CanAlaska Uranium Ltd. (TSX-V: CVV; OTCQB: CVVUF; Frankfurt: DH7N): New Important Uranium Discovery with Cameco, interview with Peter Dasler, President, CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, US

on 1/26/2018

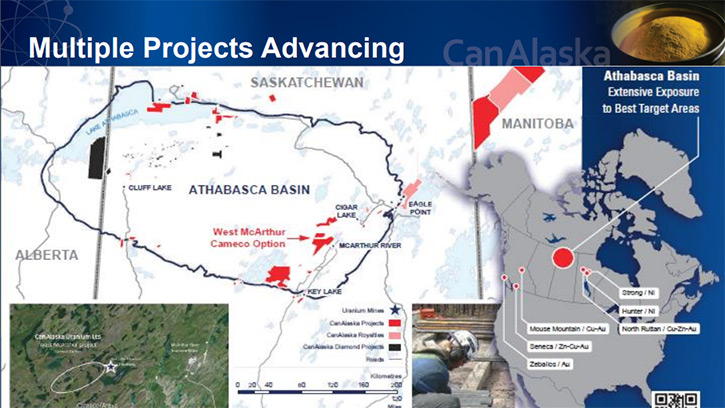

CanAlaska Uranium Ltd. (TSX-V: CVV; OTCQB: CVVUF; Frankfurt: DH7N) is a project generator that holds interests in approximately 152,000 hectares (375,000 acres), in Canada's Athabasca Basin region, famous for its large, high-grade uranium resources. While advancing the West McArthur and Cree East uranium projects, CanAlaska's primary focus is on uranium. We learned from Peter Dasler, who is President, CEO, and Director of CanAlaska Uranium, that they have had a lot of assistance from Asian industry giants like Mitsubishi and four large Korean corporations. Plans for 2018 include facilitating everything for Cameco to continue exploration drilling on their West McArthur project that shows signs of a very large deposit. To complement their uranium story, CanAlaska acquired a large amount of land in the Thompson Nickel Belt for high-grade sulfide nickel. According to Mr. Dasler, their board is very strong, many good political connections and strong strategic partners.

West McArthur Project

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Mr. Peter Dasler, President, CEO, and Director of CanAlaska Uranium Ltd. Could you give our readers/investors an overview of your company, your focus and current activities?

Mr. Peter Dasler: We're principally involved in uranium exploration in the Athabasca Basin in Saskatchewan. We've had a lot of assistance in the past from Asian industry giants. Mitsubishi provided a large amount of money for us on our West McArthur project, and four large Korean corporations funded just over $20 million worth of work on our Cree East project in the eastern part of the Athabasca Basin.

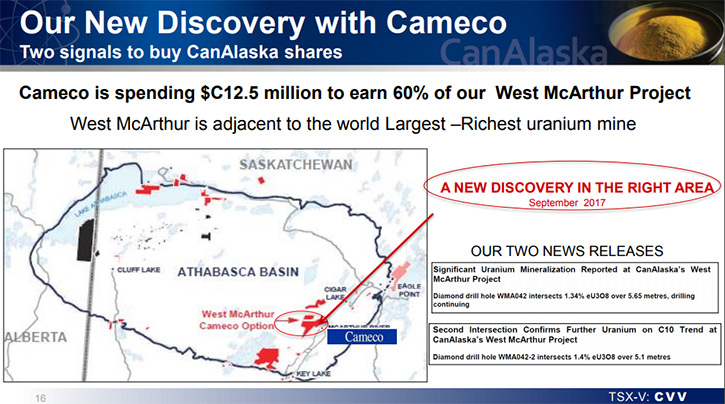

We've done a lot of intensive work, looking for another target similar to McArthur River or Cigar Lake. Last year, in January, we were able to buy out Mitsubishi, and within the month do another deal with Cameco Corporation. Right now, they have two drill holes into a new uranium discovery. It's on the Grid 5 target area. That's about 10 miles west of the McArthur River mine, which is the largest high grade uranium mine in the world. We think these discovery holes will lead to more discovery holes. We have two intersections right now, of 1.5% uranium at the unconformity, but we have a very, very large system. That's the focus of the company.

We do have a number of other things that we've worked on over the years, and they're in the wings, but we will continue with our uranium story and just keep those as prospect generation, whether they are nickel, or gold, or copper. They're on our website, with some detail on them.

Dr. Allen Alper: That sounds exciting. What are your prime objectives for 2018?

