Chatham Rock Phosphate Limited (TSXV: NZP, NZAX: CRP): The Premier Supplier of Direct Application Phosphate to the New Zealand and Global Agricultural Sector, Interview with Chris Castle, President, CEO and founder

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, US

on 4/5/2018

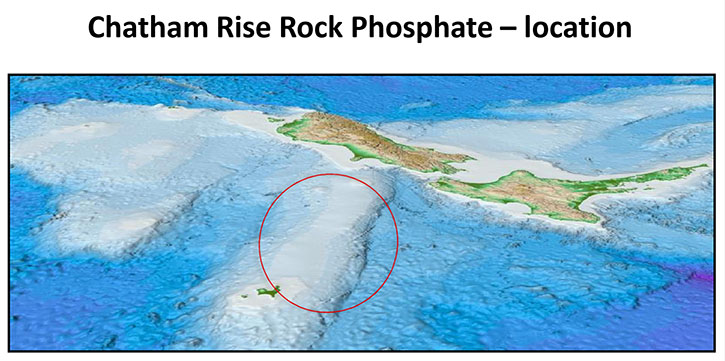

Chatham Rock Phosphate Limited (TSXV: NZP, NZAX: CRP) aims to be the premier supplier of direct application phosphate to the New Zealand and global agricultural sector. Chatham Rock Phosphate is the custodian of New Zealand’s only material resource of ultra-low cadmium, environmentally friendly pastoral phosphate fertilizer. Chatham Rock Phosphate Ltd holds a mining permit over an area off the coast of New Zealand, with significant seabed deposits of rock phosphate and other potentially valuable minerals. We learned from Chris Castle, President, CEO and founder of Chatham Rock Phosphate, that their deposit is offshore about 450 KM to the west of New Zealand, 400 Meters under the water. The resource is 35,000,000 tons, of which 23,000,000 are 43-101 compliant, which makes for a 15-20 year mine life. Chatham Rock Phosphate anticipates significant return on investment. According to Mr. Castle, their New Zealand project has quite a number of environmental benefits, including lesser carbon emissions, better water quality, and low levels of cadmium.

Chatham Rock Phosphate Limited

Allen Alper Jr.: This is Allen Alper, Jr. with Metals News, interviewing Chris Castle, President, CEO, founder, and just about everything else with Chatham Rock Phosphate. Could you give our readers/investors a bit about your background, an overview of your company, your focus, current activities and your properties? Chris, how did you get started?

Mr. Chris Castle: First of all, thanks for coming by, Allen. I first got started in the mineral sector back in 1975, I started working for a group of companies that had a minerals arm. I was doing the accounting work there, and I became fascinated by the projects and started by forming my own minerals companies back in 1982. They operated successfully during the 80's, until the big crash of 1987.

During the 90's, I did something else, and then I re-entered the minerals business in 1999 with a company in Vietnam, called Asian Mineral Resources, which I listed here in 2003 on the Venture Exchange. It commenced production about a decade after that and has already mined out the primary orebody, the high-grade nickel sulphide deposit. I'm very proud of that, we employed 500 people when it was in production and were for a time the biggest tax payer in North Vietnam.

So that's my background. I've been involved with this Chatham project for a decade, starting in 2007, when the phosphate price started moving up and I saw the opportunity of exploiting the marine phosphate deposit offshore New Zealand.

Mr. Chris Castle: The deposit is offshore New Zealand about 450 KM to the east of the country. It's at a depth of 400 Meters under the water, which makes it an unusual deposit not being land-based. However it is able to be extracted quite easily and cheaply using modified dredging technology.

The deposit contains approximately 35,000,000 tons, of which 23,000,000 are NI43 101 compliant. The additional 12,000,000 tons need further sampling in order to make them compliant. But without that additional tonnage, we still have a 15 year mine life, at the rate we're going to mine (1.5Mtpa).

The rock itself is special. It's a reactive phosphate rock, with special and distinctive properties, which means we can get a premium for it (up to 50%) in some markets. Importantly, and this is really important, we are not competing with the Moroccans as we have a different quality rock. Based on presently estimated costs, we should make roughly $US75 a ton gross profit for every ton of rock we mine.

We don't mine it ourselves, our dredging contractor mines for us. As a result, we have no capital development cost. That's a special thing about our business model.

We don't have any capital development costs. NONE.

We just obtain the two permits (mining and environment) and then we pay a dredging company to mine it for us. We don’t do anything other than take delivery of the rock, then on-sell it.

It doesn't sound like much, but our current market value is $CA 5,000,000. If our estimates are correct, we're going to make 13 times our current market value in our first year of production, based on the current projections. So that's pretty exciting.

