Azarga Uranium Corp. (TSX: AZZ): A Uranium Developer Progressing the High Grade Dewey Burdock ISR Uranium Project in South Dakota; Interview with Blake Steele, President and CFO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 4/23/2017

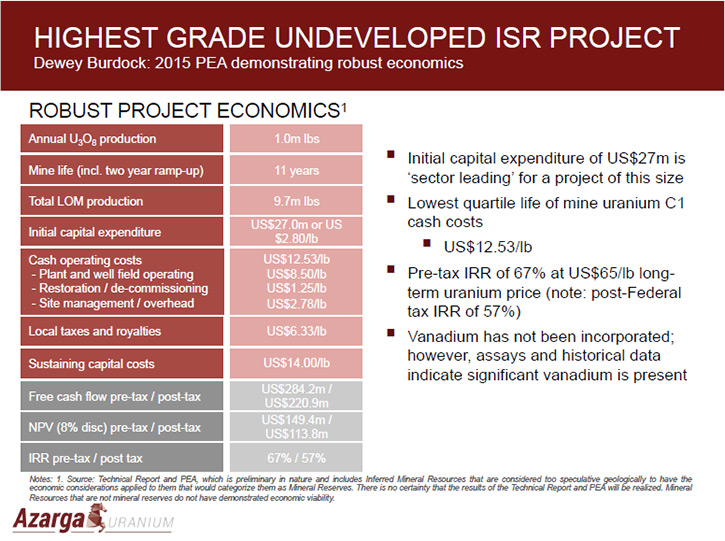

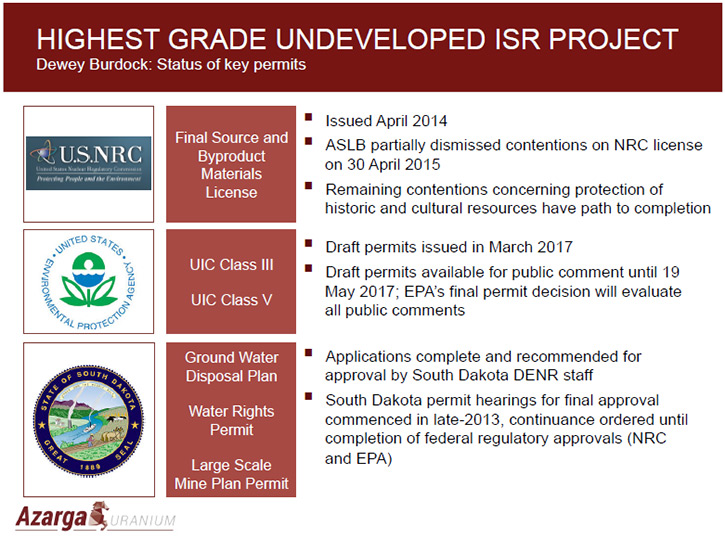

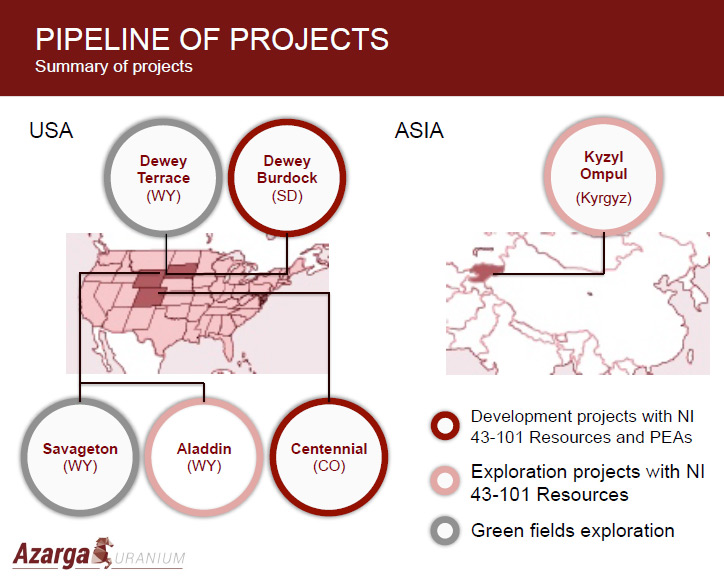

Azarga Uranium Corp. (TSX:AZZ) is a mineral development company that controls six uranium projects, deposits and prospects in the United States of America (South Dakota, Wyoming and Colorado) and the Kyrgyz Republic. We learned from Blake Steele, President and CFO of Azarga, that their flagship project, the high-grade, in-situ recovery, Dewey Burdock Uranium Project in South Dakota, recently received its draft class III and class V underground injection control permits (UIC) from the Environmental Protection Agency, moving the project closer to production. According to Mr. Steele, the initial capital expenditure of US$27 million makes Dewey Burdock "sector leading", among projects of this size. It also has lowest quartile life of mine uranium C1 cash costs. Plans for 2017 include finalizing regulatory permit approvals, while at the same time focusing on other business initiatives such as financing and off-take partners.

PDAC 2017: Blake Steele, President and CFO of Azarga Uranium

Dr. Allen Alper: This is Dr. Allen Alper, Editor-In-Chief of Metals News, interviewing Blake Steele, President and CFO of Azarga Uranium. Blake, could you give our readers/investors an overview of your company?

Blake Steele: Sure, not a problem Allen, thank you. Azarga Uranium controls five uranium projects in the United States and one in the Kyrgyz Republic. Azarga’s flagship asset is the Dewey Burdock project in the United States, specifically in South Dakota. It's an in-situ recovery project, with an 11-year life of mine. It's the highest grade amongst its peer group. Its initial capital expenditure of US$27 million, to bring it into production, is sector leading for a project of this size. It has the lowest quartile life of mine uranium C1 cash costs, US$12.53/lb.

Dr. Allen Alper: That sounds great! I heard you have some good news?

Blake Steele: Yes, we recently received some exciting news! We received our draft EPA permits for our class III and class V UIC wells. The original permit applications were made as early as December 2008. So it was almost nine years in coming. It's a very significant milestone for our business. We can now move beyond that as a company and focus on moving the asset into production and securing project financing, uranium off-takes, etc. So it's an exciting time for our business.

