Lepidico Ltd (ASX: LPD): Focused on Becoming a Fully Integrated Lithium Business from Mine through the Value Chain to Lithium Carbonate Production, Joe Walsh, Managing Director

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 10/28/2017

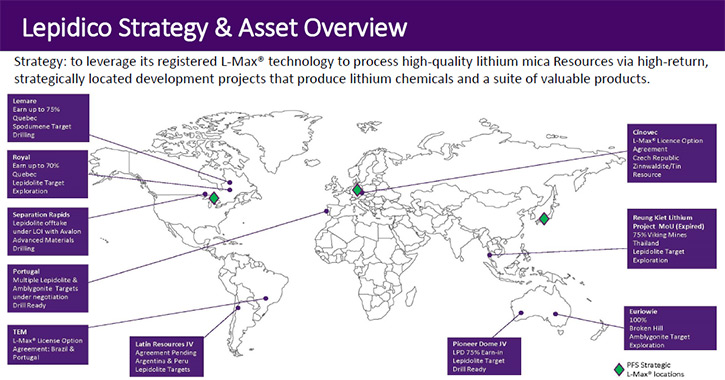

Lepidico Ltd (ASX: LPD) is focused on exploration, development and production of lithium. Lepidico owns the

technology to the L-Max® Process that has successfully produced lithium carbonate from non-conventional sources,

specifically lithium-rich mica minerals including lepidolite and zinnwaldite. Recently a major capital raising

has been taking place that includes a placement to Galaxy Resources Ltd, an A$1.5 billion capitalized lithium

producer. We learned from "Joe" Walsh, Managing Director of Lepidico, that they have a strategic objective to

become a fully integrated lithium business from mine through the value chain to lithium carbonate production by

the end of this decade. What differentiates Lepidico from its lithium peers is the fact that they are looking to

develop lithium mica deposits, which is a relatively uncontested space.

Lepidico Ltd. the L-Max® Process

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Mr. Julien "Joe"

Walsh, Managing Director of Lepidico. Could you give our readers/investors an overview of your company?

Mr. Joe Walsh: Sure. Thanks, Al. It’s good to talk with you. Lepidico is an ASX listed lithium

exploration and development company with market capitalization of around 56 million dollars. With our current

fund raising it will increase to about 65 million dollars. We have a strategic objective to become a fully

integrated lithium business from mine through the value chain to lithium carbonate production by the end of this

decade.

What differentiates Lepidico from its lithium peers is the fact that we are looking to develop lithium

mica deposits, rather than the incumbents, who are generally chasing either lithium brines or spodumene deposits.

The lithium mica space is relatively uncontested, as prior to the advent of our patent-registered

technology, L-Max, there wasn't a sustainable process capable of producing lithium chemicals from lithium micas.

So we have a strategic advantage in that regard, because the best quality lepidolite deposits, or lithium mica

deposits are effectively still in the ground.

On October 10th, we announced that we have secured a strategic alliance with Galaxy Resources. Galaxy Resources

Ltd, is an A$1.5 billion capitalized lithium miner and concentrate producer. Galaxy has agreed to subscribe $2.9

million for 12% private placement of Lepidico Shares. Lepidico has offered shareholders an opportunity to

participate on the same terms through a renounceable entitlement offer, offered on a one for six basis at $0.01

per share, to raise up to approximately $4 million. The total gross proceeds of up to $7.0 million will be used

to fund the Phase 1 L-Max® Feasibility Study through to final investment decision and further advance Lepidico’s

resource development and exploration activities.

Dr. Allen Alper: That sounds excellent. Could you tell us a bit more about those deposits?

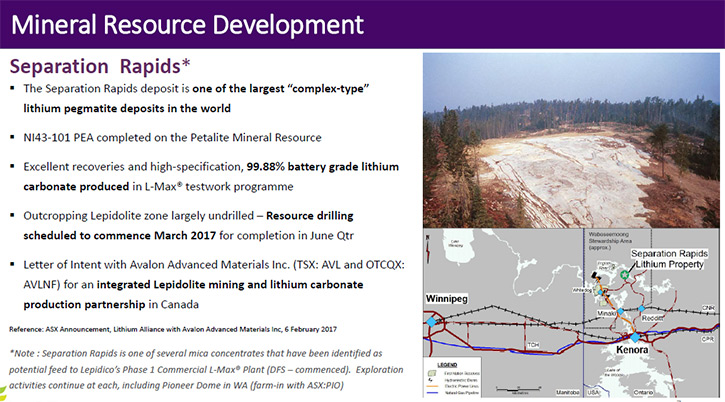

Mr. Joe Walsh: We currently have arrangements with four companies over lithium mica deposits. One of

those is in Canada, with a company called Avalon Advanced Materials, which owns the Separation Rapids deposit in

northwest Ontario. They've completed a preliminary economic analysis on Separation Rapids for a petalite project,

However, that didn't contemplate the potential of the lithium micas that are also contained within the deposit.