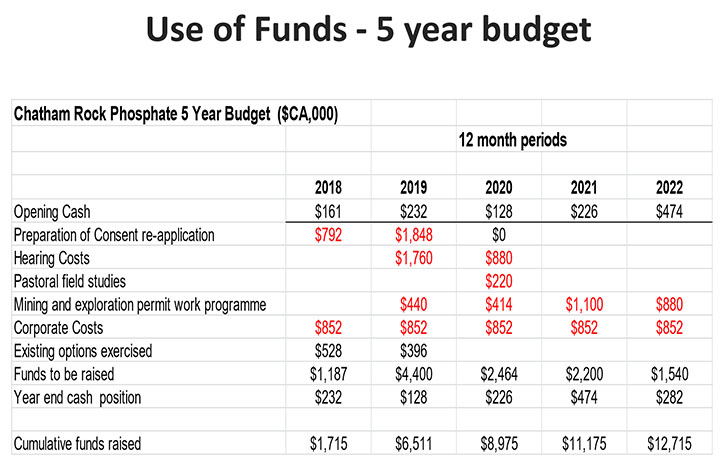

As a result, I haven't had any real difficulty raising money for this project since 2007, when I was first involved. I've raised $CA35 m of development capital and I'm in the process of raising another $CA 1.2 million right now to fund the rewriting of the environmental application. We have a mining permit (granted in 2013), we don't have an environmental permit. So that's pretty much where we are at the moment.

Allen Alper Jr.: What are your challenges, are you worried about the permitting or is that proceeding smoothly as planned?

Mr. Chris Castle: The permitting is the largest challenge. It's the biggest risk that the project faces because we applied for an environmental permit back in 2014, after several years work, we were unexpectedly turned down.

However, subsequent independent reviews identified that the next application could be improved significantly and many of the previous supporting reports could be used again once updated.

Further, the law has also changed in New Zealand, the governing Act has been refined, with more streamlined processes to make it easier to get an environmental permit next time.

Additionally, another company has just been granted an offshore environmental permit, so a precedent has been established. We're ultra-confident we will get the permit next time otherwise we would not be bothering to reapply.

But that's the biggest risk that faces this project and people see that as a binary risk. We either get the permit or we don't. We can't be 100% certain either and that's why we're diversifying into Namibian marine phosphate mining to remove the perception that we are a single project, binary risk company.

Allen Alper Jr.: Do you have a time frame on permitting?

Mr. Chris Castle: Once I've raised this money, it will take 15 months to complete the reapplication process and then the actual hearings take nine months. So that's a two year process from the time that I raise the cash. After that there are two years for our contracting partner to modify their process and go mining. So we're looking at mining four years away.

Allen Alper Jr.: So large possible upside and binary risk.

Mr. Chris Castle: Well there was the perception of binary risk until we started diversifying into the Namibian marine phosphate prospects. There, in conjunction with local partners, we have two granted permits and ten applications in very strategic areas. We are also aware that the Namibian government is about to introduce new environmental permitting regulations to further refine their existing processes. As a result, given their strong resource base, we anticipate a flow of international investment into that country and we will be there pretty early in the queue. That's part of our diversification strategy.

Allen Alper Jr.: Tell us a bit about your management team and Namibia.

Mr. Chris Castle: I head it up and I work mostly with a group of scientists, since it's a science based project in the ocean. Therefore the application was very science focused.

Three of our team have worked on this project since the late 1970s, for prior Chatham Rise permit holders. The first of those is Dr. Robin Falconer, our principal scientist and a Director. Our Chief Operating Officer is Ray Wood, who is also a marine geo-physicist. Our expert panel also includes Dr. Hermann Kudrass, who lead or co-lead German government work on the Chatham Rise back in 1978 and 1981.

The head of our geological team is Cam McKenzie, who leads a team from RSC Consulting that contracts all geological services and permits related to us.

On the phosphate marketing side, we've worked for some years with a gentleman called Najib Moutia. He is a Moroccan who worked with Morocco based OCP, which is the largest phosphate trading company in the world, for some 30 years. He is not with us currently, but he's worked with us for the past few years on market development.

The really key person is Renee Grogan, who is going to be leading our environmental reapplication process. She's an Australian, who is very well known in the marine mining scene. She's the director of the World Ocean Council, works on International Seabed Authority issues for NGO clients. She has an impeccable reputation for successfully permitting mining projects, eight on shore and one offshore. The offshore permit being Nautilus Minerals in Papua New Guinea, which is probably the best known marine mining venture in the world.

Allen Alper Jr.: So, tell me a little bit about your share structure and what you're doing to raise money in a way that is not further diluting it or if that's a concern?

Mr. Chris Castle: The current share structure is very tight. We merged with a Canadian company last year in order to become listed on the TSX.V and that involved a 66 for one rollback. So we went from close to a billion shares down to 15,000,000 shares. We now have 17.7 million shares out and about 20.7 million fully diluted. So it's a very tight capital structure and I think it fits the TSX.V market really well. The plan is to issue up to another 4.8 million units at 25 cents to raise the 1.2 million we need. Those 4.8 million units will comprise one share and half of a 45 cent two year warrant. So that's going to be pretty tight capital structure still.

