Interview with Patrick Mutz, Managing Director, Image Resources NL (ASX: IMA): Emerging High-Grade, High-Value, Low-Cost Mineral Sands Producer, Positive Cash Flow 1st QTR 2019

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/5/2018

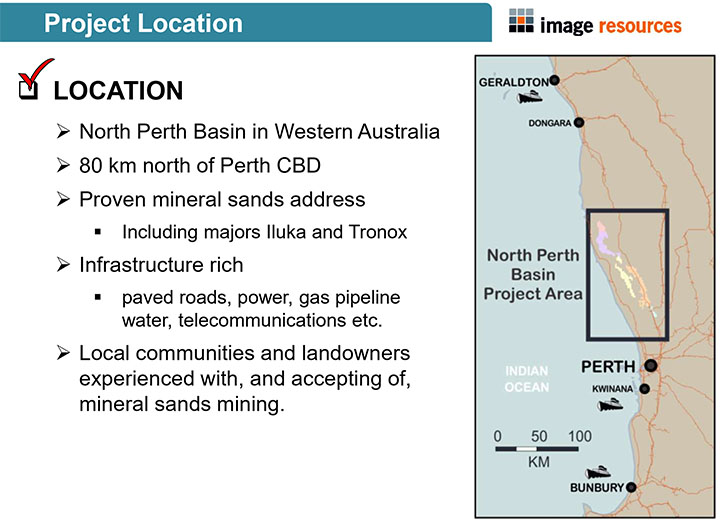

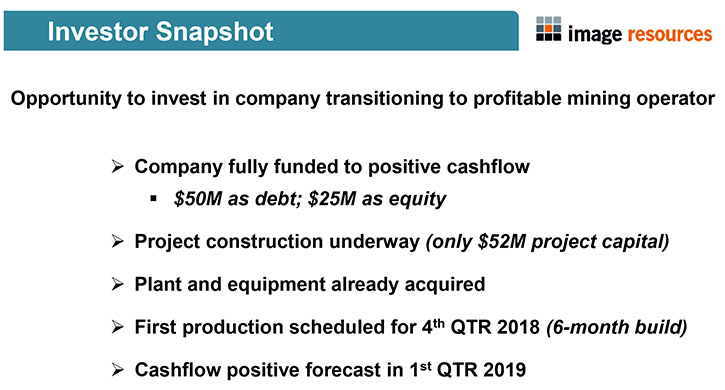

Image Resources NL (ASX: IMA) is an emerging mineral sands producer focused on the rapid construction of its first mining operation at its high-grade, high-value, low-cost Boonanarring Project, in the North Perth Basin, Western Australia. The Boonanarring project is located in an area with advanced infrastructure and skilled workforce. We learned from Patrick Mutz, Managing Director of Image Resources, that the two main minerals the Boonanarring project will produce are ilmenite, used in paint and paper products, and zircon used in ceramics. We learned from Mr. Mutz that the project is now fully funded and on the fast track to be commissioned in October of 2018, with the first production expected before the end of the year. According to Mr. Mutz, the company has already negotiated 100% off-take for all of its production for the life of the mine. First quarter of 2019, they are expecting to see positive cash flow.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Patrick Mutz, Managing Director of Image Resources. Could you give our readers/investors an overview of your company, your focus and current activities?

Patrick Mutz: Certainly. I'd love to provide an update on Image Resources. To begin with, Image Resources is technically an advanced mineral sands explorer; but in fact sufficiently advanced that we are currently constructing our first mining operation in Western Australia. In May we announced that we've completed full funding for the project, but we actually started construction in March. As we stand today, we plan to be commissioning the project in October of 2018, and seeing first production before the end of December of this year.

Dr. Allen Alper: That's fantastic. That's fantastic news. You must feel very happy to see that happening.

Patrick Mutz: That's absolutely right. Image has been working very diligently to fast track this project. I think the thing that took the longest time was, of course, finalizing project financing, but now that that is done, we will be working to complete construction and commissioning and planning to move to positive cash flow early in 2019.

Dr. Allen Alper: Well, that's fantastic, a lot of hard work coming together. That's really great news for investors. Could you tell our readers/investors a bit more about what your product will be, how it's used, and why it's so important?

