Interview of Paul West-Sells, President and CEO of Western Copper and Gold Corporation (TSX: WRN; NYSE MKT: WRN)

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 5/26/2016

Last summer Goldman Sachs took a look at all the copper projects in the copper universe and ranked Western Copper and Gold Corporation number one

based on economics. The Yukon is getting a lot of attention these days, after Goldcorp’s recent offer to enter into the territory. The company is led

by the very competent Paul West-Sells, President and CEO and a very knowledgeable Board and team.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News interviewing Dr. Paul West-Sells, President and CEO of Western Copper

and Gold.

Dr. West-Sells has over 20 years’ experience in the mining industry. After obtaining his

Ph.D. from the University of British Columbia in Metallurgical Engineering, he worked with BHP, Placer Dome, and Barrick in increasingly senior roles. Dr. West-Sells has over 20 years’ experience in the mining industry. After obtaining his

Ph.D. from the University of British Columbia in Metallurgical Engineering, he worked with BHP, Placer Dome, and Barrick in increasingly senior roles.

Paul, you have one of the most massive properties for gold and copper in the world, and in a wonderful location. You yourself have an amazing

background, a great education and a great background in mining and metallurgy. Could you tell me a bit about your company? What progress it's been

making, and what you're plans are going forward?

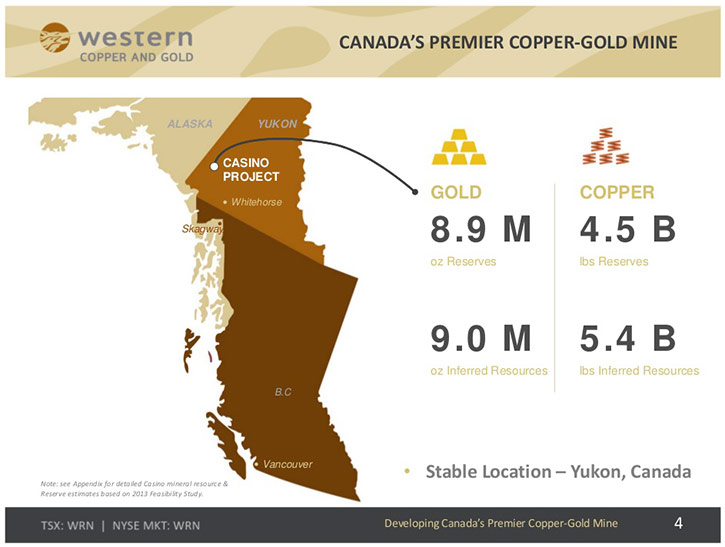

Dr. Paul West-Sells: Sure. And as you said, you're familiar with the project. It is a very large project with 9 million ounces of gold and 4.5

billion pounds of copper in the reserve, plus an additional 9 million ounces of gold, and 5.4 billion pounds of copper in the inferred resource which

makes it a tremendous asset.

One of the things that we think is unique about the Casino Project, is that throughout this current commodity down cycle, we've never seen the IRR on

the project drop below 16%. And there are a few reasons for that. First of all, the revenue distribution between copper and gold, in today's commodity

price environment, is fairly evenly split between copper and gold – and gold has seen a recent rally – and second, the Canadian-US exchange rate, which

improves commodity prices in Canadian dollar terms. But the key reason is that it's just a very, very robust copper project. One of the things we point

to is that when Goldman Sachs, last summer, took a look at all the copper projects in the copper universe, they ranked ours number one based on

economics, and recently the Mining Journal ranked us the #7 top undeveloped Copper Project.

So talking a bit about where we are and where we're going; we've been working on this project since 2006, we finished off all of the drilling, completed

two pre-feasibility studies, and then a full bankable feasibility study. It has received an incredible amount of engineering attention, which is what

you would expect for a project of this size. We now have two years of permitting under our belt, and so we're somewhere around halfway through the

permitting, and environmental assessment process. I think this timing will leave us very well-positioned to benefit from the recovery in copper prices.