I expect that there will be some participation from existing shareholders and I should mention that I represent the largest shareholder group. Management has about twelve percent and we have two cornerstone shareholders who have another 21%. In total we have about 33% tied up in-house and I think with another ten phone calls I can get up to 50% pretty fast. The company is very tightly held and most of the shareholders are in for the long haul, so trading can be pretty thin. That’s one reason why we are fundraising in Canada in order to increase liquidity in the market.

Allen Alper Jr.: So you definitely have skin in the game.

Mr. Chris Castle: Yeah, very much so. I really believe in this project and I've put in quite a lot of cash. So it's actually my biggest single asset apart from my own home. So I'm putting my money where my mouth is. I think it's called walking the walk isn't it?

Allen Alper Jr.: Right.

Mr. Chris Castle: I'm very committed to it. I'm the one who has raised NZD 39m, basically face-to-face. I found that talking to individuals in institutions, face to face, I can get my enthusiasm across. We haven't been very successful in getting brokers to raise money for us. I think probably because they can't answer all the questions they are asked. I usually can.

Allen Alper Jr.: So, what do you think are the main reasons that high-net-worth readers/investors should be interested in Chatham Rock Phosphate?

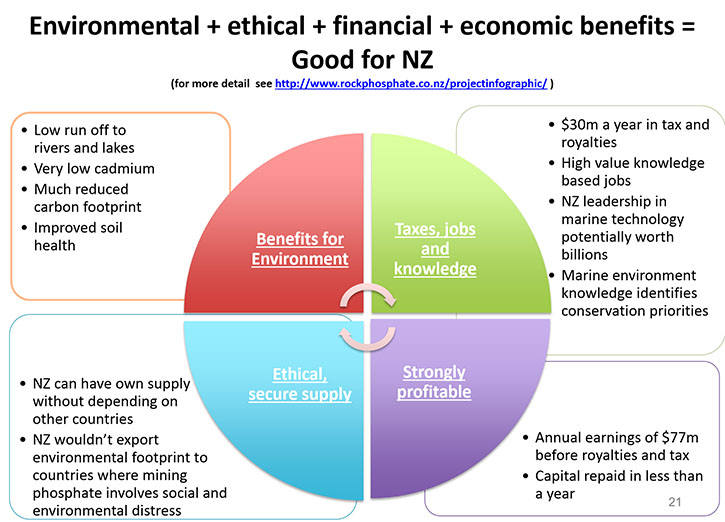

Mr. Chris Castle: First of all, there is obviously a potentially significant return on investment. Secondly if they're interested in investing ethically, we have quite a number of environmental benefits that will flow from the use of our product.

Although we are mining in the ocean, probably the impact will actually be less than mining phosphate on shore.

Secondly, the carbon emissions involved in mining are reduced. If rock phosphate is mined in New Zealand, rather than imported from Morocco, it takes 19,000 vehicles off the road in New Zealand. And that's significant! We only have 5,000 electric vehicles now that would take it up to 24,000 and our 2025 target is 60,000. So reducing New Zealand carbon emissions is a pretty big deal.

Thirdly, New Zealand has significant concerns about water quality issues and water quality is most affected by fertilizers going into rivers and lakes when it rains.

But our particular form of rock phosphate doesn't leak into rivers and lakes at anything like the same rates as traditional fertilizers.

Fourthly, our rock has very low levels of cadmium and it is well established that cadmium causes cancer in humans. Rock phosphate with high cadmium levels is being legislated against in the European Union now. We understand that the limits are going to be set at 60 parts per million and then 20. The EU initiative will spread around the world.

Much of the rock phosphate in the world is actually running at several hundred parts per million and therefore will eventually be outlawed.

The good news is that our rock is running at about two parts per million.

So if you invest in Chatham Rock Phosphate, you're investing in an ethical business as well as making substantial returns over time. Not that I'm allowed to predict substantial returns as a director of a TSX.V company, but I think anyone can see that when we go into production and make anything like the money we're talking about, there is a significant upside in the shares for us.

Allen Alper Jr.: Do you have anything else that you would like to add, Chris?

Mr. Chris Castle: No I'd just like to thank you for the opportunity to talk with you Allen.

Allen Alper Jr.: What do you think of PDAC?

Mr. Chris Castle: This is my 15th or 16th time here since first attending in 2001 - either for Chatham or earlier for Asian Mineral Resources, the company I mentioned earlier.

Every year it seems to have a real buzz. As you know it’s Sunday, which is quite often the busiest day and today is no exception. From my perspective as a New Zealander and a raiser of funds you really do have be at PDAC. This conference is the only place to go in the world if you seriously want to raise money for a resource project. This is definitely the place to come and for a company exhibiting here this is incredibly good value for your money.

Allen Alper Jr.: We love this show. We’ve been coming for 17 or 18 years and we are a Media Partner.

http://www.rockphosphate.co.nz/

Chris Castle

021 55 82 85

chris@widespread.co.nz

|

|