Dr. Allen Alper Interviews Mr. Robin Goad, President and CEO of Fortune Minerals: Focused on Advancing their NICO Gold-Cobalt-Bismuth-Copper Project in the Northwest Territories

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 6/5/2016

Fortune Minerals Limited (TSX (Canada): FT | OTC QX (USA): FTMDF) is a North American mining company

focused on advancing their NICO gold-cobalt-bismuth-copper project in the Northwest Territories, Canada.

Recently, Dave Ramsay, former Cabinet Minister with the Government of the Northwest Territories, joined

their board bringing in his important political experience and business background. According to Mr.

Robin Goad, President and CEO of Fortune Minerals, their metals are well positioned for recovery, and the

products that they are going to produce have very significant demand growth right now. Currently, the

company is concentrating essentially on a project financing and talking to potential offtake

partners.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking

with Robin Goad, who is President and CEO of Fortune Minerals. That's exciting news, that you have such a

great new board member. Could you tell us about Mr. Ramsay joining your board, also what Fortune Minerals

is doing in cobalt, bismuth, copper and gold development?

Mr. Robin Goad: Sure. We can start with the lead item, which was Dave Ramsay joining our board.

Dave is a former Cabinet Minister with the Government of the Northwest Territories. Most notably, his

last Cabinet position was Minister of Industry, Tourism and Investment, which includes the Mining

Portfolio. Mining is responsible for about 50% of the private sector GDP of the Northwest Territories. A

very important component of the Northwest Territories' economy and he was also Minister of

Transportation. While in Cabinet, Dave was also President of the Northwest Pacific, a regional economic

collaboration of Canadian Provinces and U.S. states in the northwest part of the continent.

Dr. Allen Alper: That's excellent.

Mr. Robin Goad: Dave is an important contribution to our board, not only for his political

experience, but he also has a strong business background, as well as his experience in municipal

politics. We are also in a dialogue with 3 levels of government on infrastructure very important to our

project, including an all-weather road, which is now being permitted by the Government of the Northwest

Territories and important new power generation projects to add to the electrical grid that we hope to be

able to tie into for our mineral development in the Northwest Territories.

Dr. Allen Alper: That would be great.

Mr. Robin Goad: We're only 22 kilometers from 4 hydroelectric dams. There's insufficient surplus

power now, but it can be quickly dealt with by the conversion of a diesel plant in Yellowknife to natural

gas that is connected to the same grid. There's also an opportunity for a hydro expansion just a little

bit to the south of our project. Having somebody with good political connections on our board will be

very helpful.

Dr. Allen Alper: That's excellent. Could you tell me a little bit about your project and plans,

and why cobalt is so important?

