Interview with Mark Brennan President and CEO Sierra Metals Inc. (TSX:SMT) (BVL: SMT): A Low-Cost Diversified Producer of Gold, Silver and Copper

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 5/26/2016

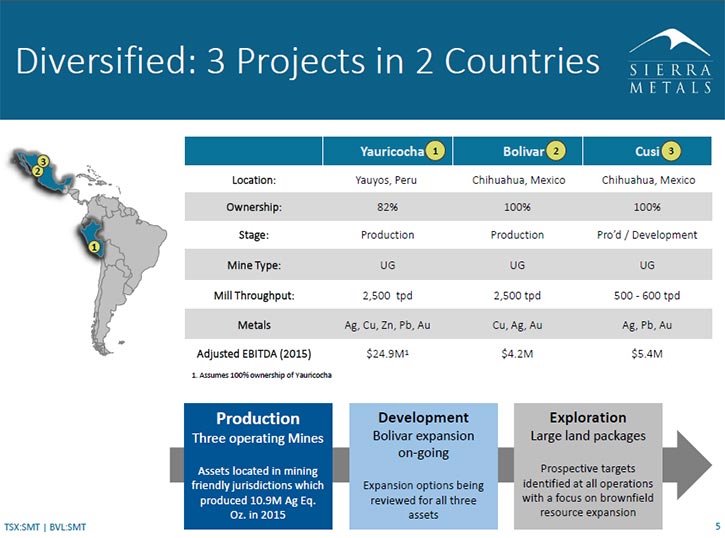

Sierra Metals Inc. (TSX: SMT) (BVL: SMT) is led by Mark Brennan President and CEO. He and his new management team have a proven successful track

record. The company has undergone restructuring that is increasing profits and cash flow. Sierra Metals is a low-cost diversified producer of gold,

silver and copper in Peru and Mexico. Sierra Metals has identified and is developing many opportunities for growth. The Esperanza Zone transformational

discovery has the thickest high grade intercepts in the 60 year history of the mine. Mark Brennan tells us they expect to increase production and grade

in 2016 across the board.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News,

Interviewing Mr. Mark Brennan, President and CEO of Sierra Metals Inc.

Mark could you tell me a little bit about what's happening? I know you just published your 1st quarter

results and it was a big improvement.

Mark Brennan: Yes, in the first quarter we were very, very pleased with the restructuring process, which we started in the third quarter of

last year, starting to kick in. The first quarter production was a good improvement from the fourth quarter. We expect the second quarter will be an

improvement upon the first. We think the real kick-in point will be in the third quarter as we complete much of the restructuring efforts and where

we'll start to see very good momentum building.

