Interview with Don Bubar, President and CEO of Avalon Advanced Materials Inc. (TSX: AVL, OTCQB: AVLNF)

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 3/31/2019

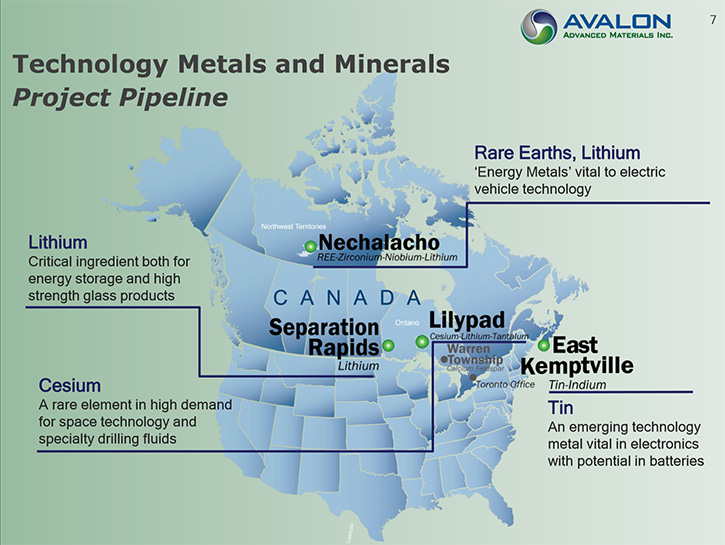

Avalon Advanced Materials Inc. (TSX: AVL, OTCQB: AVLNF) is currently focusing on developing its Separation Rapids Lithium Project, Kenora, ON and its East Kemptville Tin-Indium Project, Yarmouth, NS to production, while continuing to advance its Nechalacho Rare Earths asset. At PDAC2019, we learned from Don Bubar, President and CEO of Avalon Advanced Materials, that they were an early mover in the space of the advanced materials and have created a portfolio of assets, with a broad range of exposure to the emerging new clean tech materials. Avalon’s overall strategy is to be in a position to bring a new supply to the market, as new technology creates new demand. According to Mr. Bubar, it has taken a while for the circumstances to be perfectly aligned, and right now Avalon finds itself in the great position of having three projects coming together at the same time.

Avalon's Nechalacho camp, at Thor Lake NWT, lit up at night

Dr. Allen Alper: This is Allen Alper Jr., President of Metals News, here at PDAC, interviewing Don Bubar, who is President/CEO of Avalon Advanced Materials. Don, could you give our readers/investors an overview of your Company, of the various metals, strategic and critical materials that you're exploring, and what your plans are?

Don Bubar: Sure. Avalon's been in advanced materials development for over 20 years now. We were an early mover in this space and we've created a portfolio of assets that gives us exposure to a broad range of these emerging, new clean tech materials, with the overall strategy of trying to be in position to bring a new supply of these to the market when new technology created a new demand. It's taken awhile for that circumstance to be perfectly aligned, but right now we're in the fortunate circumstance of having three projects that are all coming together at the same time for us.

