SSR Mining Inc. (NASDAQ: SSRM, TSX: SSRM): Growing Canadian-Based, Intermediate, Diversified, Precious Metals Producer, Favorable Jurisdictions, Interview with David Wiens, Director, Corporate Finance

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/18/2018

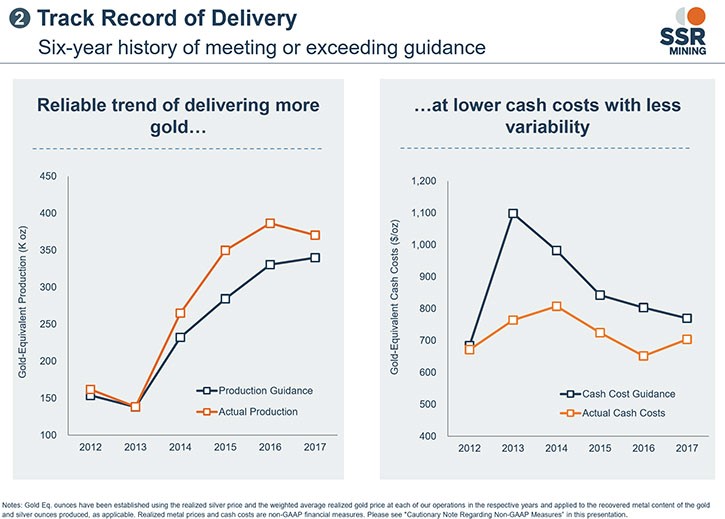

SSR Mining Inc. (NASDAQ: SSRM, TSX: SSRM) is a Canadian-based, intermediate, diversified, precious metals producer, with capacity to grow in favorable jurisdictions. The Company has three operations, including the Marigold gold mine in Nevada, U.S., the Seabee Gold Operation in Saskatchewan, Canada and the 75%-owned and operated Puna Operations joint venture in Jujuy, Argentina. We learned from David Wiens, Corporate Finance and Investor Relations at SSR Mining, that the company is looking at over forty percent growth over the next three years, and that's coming from growth at all three of their operations. According to Mr. Wiens, for each of the last six years SSR Mining has met or exceeded its production, as well as cash cost guidance. The company has been successful in growing production, while decreasing costs. In addition, SSR Mining has two feasibility stage projects and a portfolio of exploration properties in North and South America.

Marigold gold mine, Nevada

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing David Wiens, who is Corporate Finance and Investor Relations at SSR Mining. Could you, David, give our readers/investors an overview of SSR Mining?

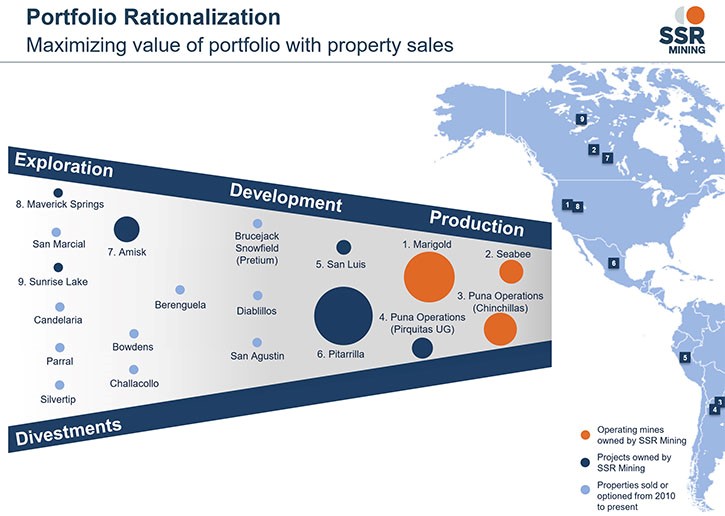

David Wiens: Sure, absolutely. As background on the history of our Company, we've actually been around for about seventy years. Over the last five years or so, we have transformed ourselves into the Company we are today. Historically, the company’s strategy was to give investors as much leverage to the silver price as we could, by accumulating deposits of silver throughout the Americas. The company didn't have a strategy to develop any of those silver deposits themselves until about 12 years ago, when we decided to build the Pirquitas mine in Argentina. We completed the mine in Argentina in 2009, which turned us into a single asset silver producer.

