Abitibi Royalties Inc. (TSX-V: RZZ): Owns Royalties, at the Canadian Malartic Mine, Canada's Largest Gold Mine, Interview with Ian Ball, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, US

on 4/16/2018

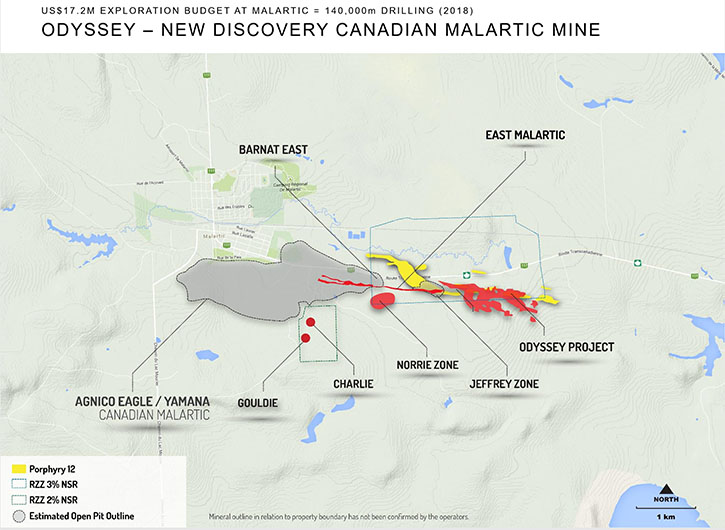

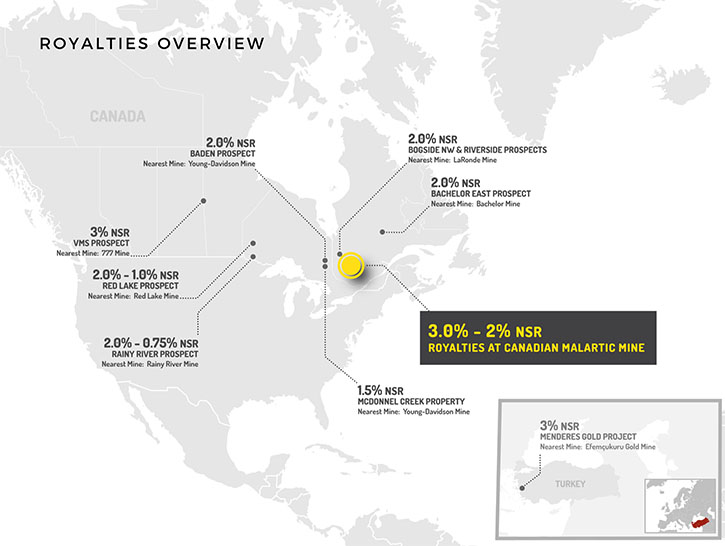

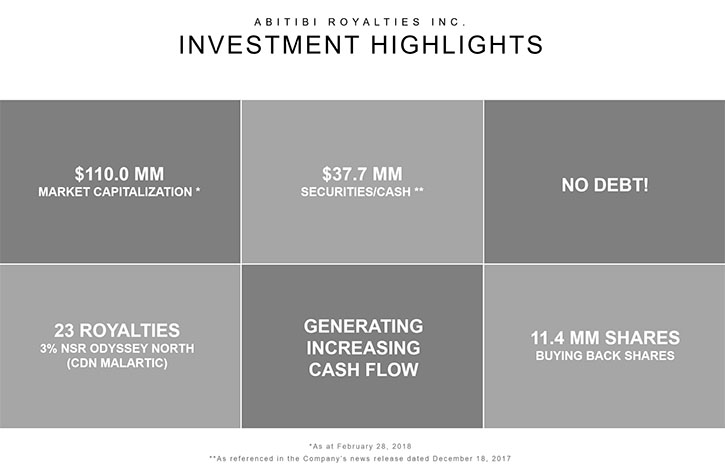

Abitibi Royalties Inc. (TSX-V: RZZ) owns various royalties, at the Canadian Malartic Mine, Canada's largest gold mine, that covers portions of Odyssey, East Malartic, Barnat Extension, Gouldie/Charlie zones and all of the Jeffrey zone. In addition, the Company is building a portfolio of royalties on early stage properties near producing mines. We learned from Mr. Ian Ball, President and CEO of Abitibi Royalties, that the company is debt free with approximately $40 million in cash and securities, and this year they expect to generate $3 - $3.5 million in cash flow and use that cash flow to buy other royalties, as well as to reduce their share account. Plans for 2018 include a 140,000 meters exploration campaign at Canadian Malartic, as well as developing ramp access to both Odyssey and East Malartic. Golden Valley Mines Ltd. and Rob McEwen hold approximately 49.2% and 12.2% interest in Abitibi Royalties, respectively.