Dr. Allen Alper: That's great! Could you tell our readers/investors what your plans are for 2017?

Blake Steele: Taking a step back, there are two key federal permits in the United States that are required to move the Dewey Burdock project into production. The Nuclear Regulatory Commission license, which we received in 2014 and the class III and class V UIC EPA permits, for which we recently received the draft permits. A public comment period will last until the middle of May with respect to the draft EPA permits. At that point, the EPA will digest the comments and determine whether there are any changes that need to be made to the final permits. We'll be working through that over the coming months. From a state permitting perspective, all of the material permits have been recommended for approval by the South Dakota Department of Environment and Natural Resources staff. They commenced the hearing process for the final state permits, but decided to put the hearing process on hold until the federal bodies, namely the EPA and the NRC, make their decisions on the permitting front.

Thus, these draft EPA permits represent a significant milestone and provide us with the opportunity to start moving forward and focusing on project financing and uranium off-take agreements. We want to continue to finalize and work through that permitting process, but at the same time continue to develop the business on other fronts.

Dr. Allen Alper: That sounds very good. Could you tell me a bit about your background, the team and the board?

Blake Steele: Absolutely. I started my career at Deloitte in Vancouver. After a few years in the auditing department, I shifted into the financial advisory group and primarily focused on the mining sector. From there I joined SouthGobi Resources, which at that time was part of the Ivanhoe Mines Group. After SouthGobi was successfully financed and listed on the Hong Kong Stock Exchange, I moved to Hong Kong to help expand the business. That's how I ended up in Hong Kong and met a lot of the business partners I'm working with today. I'm thankful for the opportunities that I was provided in the Ivanhoe Mines Group. You really learn the entrepreneurial lifestyle of the modern business in that group of companies. That's how we operate Azarga.