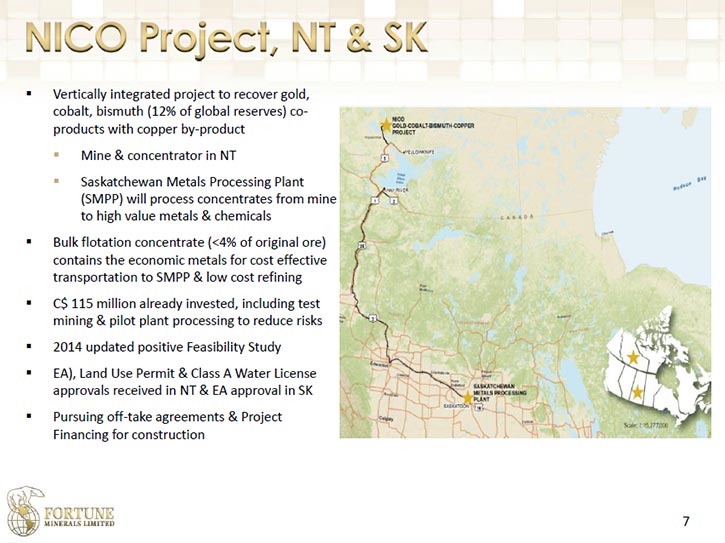

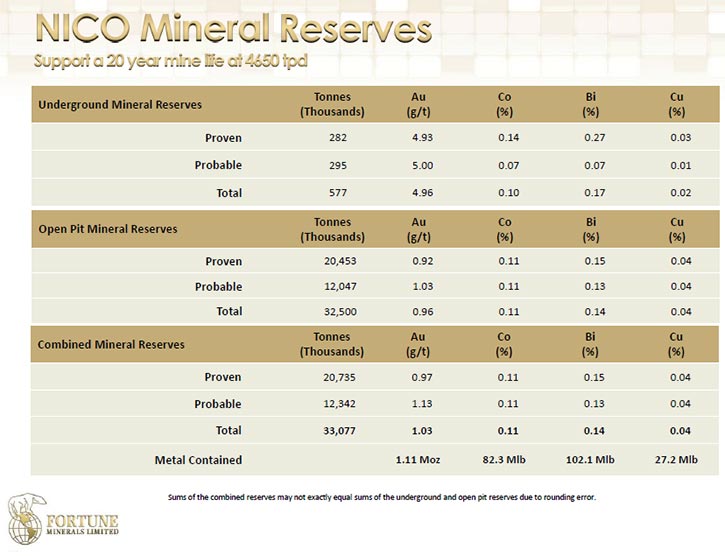

Mr. Robin Goad: Sure. The NICO Project is a deposit containing a little over 1.1 million ounces

of gold in the proven and probable reserve categories. We also have about 82 million pounds of cobalt,

102 million pounds of bismuth, and 27 million pounds of copper in a 33 million tonne open pit and

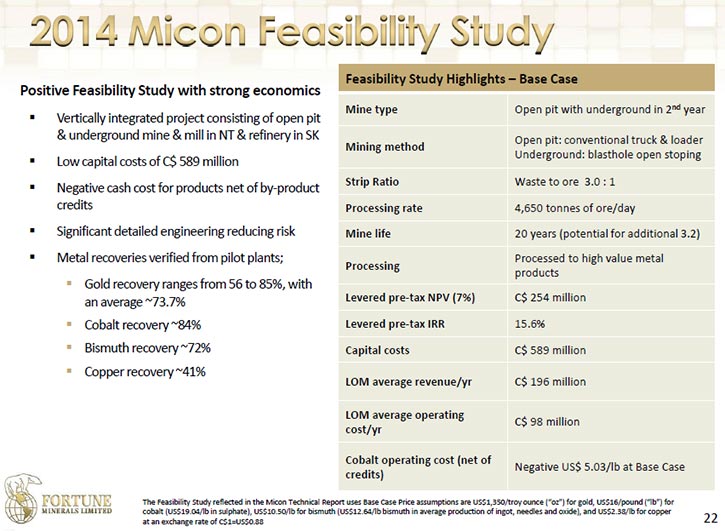

underground reserve. The project has been assessed in a positive, bankable feasibility study, and it has

received its environmental assessment approvals for the 2 locations. One being the mine and concentrator

in the Northwest Territories. NICO is a proposed vertically integrated project, and will also have a

refinery in Saskatoon where we will take concentrates from the mine and process them to produce value-

added products. The most important product that we're going to produce is a cobalt-sulfate heptahydrate,

which is a material needed to manufacture lithium ion batteries.

In fact, approximately 70% of all lithium ion batteries require significant amounts of cobalt, ranging

anywhere from 9% to 60% of the battery by weight, depending on the cathode chemistry used. Cobalt is an

essential metal that has a variety of applications, but batteries have been responsible for most of the

growth over the past two decades. In 2015 battery demand for cobalt increased by about 12%. That's for a

metal that had a compound annual growth rate of 6% over the last 2 decades. Batteries were responsible

for 1% of a much smaller demand for cobalt in the 1990s but have grown to 50% of the market today, which

is now about 110,000 tonnes. What's also very important about the cobalt market is that about 65% of mine

production comes from the Congo, a politically unstable country that is also restricting exports of

unprocessed concentrates and partially processed intermediate products in order to encourage domestic

downstream processing.

This is not really possible because they don't have the infrastructure to support those kinds of

activities, as well, the Congo has been criticized, by in particular Amnesty International, for labor

practices including the use of child labor and unsafe working conditions. Many electronics companies

worldwide are members of an important organization called the Electronics Industry Citizens Coalition, or

EICC, which, among other things, promotes sustainable sourcing of raw materials. That includes,

precluding or discouraging the use of child labor, gender inequality, and poor environmental practices

highlighted as practices which the electronics industry is trying not to source materials from. Having a

new reliable Canadian source of supply of cobalt is very important.

Dr. Allen Alper: That sounds excellent. It's a critical element. I have a background in cobalt

myself; I worked for Siemen’s. They owned a company called OSRAM, and OSRAM had a facility in the US that

I ran. It was primarily a tungsten facility that was the world's largest tungsten powder, tungsten

carbide facility. We also made extra fine cobalt metal powder that was used with the cemented carbide

industry as a binding material for the tungsten carbide to make cutting tools and mining tools. I ran the

manufacturing and the whole business, it was an international business. I'm very interested in cobalt, it

has a warm spot in my heart. I like the idea that not only are you going to be a miner, but you will also

produce value added products. I think that's very smart and the right thing to do.