Mr. Peter Dasler: 2018 is to facilitate everything we can for Cameco to continue drilling and seeing the extent of the mineralization on this Grid 5 target. We certainly have a target that looks like a large unconformity uranium deposit. We have over 800 meters of alteration from the unconformity to surface, with a uranium halo, a 0.5 PPM uranium halo coming at least halfway to surface, with a large pyrite halo. That's quite typical of the very, very large deposits, and those two intersections are very good for us. The focus is that.

We did acquire a large amount of land in the Thompson Nickel Belt for high-grade sulfide nickel. That complements our uranium story. We're into clean energy, very definitely looking at battery makers down the road to store energy. The uranium story, whether it's just one or more of our six or eight uranium projects we are targeting, or it's the nickel situation, that's our 2018-2019 program.

Dr. Allen Alper: That sounds exciting. You have two very important, key elements in metals. It sounds like you have great, high growth potential. Could you refresh the memory of our readers/investors about your background, your team, your board, and your advisors?

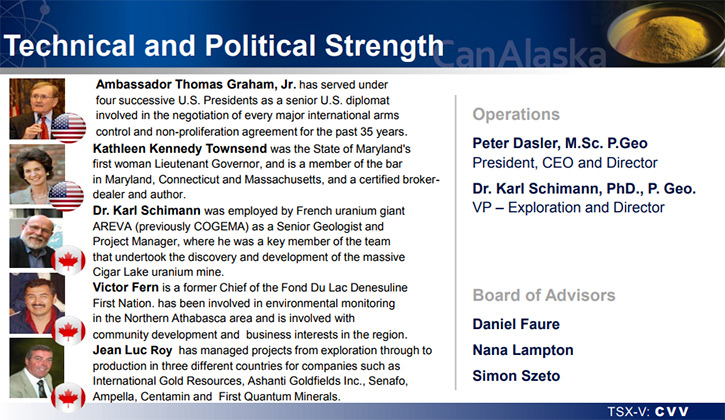

Mr. Peter Dasler: I have a great team, working with me. Dr. Karl Shimann was the gentleman that drilled the first hole into Cigar Lake, the first of these giant uranium deposits that were found. He worked for 20 years with Areva, and set up their geology department at McClean Lake, and operated there for 10 years. Our quest together has been finding another uranium deposit.

We have a strong group of geophysicists who help us identify these targets and work with us. Now we also have Cameco's team working on that key project of West McArthur. Our board is very strong, very good political connections, whether with Ambassador Thomas Graham, who led all of the U.S. strategic arms talks for 20 years, or Kathleen Kennedy Townsend, involved in uranium and also very political in the U.S., a lawyer who supports us a lot. Then through to the north, we have Victor Fern, who's a former chief of the Dene community at Fond du Lac, very active in business in the north of Saskatchewan, or Jules Lajoie, our geophysicist, or Jean Luc Roy, who's one of our directors whilst country manager for First Quantum in Africa, and has a very strong accounting background, who guides us along what we're doing, so a good group of people. I like working with them.

As for our team on the ground, prior to Fukushima, we had a team of 30-35 people working full-time on these projects for our Asian partners. Now it looks like we can probably get back into the game again with Cameco's team drilling what they're drilling right now.

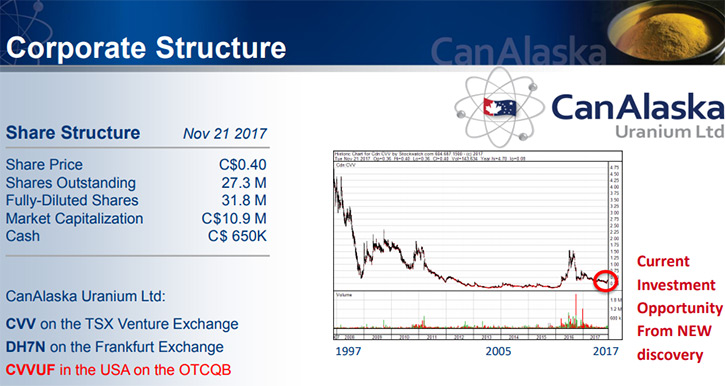

Dr. Allen Alper: Wow. That's excellent. You have an excellent background. You have a very strong team and board, so that's great to have strong technical and political strength. Could you tell us a bit about your corporate structure?

Mr. Peter Dasler: That's one of the things we have held together over the last five years. We haven't issued very many shares in the last five years. I think just after Fukushima, we were around 24 million shares issued. We're at 27 million shares issued right now. The money we did raise on those other financings went into a couple of our uranium projects to be able to do deals and for the company's nickel projects. We have about 4,500 shareholders, 27 million shares out, a very tight structure. Last year, when we did a deal with DeBeers on some diamond projects, our share price rapidly appreciated to the $1.50 range. We're sitting at the moment with a 35 cent Canadian stock and going into a major drill program, so structurally, we're well prepared for success, to give our shareholders a capital gain. In the long term, multiple projects can obviously create multiple companies and shareholders can extract growth that way, too.