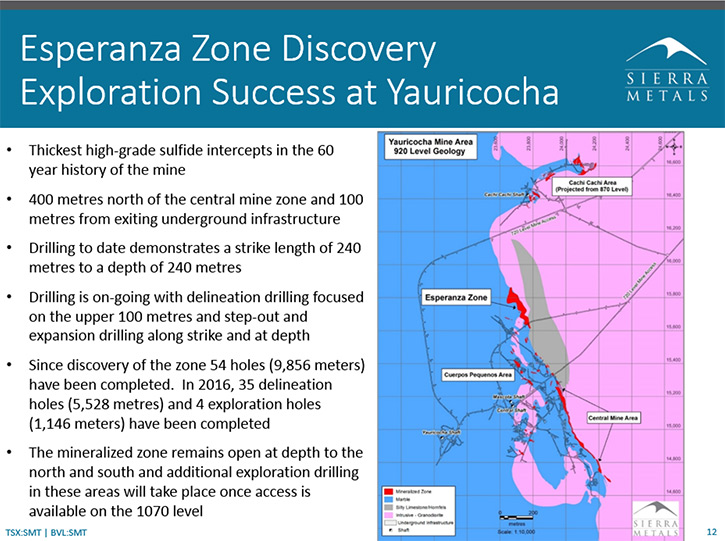

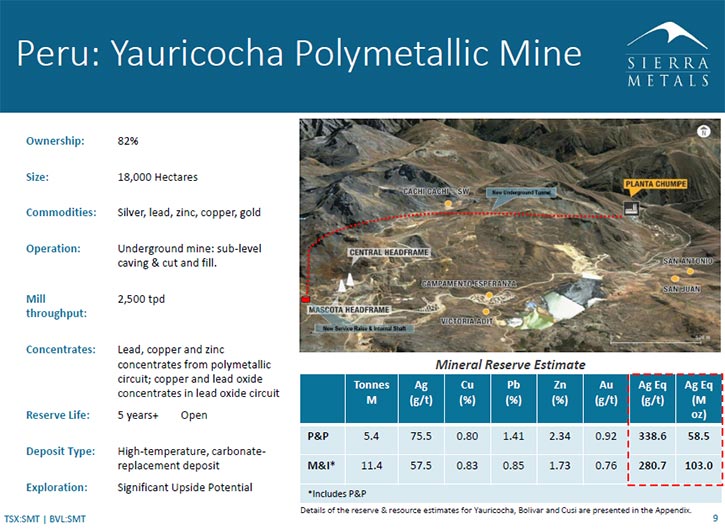

Dr. Allen Alper: I notice that you are exploring and developing and even going to be putting into production a newly discovered high grade

Esperanza Zone at the Yauricocha Project in Peru.

Mark Brennan: Yes, the Esperanza Zone discovery is truly exciting. Although we’ll see an improvement in terms of EBITDA and cash flows coming

from the restructuring, which will be good, however those improvements will be eclipsed by the transformational discovery that we have at Esperanza. In

January we announced an initial 15 holes with a strike length of at least 240 metres, successfully tested to a depth of 170 metres open along strike at

depth with potential average width of about 30 meters. With the additional four exploration holes completed in 2016 that were recently announced, we’ve

been able to extend the zone to the south and at depth. Currently the Esperanza Zone has a strike length of approximately 250 metres and the vertical

extent or depth of the zone is also approximately 250 metres. The mineralized zone still remains open at depth to the north and to the south.

Additional drilling is going to take place from the 1070 level shortly. Drill stations are currently being prepared on that level. All prior drilling

had been completed from the 870 level.

That's very, very substantive. We see in it a substantial increase in the mine life as a consequence, potentially 5 years at the moment, based

on those 19 holes. What's really important here is we anticipate we'll see higher grades and expect to see lower costs. The brownfield exploration

program that we started with the new management team, this time last year, is really starting to bear fruit, as highlighted by the Esperanza discovery

that we announced in January this year. But we're also seeing improvement in other areas near Yauricocha as well as in Bolivar in Mexico.

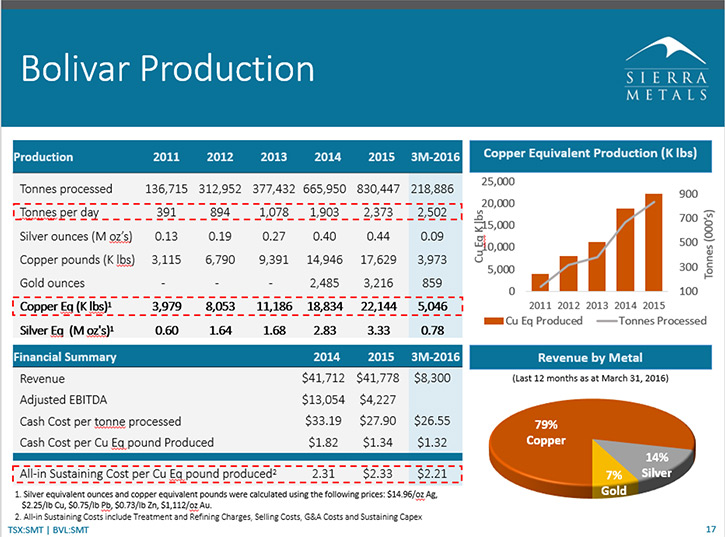

Dr. Allen Alper: That sounds excellent. Could you elaborate a bit on what is happening in Mexico? I know you had some record results in Mexico.