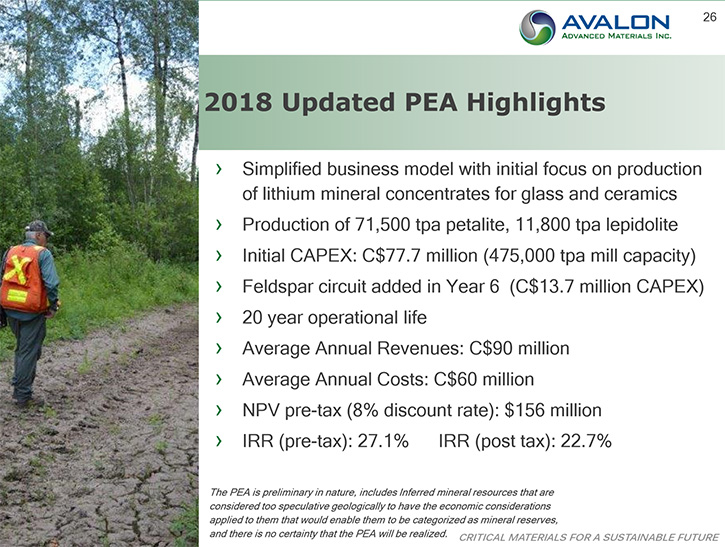

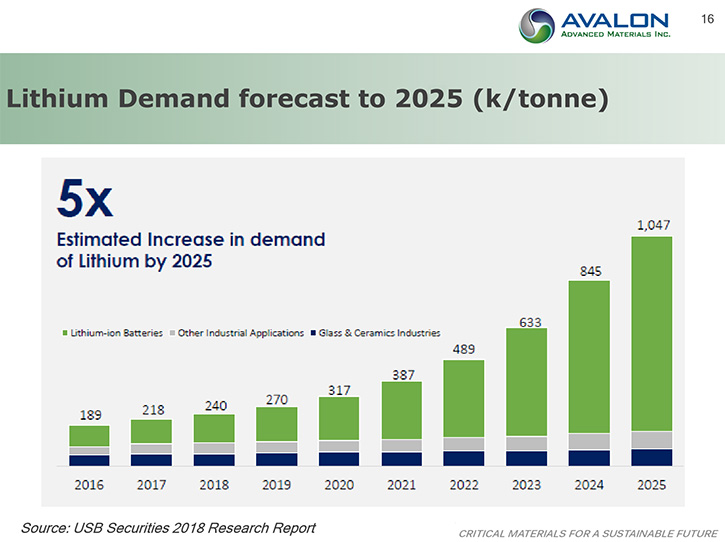

Our Separation Rapids Lithium Project ... Obviously there's a lot of new interest in lithium and we have a mineral that's ideally suited to serve the glass industry as well as making a battery material.

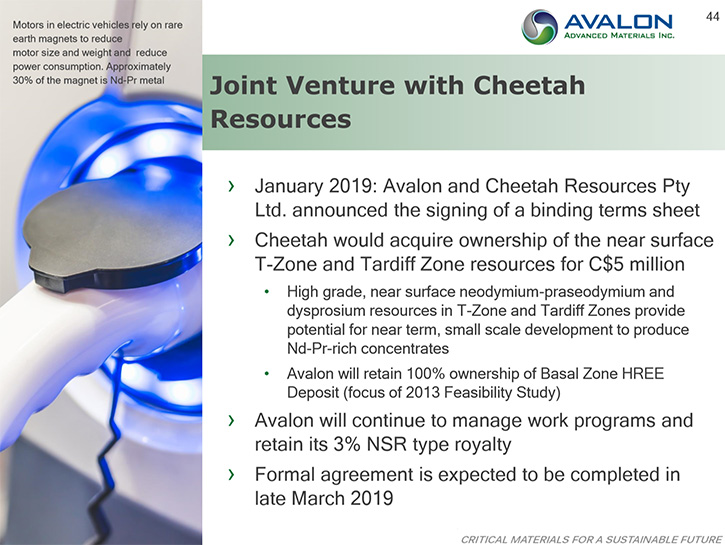

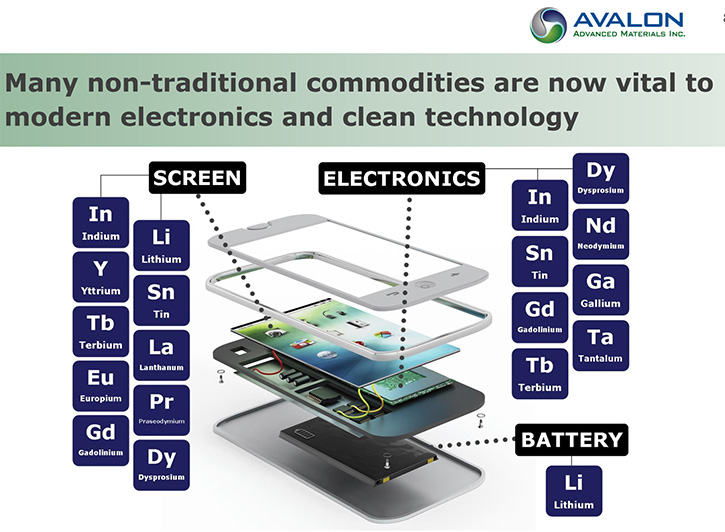

As well, we have a rare earth elements property. That was our main story ten years ago. Rare earths are coming back into view again, because of all those electric vehicles, they don't just need a lithium battery. They also need an electric motor - with rare earth magnets being key to that motor technology. That's creating new demand and the supply chain never did get created outside of China in any meaningful way after the last surge of interest.