Mr. Robin Goad: That's very interesting to hear about your background. Actually, the plant that

we plan to build in Saskatoon will not only be positioned to process our materials to value add products,

but also to be able to be a custom processor of concentrates from other projects that have complex ores.

We also envision an expansion of the plant in the future to diversify into the metals recycling business,

which we think is a particularly attractive long-term business opportunity for the refinery.

Dr. Allen Alper: I recovered my cobalt from recycling the carbide with cobalt binders. We would

put it through a chemical process and then finally we would reduce it and form an extra fine cobalt

powder, which was a premium powder.

Mr. Robin Goad: Many companies and governments are trying to avoid conflict minerals as well.

Cobalt technically is not a conflict mineral because it's produced primarily in the southern part of the

Congo, it certainly has some supply risks. Those risks were recently highlighted in the Assessment of

Critical Minerals report to the US Congress. It identified cobalt as a critical mineral on a list of

those that have “a supply chain that is vulnerable to disruption, and that serve an essential function in

the manufacture of a product, the absence of which would cause significant economic or security

consequences.” Cobalt, again, is used in batteries, and as you point out, in cemented carbides. It's also

used in super alloys for the aerospace industry, for jet engine turbines. It's used as a pigment, a

source of Vitamin B12, and it has some agricultural and food additive applications.

As a catalyst, cobalt is used in petroleum refining to remove sulfur and other impurities. It is

also used in bonding steel belts to radial tires, as well as in adhesives and PET, which is essentially

pop bottles, or plastic that's made from a cobalt catalyst. Cobalt has very diverse applications, but

batteries are driving demand growth and creating a lot of excitement. Attention is focused on Tesla’s $5

billion lithium-ion battery plant in Nevada. Market estimates note that they will require between 5,000

and 10,000 tonnes annually of cobalt material, essentially cobalt sulphate, like we’re going to produce,

to be able to make the cathodes in their batteries. Tesla’s first battery plant will produce more

lithium-ion batteries when it reaches full capacity than were manufactured globally in 2013.

Over 10 other lithium ion mega-factories are also under construction or in the pipeline by

companies such as Foxconn, BASF, LG Chem, and Panasonic. We think the excitement in the cobalt market

will continue to accelerate as an understanding of the situation develops. CRU and Roskill had both

already anticipated a supply deficit in 2016, but we have since seen an additional 6,500 tonnes of

cobalt production come off the market with the closure of the Katanga mine in the DRC, Mopani in Zambia,

Queensland Nickel in Australia and Votorantim in Brazil, as a consequence of weak copper and nickel

prices. Our project will have supply chain transparency right from ores through to the production of

cobalt sulphate products for the battery industry, and we'll be that vertically integrated reliable North

American supplier, while also producing significant gold and bismuth.

There is also more than 1.1 million ounces of gold in the NICO deposit as well as 12% of global bismuth

reserves.

Dr. Allen Alper: That's excellent. Could you tell me a bit more about your deposit, and your plans

going forward?

Mr. Robin Goad: The NICO project has had more than $115 million of investment to date, so it's a

very advanced project that we discovered in 1996. It's classified as an IOCG, or Olympic Dam-style

deposit, and most of these are typically very large, Olympic Dam being many billions of tonnes. We feel

that in addition to the upside opportunity in cobalt, gold and bismuth, you've also got the significant

exploration upside from this project because there are massive geophysical anomalies associated with our

deposit. Most of the other deposits in this class are typically much larger than our 33 million tonne

deposit. We still have a 21-year mine life, and as I mentioned, a positive feasibility study, which shows

about a $250 million net present value, at what we feel to be conservative metal prices. We also have

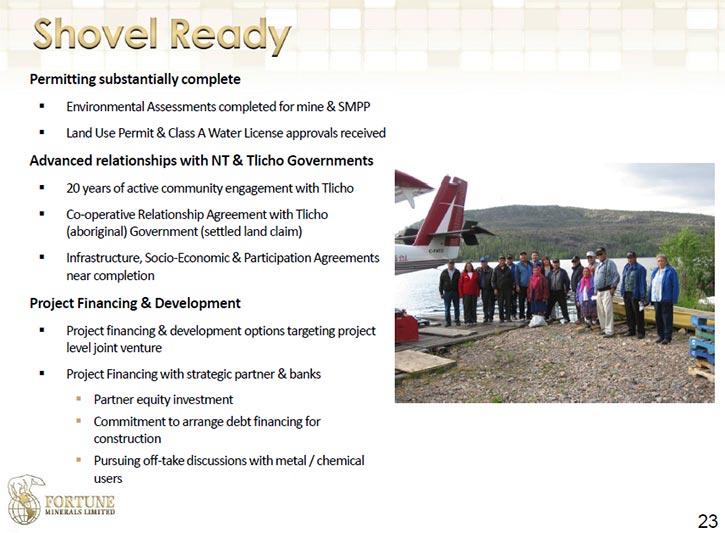

environmental assessment approvals in both the Northwest Territories and Saskatchewan.