Mark Brennan: We've had record throughput in Mexico and that's largely the consequence of both the Bolivar mine as well as the Cusi mine

growing. At Bolivar, we’ve seen record throughput, but with that increase, we've also seen a little bit of a decline in grade. Two years ago we had an

average grade of 1.3 % copper equivalent at Bolivar. You'll see in the last quarter that was down to about 1.05%. In the brownfield exploration programs

that we are undertaking, we hope to see an improvement in the grade as well as tonnage at Bolivar. Hopefully we would get back to that 1.3 % copper

equivalent level that we have produced at historically.

The big challenge we have at Bolivar is to drive grade and we're currently looking to do that through higher grade areas within the El Gallo

zone. We believe that hopefully, in the not too distant future, we can come out with news that we have proof of concept that we're going to be able to

sustain that higher grade copper equivalent production level.

Dr. Allen Alper: That's excellent. I noticed that you have several other areas where you have opportunities of finding and developing new

resources. Is that correct?

Mark Brennan: That is correct. What we're looking at Allen, just to make it very clear, we have announced the discovery of 19 exploration

holes that were drilled to-date, but we have also announced 35 delineation or infill holes which were focused on the upper 100 metres of the zone. This

program has provided us with additional information on closer drill spacing, which will not only support a NI 43-101 technical report, which we plan to

release shortly, but also it will help us prepare to begin mining the upper portion of the Esperanza zone in the third quarter, this year. We're not

looking for exploration for exploration's sake. We're looking for brownfield exploration that we can bring into the production schedule very quickly.

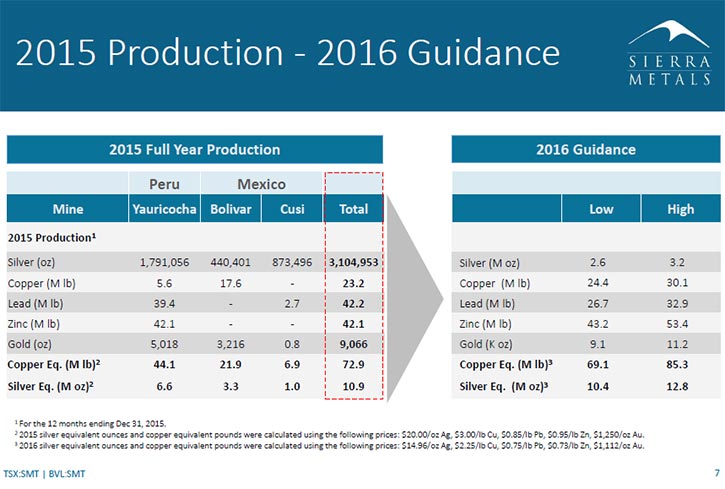

Dr. Allen Alper: That's great! Could you give me more information about your production - the silver and copper production et cetera.

Mark Brennan: Sure. Last year we saw a reduction in production as a consequence of the restructuring at Yauricocha. That had an impact,

consolidated as well as at Yauricocha itself. We would expect that we will see a significant improvement in silver or copper equivalent production at

Yauricocha this year. We are very pleased that we hit our targets last year even though the restructuring process that we embarked upon at Yauricocha

was unanticipated when the guidance was provided. But as per the guidance given for 2016 we anticipate that we expect to come in towards the top half of

that guidance. At Yauricocha we saw an improvement quarter over quarter from Q4 to Q1 and we expect to see an improvement again in Q2 and throughout the

year quarter over quarter. That should translate into a significant improvement in production at Yauricocha as well as at Bolivar and at Cusi. We're

anticipating increased production right across the board. Now the challenge will be to improve the grade as well right across the board.

Dr. Allen Alper: It sounds excellent. Could you tell me what differentiates Sierra Metals from other mining companies?

Mark Brennan: First of all, Yauricocha and the Company consolidated has always been a low cost producer. The company has always made a lot of

money because of the high quality ounces that we produce, particularly out of Yauricocha. Generally, we're looking at production somewhere in the region

of 10 ounces per ton, which is a pretty good number compared to our peers. With Esperanza, we're hoping we can drive that up to 15 to 20 ounces per ton

at Yauricocha.

