West Red Lake Gold Mines Inc. (CSE: RLG, OTCQB: RLGMF, FSE: HYK): Increasing Current 1.087 Million Oz of Inferred Resource; Interview with John Kontak, President

|

By Allen Alper Jr., President, Metals News Inc.

on 3/26/2019

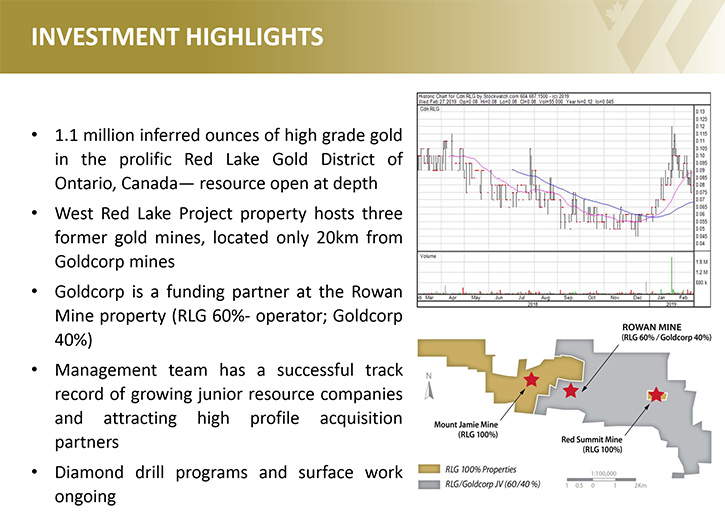

West Red Lake Gold Mines Inc. (CSE: RLG, OTCQB: RLGMF, FSE: HYK) has assembled a 3100-hectare property, which has a 12 kilometer strike length and 3 former gold mines, in the prolific Red Lake Gold District of Northwestern Ontario, Canada. At PDAC 2019, we learned from John Kontak, who is the President of West Red Lake Gold Mines, that, in 2018, they drilled below the 500 meters of the resource area at the high-grade Rowan Mine Deposit, a joint venture with Goldcorp, with the future goal to increase its current 1.087 million ounces of inferred resource. Another drilling program was conducted at the high-grade NT Zone, with good results for what could be a whole new deposit. Plans for 2019 include more exploration at the Rowan Mine Deposit and the NT Zone, with the goal to develop it into a high grade gold deposit. The company has an experienced Management team that has explored and developed and successfully sold gold assets in Ontario in the past.

Allen Alper Jr: This is Allen Alper Jr., President of Metals News, here at PDAC 2019, interviewing John Kontak, who is President of West Red Lake Gold Mines.

Could you give our readers/investors an update on what's been going on since the last time we interviewed? Also for the benefit of the thousands of new readers/investors, who have joined us since our last interview, could you give us an overview of your Company? How did 2018 go and what are you looking forward to in 2019.

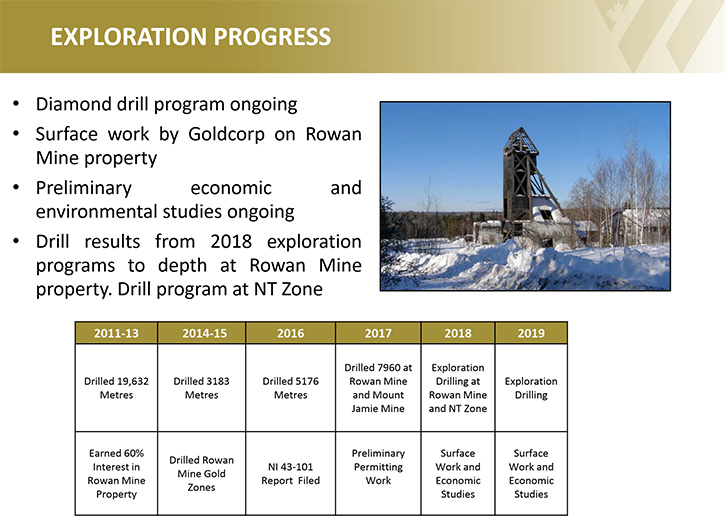

John Kontak: Well the drilling was focused on two important areas. At the Rowan Mine portion of our property, where we're in a joint venture with Goldcorp, we have the Rowan Mine Deposit, 1.087million ounces of inferred resource, 7.57 grams per ton. All within about 500 meters of surface.

In the summer of 2018 we drilled below the resource area. We drilled down to about 1000 meters and the geology and mineralization that hosts gold deposits was what we found.

Therefore in 2018 is we found good reason, through diamond drilling, to think that we can expand the mineralized envelope and, in time, increase the Rowan Mine resource from our present 1.87 million to hopefully something larger than that. We also have begun the scoping studies to indicate the potential economics of a certain portion of the Rowan Mine deposit, and are reviewing the data to determine where we stand on upgrading a certain portion from inferred to indicated.

We have continued with our ongoing water sampling as part of our preliminary permitting activities.

What we also did in 2018 is follow up on exploration work that Goldcorp has been doing on the Rowan Mine portion of our property. During the summer they were doing surface work. They were mapping and sampling and collecting data, which they're continuing to analyze.

They helped us identify what became the targets of our Fall Drill program, which was at the NT Zone, as it trends on our property from the Southwest to the Northeast and then intersects, with the East-West trending regional gold bearing structure, called the Pipestone Bay St Paul Deformation Zone. What we found from our eight hole drill program in the Fall of 2018, with each hole averaging about 200 meters in length, is good intercepts including 14 grams over 7.8 meters and all the holes ended in alteration.