We acquired the Marigold mine in 2014 and the Seabee underground mine in 2016, through the acquisition of Claude Resources. Today, through those two acquisitions and mine life extension at our silver operation, we've now emerged as a growing, diversified precious metals producer, with about eighty percent of our production coming from gold in North America.

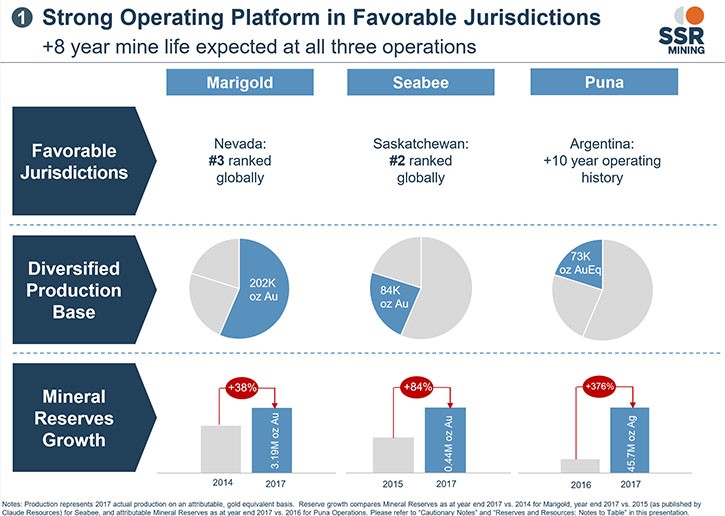

Not only do we have a diversified suite of operations, but we are also in some of the safest jurisdictions you can find from a mining perspective. Our flagship asset, Marigold, which accounts for about half of our production, is in Nevada, ranked #3 globally, while Saskatchewan, where have 25% of our production, is ranked #2 globally. In Argentina, we have a long operating history and know how to do business. One of the Canadian banks, a couple of months ago, put out a report looking at thirty-two different gold companies and ranking them by geo-political risk. We were ranked #2 out of #32.

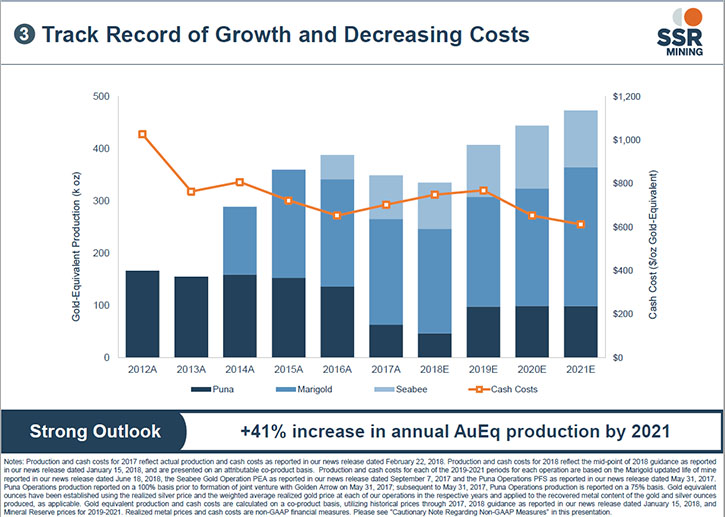

To sum it up, we are a diversified, intermediate, precious metals producer in very low-risk jurisdictions, and we have a very exciting growth profile, in front of us, over the next three years. We have a slide in our presentation, which shows that. We're looking at over forty percent growth, over the next three years, and that's coming from growth at all three of our operations.

Dr. Allen Alper: That sounds excellent. I noticed that you think of your company in three ways; operations, development and exploration. Could you say a few words about each one?