Avalon is now reevaluating its mineral resource to include the lithium micas, and it appears that a

material component of that resource is mineralized with lithium micas. It's planned that Avalon will produce

lithium mica concentrate from Separation Rapids and that will then be transported to what we call our Phase 1 L-

Max plant, which is planned to be built in eastern Canada, somewhere along the trans-Canada rail, where we have

access to sulfuric acid.

The other deposits, to which we have exposure, are at the Alvarrões lepidolite mine in Portugal, which is owned

by a Portuguese private company called Grupo Mota. They've been mining there since 1992 and are currently

supplying lepidolite concentrate to the ceramic industry, in small quantities of about 20,000 tons a year. We

just completed the first drilling program at Alvarrões and we're on schedule to have a resource there this

quarter.

The arrangement with Grupo Mota envisages that Lepidico will concentrate ore from the mine and export

that lithium mica concentrate to the Phase 1 Plant here in Canada.

We also have two exploration projects in Western Australia, which are based on earn-in arrangements with

two separate ASX listed exploration companies.

Dr. Allen Alper: That sounds excellent. By the way, I've interviewed Don Bubar from Avalon for many years.

I've worked closely with him.

Mr. Joe Walsh: That's very good.

Dr. Allen Alper: He's a great guy, Don. I'm sure that will work very well for both of you. Could you tell

us a bit about your background and your team?

Mr. Joe Walsh: Yes, certainly. I'm a mining engineer by training. I studied at Camborne School of Mines

in the UK and then did a Master's degree in geophysics. I spent approximately ten years working in industry,

followed by a similar length of time working in the financial services sector as a mining analyst, largely with

the Royal Bank of Canada and affiliated companies. Then I moved back into industry as General Manager of

Corporate Development with an Australian copper and gold company called PanAust. PanAust developed three mines in

Northern Laos, and from fairly humble beginnings, with a market cap of around 30 million dollars, became an ASX

100 copper-gold producer, with a market cap of around two and a half billion dollars. It was a fantastic journey

to be on and was a great story to be a part of. I left PanAust last year to become Managing Director of Lepidico.

As far as the team is concerned, our chairman is Gary Johnson, who is a metallurgist and has an enviable track

record in developing new process technologies. He was the architect behind the Activox process, which was

commercialized for the production of nickel, at the Tati nickel mine. Gary is also Chairman of a private

metallurgical business called Strategic Metallurgy, which developed the process technology that Lepidico now

owns, called L-Max.

Two other directors are Mark Rodda, who is non-executive Director with a legal background. He has a

number of directorships, but when he was working in industry, he was also General Counsel for LionOre Australia.

Tom Dukovcic is our Exploration Director. He is an executive with extensive experience in exploration and

looks after all Lepidico’s geology interests.

We then have Shontel Norgate, our Chief Financial Officer. Shontel joined us in November last year after

working with Nautilus Minerals for approximately a decade, where she was also CFO. Before that Shontel worked for

ASX listed coal producer McArthur Coal. Shontel has fantastic experience with both TSX and ASX listed companies

and also companies right at the sharp end of developing new technologies in the mineral sector.

Dr. Allen Alper: Sounds like you have an excellent background and a very strong team. That's great.

Mr. Joe Walsh: Absolutely. I'm very pleased with the team that we've assembled. It's a team of high

caliber individuals. We have a small board, but one with excellent experience. As we develop the company and

deliver on our strategy, I expect both the executive team and the board will need to be expanded.

Dr. Allen Alper: Sounds great. Could you tell our readers/investors a bit about the technology that you

have developed extracting lithium from lepidolite?