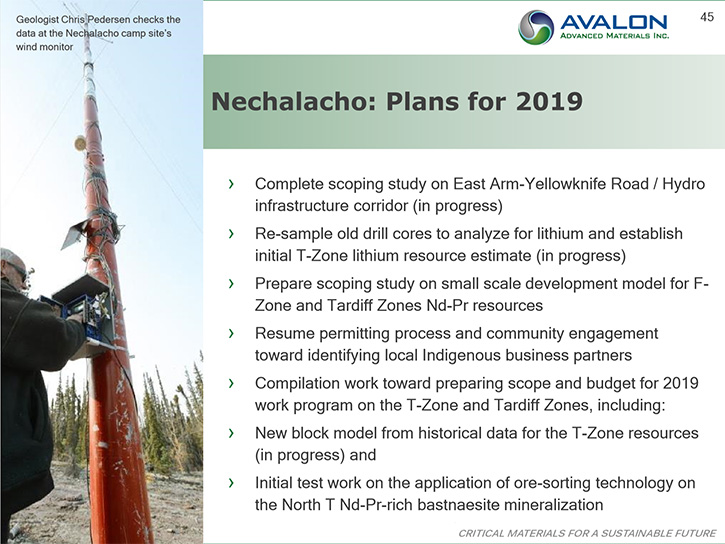

But, it is coming together for us now. We have a new partner in our Nechalacho Rare Earth Project to work with us on developing a resource that's amenable to small-scale rapid production of a concentrate of the rare earths, to get to the market in the short term.

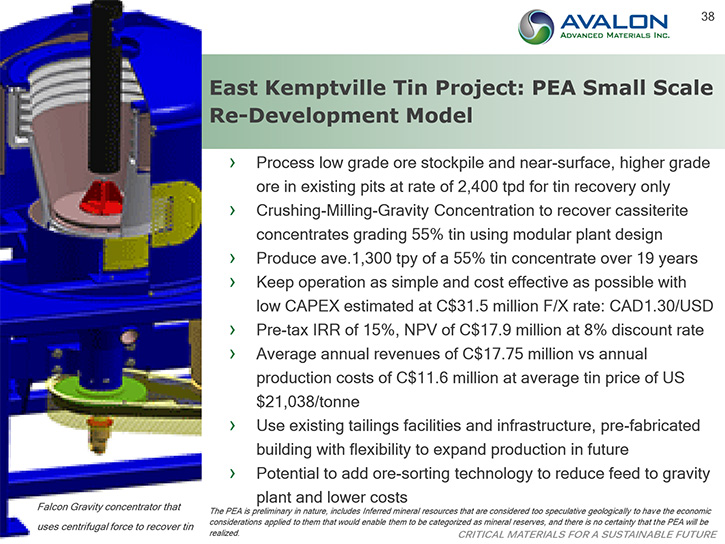

Our third project is a Brownfield Site in Nova Scotia, a past producing tin mine. We have created a model to re-establish production at East Kemptville by recovering tin from waste materials on the site, and actually rehabilitating the site while extracting value out of the waste materials in a small-scale operation. East Kemptville has the possibility of producing other by-product rare elements like indium as well.

All three of those projects look like they can get into production within the next couple of years.

Dr. Allen Alper: That sounds exciting. What are your key objectives for this year?

Don Bubar: On all projects, it's been a matter of attracting the capital and getting through the permitting process to move them forward. On the East Kemptville tin project, we actually are just trying to get through the last stages in the environmental and permitting approvals process. A European company called Cronimet is working with us on the process technology, and have expressed interest in partnering on the project, which should increase our access to capital.

Dr. Allen Alper: I know them well. Great company.

Don Bubar: Yes, very impressive company actually. We want to work with them on implementing sensor-based ore sorting technology as part of the process solution at East Kemptville, which is exciting new technology that reduces costs and reduces the amount of waste material that is generated from a traditional mining operation. So we're just going through the last steps on that and hope to be able to be finished and have a feasibility study done by middle of this year.

Then on our Separation Rapids lithium project, we're at a similar stage. It has been a matter of trying to secure those off-take commitments that you can then show your investors as evidence that you have a real market to serve that'll create an economic development opportunity there. The market we want to serve in the glass industry is really hungry for supply. The battery industry has created so much new demand that it's consuming a lot of existing supply sources and there needs to be new supply specifically designed to serve the needs of the glass industry. Our resource is ideally suited for that because it contains petalite, a rare lithium mineral that has always been preferred in certain glass and ceramics products.

We are in a position now to finish that off with a feasibility study this year, get the off-take commitments firmed up and move forward with the development plan. You might see Separation Rapids in production in as little as two and a half years.