David Wiens: Sure. The operations category really speaks to the transformation of the company over the last few years. Because most of the value in the company, up until a few years ago, was in the development and exploration categories. We have a portfolio of three assets, with about 55% of our production from Marigold, our flagship asset in Nevada, a low grade dump leach operation that has been operating for nearly 30 years. 25% comes from Seabee in Saskatchewan, a high grade underground gold operation. And about 20% comes from Puna Operations, our silver operation in Argentina. The forty percent production growth profile that I mentioned earlier is from modelling out the reserves, except for Seabee where it includes some resources as is normally done for an underground mine. We have additional upside beyond that, including a potential expansion at Marigold and exploration prospectivity driving further growth at Seabee. So that's just on the operations side - forty percent growth over the next three years.

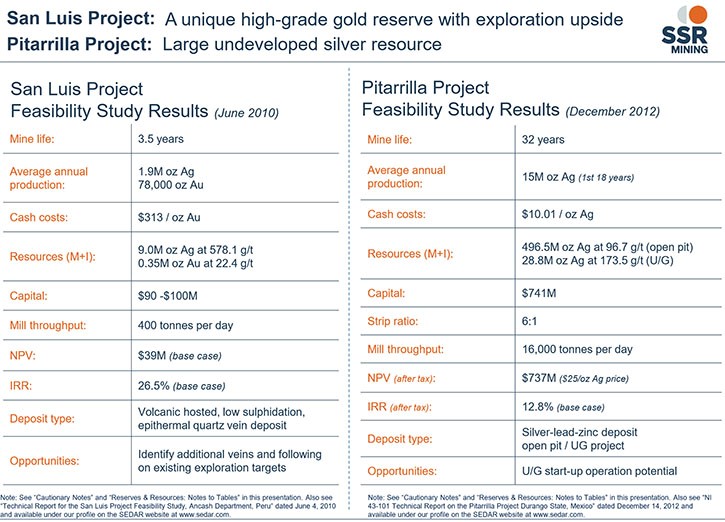

In the development category, there are a couple of key projects in the portfolio. Firstly, the Pitarrilla project in Durango State in Mexico is a particularly exciting one because it’s one of the largest undeveloped silver resources in the world. It has over half a billion silver ounces in the ground in the resource category. We're currently working through how we want to move forward with that project, and we may put out some news flow on that later this year.

So Pitarrilla is a pretty exciting one. We have another project in Peru called San Luis, and that is a very high-grade, underground project, about an ounce and a half per ton of gold. If we could build that, we'd build it tomorrow, but we're working through discussions, with the relevant communities at the moment. So we continue to try to move that one forward.

So, those are our two main development projects, Pitarrilla and San Luis, and we don't think we're getting value in our share price for either of those. Those are the pure development projects. We also have potential expansion opportunities at the operations. At Marigold, we may look at an expansion scenario, adding another rope shovel and increasing the haul truck fleet to further grow gold production. We may look at that next year, depending on the results of the drilling that we're doing this year. We've increased our exploration budget by about eighty percent this year at Marigold, to see whether we could move a substantial portion of the resource into reserve at an area of the mine called Red Dot.