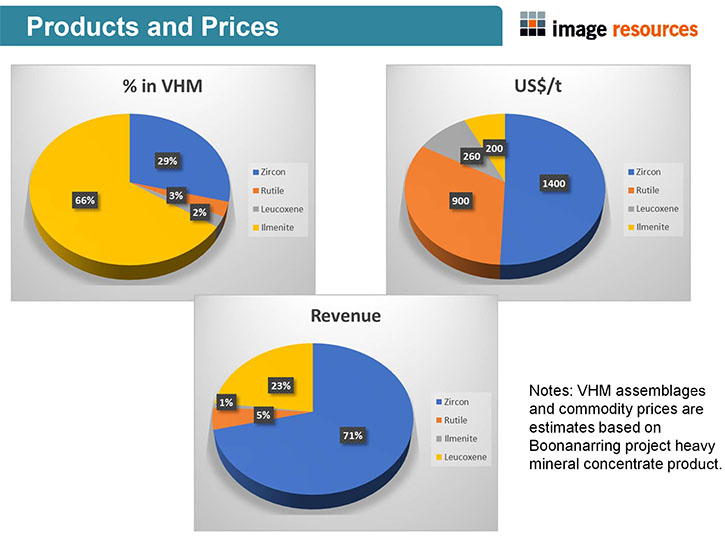

Patrick Mutz: Typical products from a mineral sands operation are zircon and titanium dioxide or TiO2. The primary product, on a volume basis, is ilmenite, and there can be much lesser quantities of rutile and leucoxene. All three contain TiO2. TiO1 has a lot of different applications, but its principal use is as an ultra-white pigment used in paints, plastics and paper. It is also used as welding rod flux and to make titanium metal, which is bio-compatible and used for medical implants.

The second key product is zircon. Of the four products that we can get out of mineral sands, zircon is the most valuable. To give you an example, zircon is priced at approximately $1500 U.S. per tonne of product, whereas the ilmenite might only fetch about $200 U.S. per tonne. Because of its high value, Image Resources is focused on zircon, much like our big brother Iluka Resources, who today is a $5 billion mineral sands mining company. We have a deposit that is zircon rich. Consequently, 70% of our revenue will be coming from the sale of zircon.

Interestingly, there has been a shortage of supply of zircon shaping up across the last six months, which I think will continue for the next 18-24 months, if not longer. Consequently, the zircon price has been rising very rapidly. The price has moved well above the price used in our feasibility study, which means today’s prices are providing a lot of icing on our project economics cake.

Dr. Allen Alper: Well, that's fantastic. Could you tell our readers/investors a bit about the uses of zircon?

Patrick Mutz: Absolutely! Zircon has many applications, from common things like underarm deodorant, fiber optics and glass, to larger, more industrial uses such as in higher temperature furnace linings and foundry castings. However, as zircon is a ceramic, it's primary use is in floor tiles, wall tiles and many different ceramic applications, including high temperature ceramic bearings. It is also used on a very high value end, such as in nuclear reactors. If zirconium metal is stripped and separated from its brother, hafnium, the resultant zirconium sponge can safely be used in nuclear reactors, because it does not absorb neutrons. Zirconium sponge is a key component used in the nuclear reactor build program in China, for example.

Dr. Allen Alper: Sounds excellent! How do you stand now with off-take agreements?

Patrick Mutz: That's one of the beautiful things about the investment opportunity in Image Resources. We have three or four very high points; one of which is the product off-take agreement. The company has already negotiated 100% of its production in off-take agreements for the life of the mine. Effectively, 100% of our revenue is secure. That's a very important advantage for launching a project. We do have the ability in the future to change the direction of that off-take agreement, but at this point it is fully binding for the life of the mine.

Dr. Allen Alper: That's fantastic! That's a great position to be in. Excellent!

Patrick Mutz: And there are three or four other high points for this investment opportunity.

