Abitibi Royalties Inc. (TSX-V: RZZ): Owns Royalties at the Canadian Malartic Mine, near Val-d’Or Québec; Interview with Ian Ball, President and CEO

|

By Allen Alper Jr., President, Metals News Inc.

on 3/28/2019

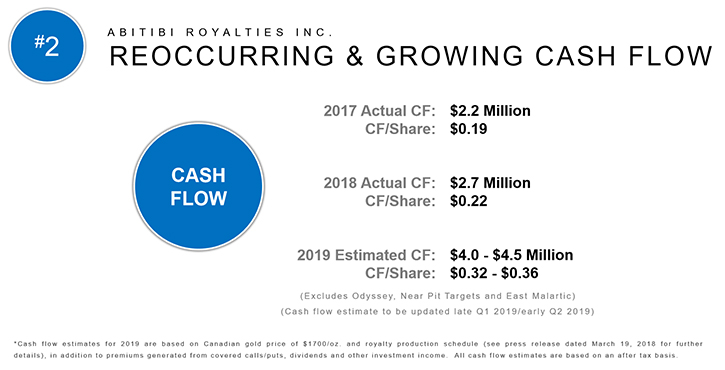

Abitibi Royalties Inc. (TSX-V: RZZ) owns various royalties at the Canadian Malartic Mine, near Val-d’Or Québec, and is building a portfolio of royalties on early stage properties, near producing mines. At PDAC 2019, we learned from Ian Ball, President and CEO of Abitibi Royalties that their royalty income started at the end of last year and the Company is looking at $4 to $4 1/2 million in cashflow this year. The Company is in a strong financial position and is debt free, and they bought back about $1 to $1 1/2 million worth of shares over the past 12 months.

Shanda Kilborn – Director, Corporate Development and Ian Ball, President and CEO of Abitibi Royalties at PDAC 2019

Canadian Malartic Mine

Allen Alper Jr.: This is Allen Alper Jr., President of Metals News, here at PDAC 2019, interviewing Ian Ball, who is President and CEO of Abitibi Royalties. Would you like to tell us at Metals News and our readers/investors a bit about Abitibi Royalties Inc. and what's been happening in 2018 and what you're planning for 2019?

Ian Ball: By way of background, our largest royalty or royalties are at the Canadian Malartic mine, which is the largest goldmine in Canada. Last year, there was an updated resource that came out that shows that the resources at the Canadian Malartic mine continue to grow in size and actually are becoming quite significant. This is the largest goldmine in Canada.

Our royalty income started at the end of last year because the area that they're now starting to mine has tapped into our royalty area. In addition to that, the mine received some key authorizations that show that they should be allowed to proceed with the underground mining below the pit, which is going to benefit our royalties, which are predominantly based on the underground resources.

Allen Alper Jr.: That's very good. So going forward in 2019, what are your next plans?

Ian Ball: We expect to see royalty income ramp up. So that's the first. The operators have spoken about beginning underground ramp construction, to start to do trial mining on the Odyssey and East Malartic deposits.

So this year we're looking at $4 to $4 1/2 million in cashflow. We do expect that to increase, once the underground comes into production. We're looking for more opportunities. Last year we spent $2 1/2 million buying additional royalties in and around Canadian Malartic. We've also been buying back our shares. So we have the smallest share account of anyone in the mining industry, over $100 million market cap at 12 1/2 million shares. So we bought back about $1 to $1 1/2 million worth of shares over the past 12 months.

We’re really just continuing to do what we've been doing during the first four years of our existence. We think it's a very good business model. It's very capital light, and it has good opportunities to reinvest our cash flows.

Allen Alper Jr.: So you were talking about your share structure. Tell us a bit more, and also give us an idea of management’s investment.

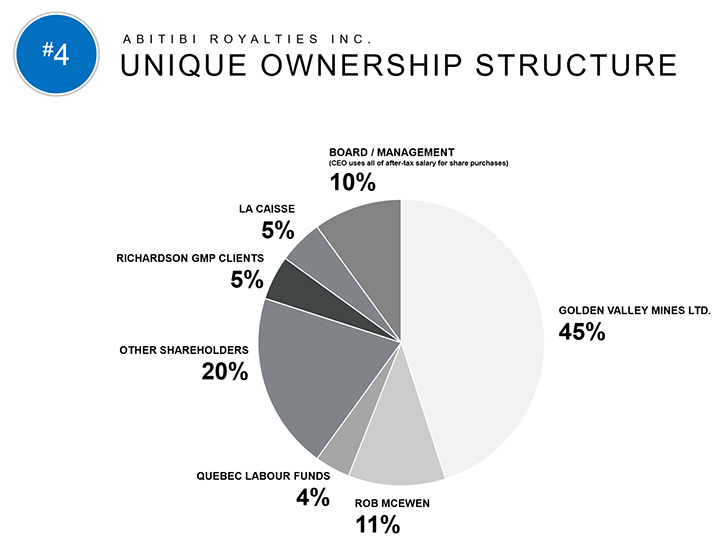

Ian Ball: Sure. So right now we have 12 1/2 million shares outstanding. We put a ban on any stock options or other forms of equity compensation. So we have no intention of issuing that to management or employees. So shares outstanding are what it is.