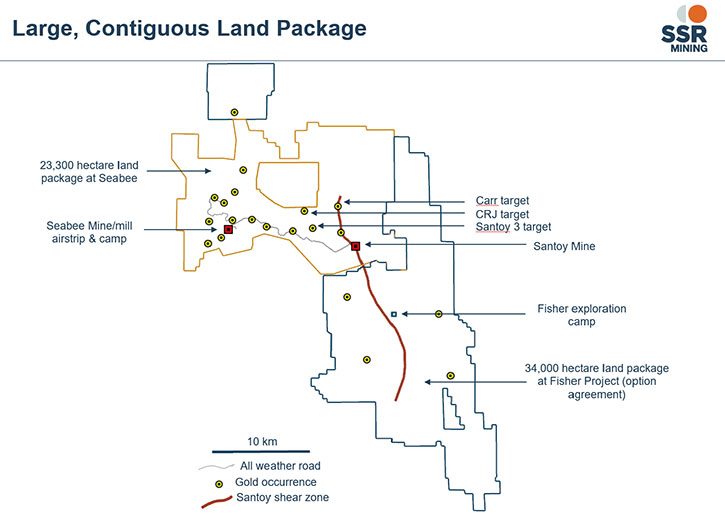

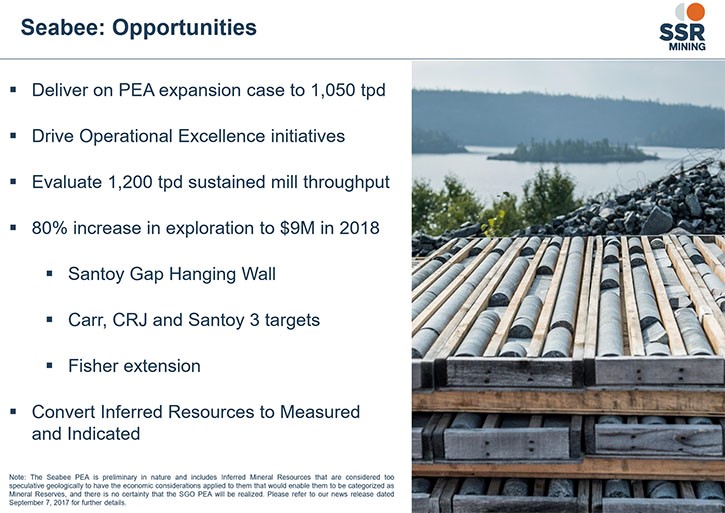

Moving to the exploration category, the geological prospectivity at the Seabee Gold Operation is one of the reasons, in fact the primary reason, that we acquired Claude Resources in 2016. Just like Marigold, we're increasing our exploration-spend there by eighty percent this year as well. We’re spending that in two broad categories. First of all, we’re drilling at the Santoy mine, where we currently get all of our production. We’ve found that the deeper we go, the better the grades and the wider the veins. At Santoy, we've mined down to about the four hundred meter level, our drilling has gone down to about the eight hundred meter level, its wide open at depth, and it gets better as we go deeper. Just based on the mine plan we put out last year, we have seven, eight years of mine life ahead of us, and we're hopeful that we will have many more years than that, just from the Santoy mine.

That's the first exploration area at the Seabee property. The second is regional drilling. We have a large land package that we inherited when we acquired Claude Resources. We're spending about two thirds of this year's exploration budget on looking for a brand new deposit, which could be a complete game changer for the company if we found something like Santoy. We're currently earning into a property, to the south of our land package, where the Santoy shear continues – effectively the plumbing system that brought the gold bearing fluids up to form Santoy, our existing mine. We'll soon have an eighty percent interest in that property after we earn into it, and we have years ahead of us on the regional drilling.

Dr. Allen Alper: That sounds excellent. Could you tell us a bit about your background, your Board and Management Team?

David Wiens: Sure. Not only do we have a very strong Board and Management, in terms of their track record, experience and skill sets, but investors will be able to sleep well at night knowing that we have top notch corporate governance.

Our CEO Paul Benson spent the majority of his career at BHP Billiton in a variety of operational and business development roles. He joined us in 2015, replacing John Smith, who also had a background from BHP. Nadine Block, our VP of HR, brings over twenty years of experience to the company from various HR roles. John DeCooman, Vice President Business Development and Strategy, to whom I report, has been the longest serving member of our management team, and has a project finance and M&A background. Greg Martin, our CFO, who joined us in 2012, has held a number of financial roles in the sector, including at Placer Dome. Our COO, who joined us this year, Kevin O'Kane, spent over thirty-five years at BHP, working at their South American operations and has worked at Escondida, which moves over five times the dirt that Marigold does. So a perfect fit with our flagship asset, Marigold, with Kevin coming in.

The Board is chaired by Michael Anglin, who also spent a large part of his career at BHP, and is a mining engineer by trade. In terms of other representation on The Board, Brian Booth is a geologist by trade. Gustavo Herrero is an Argentine industrialist, so very helpful for operating in Argentina. Richard Paterson has a private equity background. Steve Reid, is a mining engineer and former Chief Operating Officer of Gold Corp. Simon Fish brings a legal background. Beverlee Park has an accounting background. Elizabeth Wademan has an investment banking background, and Paul is the only executive director. So we have a very strong and varied experience and skill set across The Board and management team.

In relation to Board structure, one of the things we’re most proud of is our corporate governance score from ISS. One is the best rating you can get, ten is the worst, and they have given us a score of one based on Board structure, compensation, audit and risk oversight, and shareholder rights. We have a slide in our presentation where you can see that our corporate governance rating is far and away the best in our peer group.

