John Robins, Executive Chairman, Bluestone Resources Inc. (TSXV:BSR): Discusses Exploration and Development of their High-Grade Gold & Geothermal Projects

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, US

on 2/19/2018

Bluestone Resources Inc. (TSXV:BSR) is a mineral exploration and development company focused on advancing its 100% owned Cerro Blanco Gold and Mita Geothermal projects, located in Guatemala. The Cerro Blanco Gold project Preliminary Economic Assessment indicates a robust project, with an expected nine-year mine life, producing 952,000 ounces of gold and 3,141,000 ounces of silver. We learned from John Robins, who is executive chairman of Bluestone Resources, that Cerro Blanco is one of the highest grade undeveloped, fully permitted gold projects in the world, and it had almost a quarter of a billion dollars invested in it by Goldcorp, in terms of infrastructure and exploration work. The Mita Geothermal project is a renewable energy asset that has a 50 year license to build and operate a 50 megawatt geothermal plant. According to Mr. Robins, in the next month or so, they are going to start a very steady flow of news from their drilling and they will be making a production decision within 12 months from now.

Cerro Blanco Gold Project

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing John Robins, Executive Chairman of Bluestone Resources Inc. Could you give our readers/investors an overview of Cerro Blanco and Guatemala, your focus and current activities?

John Robins: Bluestone is a relatively new company. We signed a letter of intent with Goldcorp, around this time last year, and we acquired the Cerro Blanco project, in Guatemala. It's a fully permitted gold project, which was the main attraction for us, along with the fact that it's one of the highest grade, undeveloped, fully permitted gold projects in the world. We then raised approximately C$80M last year to fund the acquisition, which was US$18 M or approximately C$25 M. We're using the rest of the money in the development and feasibility work that we're doing right now.

The important thing is, we were able to pick up a project that had almost a quarter of a billion dollars invested in it, by Goldcorp, in terms of infrastructure and exploration work. It's a very interesting project. It has two components. It is a high grade gold deposit, with a fully-permitted geothermal project adjacent to it. So right now, we're in the process of working through a full feasibility study, with the anticipation that we'll be in a position to make a production decision about this time next year.

Dr. Allen Alper: That's excellent. Could you mention some of the highlights of the PEA study that has been done?

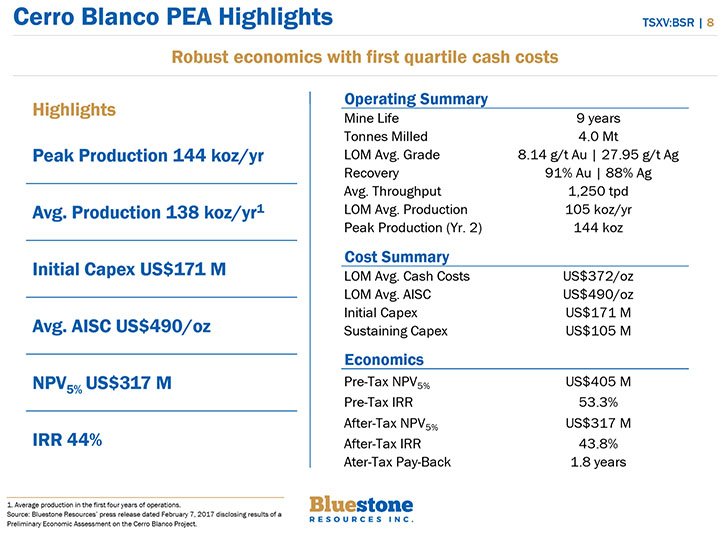

John Robins: It started out in part, as due diligence by us, to establish whether or not we were interested in making the acquisition. I engaged an engineering firm in Vancouver by the name of JDS. That work evolved into a PEA that we published about a year ago. It indicated a very robust project with an IRR, after tax, of about 44 percent. Annual production in the neighborhood of 138,000 ounces a year. Very low CapEx of 170 million. That's explained, in part, by all the money Goldcorp had spent on the project already and the high-grade nature of the deposit. There are three kilometers of underground development work, substantial surface infrastructure, etc. Very low all-in sustaining cash costs! Projected to be around US$500 dollars per ounce, so an extremely robust project!

It has about a nine year mine life right now. Although, I believe with my view of the exploration potential, it's likely that the mine life will be extended beyond the nine years.

Dr. Allen Alper: That's very impressive. That's an excellent project. Could you mention a bit about how your project compares to some of its peers?