I think there's a pretty broad consensus out there that you're going to see a real dearth of new copper supply in the future. There's a real need for

copper supply around 2020 - 2021. Working backwards from that, it takes three or four years to build a big mine so you need to start getting projects

permitted and start construction pretty quickly over the next couple years, in order to be bringing new supply online in the early 2020s.

Dr. Allen Alper:

It looks like you have the right project. It's in the right area. Could you tell me a bit about operating in the Yukon?

Dr. Paul West-Sells:

Well, first of all the Yukon is garnering a lot of attention lately. Especially after Goldcorp’s offer to acquire our closest Yukon neighbor, Kaminak

Gold. Goldcorp’s CEO stated, "This acquisition is consistent with our strategy of partnering with junior exploration companies to identify and develop

mining districts”. I think it’s safe to say that other majors are looking at the Yukon as a publically safe mining-friendly jurisdiction.

In a practical sense, the benefit of working in the Yukon is that you have an incredibly supportive government and people. The Yukon has a long history

of mining. I tell people there's a miner on the license plates. This gives you an idea of the long history of mining in the Yukon. And the government is

very, very supportive. This was confirmed by the fact that the Yukon government has submitted an application to Ottawa for infrastructure funds to build

part of the access road to the Casino Project. I was in Ottawa with them on February 1st and was very happy to see the government essentially putting

their money where their mouth is in terms of supporting the mining industry.

People think of the Yukon, and they think of "north" and "cold" and all those sorts of things, but one of the advantages of the Yukon is that it's in

the west. Our project is 560 kilometers from a year-round port in Skagway, Alaska. That's a real benefit. This is a year-round, ice-free port connected

by a very good highway network, which is absolutely critical to us bringing our concentrate to market. And you compare that to other northern

jurisdictions where they don't have that year-round port access, and it makes the Yukon a really great place to be looking to build a mine.

Dr. Allen Alper: Sounds great. Are you still working on liquid natural gas? Is that project still going on?

Dr. Paul West-Sells: Yes, we do need to provide our own power at the Casino mine site, and we've looked at this closely. We've settled on using

liquefied natural gas. Liquefied natural gas is a great fuel. It's a lower carbon emission fuel than diesel and for these northern regions, for the

amount of power we're talking about, there are not really any serious alternatives. It makes a lot of sense. This is such a good idea for the north that

the city of Whitehorse recently put in a liquefied natural gas-powered power plant last summer.

This plant brings the transportation and the supply infrastructure together. There are a couple of other LNG fired power plants coming to the north. All

of this will be very beneficial for us.

Dr. Allen Alper: So that could lower your energy cost, I would think, also make it reliable.

Dr. Paul West-Sells: Yes, our last feasibility study incorporated the use of liquefied natural gas. But with the infrastructure coming together

with the introduction of the Whitehorse plant, and natural gas prices, therefore the liquefied natural gas prices are significantly lower today than

they were at that time. I expect that energy costs are lower today than what we used in our Feasibility Study.

Dr. Allen Alper: That's great. You have this abundance of natural gas in Canada and in the United States, so I don't think you'll ever have to

worry about a source of energy.

Dr. Paul West-Sells: I think you're right.

Dr. Allen Alper: Could you tell me a bit about your background and your team?

Dr. Paul West-Sells: Sure. You know my background. I've been in the mining industry my whole life. I started off my career in research and

development, then moved to project development. I worked for BHP and Placer Dome and then Barrick, when Barrick took over Placer Dome. And then, about 9

years ago, I joined Western as a metallurgical engineer. My responsibility grew over time and now I'm President and CEO.

I think what you're seeing in this downturn in our industry is that the people, who are left, are the real mining guys, in terms of the people,

who are operating development-stage companies such as ourselves. You don't have a lot of the sort of speculators out there anymore. It's really the

mining guys that are running the company. Our executive chairman, Dale, has also been in the mining industry his whole life. His big win happened during

the acquisition of Western Silver by Glamis Gold for $1.6 billion. That was back in 2006. Cam Brown, who is our VP of engineering, is also a long-term

miner, with a very long history. He worked for Bechtel Engineering and was instrumental in the development of the Los Los Pelambres project in Chile. So

he has big mine experience, big copper mine experience and is key to the team going forward.