As for my own background, I've been at SSR Mining for just over five years. I currently report to John DeCooman, the Vice President of Business Development and Strategy within the investor relations function.

Dr. Allen Alper: That sounds excellent. That's really, extremely good, giving your investors confidence. Could you tell our readers/investors a bit about your capital structure?

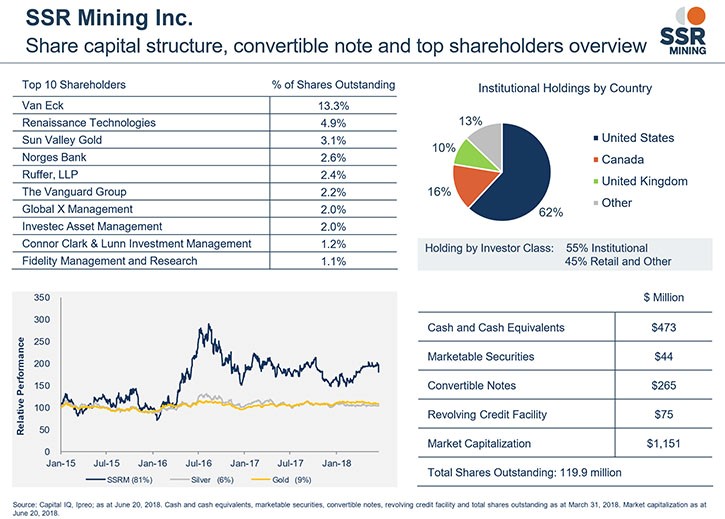

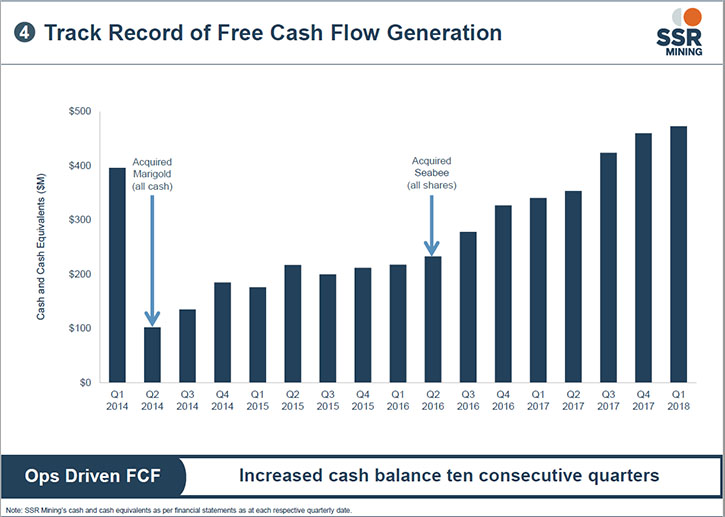

David Wiens: Yes. One of the things that we think differentiates us from our peers is our balance sheet. As of March 31st of 2018, we had four hundred and seventy three million dollars of cash on the balance sheet. If you include some marketable securities divestitures that we did after the quarter, that number would be over five hundred million dollars. So we have about half a billion dollars of cash on the balance sheet. We have a convertible note outstanding, which is for two hundred and sixty five million dollars. That is due in 2033, but is puttable to us by the holders in 2020. The good news is that not only do we have a rock solid balance sheet, but we've demonstrated a track record of generating cash, quarter after quarter. We’ve added cash to the balance sheet for the last ten quarters in a row.

We also have an undrawn seventy five million dollar credit facility that is completely undrawn. We have about a hundred and twenty million shares outstanding, and our capitalization is about 1.2 billion dollars US. We have not issued equity for capital since 2010.

Dr. Allen Alper: That's excellent. You're in a very strong position, very enviable, so that's excellent. Could you tell our high-net-worth readers/investors the primary reasons they should consider investing in your company?

David Wiens: What it comes down to is that we have a long term track record of creating shareholder value. We can demonstrate that in a number of ways. Firstly, we have a track record of delivering to guidance. For each of the last six years, we have met or exceeded our production, as well as cash cost guidance. There aren’t a lot of companies that can claim a perfect record on that, and we're one of them. That speaks to the competence of our management team.