John Robins: Well, because of the money that's already been spent and the fact that it's going to reduce our capital costs a great deal, we will be one of the lowest cost producers. It's going to be a modest sized mine. But what will make it stand out from its peers is the high grade. It's one of the highest grade projects going into development. Against our peers on a P/NAV basis, we're one of the lowest companies out there. Currently, we trade on a P/NAV basis about 0.25x price to Nav. So much, much lower than any of the other companies that are in our peer group. Part of this is due to being a new opportunity that has only come together a few months ago.

Dr. Allen Alper: That's excellent! Sounds like a great opportunity for investors. I know you, your executive team and Board have a proven leadership record. Could you tell us about your background, the teams’ and the Boards’?

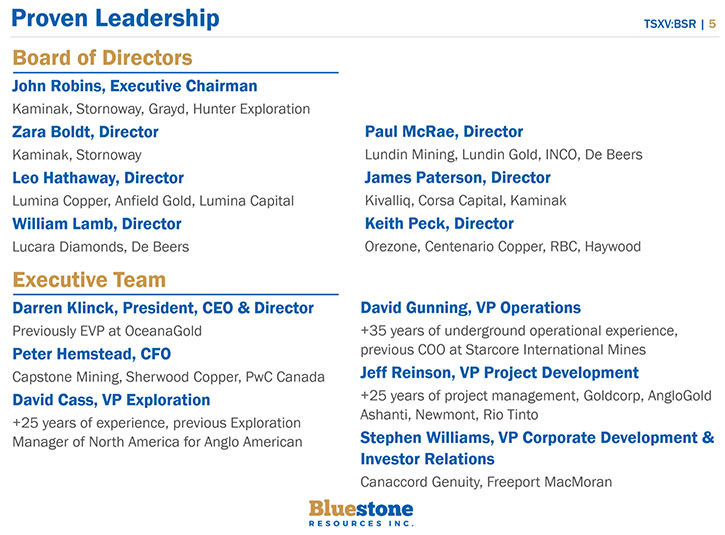

John Robins: Absolutely. I'm a geologist by training. I have about 35 years of experience in the industry. One of the challenges, but also one of the great opportunities is when you start from scratch and acquire a project in a new company, you are able to build the team you want around the project. Last year, it was just myself. Over the course of the last 12 months, I've built an outstanding, well rounded board of directors. It includes William Lamb, who's the CEO of Lucara Diamonds, Leo Hathaway, who's involved with Ross Beaty’s group, Lumina Copper, Zara Boldt, who was with us when I was the Chairman of Kaminak, which we sold last year to Goldcorp, in addition, Paul McRae, who comes from Lundin Mining, Keith Peck, investment banker and Jim Paterson. So we have a very strong board.

Our executive team is led by Darren Klink, who was most recently Senior Executive Vice President at OceanaGold, so tremendous amount of experience there. Peter Hemstead is our CFO, out of Capstone Mining. Dave Gunning’s our VP operations, 35 years of experience in mining. We just hired Jeff Reinson out of the Goldcorp camp. David Cass as VP Exploration who has spent his career mostly internationally including much of it in Latin America; And Stephen Williams came out of the banking side with Canaccord. So we put together a very, very strong board. And very, very strong executive team. I'm very proud of that.

Dr. Allen Alper: Well done! Excellent! You have a very impressive background, board, and executive team. Extremely strong! So that's great. Can you tell us a bit about the location of Cerro Blanco and how it is operating in Guatemala?

John Robins: We're operating in the region of Guatemala, down in this southern part of the country. Guatemala is a complex country. We all know there are projects that have had some serious challenges there. We operate in an area that's dominated by fairly large farms and ranches. One of the key things, a cornerstone of our company's belief system, is that social responsibility is an integral part of our development program. Goldcorp, from whom we acquired this project, had done a tremendously good job in terms of socializing the project locally. We're carrying on that work and expanding upon it. We’ve been very pleased with the level of support and engagement we’ve received in Guatemala and are confident that we have the right project in the right part of the country with strong support from the government and community stakeholders.

Dr. Allen Alper: That sounds excellent. Could you tell us a bit about your capital structure and some of your key investors?