Canadian Malartic Mine

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Ian Ball, President and CEO of Abitibi Royalties Inc. Could you give our readers/investors an overview of Abitibi Royalties Inc, your focus and current activities?

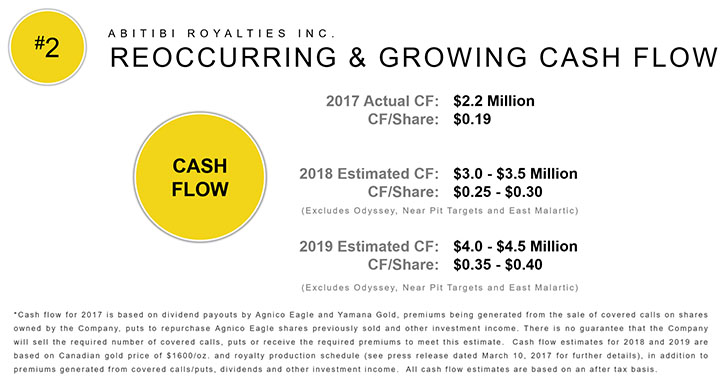

Mr. Ian Ball: I would be happy to. Abitibi Royalties’ principal asset is a 3% NSR on the eastern portion of the Canadian Malartic Mine, and that royalty covers various zones including portions of the Odyssey discovery, the East Malartic discovery, the Barnet Extension, and the Jeffrey zone. We have approximately $40 million in cash and securities. We're debt free. This year we expect to generate $3 - $3.5 million in cash flow and we've been using that cash flow to buy other royalties as well as to reduce our share account.

Dr. Allen Alper: That sounds very good. Could you tell our readers/investors your principle goals for 2018?

Mr. Ian Ball: One is monitoring the development at Canadian Malartic, where we have our royalties in and around that area. The operators of the mine, Agnico Eagle and Yamana Gold, are looking to drill 140,000 meters. It's a considerable exploration campaign. We just received an updated resource estimate, for our royalties, at that project. So there was a new and inferred resource put out of 2.3 million ounces of gold. In addition to that, we have other measured indicated resources of approximately 300,000 ounces. Beyond the exploration that's expected to occur, the operators have spoken about developing ramp access to both Odyssey and East Malartic. How that ends up playing out remains to be seen, but they're moving these projects ahead quite quickly.

Dr. Allen Alper: That sounds very good. Could you tell our readers/investors what kind of cash stream you expect to receive in 2018, and how you project that to grow as the project is developed?

Mr. Ian Ball: Right now we're expecting approximately $3 to $3.5 million in cash flow in 2018. We're seeing growth at the respective discoveries. Principally East Malartic and Odyssey. We don't have a defined figure as to where it will ultimately grow. But we do expect that the cash flow will be going up considerably from where it is today.

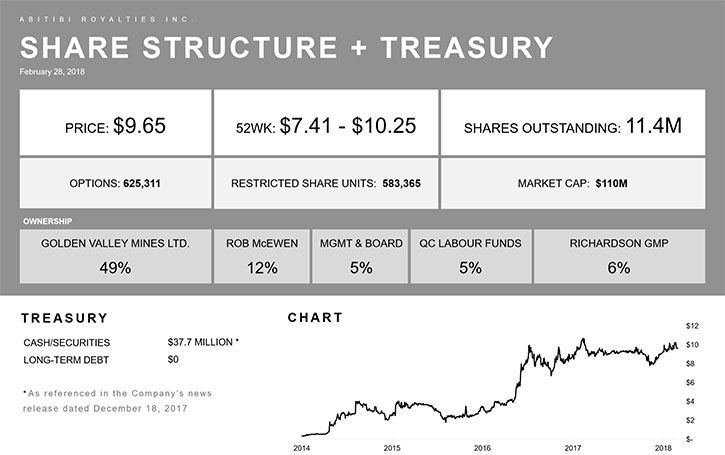

Dr. Allen Alper: That sounds great. Could you tell us about your share structure and your balance sheet?

