First Vanadium Corp. (TSXV: FVAN, OTCQX: FVANF, FSE: 1PY): North America’s Largest Highest-Grade Primary Vanadium Resources; Interview with Paul Cowley, President & CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 3/16/2019

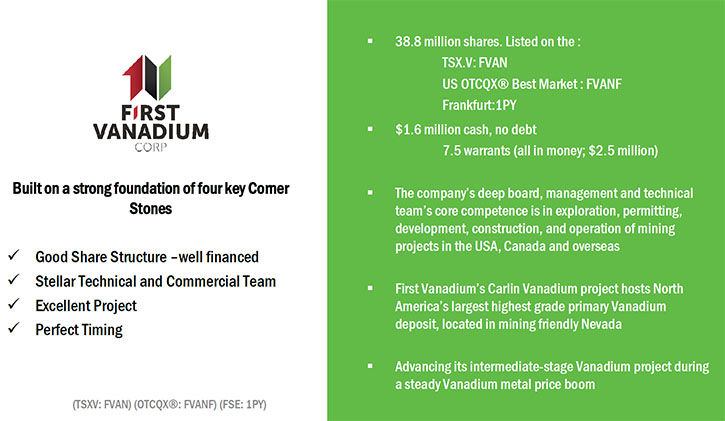

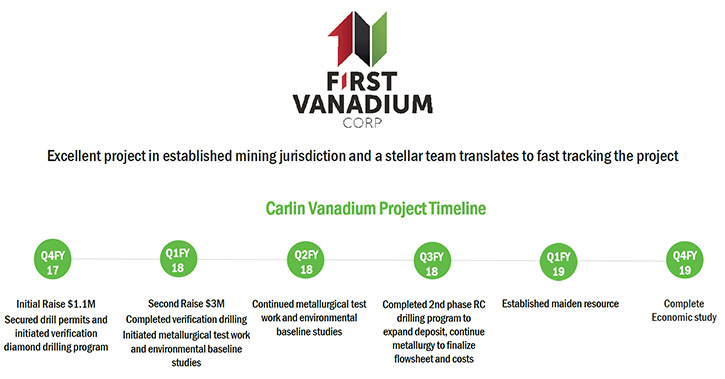

First Vanadium Corp. (TSXV: FVAN, OTCQX: FVANF, FSE: 1PY) (formerly Cornerstone Metals Inc.) has an option to earn a 100% interest in the Carlin Vanadium Project, located in Elko County, Nevada. The Carlin Vanadium Project contains North America’s largest highest-grade primary vanadium resources and is situated 6 miles south of a major rail hub and mining community of Carlin, Nevada, a major highway (I-80) and power. We learned from Paul Cowley, President & CEO of First Vanadium Corp., that vanadium is used in the steel industry to strengthen and lighten steel, as well as in the battery sector for large power storage and sustainable energy applications. We learned from Mr. Cowley that First Vanadium Corp. was recognized as the second best-performing mining stock on the Toronto Venture Exchange for 2018. According to Mr. Cowley, the company is run by professional engineers and geologists who have all worked for major mining companies in the past. It has a very tight share structure of under 39 million shares, and has enough cash in the treasury for another year.

Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Paul Cowley, who is President & CEO of First Vanadium Corp. Could you give our readers/investors an overview of your company, Paul?

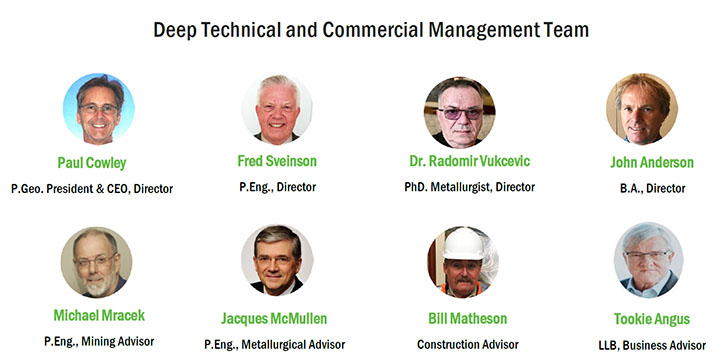

Paul Cowley: Absolutely, Al. It's great to talk with you here. First Vanadium is a company that is focused on vanadium. Its Carlin vanadium deposit is located in the world-class mining district of Carlin gold trend in Nevada. The Company is run by professional engineers and geologists, all of whom have worked for major mining companies in the past. We're all senior people with great experience with deposit discoveries and permitting, constructing, and operating mines, both in mining and processing. So we have a very, very good pool of skill sets with the technical people that we have. For a junior company, this is unique and exceptional.