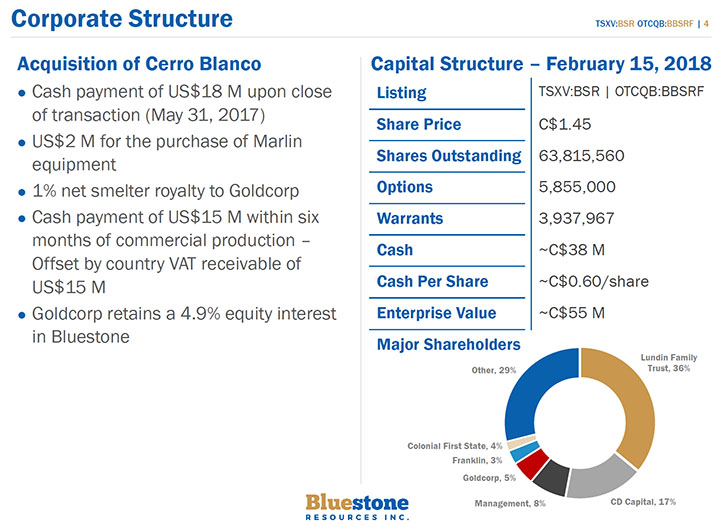

John Robins: We have only 63 million shares outstanding. We did our capital raise, 80 million dollars, at $1.50. We have 5.8 million options that are all set in the $1.50 range. We have four million warrants out there. We have C$38 M in cash. We have roughly a C$85M market cap, so we have a very healthy treasury. The Lundin Family Trust is our largest shareholder. They have 36 percent of the company right now. They're a major supporter, hence the two Lundin representatives on our board of directors. There's another 25 percent or 30 percent that's held institutionally. Management owns about 10 percent. So we have a very, very good capital structure.

Dr. Allen Alper: That sounds excellent. Sounds like it is very tight and you have very impressive investors, very experienced ones. People and companies that have been successful in the past are willing to put their money in your company. That's great.

John Robins: Yes, I think having the support and the level of investment that we've received from Lundin is a real testament to what they see as a bit of potential in the project. They probably did six weeks’ worth of due diligence before they made that decision.

Dr. Allen Alper: That's great. By the way, last week, I interviewed William Lamb. And that's a very impressive company, Lucara Diamonds.

John Robins: It certainly is. The two representatives that we have, Paul McRae and William Lamb, are very active contributors on the board level. They have a tremendous amount of operational experience that we can draw upon. So our board has a tremendous amount of experience and a lot of experience working in challenging jurisdictions. Like many developing countries, Guatemala has its challenges. But on the same token, if you operate properly and you embrace a strong social responsibility program, you can operate there. There are a number of mines, operating in Guatemala right now that are not challenged.

Dr. Allen Alper: Well, that's great. That sounds like you're in a particularly good part of Guatemala. You're close to Guatemala City and you're also close to a highway, The Pan-American Highway.

John Robins: Yeah. We're just a few miles from The Pan-American Highway. We have road access right now. We're also doing the same work to tie into the grid power, which is about eight kilometers away. So from an infrastructure standpoint, it's very well situated. It's in a very ideal location really.

Dr. Allen Alper: That sounds great. Could you say something about your hydrothermal project?

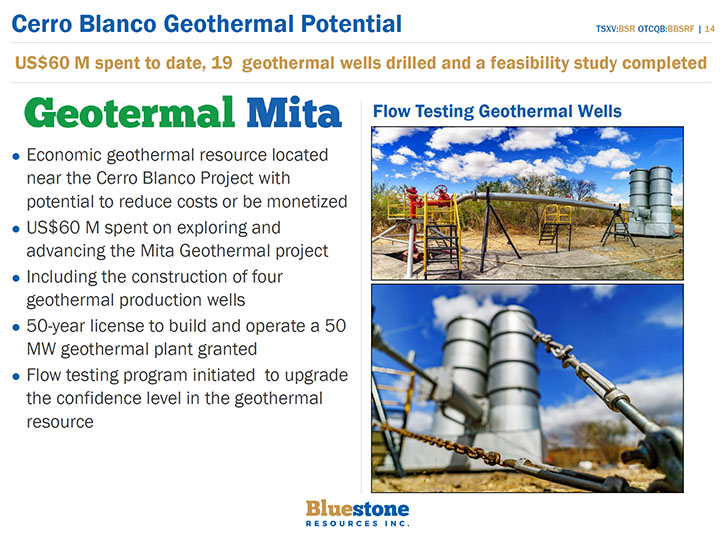

John Robins: When I was negotiating the transaction with Goldcorp, we didn't really attribute any value to the geothermal asset. I've always had quite an interest in renewable energy. So I was intrigued by it. And of the 230 million dollars that Goldcorp spent on the project, 60 million US was spent exploring what we call the Mita geothermal project. They drilled several wells, put in a fair bit of infrastructure. By doing the amount of drilling that they did, they substantially de-risked it from a production standpoint. But they didn't adequately flow test the wells. So we've announced a program that we'll be commencing fairly soon to flow test the number of wells that we drilled. That will give us a very strong baseline in terms of what the actual capacity of the geothermal project is.

As is the case globally, there is a big push towards renewable energy. And Guatemala is no exception. Something like 40 percent of the energy in Guatemala is generated by the burning of carbon. Whether it be diesel fuel, coal or sugar cane. So Guatemala has a push for renewable energy. We're lucky we inherited a project that has a 50 year license to build and operate a 50 megawatt geothermal plant. They have not done enough drilling to demonstrate 50 megawatts of capacity yet. But the belief is that with further exploration, that's a distinct possibility.