Dick Clement, Chairman of our board, has over 35 years’ experience in the industry. Formerly, head of Exxon-Mobil's uranium division for Australia, he's been with the company for over 10 years now. He’s a very valuable resource. John Mays, Chief Operating Officer, has formerly worked for companies such as Cameco and Uranium One. He's worked at operating ISR operations in both the United States and Kazakhstan. We have very capable operators that form part of the management team. For us it's a good balance, and we have the ability to move this project forward internally.

Dr. Allen Alper: Sounds excellent! Could you tell me a bit about your finances and capital structure?

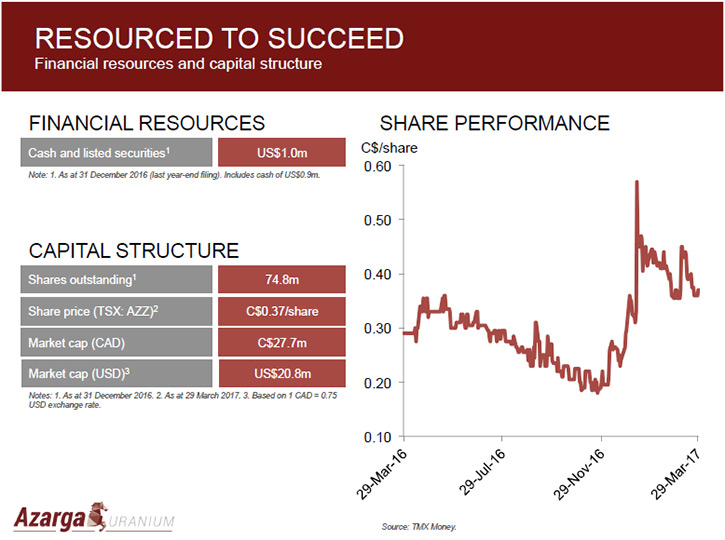

Blake Steele: We have approximately 75 million shares outstanding. In September 2016, we raised $2.2 million to finance the business through this EPA permitting process. Thankfully, that has worked out for us to this point. As a result of that financing, we have about four million warrants outstanding at $0.35. There's also approximately 4 million stock options outstanding. So the fully diluted position - you have approximately 75 million shares, 4 million warrants and 4 million stock options outstanding.

Dr. Allen Alper: That's very good. What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

Blake Steele: I think the economics, of the Dewey Burdock Project, speak for themselves and set us apart from other companies in the sector. Our project has forecast C1 cash costs of US$12.53, which is easily in the lowest quartile. The project has a 67% IRR at a US$65 price, the long-term price forecast by analysts. Further, receiving the draft class III and class V EPA permits is a significant milestone for our business and moves us closer to production.

Dr. Allen Alper: That's not too bad.

Blake Steele: Yeah, that's pretty attractive. I think when considering the operating cost profile and the US$27 million of capex required for initial production, it's not a very big hurdle for potential project financing to come in and take on. It's truly the economics of the deposit that sets us apart. The insider ownership is also important. If you look at our shareholder structure, insiders, inclusive of management and directors, form a core group of shareholders that have been with this business for a long time and are very supportive. I think this also sets us apart from other development stage companies in the industry. We're highly motivated to make sure we get this project advanced without substantially diluting our shareholder base.

Dr. Allen Alper: Is there anything else you'd like to add?

Blake Steele: Looking at our pipeline of projects, in addition to the Dewey Burdock project in South Dakota, we have another development stage asset, the Centennial project in Colorado, which has a preliminary economic assessment completed. The pre-tax NPV of that project is in excess of US$50 million, meaning that our combined pre-tax NPV on Dewey Burdock and Centennial is north of US$200 million. Our market cap today is approximately C$30 million, so there's definitely some room for growth to realize the value in those projects. Beyond that, we have a nice pipeline of projects in Aladdin and Dewey Terrace. Dewey Terrace is right next door to Dewey Burdock, on the Wyoming side of the border, and Aladdin is approximately 80 miles northwest of Dewey Burdock in Wyoming. Those projects could potentially form nice satellite deposits to Dewey Burdock itself. We have an immediate, near-term development opportunity with Dewey Burdock, but we also have a project pipeline beyond that, which is important for the future growth of the business.