Those were three very good things that happened in 2018. Goldcorp was active on the property so it's nice to have one of the largest Gold Companies in the world taking an interest in the property potential and providing their technical ability.

Then we went to depth at Rowan and it looks like we have the opportunity to expand the mineralized envelope to depth under the resource area, which was good.

Then at the NT Zone we drilled and got good results for what would be a whole new deposit, and hopefully, in time could become a new resource in addition to the Rowan Resource.

Allen Alper Jr: That's very exciting!

John Kontak: We have two key exploration areas at the Rowan Mine and at the NT Zone and we will be working to make the property more valuable.

Federal Fund rate increases, during the course of 2018, kept a cap on the gold sector. Now some are predicting in 2019 they'll actually be decreasing the Federal Funds rate. No increases and actually one decrease is what their pricing into the Federal Funds Futures, and I think that'd be good for the gold sector.

So what we'd be able to do in 2019, with capital moving into the sector, in a more positive gold environment, is continue to drill at the NT Zone and develop that deposit and eventually have enough drilling to have a potential new resource area and continue to expand the depth at Rowan.

Allen Alper Jr: Excellent! Tell us about your share structure.

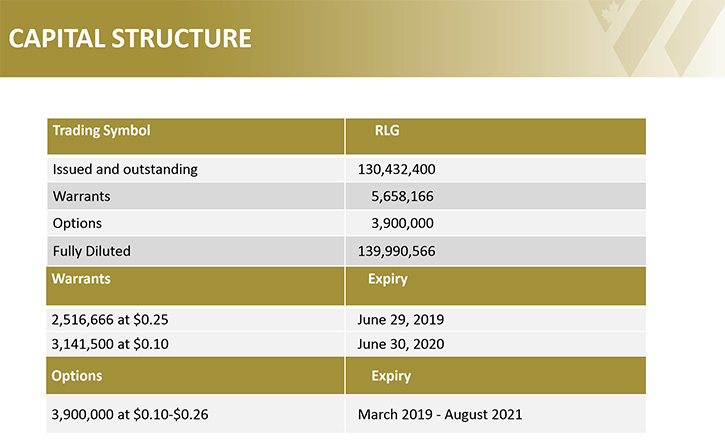

John Kontak: We have about 130 million shares outstanding. We have two institutional shareholders, who together have about 35-36% of the stock. Tom Meredith and I, and the management team, have over 10 million shares. There are some other key people who have a history with the company, a former Director for example, who are senior mining executives here in Toronto, who are significant shareholders.

So we can quickly reach over 50% of the stock just by talking to our key institutional shareholders and the management team, both current and past.

We also continue to market in Europe and we have a good relationship there. I was talking to a German shareholder just earlier in the conference today and I talk with the shareholders regularly on the continent and in London.

We have a good shareholder base there and a good retail support across Canada. We're listed on the OTC QB in New York as well, we traded quite a bit after our January 30th news release, with the NT Zone drill results, so the overhang was taken care of to a certain extent.

So we think we have the stock in good hands and are looking forward to the next leg up in the gold sector.

Allen Alper Jr: Excellent! What would you say are your biggest challenges right now and what are you doing to address them?

John Kontak: Well the biggest challenge in our very cyclical industry is to be in the down portion of the cycle. So you have to be managing that, so that you're around with a good capital structure and good relationships in place when the turn comes.

There's a lot of gold on our property, but our biggest challenge now is to develop good gold deposits. Tom Meredith and I, in our last two companies, had gold assets, which are now held by McEwen Mining and Osisko Mining. That's what we plan for these assets on this West Red Lake project property as well, sell them to larger players, within the Canadian mining community, who could bring them into production. Finding the assets in economic quantities, and developing deposits by showing the all in sustained cost, and the Capex and the IRR and the NPVs - that would make them attractive to the Canadian mining community. That's always the challenge, but we've done it before and we think we can do it again.

Allen Alper Jr: Excellent strategic thinking! What would you say are the main reasons investors should be looking into West Red Lake Gold Mines?

John Kontak: The most important thing, whether it's West Red Lake Gold Mines or any junior company, is to look at the Management team, who's running the show? I go on their websites. This is the third time Tom Meredith, and myself and Ken Guy, our exploration manager, have explored and developed gold assets in Ontario, and we've sold them successfully in the past for as much as a couple hundred million dollars.

We think this is as good an asset as we've had. We have a market cap now of about 10 million dollars. So we think we can do some good over the next number of years, as the interest rate policy becomes more on our side, now that the economic data from China or where ever is not as positive as it once was.

Knowing where you are in the cycle is a big part of this industry. We're at a good portion of the cycle now for investors to consider junior exploration and development companies with experienced management teams like us at West Red Lake Gold Mines, in good jurisdictions, and Ontario is one of those.

We have an experienced Management team, in Ontario, a safe jurisdiction. We're in a high-grade gold district that has all the infrastructure. Our deposits are close to surface. There are not a lot of Junior's out there that have all those things.

Allen Alper Jr: You are checking all the boxes: Great management, great location, great jurisdiction, great grade.

John Kontak: Exactly.

Allen Alper Jr: Excellent! Is there anything else you'd like to add?

John Kontak: Just to thank you for doing an interview on West Red Lake Gold Mines for Metals News. We really appreciate it.

Allen Alper Jr: Thank you. I’ve been very impressed! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.westredlakegold.com/

John Kontak

President

Phone: 416-203-9181

Email: jkontak@rlgold.ca

|

|