One of the most important economic attributes of our project is a very high concentration ratio. We

process ores at the rate of 4,650 tonnes per day, and convert that to only 180 tonnes of concentrate

containing all the valuable metal. That allows us to take that concentrate and cost-effectively transport

it down to a lower cost jurisdiction for the processing, which we will do in Saskatchewan. We've also

negotiated a 5-year tax holiday with the Saskatchewan government, and by conducting the processing there,

have mitigated our risk to staff turnover by having the more complex downstream processing being done in

an environment where we can get skilled labor, engineers and metallurgists, as well as access to low cost

power and proximity to reagents for processing. This project, initially discovered in 1996, has gone

through feasibility studies, test mining, pilot plant processing, Front- End Engineering & Design, and

now what we're essentially trying to accomplish is securing the project financing.

About US$450 million is required to develop both sites, the mine and concentrator in the

Northwest Territories and the refinery in Saskatchewan. That's what our objective is right now, securing

the project financing.

Dr. Allen Alper: What kind of funding are you looking for?

Mr. Robin Goad: We're concentrating essentially on a project financing that would include project

level equity as well as debt, and yes indeed, we are talking to companies about potential offtake. Those

include battery companies, including those that make the cathodes in the batteries. We are also talking

to cobalt traders, and companies that make other products out of cobalt principally. I can't disclose any

identities of these companies because we have signed confidentiality agreements. Project financing

discussions are also being held with Engineering Procurement & Construction (EPC) companies with

financing backed by large engineering firms –

Dr. Allen Alper: That sounds like an excellent approach. It’s been a very tough time for the

mining area for the last 5 years. It looks like things are beginning to turn, and with Tesla and the

batteries coming on so strong, it looks like your timing is right. What are your thoughts on that?

Mr. Robin Goad: You're absolutely correct, because historically, we've been developing this

project and advancing it for quite some time. There were always people saying, "Well, there's more cobalt

in the Congo than we need," or that laterite projects are going to be able to produce so much of this

product there will be no need for projects like NICO. Primarily because of the batteries, people are

starting to recognize that there just isn't enough readily available cobalt to service the growth in

demand. New deposits are going to be required. As we mentioned, Tesla alone will require between 5,000

and 10,000 tonnes of cobalt contained in sulfate for their first plant. We're only going to produce 1615

tonnes, about 1% of the total market that is growing at 6% per year. Every year you're going to need an

approximately 6,000 tonne new producer just to be able to sustain the current growth in the demand for

cobalt.

Dr. Allen Alper: That sounds excellent. You’re in the right location, and the market is growing.

It's good to be serving a growing market. It sounds like everything is coming together right now.

Mr. Robin Goad: It certainly is, and you're right. It has been a very difficult last few years.

We had a producing silver operation in Colorado last year which unfortunately we lost due to low metal

prices. That has created a fantastic buying opportunity, because we're trading at a market capitalization

of approximately C$30 million, which is grossly undervaluing $115 million worth of previous work, a $250

million NPV, or even if you just simply look at the gold content, proven and probable mining reserves

containing 1.1 million ounces of gold. In a normal market, most people would allocate a value of US$50 to

$75 per ounce of gold in the ground in reserve, which does not include the value of the cobalt or

bismuth reserves.

Dr. Allen Alper: It sounds like with the gold credits and the bismuth and the copper you should

have some rather competitive cobalt costs, mining costs and manufacturing costs. Is that correct?

Mr. Robin Goad: You are correct. In fact, net of byproduct credits for those products, we can

produce cobalt at a negative cash cost. That's on an operating cost basis, however. Really, the challenge

with developing mining assets these days is to have sufficient longevity and grade to be able to not only

pay for the capital but also to service its costs. On an operating cost basis, we have a negative cash

cost for any one of our metals net of by-product, meaning after credits for the other metals that had

been produced.

Dr. Allen Alper: That's great. I think that people, Investors, and bankers and venture

capitalists, seem to be coming back to the mining industry. I think your chances of putting a good

package together are very high now. I think once the market sees that, you'll see the price of your stock

changing quite a bit.