The first one is the location. We have a project that turns out to be just about a bit more than an hour’s drive north of the city of Perth in Western Australia. That's important, first of all, because it's an infrastructure rich area. Secondly, because it's within driving distance of the northern suburbs of Perth, giving us access to a large workforce, which in Australia is very significant. The workers won't have to stay on site in a mining camp. They won't have to fly-in and fly-out. They just have to drive to work in the morning and drive back home to their families, in the afternoon, or at the end of their shift in the case of some of the shift workers. This makes Image an attractive employer for those people working in the mining industry, who currently are away from family. We're getting a lot of interest from mining related employees in the area, who want to come to work for us for a better work-life balance, which is rare in the mining industry in Australia.

Dr. Allen Alper: That's excellent. That's a very good position to be in.

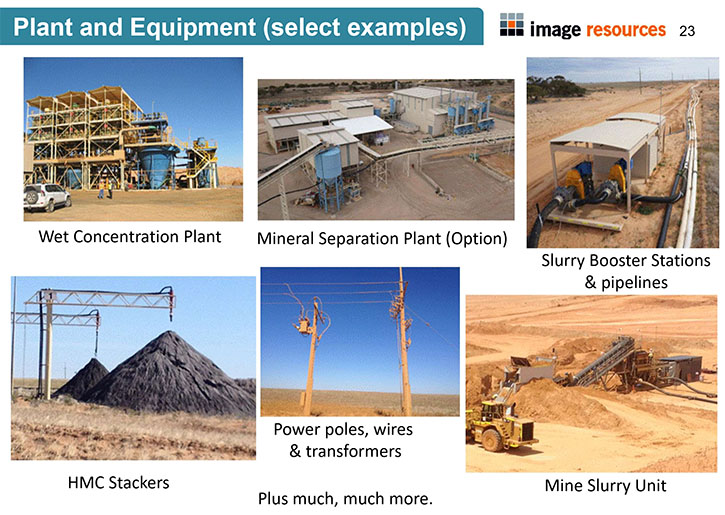

Patrick Mutz: One of the other important aspects, is that the project is going to be put into production very rapidly and at very low capital cost. The total capital spent on the ground at the project is about 52 million Australian dollars. It's low for two reasons. The primary one is that we already own the equipment that we need to put the project into production. This was acquired in an equity deal back in 2016. It also shortens the construction period, because it's not so much of a construction project, but rather an equipment relocation and reassembly project, which makes it a little bit quicker. That also makes it a little more certain. New plants, that are built out of an assembly of all new equipment, are just that: an assembly of new equipment, and therefore there's a learning curve, and adjustments have to be made that can take up to 18 months to ramp-up to full production. That’s very typical of a new mining operation.

This project involves the relocation of an existing plant, and equipment that has been pre-engineered, pre-commissioned, and proven to work together. Therefore the commissioning curve is down to less than six months.

Dr. Allen Alper: That's fantastic, excellent! That's a great position to be in. It's really amazing that you could get it built so rapidly, be in production so rapidly, and with low capital cost. That's fantastic. Could you refresh the memories for our readers/investors on your background, your board, and your team?

Patrick Mutz: Yes; my background is metallurgy. I have more than 30 years in the mining industry, in the international realm, starting in the U.S. for 20 something years, with the likes of Chevron, in the resources industry. But I've been in Australia now for 15 years, and have been in mineral sands now for the last almost ten years. This is one of the most exciting projects, with which I've ever been involved, from the standpoint that it has all of the positive attributes that investors like, and that Boards of Directors like, for a project being pushed to production. The project has many positive attributes and the timing of moving the project to production, while the commodity prices are rising rapidly, is a very positive adder.

The majority of the board, principally come from a background of mineral sands operations and marketing, so we are well equipped to be able to pull off a project like this. Half of the directors, including myself, were involved in an operation in South Australia from 2011 through 2015, so we have a significant track record in mineral sands, and now we're here to do it again in Western Australia.

Dr. Allen Alper: That's fantastic. Could you tell our readers/investors a little bit about your share structure and capital structure?

