things for us this year is to complete the infill drilling and complete the permit application, and engineering studies to go forward to build the mine. Thanks very much.

Allen Alper Jr: Could you tell us about your shareholders.

Derek White: In the proforma company, assuming the deal goes through, IDM is about 60% to 70% institutional and we're about 60% to 70% retail. On a proforma basis the institutional shareholders will probably be down about 30 or so percent. Our biggest shareholder is Eric Sprott. Eric Sprott has on a proforma basis around 9.9% of the company. The next major shareholder is Osisko Royalties, followed by some institutions out of the UK and in Canada.

We have a large retail group that's represented out of Calgary, Alberta, who are oil and gas guys, who have been in the Ascot story for quite some time.

Allen Alper Jr: Could you tell us about insider ownership.

Derek White: On the insider ownership, the Directors and Management, on a proforma basis, will probably have a little bit over 1%. Hopefully after the IDM deal is over, we'll be able to go back into the market and start buying. A number of our employees have been incentivized, with options and they have some shares. The share price is pretty low right now, and as we move to production, we expect the price to go up. There's quite a keen interest by the employees to start acquiring some shares.

Allen Alper Jr: What are the main reasons that investors should be looking at IDM and Ascot together?

Derek White: Well, I think a few things. To be relevant in the gold industry today you need critical mass. That means you need a pathway to 200,000-plus a year for 10 years. IDM/Ascot has that. This is very high grade. It's in the top 10% grade of the world, so IDM has a feasibility study indicating all in sustain cost of $644 per ounce produced. Depending on long term gold prices, we are talking about margins of $400, to $600 per ounce, which can generate potentially a lot of cash flow. Despite the fact that the Company’s stock price has suffered from retail malaise, in the end it's hard to argue with cash flow. We have a shorter timeframe and much lower capital to get to production than most greenfield projects because: our site is already historically permitted and our infrastructure already exists. Also IDM has an Environmental Assessment completed. This gives us the ability to get into production more quickly, and at a fraction of the usual capital cost. If you get into production and you make money the share price can be measured by cash flow. Yes, there are lots of exploration stories out there and that's great, but there's an opportunity to have a multiple return on your investment, without as much risk as you would have in a pure exploration play.

Allen Alper Jr: Well, thank you very much for your insight. That all sounds very, very tempting and exciting.

Derek White: Thank you very much, Allen.

Allen Alper Jr: You are very welcome. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://ascotgold.com/

Ascot Resources Ltd.

Kristina Howe

VP, Investor Relations

Tel: 778-725-1060 ext. 1019

Email: khowe@ascotgold.com

|

|