Dr. Allen Alper: Paul, you have a great team of people, with excellent backgrounds, excellent experience and very knowledgeable, so that's very,

very good. You have a great copper/gold project in a very stable jurisdiction and great plans for it. The two seem to go together very well. Could you

tell me 4 reasons why investors should invest in your company?

Dr. Paul West-Sells: Sure. We've got a project that at today's commodity prices has a net present value of $1.4 billion. It is a large

copper/gold project, located in a very stable jurisdiction in the Yukon. So it's a tremendously economic asset. If you look at your leverage right now

in terms of buying shares of Western Copper and Gold for leverage to copper and gold, it's incredibly attractive. And we've certainly seen the share

price go up a fair bit over the last little while, but it's still well-off our historical highs, and now that it looks like Kaminak is going to be

bought by Goldcorp, we are finally seeing major mining company attention in the area.

The second reason is that we pride ourselves as a company on being very protective of our shareholders' interest. The last time we did a financing was

in 2010 at $2.50. We've brought in money since that time in terms of a royalty sale, but we've been very careful. We understand who owns the company -

it's the shareholders, and we are very, very careful about making sure that the value to the shareholders is something that grows.

The third thing is that these large assets with significant copper and gold are incredibly valuable, and are very rare. They're even rarer to find in a

great jurisdiction such as Canada. Having ownership of an asset like this is very exciting.

Dr. Allen Alper: Now you're in the permitting process and your permit is moving along. What’s happening with that?

Dr. Paul West-Sells: Permitting is one of those things that everybody thinks should happen more quickly, but it sort of is what it is. For

these more developed locations such as Canada and the US, it typically takes four to five years. But what's important is that you make progress, and we

are making progress on that, and we're beginning to see the light at the end of the tunnel.

Dr. Allen Alper: Your project has quite a high Capex, but it also has a great return, considering that Capex, even at today's prices. So what are

your plans on funding and timing and advancing your project?

Dr. Paul West-Sells: There are three ways we could move the project forward. One option is that somebody just comes in and buys us out, a

larger company, and builds it on their own. Certainly you've seen that happen to companies such as ours, with copper projects of this magnitude.

The second is that we do it completely on our own, and we've looked at that. There are avenues to do that that likely involve putting together a

good sized royalty stream on the precious metals and then some debt and some equity.

Then the third option, which is the one that we're pursuing the most strongly, is bringing in a strong partner to help fund it. That's the

avenue we've been working on, over the past year and we'll continue going forward looking for a strategic partner to help us bring the project online in

terms of the capital.

Dr. Allen Alper: You have a great background to move that project forward, being a metallurgical engineer. I would think that would fit in well.

Dr. Paul West-Sells: We're really a team of strong engineers. There's myself, and there's Cam, and there's a number of other engineers on our

team. We're really more of a company of engineers than a company of geologists, which is unique in the junior mining space. All of us have worked in

operating mines, are familiar with operating mines, and understand the importance of and the challenges of that and will continue to bring that

experience into how we move the project forward.

Dr. Allen Alper: Sounds great. It sounds like you're doing all the right things and are on the right track to bring this project to fruition.

Dr. Paul West-Sells: Yeah, It's funny. You wake up and it's 9 years later, but we still have the same team. The people I talk about are a group

of individuals, who have been with the company since 2006 and who are committed to moving this project forward. We've continued to move it forward

through the down cycle in 2008 and the most recent down cycle, and we've never stopped knowing the value of this project. We are just continuing to move

it forward. So we're excited about the next few years, and I think it could be exciting for everyone involved with the company.

Dr. Allen Alper: That's great. I enjoyed talking with you, Paul.

Dr. Paul West-Sells: Thanks a lot, Al.

Dr. Allen Alper: You're welcome.

http://www.westerncopperandgold.com/

Tel: +1 604 684 9497

Toll Free: 1 888 966 9995

Email: info@westerncopperandgold.com

15th Floor, 1040 West Georgia Street

Vancouver, BC V6E 4H1

Canada

|

|