What I think differentiates ourselves from our peer group is one, we're going to see some improvement acknowledged from the restructuring. Although I

think, with the lower commodity price environment that we've entered into in the last 6 months, everybody is now trying to reduce costs wherever they

can. But where I think we have a very strong competitive advantage is with our brownfield exploration program. I don't think all mines have that

opportunity, or all companies have that opportunity to go and find very substantial tonnage as well as high grade material in close proximity to mining

operations.

I think that's a very strong competitive advantage that Sierra has over anybody.

Dr. Allen Alper: That's excellent. That's really fantastic. Could you tell me a little bit about yourself and your background?

Mark Brennan: Sure. We have a group of very entrepreneurial driven individuals who have the ability to accomplish their goals. I think, with

respect to myself, I've been involved in the mining business for some while. We were able to, first with Desert Sun and we managed to sell that to

Yamana. Then with Admiral Bay, we were able to drive that to a much higher price before I left the company. Then with Largo I was able to build the

world’s leading vanadium project. Really, coming to Sierra has been a different challenge. What we've looked at here is a project optimization as well

as a growth profile addition to the company. That's been my kind of contribution.

The whole management team is relatively new at Sierra from exploration to finance to operations and investor relations. All are very strong

professionals in their perspective fields and bring a wealth of experience to the company.

I think that we've got a very hungry team here. One very important factor here, as you're probably well aware Al, is we have a significant

shareholder that probably has a couple of years before he has to liquidate his position. So he's very, very motivated. He has made management very

motivated to create value in the short term. He's looking to monetize his investment within the next couple years because his private equity firm has to

be liquidated. I think that drives everybody within the group to maximize value, to wring out whatever value we can wherever we can, within a limited

time frame. I think it's unlike a lot of other companies, where you have entrenched management, trying to look at maximizing their value over a longer

period of time. We're also trying to do that. But we have the impetus to create value in the short term as well. We're a very highly motivated group.

From that perspective I think we have some really good talent here.

Dr. Allen Alper: You definitely have a very strong team and a team with a proven track record of great success. I'm sure our readers are going to

be very interested in your company. Could you tell me a bit more about your finances and your capital structure?

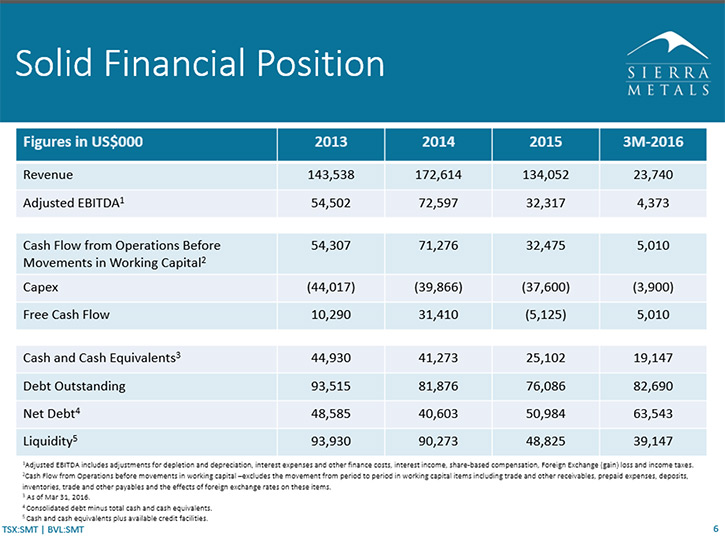

Mark Brennan: Certainly, We’re in very good shape. We currently have just over $19 million dollars in cash and $20 of undrawn credit for total

liquidity of $39 million. Our debt is running around $83 million. That $83 million is broken down into a number of components but $25 million of that is

actually a bullet payment which is due in August, 2020. We had $32 million cash flow in 2015, and $5 million in Q1. From that perspective we have a very

manageable debt structure. Most of the debt is running between 3.5% to 4.5%. It's very cheap debt and very manageable. We're in very good shape from our

balance sheet perspective.

Also we're just coming off from a 3-year program of approximately $120 million dollars of capital expenditure. Those have been very significant

programs with projects that we have mostly completed and our capex will be greatly reduced as we go forward. The objective that we have, as a management

team, is to reduce our debt as we go forward.

Dr. Allen Alper: That's nice. Tell me a bit about Peru and Mexico as an environment for operating mines.