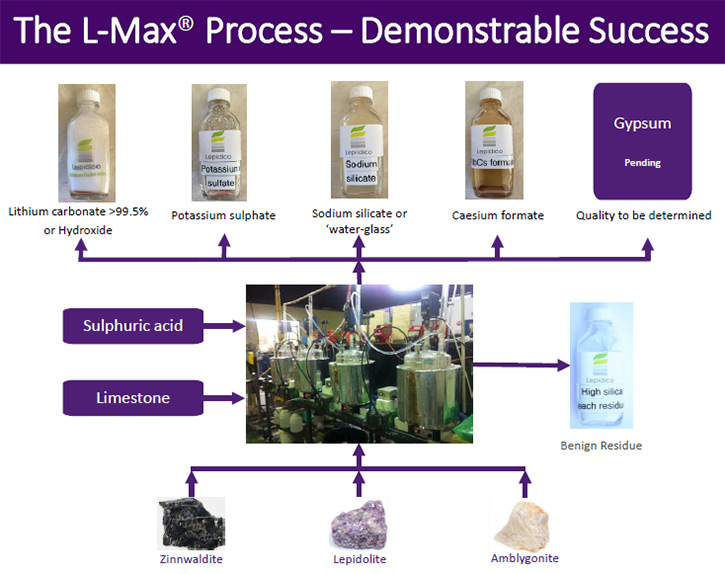

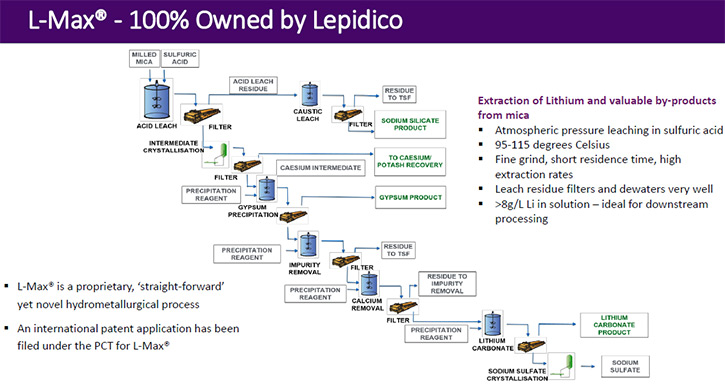

Mr. Joe Walsh: Sure, Al. The technology is called L-Max. It's a patent-registered process. The patent

process commenced with an application in Australia a couple of years ago. The Australian Patent Office declared

that the process was novel, inventive, industry applicable and patentable.

I believe it's a very elegant process. It uses industry standard reagents, in the form of sulfuric acid and

limestone, as the two main ones. Also, it employs industry-standard equipment.

The process feed is a lithium mica concentrate. The first part of the process is a saturation sulfuric

acid leach, which takes the elements of interest into solution and leaves a residue, which is rich in amorphous

silicate, which represents an important byproduct.

The pH of the leach liquor is initially low, it's about 2. Limestone is then progressively added to raise

the pH to specific pH ranges to then precipitate out various elements. Some of these elements are impurities.

However, at a number of those precipitation stages, we also produce other valuable byproducts.

The final product is then lithium carbonate that we clean up with a re-precipitation stage.

Dr. Allen Alper: That sounds very good. Is that technology patented?

Mr. Joe Walsh: Yes it is. The first patent application was lodged in Australia several years ago. We are

now in the international patent phase with applications lodged in about 12 different regions. I expect that we'll

be going through that part of the process for the next couple of years. Through the patent application process we

have secured priority with regard to our technology, versus any other applications that might try to be made for

similar technologies.

Dr. Allen Alper: That sounds very good. Could you tell me what your plans are for the remainder of 2017,

going into 2018?

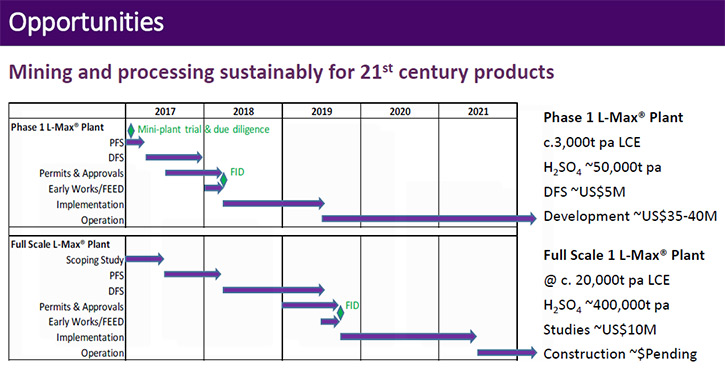

Mr. Joe Walsh: Absolutely. We completed the pre-feasibility study in February of this year. After

raising some additional capital, we committed to a full feasibility study in May. That feasibility study is

ongoing. A major component of that study is the engineering package, which is being undertaken by an Australian

company called Lycopodium, which also has a presence in Ontario, Canada. That engineering is on schedule for

completion at the end of 2017.

The critical path items for the feasibility study, however, are likely to be the permitting and approvals

phase and off-take arrangements, which we expect should be concluded around the middle of 2018. We're looking for

a final investment decision probably in the third quarter of 2018. Assuming that we achieve that objective, we

expect a 15 month build for our Phase 1 Plant, for first production in late 2019. That plant is planned to be

built at a location in the Great Lakes region of Canada.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors why lithium is so important

and what's happening with the lithium ion batteries and what the forecast is? Give them a general overview.