We don't intend to issue stocks for acquisitions. We're opposed to that. We want to grow through cash and cash flow, so cash on hand and cash flow. Our majors and shareholders include Golden Valley Mines. We were spun out of them in 2011. They own 44% of the company. Rob McEwen, who is the Founder of Goldcorp and is CEO of McEwen Mining, owns 11% of the Company. This past summer, Caisse de dépôt, which is one of the largest pension funds in the world, bought 5% of Abitibi Royalties.

For the past four and a half years, I invest all of my after tax salary and any bonuses back in the company on the open market. So management owns 10% of Abitibi Royalties.

Allen Alper Jr.: That's excellent! So tell us a bit more about your Management team.

Ian Ball: The management team's very small. We say we've heard a joke. We have two and a half employees, and the half comes from not working full time with us. But we have our Chairman, Glenn Mullan, who is the Founder of the Company. He is the President of the PDAC, where we are today. I was with McEwen Mining and Goldcorp previously. Shanda Kilborn, who helps me with the royalty acquisitions that we've been looking at. Our CFO, Rico De Vega came from Torex Mining as well as First Quantum. Our Corporate Controller, Daniel Poisson, who is in Montreal has been with the Company since it was founded.

Allen Alper Jr.: Could you tell us what you see as the biggest challenges, right now, for a royalty company?

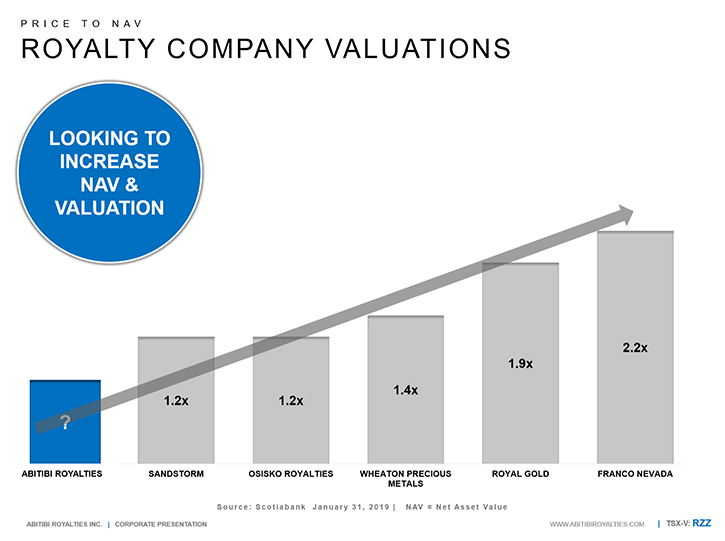

Ian Ball: Well, the biggest challenge is the other royalty companies. Obviously you're in competition with them to acquire a good opportunity. So how do you compete with Franco-Nevada that's many times our size and has much more financial resources? You have to have a different business model for acquisition. So that's first. Second is, obviously, as the gold price goes up, less royalty becomes available because equity markets open up. So that's obviously something that could hinder the business going forward.

Beyond that, I think it's just trying to find attractive royalties, that you believe have good exploration upside that you can see value in, perhaps more so than what the seller sees. So I think those are the main challenges that face the business.

Allen Alper Jr.: So how are you competing with the big guys? What is your model to be successful?

Ian Ball: Well, it's two-fold. One, we're focusing on royalties generally within the Abitibi district, Malartic specifically. We know the area. We know the properties, the projects, the permitting timeframes. So when a royalty comes up for sale, we can generally make a decision in one to two days, versus I think a bigger royalty company will take longer because they're not as heavily invested in the area as we are.

So I think our ability to act quickly is our competitive advantage in the Abitibi.

Allen Alper Jr.: Excellent. So what do you think are the main reasons that investors should be looking at Abitibi Royalties, Inc.?

Ian Ball: No share dilution; we get exposure to exciting discoveries at the largest goldmine in Canada. We have free cash flow that can be reinvested in other future royalties, hopefully at a reasonable valuation, and management's aligned with us. I think we're the only company that I'm aware of that has banned equity forms of compensation. I don't think there's anyone who's taken that step. So we're trying to do everything we can to treat our shareholders like partners in the business.

I would also stress that if you are not an investor that takes a long-term view, Abitibi is probably not the right type of company for you. But if you are long term and you like growing a business in the mining sector and you want exposure to gold and exploration, Abitibi should be on your radar.

Allen Alper Jr.: Well, thank you very much. Is there anything else you'd like to add?

Ian Ball: Just thank you for doing an interview on Abitibi Royalties Inc. for Metals News. I appreciate it.

Allen Alper Jr.: I’ve enjoyed learning more about your Company and hearing your insights. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.abitibiroyalties.com/

Shanda Kilborn – Director, Corporate Development

2864 chemin Sullivan

Val-d'Or, Québec J9P 0B9

Tel.: 1-888-392-3857

Email: info@abitibiroyalties.com

|

|