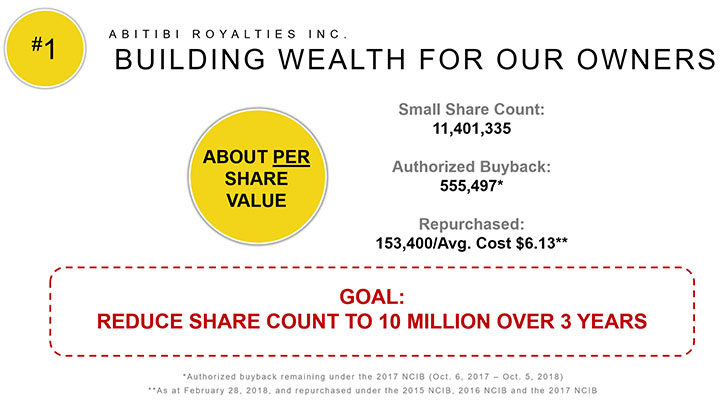

Mr. Ian Ball: We have approximately, on any given day, $40 million in cash and securities. We are debt free. We do look to make investments from that $40 million and it's very, very hard to make good investments in the mining industry. One of the reasons for that is it's very easy to discount future cash flows to the present and apply a value on that. Where it becomes more difficult, is seeing beyond the financials, and the upside in a project. Is there something that's going to cause it to dramatically improve, or are risks associated with the project that are not being recognized, or may come to fruition? So we're always looking. We want to stay in gold for our royalties. We want to stay principally within North America and certain countries in South America. We think one of the best areas right now is where there's a big paradigm shift going on within the Malartic Gold Camp, where the potential for bulk tonnage discoveries at depth is coming to the forefront. So we think the best opportunity is probably in our own back yard. That really includes buying back our shares and believing in our current assets.

Dr. Allen Alper: Could you tell our readers/investors a bit about some of your royalty projects?

Mr. Ian Ball: We have various other royalties around existing mining operations. Some of the ones that are gaining the most traction are royalties in Red Lake, Ontario, which surround Pure Gold, which has the historical Madsen Mine. They are making new discoveries there, both at the old mine and along strike, and we straddle their property boundaries to the east and to the south.

The same is true in Turkey, we have a 3% royalty around Eldorado Gold, and their exploration is getting closer and closer to the property boundaries, where we have a royalty. Eldorado does not own that property, it is held by a junior called Frontline Gold, but we like what we're seeing there.

The last area is in the Rainy River District, where we have a 2% royalty not too far from the open pit of New Gold, which just completed construction of the Rainy River Mine. We have royalties throughout the district. Those are non-core royalties, they are more like lottery tickets, but they are within the company.

Dr. Allen Alper: Could you refresh the memories of our readers/investors on your background and your board?

Mr. Ian Ball: Prior to joining Abitibi Royalties, I was at McEwen Mining and Goldcorp. When I left McEwen Mining, I was President there, mainly looking after the operations side, the production, construction and exploration.

In terms of members of the Board, our Chairman and the founder of Abitibi Royalties is Glenn Mullan. He is also the President of the PDAC. He is CEO and Chairman of Golden Valley Mines. He was the founder and CEO of Canadian Royalties that was acquired back in 2008, which has now become a nickel producing mine in the Province of Quebec.

In addition to the Board, we have Frank Mariage. He is the head of the Quebec Geological Society and is a securities lawyer. We have Louis Doyle, who was most recently in the TSX Venture Montreal office. We have Jens Zinke, who has his doctorate in geophysics, and Andrew Pepper, who is in the financial industry, running his own firm. So that's the make-up of the Abitibi board.

Dr. Allen Alper: That's a very strong board. You all have great backgrounds and a proven track record. Very impressive!

Could you tell us how Abitibi Royalties compares to its peers?

Mr. Ian Ball: We probably don't have much in the way of a peer group. The other royalty companies, are either much larger or pursuing different business models, where they're acquiring new streams on a regular basis. We have been driven more by exploration success. We are certainly open to looking at opportunities, but we think the best royalty to hold is the one we already own and expect to get a lot better. Many in the mining industry believe that the best asset is owned by somebody else, not themselves.