Mr. Joe Walsh: Certainly, Al. Lithium is one element that is an essential component of batteries used

for electric vehicles and home storage units. These are the largest areas of growth for lithium battery usage.

There are a variety of different chemistries used in lithium ion batteries, but the common element across all of

them is lithium, which is predominantly used in the cathode. Similar quantities tend to be used across all of

those battery technologies. Around 10 or 11 percent of the mass of the battery is lithium.

Given the projected increase in demand for electric vehicles and for electric storage, the demand for

lithium is expected to increase from currently around 200,000 tons a year to possibly as much as a million tons a

year by 2026. Those numbers are from a recognized commodity commentator out of the U.K called Roskill.

Dr. Allen Alper: That sounds excellent. Sounds like it's a growing and very important market and one that

needs huge quantities of lithium and it's also a green technology. That's excellent. Could you tell me a little

bit more about your capital structure and your key investors?

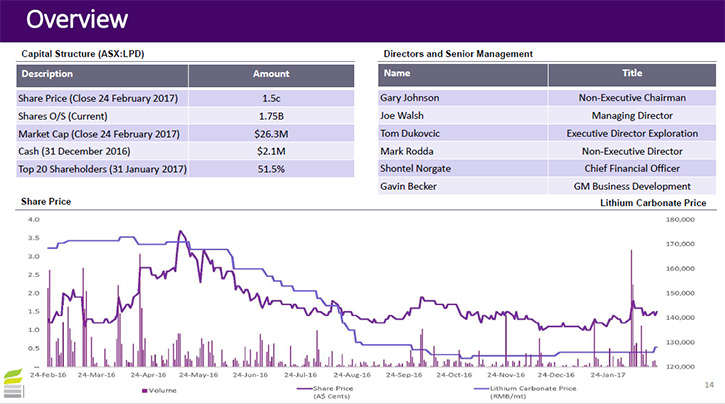

Mr. Joe Walsh: Certainly. As I mentioned, we're listed on the Australian Securities Exchange, our ticker

is LPD. We have just over 2.4 billion shares on issue. Currently, our shares are trading between 2 and 3 cents

per share. Our major shareholders are Strategic Metallurgy, which is the metallurgical consulting business owned

by our chairman Gary Johnson and Galaxy Resources, the ASX listed lithium mining company.

Importantly, a couple of months ago, Lycopodium, who's the engineering firm conducting the engineering

package for our feasibility study, took shares in lieu of payment for that body of work, which is a real

endorsement of our company and its strategy.

Aside from that, our register is reasonably open.

Dr. Allen Alper: That sounds very good. What are the primary reasons our high-net-worth readers/investors

should consider investing in Lepidico?

Mr. Joe Walsh: Lithium, our underlying commodity has extremely compelling supply-demand fundamentals,

which are supportive of the higher prices that are currently prevailing. While there are a good number of lithium

companies in the market that the investor can choose from, Lepidico is differentiated. We are looking for

minerals, the lithium micas, where we're almost uncontested. We have the patent-registered process to be able to

treat those minerals, and unless you have an L-Max license, they're not a viable proposition for most other

lithium companies.

There's never been systematic exploration for lithium micas previously because there hasn't been a

process to treat them. I think we do have, in that regard, something of a blue ocean strategy here, where, as I

mentioned we're largely uncontested.

Furthermore, Lepidico plans to go all the way from mine to lithium chemical production. We also produce

byproducts, which diversify revenue risk and also mean that we should be a relatively low-cost producer when you

look at the cost curve on a net-of byproducts basis.

Dr. Allen Alper: That sounds excellent. Joe, is there anything else you'd like to mention?

Mr. Joe Walsh: The only other thing is that we have a very dedicated team of professionals that are

committed to delivering on Lepidico's strategy. We plan to build our first plant in Eastern Canada, this is where

we'll be employing most of our people and spending most of our money. I relocated to Canada in the middle of this

year and our CFO is looking to relocate next year. We've built a base in Toronto and this is where we're looking

to build our team.

Dr. Allen Alper: It sounds like your company is very well-positioned to take advantage of what's happening

in the lithium space. It's being driven by a demand for electric vehicles and also for electric storage. I'm very

impressed with what you all are doing.

Mr. Joe Walsh: Thank you very much for that, Al. I agree with you, I think that we are very well-

positioned and we look forward to delivering on our strategy for the benefit of all of our shareholders.

Dr. Allen Alper: That sounds great.

http://www.lepidico.com/

Joe Walsh

Managing Director

Lepidico Ltd

+61 (0) 417 928 590

|

|