The Company has a very, very tight share structure of under 39 million shares. We have about $1.6 million in the treasury and we have about 7.5 million warrants that are all in the money, that could bring another $2.5 million into the treasury, and they're good for another year to year and a half. So that gives you a bit of a snapshot of the company and its corporate aspects.

Allen Alper: That sounds great. Could you expand on why vanadium is so important in the steel sector and the energy sector for our readers/investors?

Paul Cowley: For sure. Vanadium is principally a steel story, because 90% of vanadium goes into steel to strengthen it and lighten it, but there's also an aspect, a very, very interesting and exciting part of the battery sector that I can talk about too. But coming back to the steel, basically 2 pounds of vanadium goes into a ton of steel and will double the strength of the steel, so this is primarily an infrastructural alloy that's used in our everyday modern world. As we build higher buildings, wider expanses of bridges, pipelines, long range airplanes that need to be light, but strong, car chassis that need to be lighter and stronger for EPA fuel efficiency standards, vanadium is really a very, very fundamental alloy that the world really needs, increasingly, and there's just not enough of it around that's being produced. So we're seeing a strong demand, but a tight supply line of vanadium.

That's what's driving the metal price up. Over the last 3 years, prices have gone up extremely high, 11 times its normal price. It had a pullback last year, but now it's back into a strong uptick, and we expect 2019 to be another strong year for vanadium. Vanadium for batteries is a small portion of the consumption of vanadium, about 5%. But this has just started to become commercialized, only in the last 2 years in these large scale industrial batteries that hold gigawatts of power. For wind farms, solar farms and power companies, this is the ideal battery solution for a sustainable energy. It's much more efficient, and longer lifetime than the lithium ion battery for this particular application.

So the battery application is definitely going to be a growing industry and demand, and so that's adding on top of the steel demands for vanadium.

Allen Alper: That sounds excellent, sounds like it's an excellent opportunity for your company and other vanadium mining companies, and exploration companies. Now, recently you were recognized by the Toronto Venture Exchange, could you mention that to our readers?

Paul Cowley: It's a real honor to be recognized as the second best performing mining stock on the Toronto Venture Exchange for 2018, so we're part of this Toronto Venture Exchange’s Top 50. There are 5 different sectors, including mining, which is just one of the sectors, and we're in that as the second best performer for last year. It shows that we were unlocking shareholder value as we progressed with our technical milestones on the project. The award is based on a combination of improved market cap, improved share structure and volume trading on the exchange. Allen Alper: Well congratulations!

Paul Cowley: Thank you, thank you.

Allen Alper: Quite an achievement for you and your team!

Paul Cowley: Yes, thanks to our shareholders, too.

Allen Alper: Right. Shareholders’ backing is very important for exploration work.

Paul Cowley: 100%. Yes.

Allen Alper: You recently released your maiden resource, could you tell our readers/investors about that?

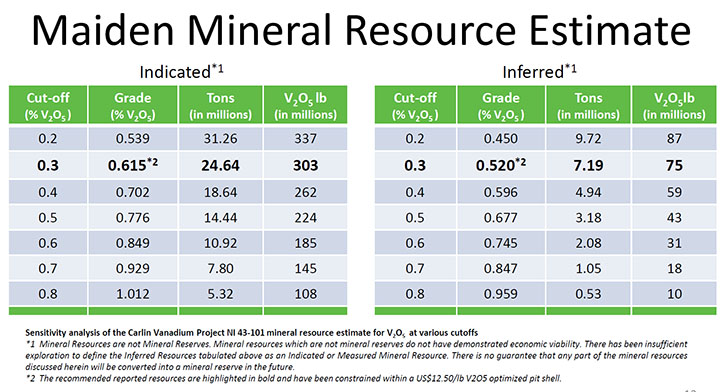

Paul Cowley: Yes, that was just yesterday, February 27th. We completed two drill programs in 2018, adding 89 holes. Mostly in-fill holes to an existing network of historic drilling. We also stepped out beyond the known dimensions of the deposit. This culminated in a maiden resource estimate. There was a historic resource from the old data of 28 million tons of 0.515% V205. This maiden resource replaces that and there was significant improvement, both in category, about 80% of the resource is in indicated, which before it was 100% in inferred. The grades increased by about 20%, and we have a sizeable increase in contained metal, in both the indicated and inferred categories. So this are big, big gains for us.

Allen Alper: Well that's excellent! Really fantastic!

Paul Cowley: Basically, we spent about one million US dollars in drilling, and we added about $1.5 billion of new metal in the ground.

Allen Alper: Very exciting!