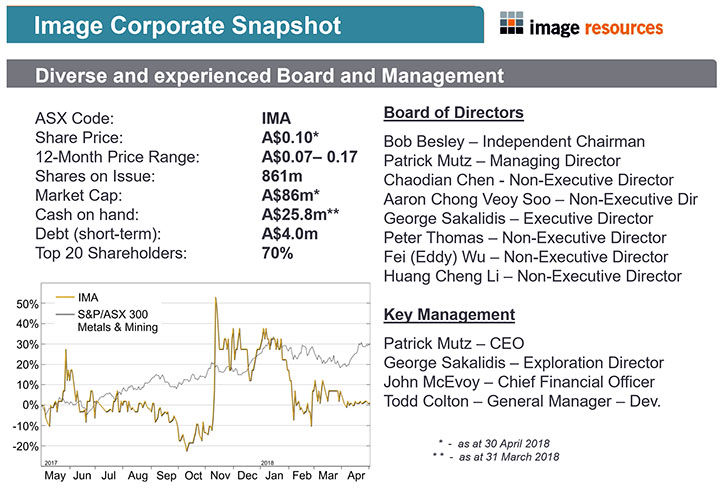

Patrick Mutz: We recently completed project funding. One element of that funding was an equity raising of $25 million from shareholders, both existing and new. This pushed the register to approximately 900 million shares on issue. Prior to about January and February of this year, the share price had been fairly solid at around ten cents per share. With the recent announcement about the completion of full project funding, which was the completion of the debt facility of $50 million, the share prices started firming up very quickly, and today it's around 14 cents, which puts the market cap at about 110 million dollars Aussie.

Dr. Allen Alper: That sounds excellent! What are the primary reasons our high-net-worth readers/investors should consider investing in Image Resources?

Patrick Mutz: There are a number of fundamental reasons like location, but more importantly are the project economics and how quickly the project will be into positive cash flow. We are expecting to see positive cash flow late in the first quarter of 2019, and we are fully funded with project capital to get to positive cash flow. The second reason is that we are in that part of the share price curve, that we will only realize our full value after we have achieved first production and can demonstrate the economics forecast in the bankable feasibility study. Therefore our share price has substantial room for growth. Research by independent brokers suggests that the more likely price for Image's shares are 20 to 21 cents in the next 12 months. The final reason high-net-worth readers/investors should consider Image is the upside potential. Image has multiple other 100%-owned projects in its portfolio in Western Australia and any one of them could be developed into a stand-alone project like Boonanarring. We have to start with our first mining project, but our intentions are to grow into a multi-project company.

I‘ve been trying to help investors understand the value proposition of Image Resources by looking at the project economics relative to a gold project. In Australia, we have a lot of gold companies, and many of them are quite popular with investors. The bankable feasibility study project economics indicate the forecast average revenue for the years 2019 and 2020 from Boonanarring are comparable to a 100 thousand ounce per annum gold production mine. However, our gross margins are nearly 100%, whereas a typical gold project may only have margins of about 50%. Importantly, a 100 thousand ounce per annum gold project would likely have a market capitalization of $300-400 million, whereas Image’s current market cap is only about $110 million.

Image may not realize its full value until we publish production numbers, revenue and costs that demonstrate the actual project economics and profitability. In the meantime, savvy investors that recognize the opportunity early will be the ones that benefit the most from the eventual uplift in share price.

Dr. Allen Alper: Well, that sounds fantastic. What a great opportunity for our readers/investors to consider investing in your company. Is there anything else you'd like to add?

Patrick Mutz: The Company uses its website http://www.imageres.com.au/ to keep investors informed about the progress on the project, through various announcements on all fronts. If investors want to follow the story and the progress of construction, which is on a very rapid burn to achieve first production by the end of the year, the website is a good place to start. Just subscribe, with your email address, and you will receive an email notice of every announcement. We have also posted an aerial drone video of site development activities and it will be updated regularly.

Dr. Allen Alper: That sounds excellent. I enjoyed talking with you again, and I'm very impressed with what you and your company have accomplished, and I'm looking forward to making those announcements, and discussing them in our Metals News, and Facebook, Twitter, and LinkedIn, and informing our readers/investors.

Patrick Mutz: Very good. Thank you very much for the opportunity, Allen.

Dr. Allen Alper: You’re very welcome. We’re always happy to talk with you.

http://www.imageres.com.au/

Patrick Mutz

Managing Director

+61 8 9485 2410

info@imageres.com.au

|

|