Mark Brennan: In Peru, we're located southwest of Lima. While we have a very big project for Yauricocha, 18,000 hectares, we're somewhat

isolated away from any communities. For the most part we've been very much left alone. There are some issues in Peru, particularly in the northern part

of Peru, which are getting better. But Peru accounts for about 30% of its GDP from the mining sector. It's a critical business and industry for the

country.

We recently have had a run off in the first step of the election, the second and final step will be on June 5 and it will be either Keiko

Fujimori or Pedro Pablo Kuczynski who is elected. We don't expect to see any major changes in terms of regulations or operating environment. The

communities have been impacted by the global recession, so they are now looking for work and looking for industry to come and help them create jobs.

Obviously they're looking very closely at the mining community to help with that. From that perspective, I think you're going to see a much more

positive tone towards mining as you go forward as a consequence of the recession, but also potentially through the politics and the politicians.

I think Peru is a very, very good place to work. The regulatory environment is very good. Mexico, as well has a very, very long history of

mining. Mexico is probably a little more complicated from a legal perspective. You tend to find some legal issues that tend to be out of whack from what

reality perhaps accounts for in other jurisdictions. But if you look at absolute mining and such and the regulatory environment, it's very good as well.

They have a lot of history of very strong mining. It's very much accepted in terms of their communities.

Both jurisdictions, I think, are very healthy and very good environments to be mining within.

Dr. Allen Alper: That's very good. Could you tell me a bit about what your thoughts are and what might happen to copper prices and silver prices

as we move forward in 2016 and into 2017?

Mark Brennan: Sure. I guess my own personal view is I think copper prices are probably going to be pretty flat. I think we need to see a

strengthening of the Chinese demand in order for copper to grow strongly, as with many other commodities. I think it should be pretty flat. You're

seeing a lot of production turned off, so from that perspective, I think it'll be pretty balanced.

Silver, as you've seen in the last number of weeks, is really starting to follow gold on the dollar trade in my view. Obviously there's a very

big bet that the dollar will remain strong. From that perspective we'll soften off a little bit from here until you start to see interest rates being

raised again. I think that people are making a bet on gold and now that's trickled down into the silver market as well. I continue to see upside for

silver. It's been the best performing metal so far this year amongst the major metals. I continue to see potential for that to grow. That's kind of

where we are at the moment.

Dr. Allen Alper: Okay. That sounds good. Could you tell me a little bit about the primary reasons why our readers should invest in your company?

Mark Brennan: Sure. I would say the reason people should be investing in Sierra Metals Inc. right now is growth. We have very, very strong

growth backed by a solid financial position and solid earnings. From that perspective we see downside is very limited, particularly as compared to our

peers. We see very strong growth potential coming from our brownfield exploration programs. I think Yauricocha has now advanced significantly through

the restructuring and will continue to improve quarter over quarter through 2016. Sierra is transitioned itself from being pretty much a stable

operating company to what I consider to be a high growth company.

Combined with our financial strength, really means that we've got the ability to execute on that growth without any risk to shareholder.

Dr. Allen Alper: That sounds excellent. Is there anything else that you'd like to add?

Mark Brennan: Yes, I think Sierra Metals remains a somewhat unknown entity. I think as the Company continues with its investor relations

programs and marketing working with groups like yourself, we're going to become increasingly better known, particularly as we continue to see news out

on Esperanza. We will continue to be very aggressive in putting out news whenever we can. I think, we'll also probably see some analysts picking up

coverage before the end of the year. I think we have an educational period to get through with the market, but I think as people get to know the Sierra

story, they'll recognize our inherent value that is not inherent in our share price today.

Dr. Allen Alper: That sounds excellent. I think Sierra Metals has very excellent management, excellent properties, is very well run, with a nice

cash flow. It sounds like a very promising company to me.

Mark Brennan: We certainly think so Al.

http://www.sierrametals.com

79 Wellington Street West

TD Tower South

Suite 2100, P.O. Box 157

Toronto, Ontario, M5K 1H1

Canada

T +1 866 493 9646

T +1 416 366 7777

Mike McAllister

Sierra Metals Inc.

T +1 866 493 9646

info@sierrametals.com

|

|