Paul Cowley: That's how significant that resource is.

Allen Alper: That's a great payout for the amount you spent! Could you tell our readers/investors a little bit more about your location, your infrastructure, and your site conditions?

Paul Cowley: It's hard to beat our location! We're in the Carlin Gold Trend, so this is a world class mining district where Barrick and Newmont dominate. We're in that geological terrain. We're 6 miles by road to a major rail hub, a major highway, mining community of Carlin, and power. This is an amazing location. It gives us tremendous advantages and cost savings, not only in exploration, but anticipating that for the project going forward. We're just south of I-80, about halfway between Reno and Salt Lake City. That's the major highway I mentioned. The towns of Carlin and Elko, which are steeped in mining, with all the vendors and suppliers and contractors for mining in that community. There is tremendous infrastructure that we have available to us.

Allen Alper: That's excellent, that's an enviable place to be, right in the hub of mining in the United States. That's excellent. You have a lot of big neighbors, mining neighbors in that area.

Allen Alper: Could you tell us, our readers/investors, a little bit about the geology of the area, and how there's a primary vanadium deposit, deposited in black shale, et cetera.

Paul Cowley: This is a black shale hosted deposit, so this is a sedimentary bed of higher grade vanadium within other beds of black shale. Because of that the high grade bed of vanadium is quite continuous and large, more than a mile north/south, and about half a mile east/west. Its average thickness is about 120 feet thick. So it's a sizeable bed that's relatively flat-lying or shallow dipping, and it's near surface. Those are other great benefits from a mine-ability standpoint. Our stripping ratio is estimated to be about 2.6 to 1.

Allen Alper: Could you tell our readers/investors a little bit more about where your stocks are listed and your capital structure?

Paul Cowley: Our principal exchange is the Toronto Venture Exchange, and our symbol is FVAN. And in the US, we're on the OTCQX, under FVANF.

Allen Alper: Okay, that sounds great. Could you tell our readers/investors a little bit about your background, and your team?

Paul Cowley: I'm an exploration geologist with 38-years’ experience in discovery and evaluating mineral deposits around the world. About half of my career was working with a major mining company, BHP Minerals. I was involved in leading the team in the Canadian arctic to make 4 gold deposit discoveries for BHP that generated about 6 million ounces of gold. I also worked at Escondida during the exploration days and up at BHP's Ekati diamond mine. So I'm a senior guy, I'm probably the youngest of our group, the rest of the group is 5 or 10 years older than I and they're still working. We have two mining engineers that have worked all the way up to general managers of major mines for major companies. We have four metallurgists that have worked for major mining companies in the past, at senior levels. We have a construction engineer who's built about 20 mines in North and South America, he's currently building Lundin's mine in Ecuador right now.

And then we have two business guys, Tookie Angus is on our Advisory Board, and John Anderson from Vancouver is also on our Board of Directors. They're financial and business people.

Allen Alper: That sounds excellent, sounds like you, your Team and Board have very strong experience and backgrounds and knowledge, and can move this project forward.

Paul Cowley: Thank you.

Allen Alper: Could you tell our readers/investors what are the primary reasons they should consider investing in First Vanadium Corp?

Paul Cowley: Well, I think most investors are looking for good value, they're looking for safer value, so I can speak a little bit on those. We have very strong fundamentals, which are important for shareholders that are looking for investment. We have a very good, solid team that knows how to move projects and advance projects. We have a very good, tight share structure. We have an excellent project, and excellent timing advancing this project during a time when all the elements of supply and demand of vanadium have changed, so there's a much stronger demand side for vanadium. Really, really good timing for us!

In very quick order, in 15 months we've permitted two drill programs and completed a maiden resource with a high percentage in the Indicated category, and that's fast-tracking. Normally for a company and project, that would take about 3-5 years and we did it in 15 months. So you can see from that performance that we know what we're doing, and we're in a good jurisdiction, with a good project.

This resource is exceptionally strong and, I believe, very, very undervalued. With 303 million pounds of vanadium in the indicated, and 75 million pounds of vanadium in the inferred, you multiply that by the spot price of vanadium right now at $17.60 per pound, you can see that it's a huge amount of metal in the ground. Billions, worth billions. So I think that's the investment opportunity. Also, I believe, 2019 is going to be another strong metal price year for vanadium. So I think that adds to the opportunity for the investor.

Allen Alper: Sounds like very strong reasons for our readers/investors to consider investing in First Vanadium Corp.

Thank you. I enjoyed talking with you again. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://firstvanadium.com/

Paul Cowley

CEO & President

(778) 655-4311

pcowley@firstvanadium.com

|

|