Dr. Allen Alper: That sounds exciting. It sounds like 2018 will be an excellent year for you and your company. Could you elaborate on that?

Mr. Peter Dasler: All I can say to that is, “Finally!”

Dr. Allen Alper: The mining business is a long, tough business, and you need these quality projects. You need perseverance. I'm glad to see you're sticking with it, getting data, and building your company. It's looking good for 2018. Could you elaborate a bit on clean energy and the role uranium and nickel play in that?

Mr. Peter Dasler: There's no doubt in my mind that we need to create a lot more nuclear power plants to provide very clean energy. We can't keep burning coal. We can't keep burning gas. We can't keep burning petroleum to supply us with heat and light. We have to do something that's a lot less destructive to the environment. Ambassador Thomas Graham, our Chairman, has just coauthored a book called “Seeing the Light: The Case for Nuclear Power”. The Chinese and the Indian governments have understood this, also the Saudi government and the UAE. We can't keep polluting the atmosphere we live in. There are too many health problems. There's too much heating going up into the atmosphere. We need to do something about global warming. The only way we can handle that is to provide a tremendous amount of base power from nuclear sources. They don't pollute the atmosphere. We can use wind and solar as well, to supplement nuclear, but the amount of energy available from nuclear power, clean energy, is the only way for us to go. I believe in that.

Storage of energy is extremely important, whether they're lithium batteries, or lithium-nickel batteries, or cobalt-nickel batteries. They are very necessary components. We need to rethink what we're doing. As a geologist, we're out there looking for those components. CanAlaska is heavily involved in looking for a large uranium deposit and also now we've put under our belt about $12.5 million of prior work on some nickel projects in the Thompson Nickel Belt. That's the fifth-largest nickel belt in the world, and I think sulfide-nickel is going to be in tremendous demand for batteries. To me, it's all about looking for clean products

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a bit about your Premier strategic partners?

Mr. Peter Dasler: The Premier Property is the West McArthur property. That's the one that Cameco is drilling right now. We have probably a three-month period of drilling, and they will earn close to a 30% interest in the project at that stage. They have another $7.5 million to spend to get to a 60% earn-in on that project. We're in the eastern side of the Athabasca. We're very close to the infrastructure of Cameco’s main mine. We can drive to the project, and what we've drilled into so far looks like another one of these very large alteration systems associated with uranium. We have very high hopes for that.

One further project south of there, about 100 kilometers, 75 miles to the south, is our Cree East project, a similar project, where we worked with Korean corporations, Korean Electric Power, Korean Resource Corporation, and found similar targets. They will take time for us to raise money to drill, but they're sitting in the wings ready to do next, so two key projects, really, West McArthur, which is very active now, and Cree East, which can become very active as funding comes into the uranium market.

Dr. Allen Alper: That sounds great. What are the primary reasons our high-net-worth readers/investors should consider investing in CanAlaska Uranium?

Mr. Peter Dasler: I think the prime reason is to make money. I don't think investors do anything other than that. The opportunity that we present is a very well structured company that has a tremendous opportunity for capital gain and growth. We've seen a company like NexGen, they had a similar situation, over the space of three years create well over $1 billion worth of wealth. We have an $8 million company at the moment, and we have Cameco aiming to make a discovery similar to NexGen's, and so I think there's tremendous opportunity for capital gain, but there's a are also tremendous long-term opportunities for the shareholders as we develop, not just this one property, but each of the other properties that are in our portfolio. We have copper, nickel, diamond, and uranium projects in this portfolio.

We believe in what we're doing. We have a good team. We have the attention of the majors, and our structure and cash position at the moment allows us to ride out a discovery here and make some good opportunities investors, who come in now.

Dr. Allen Alper: That sounds great. Those sound like very compelling reasons to consider investing in your company. Is there anything else you'd like to add, Peter?

Mr. Peter Dasler: All I should say is that the staff and management are very dedicated to what we're doing. We have seen tough times. I think we've come out on the other side of those tough times. We're seeing a tremendous opportunity right now. This is really what we sat down 14 years ago to do. The first two drill holes that were drilled by Cameco into this target last September have shown extremely high-grade uranium mineralization with the opportunity for a far greater system to be discovered over the next three to four months. We fully believe in what we're doing, and the company is ready to run with that.

Dr. Allen Alper: That sounds excellent.

http://www.canalaska.com/

Peter Dasler, President and CEO.

Tel: +1.604.688.3211 x318

Email: info@canalaska.com

|

|