Mr. Robin Goad: The market is starting to recognize the opportunity. Our share price was

incredibly depressed in early January, but has since started to recover. I think it's got a lot more

horsepower yet to be recognized in the share price as money returns to the sector with the gold recovery

and outlook for cobalt in lithium ion batteries.

Dr. Allen Alper: Could you tell me a little bit about information about yourself and your team?

Mr. Robin Goad: Personally, I'm a geologist, geochemist. I have a Master's degree in geology and

geochemistry, but I have a little over 30 years of experience in the mining mineral development industry,

I've worked in operations as well as in the exploration and development industry. I've worked for large

companies like Noranda and Teck, and was responsible for the discovery of this deposit for Fortune in

1996. We have excellent people on the management team that have not only permitted and discovered mineral

deposits but have also operated them successfully. Our employee count is down to about 7 after last

year’s retrenchment but we will be able to rebuild the team if we secure the project financing.

We also have a good team of directors which was recently augmented with the appointment of Dave Ramsay,

the former Cabinet Minister of the Northwest Territories, our Chairman was the former Chief Financial

Officer and one of the founding directors of IamGold. We have other members of our board that have very

extensive pedigrees in mining as well as finance.

Dr. Allen Alper: That sounds like an excellent team, and a great board. That's very good. Could

you give me the main reasons why our readers/investors should invest in your company?

Mr. Robin Goad: I think we talked about the value gap between our market capitalization of $30

million versus the $250 million net present value, the previous expenditures of $115 million, as well as

the gold content in the deposit. There's also the opportunity of cobalt and particularly its use as an

energy metal in lithium ion batteries. Cobalt pricing has been very volatile in the past and the current

price is about $10 to $11 a pound for cobalt metal, but it has traded within a range up to $50 per pound

historically. When there is supply disruptions or significant demand increases, it has the potential to

react very positively. If we look at long-term average prices for cobalt it's typically around $20 per

pound, so we feel that there's tremendous upside in the deposit from the cobalt contained in the deposit.

China is the primary source of the world’s bismuth production,

accounting for about 80% of global production. China has been closing down small bismuth mines that are

not compliant with the environmental and labor standards and this is also a significant opportunity for

share price appreciation. Having a Canadian source of supply for that metal is going to be very

important. Bismuth is used extensively in the automotive and pharmaceutical industry, but is also

replacing lead because of lead-toxicity concerns in solders, brasses, aluminum, steels, particularly..

Drinking water sources actually ban the use of lead, as well as consumer products in the European Union.

We're very well positioned to be able to service that market as it develops.

With respect to the gold price, many people feel that the world has seen peak gold production and the

future price of gold is going to be much higher. I personally believe that the current gold price is too

low because a lot of the gold production is currently uneconomic. Mines are being high graded, taking out

the very best parts, while gold consumption continues to grow.

The mining industry and the resource sector seem positioned for recovery, and the products that

we will produce are seeing significant demand growth, which positions us extremely well for a much higher

share price.

Dr. Allen Alper: Those are all excellent reasons why our readers/investors should consider

investing in your company. Is there anything else that you'd like to add?

Mr. Robin Goad: I think it's just a highlight that capital is returning to the mining industry,

what has transpired in our sector over the last 5 years has created an incredible buying opportunity. You

can get good companies at extremely low prices right now. I think in part, the difficult conditions we've

had over the last number of years have culled some of the pretenders in our industry so that we have a

smaller pool of better quality companies to choose to invest in.

Dr. Allen Alper: I totally agree with that assessment. I think it is now an opportunity for

investors. It looks like banks and venture capitalists and institutions are ready to help with projects

that need capital to build plants and facilities.

Mr. Robin Goad: One thing I didn't mention is, our project is at a very important point in its

development cycle. Typically, when you invest in a mining project, there is appreciation associated with

discovery, and as you go through the more monotonous resource delineation, feasibility and permitting

processes, which can take quite a long time, investor interest tends to wane. Lower risk opportunities

are often available when the project is in the development phase and ready for construction. That's where

we are positioned right now. We have secured our environmental assessments, as soon as we have project

financing, we're constructing. That's often when significant value is unlocked for investors.

Dr. Allen Alper: That's very good, that's really excellent. You've done all the tough work, and

now you're ready to go. That's excellent.

http://www.fortuneminerals.com/

Head Office: Fortune Minerals Limited

148 Fullarton Street, Suite 1600

London, Ontario, Canada

N6A 5P3

T: (519) 858-8188

F: (519) 858-8155

E: info@fortuneminerals.com

|

|