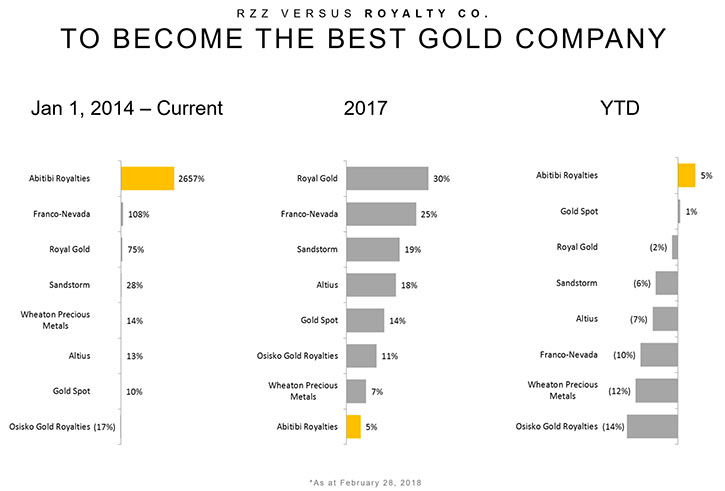

At Abitibi, we want to have a laser focus on our own royalty. We want to be able to assess where we're going, objectively. We think there's a big shift going on at Canadian Malartic, where the discoveries are growing quite quickly. There are new mining methods being applied to mine these deposits. It has helped that the discoveries are located at Canada's largest gold mine, with two very strong operators. All the ingredients exist to create value for shareholders. It's already been happening. In 2014 we started at $0.35 a share, now we're just over $10 a share. I believe we're the best performing gold company in North America, if not the world during that time.

Dr. Allen Alper: Fantastic! Great, great performance! Can you say something about your share structure and capital structure?

Mr. Ian Ball: We've been extremely disciplined with our share structure, where we refuse to issue shares. We have 11.4 million shares outstanding. There have been no roll backs in the company's history. We are buying back shares through our cash flow. Starting two years ago, we created a policy where we would not issue any stock options or restricted share units. So people would be paid in cash. They can then choose to buy stock on the open market.

For the past four years, I've been using all of my after tax salary and bonus to buy shares on the open market. So I'm not receiving any money to support a lifestyle. It's all going back into the company so I’m walking in the same shoes as every one of our shareholders.

Dr. Allen Alper: Well, that shows you have great confidence in your company and its’ growth. That's absolutely excellent!

What are the primary reasons our high-net-worth readers/investors should consider investing in Abitibi Royalties?

Mr. Ian Ball: They should only consider it if they believe that they're long term holders. It's not a company that, because of its lack of liquidity, should be traded in and out. I think of it as the Berkshire Hathaway of the mining industry, where we have such a small share flow it doesn't trade as actively as others.

Secondly, I think there are very few times in one's life, where you can invest in a deposit that has the ability to really generate a lot of wealth. And I think that is what we have here at Abitibi. We've seen that by the share performance during the past four years.

We have a management team that's aligned on the corporate governance side, and our financial interests are aligned with the existing shareholder base. Our royalty is with two extremely strong operators, including the biggest gold mine in Canada. So you can be sure that there's money being reinvested back into this asset to insure its future growth. I think all the ingredients are there, and I don't think that there's a comparable gold company to Abitibi Royalties.

Dr. Allen Alper: Sounds like excellent reasons for our high-net-worth readers/investors to consider investing in Abitibi Royalties.

Is there anything else you'd like to add, Ian?

Mr. Ian Ball: I think investors have almost forgotten what it's like to make money in the gold mining sector because it's been so long. I think there are opportunities out there, but very few companies really put the shareholder first. One of our primary objectives is and has always been to put the shareholder first. There are a lot of places investors can put their money. It could be in financials, it could be in technology. We understand that as a gold company, we are competing for investment dollars. To win in that game, we have to treat our investors properly and take them very seriously.

Dr. Allen Alper: That sounds excellent. Anything else you'd like to add, Ian?

Mr. Ian Ball: We do have a fairly strong shareholder base. Golden Valley Mines owns 49% of the company. Rob McEwen owns 12%. The Quebec Labor Funds own 5%. Richardson GMP financial advisor and his clients now own 6% of the company, and management and the board own about 5%. So it's an extremely tight share structure from not only the share count, but who makes up the shareholders.

Dr. Allen Alper: That's excellent, really great!

http://abitibiroyalties.com/

Shanda Kilborn - Director, Corporate Development

2864 chemin Sullivan

Val-d’Or, Québec J9P 0B9

Tel.: 1-888-392-3857

Email: info@abitibiroyalties.com

|

|