Dr. Allen Alper: Wow, it sounds exciting. Sounds like your time and your company's time is coming very soon.

Don Bubar: Yes, I think one of these projects is going to work for us in the near term, if not all three. It's challenging having three major active projects on the go at the same time but I put it in the category of nice problems to have!

Dr. Allen Alper: That's great. Could you give our readers/investors an update on what's been going on since the last time we interviewed? Also for the benefit of the thousands of new readers/investors, who have joined us since our last interview, could you give us an overview of your Company, your background and your team’s?

Don Bubar: I'm a geologist. I've been doing mineral exploration in Canada for about 40 years now. I got Avalon going 23 years ago, as a small cap mineral exploration company, focused in northern Canada, initially looking at traditional commodities. Then we had the fortunate discovery of this rare lithium pegmatite, in northwestern Ontario around 1998 (Separation Rapids). That's when we oriented ourselves towards the emerging new clean tech mineral products. It was early, 15-20 years ago, for this idea, but I knew there would be new demand in new technology for these elements, and of course we're seeing it now big time in a lot of these materials, so our time has come.

Dr. Allen Alper: That's great. Could you mention some of the backgrounds of any of your Board Members or Team?

Don Bubar: One of the strengths of the company right now is, during the rare earth boom we put together a management team, with all the skillsets we needed to move these types of projects forward, and we've kept those people in place. We've adopted sustainability in mineral development as a core philosophy in our business. Our whole team has really bought into that and really believes in it as part of the future of our industry. So that's helped keep the team together.

We have an expert exploration geologist, in Bill Mercer, a highly respected veteran of the industry. Dave Marsh, a process engineer with key expertise for building one of these operations, which is knowing how best to process the ore to turn it into that product that will meet the needs of the marketplace. Mark Wiseman is our Vice President of Sustainability, and a really key person right now as we move our projects through the environmental assessment and approvals process; he's an expert on all that, as well as on implementing sustainability in mineral development. He has really made us a leader in sustainability in this space. We also have a sales and marketing VP, Pierre Neatby, to find the customers for us in the marketplace, and finally a great support staff that we have held onto since the rare earths boom.

Dr. Allen Alper: Sounds like you have a very strong team, and you have an excellent background, and you know what you're doing, so that's great. Could you tell our readers/ investors, a little bit more about your share and capital structure?

Don Bubar: Right now we have about 265 million shares outstanding, 300 million on a fully diluted basis. Market cap of, in U.S. dollars, about 10 to 12 million. We've struggled to raise capital like most juniors in this bear market environment we've been in the last few years, so we've had to do a number of fairly dilutive offerings that has raised our issued capital up fairly high, but things are falling into place now for us, so I think right now is probably a very good time for people to look at us as a undervalued investment opportunity with quite a bit of upside. Once we start to really show the market that these projects are going ahead, I think we'll start to see renewed investor interest in this company, so it's definitely a good time to take a look.

Dr. Allen Alper: That sounds very good. Could you add any other reasons for our readers/investors to consider investing in your company?

Don Bubar: We think this is a strong growth industry now. My whole strategy has been to get at least one of our projects into production and cash flow even at a modest scale, to serve as a platform for growth. We're very close to being able to do that, and I see so many other opportunities in these emerging new cleantech materials markets.

We have the expertise to identify where the resources are and where the markets are. Once we're established in business we see lots of possibilities to grow, not only through increasing production of the materials we already have, but expanding the range of products we can offer the market. Many of the resources we have contain other elements that we can start to recover as byproducts and bring to market. Indium, gallium, germanium are other examples that usually you find with tin. Cesium is something you find with lithium. We actually have resources that are very interesting for cesium, that's another exciting new rare element that's seeing increased demand and limited supply.

There are lots of possibilities out there that are future growth opportunities for this Company. We want to be one of the leaders in technology materials for the new economy.

Dr. Allen Alper: It sounds like you're very well positioned to play that role in the industry.

Don Bubar: And produce them in an environmentally and socially responsible way, adopting the principles of sustainability.

Dr. Allen Alper: That sounds excellent. Is there anything else you'd like to add, Don?

Don Bubar: That pretty well covers it, Al, good to catch up with you. Thank you for interviewing Avalon for Metals News again

Dr. Allen Alper: Thank you. We’ll publish your press releases as they come out, so our readers/investors can follow your progress.

http://avalonadvancedmaterials.com/

Don Bubar

President & CEO

416-364-4938

ir@AvalonAM.com

|

|