Dr. Allen Alper: Sounds great! What would you say is the long-term objective of your company?

Blake Steele: The long-term objective is to move through the final stages of the permitting process, as swiftly as possible, raise project financing, and commence construction. The other thing that's quite unique about our project is that once fully permitted and construction has commenced, initial production is forecast to occur after just one year. The one-year construction timetable to initial production, provides us with the ability to assess market conditions more readily and determine the right time to move forward, as opposed to having to commit to a multi-year development plan, a higher-risk decision that faces many conventional mines. Another differentiating factor from conventional mines, using Cameco as an example, if you look at the grades of their conventional projects in the Athabasca Basin and compare that to the grades of their in-situ recovery projects in Kazakhstan and the United States, the average grades of those projects in the Athabasca Basin is in excess of 150 times that of their in-situ recovery projects; however, the cash costs of their in-situ recovery projects are actually 10% lower than those of their conventional projects in the Athabasca Basin. I think a lot of people look at the grade of Uranium projects, not necessarily the mining methodology to be deployed. What's important about the Dewey Burdock project is the in-situ recoverability of that project and the low capex and cash costs because of the mining methodology that can be deployed.

Dr. Allen Alper: Sounds like that's a really important advance.

Blake Steele: Absolutely. Don't get me wrong, there are some great conventional assets out there in the Uranium sector, as well.

Dr. Allen Alper: But you're challenging them on costs.

Blake Steele: If you look at in-situ recovery projects versus conventional projects, they certainly don't have that massive capex hurdle that conventional projects need to overcome. There may be larger scale conventional projects, but if you look at the example of Cameco, their in-situ recovery projects have a lower cost despite the lower grade. That's simply because, for in-situ recovery projects, you're not moving materials, it's really a simple process. In-situ is a Latin term meaning “in place”. For in-situ recovery projects you drill well field patterns and inject a sodium bicarbonate solution that separates the Uranium from the sandstone hosted rock in a contained aquifer. The uranium bearing solution is then pumped back to the surface through recovery wells for processing. There's no removal of overburden and no construction of a mine shaft.

Dr. Allen Alper: That sounds great. It sounds like a very good project. You have a great team. You have a good area. You now have the right administration to back you up. You can move this project forward. Sounds great!

Blake Steele: Yes, I definitely think we've been able to make some advancements of late, both on the NRC, and on the EPA front, which are positives for our business. I believe 2017 is going to be a great year for Azarga.

Dr. Allen Alper: That's great! We’re excited for you!

Blake Steele: Thank you very much.

Dr. Allen Alper: What does the uranium market look like?

Blake Steele: Of late, there have been some strategic, fundamental shifts that have occurred. You can look at Kazatomprom’s decision to reduce production by 10%, which equates to approximately 3% of global supply. After pursuing a growth strategy for a number of years and building a 40% market share, they're shifting their strategic focus from increasing market share to value maximization. To support this structural shift, they have opened a marketing arm in Switzerland. I think that's an important strategic shift for the overall sector and should improve uranium prices.

Aside from what the Kazakh’s have done, you really have Cameco. They've suspended operations at Rabbit Lake. They've announced working holidays at Cigar Lake and MacArthur River in 2017. I think there's supply pressure coupled with the demand-side pressure coming out of China. The Chinese recently announced that they are going to be completing five additional reactors this year and commencing construction on another eight. So I think we're starting to get to a point in the industry, where the supply-demand equilibrium, that inflection point, is going to happen. Rob Chang at Cantor Fitzgerald believes that a violent increase in the price of uranium is coming. I tend to agree with him on that.

Dr. Allen Alper: Excellent! I appreciate your insights and sharing them with our readers/investors.

http://azargauranium.com/

Investor Relations Team

Email: info@azargauranium.com

Corporate Office

Suite #140 – 5575 DTC Parkway

Greenwood Village, Colorado

USA 80111

Phone: 303 790 7528

|

|