Secondly, we have a track record of growing production, while decreasing costs. Thirdly, we have a track record of generating free cash flow. As I mentioned earlier, we have added cash to the balance sheet for each of the last ten quarters.

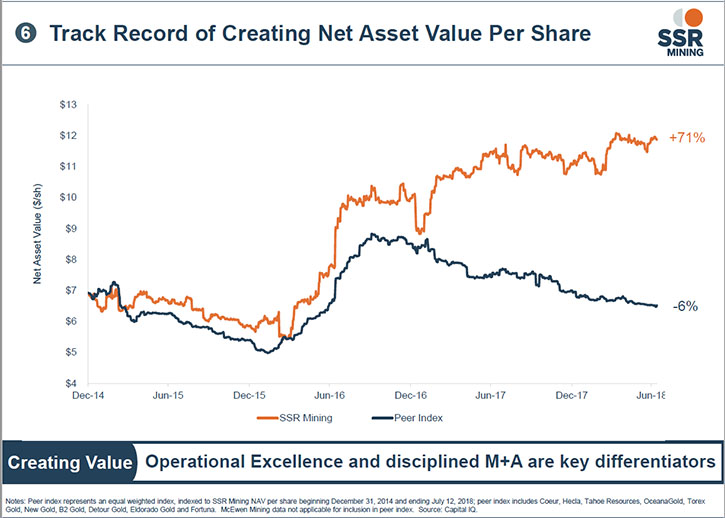

At the end of the day, it comes down to creating shareholder value. One of the ways we measure that is by looking at the average value of an SSR mining share over time, measured objectively by the average valuation from the research analysts that cover us. What we've seen is that our average value per share has gone up by about sixty-six percent over the last three and a half years. If you look at our peer group, it's actually declined during that same time period.

So how have we been able to outperform our peers on creating shareholder value? Well, number one we're good operators of assets, and number two we're good acquirers of assets. Probably the best example of that is the Marigold mine. We purchased it in 2014 for two hundred and sixty-eight million dollars in cash. Since that acquisition, we've had four years of cash flow, we’ve reduced operating costs, we've increased the production profile, we've increased reserves, and we put out a mine plan a couple of weeks ago, with a base case value just on the reserve of five hundred and fifty million dollars, which is about double what we paid for it in 2014. So it has been a runaway success for us, and the recognition from the market for that is now really starting to show. The Seabee mine, which we acquired in 2016, is already starting to trend in the same direction, in terms of creating shareholder value. We're consistent, we have a track record, and we're continuing to create shareholder value.

Lastly, another attractive aspect of SSR Mining as an investment is our leverage to the gold and silver prices. That's one of the reasons that investors buy mining stocks. We have the best beta over the last three and a half years to the gold price amongst our peer group - we have a beta to the gold price of about 2.7 times over the last three and a half years, so you'll get lots of leverage as an investor to precious metals prices.

Dr. Allen Alper: That sounds fantastic. You all are doing a fantastic job. That's really great, something of which to be very proud! Is there anything else you would like to add, David?

David Wiens: Thank you Doctor. We’ve touched on the near term growth profile, forty percent plus just on the base case. We also touched on the expansion opportunity at Marigold, and the huge exploration prospectivity at Seabee, and the development portfolio.

One thing we didn't touch on is the mine life extension we're doing at our 75% owned Puna Operations in Argentina. Our Pirquitas mine closed down in 2016 and we're in the process of doing a Brownfields project called Chinchillas to extend the operating life by another eight years. That is scheduled to be completed in the second half of 2018. We'll have an update on that soon. We're excited about the near term silver growth and the ability to extend our life by eight years there. The asset also has exploration and expansion potential, including through a potential high grade underground deposit that we may develop and combine with the ore that we will be getting from the Chinchillas deposit, which we're developing right now.

We have an exciting growth profile, we have prospectivity, we have leverage within our share price from our development portfolio, we have an excellent management team, and we have got a strong track record. So I think that sums it up, Dr.

Dr. Allen Alper: That sounds excellent!

http://www.ssrmining.com/

|

|