We're not going to take our eye off the ball in terms of developing the gold project. But I think the geothermal has a very real chance of being commercially viable. We have many options. It could be selling the asset, which I don't think we would look at. It could be partnering. We've had a lot of inbound calls from strategics that are interested in the geothermal asset. There is also a possibility we could develop it ourselves. Cerro Blanco will require about 12 megawatts of power. If we could generate our own power through geothermal, we’d have a unique opportunity to be as green a mine as you could be. I think, from a social standpoint, that's very important.

Dr. Allen Alper: That's excellent. What are the primary reasons our high-net-worth readers/investors should consider investing in Bluestone Resources?

John Robins: Sure. There are a couple of key takeaways, and these are the very reasons that I invested in it myself. Having been involved, most recently, with Kaminak, which made a very exciting discovery in the Yukon that was purchased by Goldcorp for 500 million dollars. We did a full feasibility study on that. It was very robust, but you also realize you're at that point and then you have to go into permitting. That can take years to complete. The fact that Cerro Blanco is a permitted project to me is one of the number one things because permitting risk, anywhere in the world, is very significant and takes time. Here, the permits are all in place to build and develop this. It has had a prior owner that spent almost a quarter of a billion dollars on the project. We bought it for literally pennies on the dollar. We purchased it for 25 million dollars Canadian. And it has high grade. And grade is always king. This is a ten gram gold deposit. 1.25 million ounces of ten gram gold permitted.

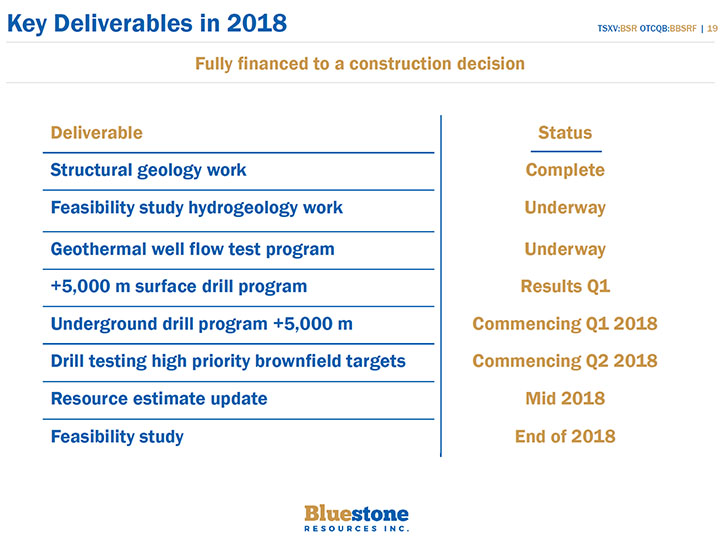

This is one of the very few projects of its kind globally. We have a tremendous share structure where over 40 percent of our market cap is cash right now. We have extremely strong shareholders in the form of, particularly Lukas Lundin. The job for us, right now, is to work our way through the feasibility study. We have three drills turning right now. We'll have a fourth drill turning shortly. So probably in the next month or so, we're going to start a very steady flow of news from our drilling. So we're going to have news flow. We could be a project that's making a production decision within 12 months from now. We'll have a resource update coming out later in the year. And yeah. There are lots of catalysts to move the stock here over the next year

Dr. Allen Alper: That sounds very exciting! Sounds like 2018 will be a great year for your company, for discovery, and for moving forward!

John Robins: Yeah. We're very excited about it. Being an exploration geologist, I have to mention the exploration potential of the project. One of the other reasons I think Cerro Blanco is exciting is the massive hydrothermal alteration area on this project. The deposit fits down in the southern part of it. There's this huge area to the north that remains unexplained. One of the things we undertook, as soon as we got control of the project, was a detailed structural review of the project. There was some drilling done by Goldcorp to the north that failed to intersect economic grades, even though there were samples on surface. Based on our new structural reinterpretation, we believe that that drilling was conducted in the wrong area. So we're pretty excited about the opportunity to drill some of these targets to the north. In my view, the potential to expand significantly on Cerro Blanco is very real. And we'll be testing a number of those high priority targets this year.

Dr. Allen Alper: That sounds fantastic! Sounds like you have a great company and a great property. High grade is absolutely king, and you have an opportunity of expanding the life of the resource. Really excellent!

http://www.bluestoneresources.ca/

Bluestone Resources Inc.

Phone: +1-604-646-4534

info@bluestoneresources.ca

|

|