It is 9,056 kilometers between Nuinsco Resources’ Diabase Peninsula uranium project in Saskatchewan’s Athabasca Basin and northeastern Turkey where it is a 50 percent partner with Xstrata Copper on the Berta copper porphyry project. But these two very different ventures are part of a unified strategy for this growth-oriented, multi-commodity company.

Nuinsco is prepared for production and focused on growth through uranium, base and precious metals exploration and development in world-class mineralized belts. It also holds significant equity positions in near-production Victory Nickel Inc. (TSX:Ni) and copper and gold producer Campbell Resources Inc. (TSX:CCH).

We talked to Sean Stokes, Corporate Secretary and Director of Investor Relations for Nuinsco Resources. He discussed the company’s strategy for growth, which was clearly illustrated in February 2007 when Nuinsco spun off its three nickel assets: the Lac Rocher deposit in Québec and the Mel and Minago nickel projects in Manitoba on the Thompson Nickel Belt. These assets, along with $12 million, were used to create Victory Nickel, Inc. (TSX:Ni), of which Nuinsco holds a 22 percent equity interest.

Drilling at Victory Nickel’s Minago Sulphide Nickel Project

Victory Nickel has over 660 million pounds of in-situ sulphide nickel in NI43-101 measured (154,000,000 pounds) and indicated (511,000,000 pounds) resources in these three projects. The Minago Project has more than 553 million pounds of in-situ nickel in measured plus indicated (M&I) resources and an additional 513 million pounds of inferred resources, making it one of Canada’s largest undeveloped nickel deposits.

Mel Nickel Project in Manitoba, Canada

The Mel Project is located in northern Manitoba, 25 kilometers north of Thompson. Recently increased by 79 percent in terms of tonnage and by 14 percent in terms of grade, Mel has 4.3 million tons of indicated resources grading 0.875 percent nickel between of 46 and 183 meters. “We see potential nickel production in the second quarter of 2009 on a direct-ship basis,” Stokes said.

Mel is a joint venture with CVRD Inco Ltd., which has an obligation to process any ore mine from Mel at a cost plus 5 percent basis. “We can ramp into it, mine the ore and then ship it directly to Thompson, 25 kilometers away, and process it at their facilities without incurring the cost of developing our own processing infrastructure,” Stokes said.

Keeping Significant Assets

“A key part from Nuinsco’s perspective is that when the nickel assets were spun out and Victory Nickel was created, Nuinsco still owned 22 percent equity interest in Victory Nickel. So that’s a significant asset that adds tremendous value for Nuinsco’s shareholders and it’s something that obviously gives Nuinsco a lot of flexibility as we go forward financially,” Stokes said.

Of the three assets, Minago is the largest and most advanced. “It’s a very large bulk tonnage nickel project, which we expect will be in production in early 2010. The feasibility study’s ongoing right now, and we expect that will be finished in the second quarter of 2008,” he said.

Located in northwestern Quebec, the high-grade Lac Rocher project has M&I resources totaling 1.19 million tons, grading 0.91 percent nickel, at a 0.5 percent nickel cutoff, for approximately 25 million pounds of in-situ nickel located between surface and 125 vertical meters.

“The Lac Rocher deposit has a high grade core. We’re now evaluating the economics of ramping down into it and mining for direct shipment to a mill for processing, which wouldn’t incur the costs and environmental issues of building a mine. Our goal is to begin development in 2008 and to start mining about 50,000 tonnes of 4 percent nickel in 2009,” said Stokes.

Focusing on Exploration

Nuinsco’s focus always has been, and continues to be, exploration, with projects in uranium in Saskatchewan and Ontario, gold in Ontario, and copper-zinc, copper-gold in Turkey. With Victory Nickel as a separate venture, what remains within Nuinsco is this range of exploration projects, and one development asset, the Corner Bay Copper deposit, a 50/50 joint venture with Campbell Resources Inc., the top producer in Quebec’s prolific Chibougamau mining camp. Nuinsco is also a consultant to Campbell’s currently producing copper/gold mines.

“Corner Bay will be our first cash flowing asset and is part of our strategy of non-dilutive financing, however Nuinsco is focused on exploration and we always have been. Though we have had several discoveries, we’re pushing forward for more,” Stokes said.

Two of these programs are looking for uranium deposits.

Nuinsco’s Diabase Peninsula uranium project totals 21,900 hectares northwest of La Ronge, Saskatchewan on the Athabasca Basin, near the world’s largest and richest uranium mines. The property is a joint venture with Trend Mining Company of Denver. Nuinsco has completed two drill programs that returned uranium values as well as key indicator minerals associated with uranium deposits. Nuinsco has been identified as a leader in the race to find the next uranium “Super Deposit” here.

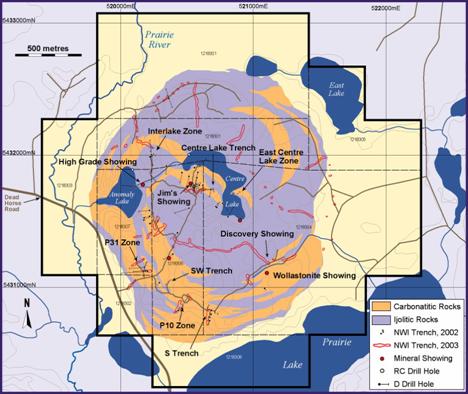

Nuinsco is also awaiting assays from drilling at its Prairie Lake deposit, near Marathon, Ontario, which hosts a near-surface historic (non-NI-43-101-compliant) uranium resource of over 180,000 tons grading 0.09% U3O8 (and 0.25% niobium) from the mid-1960s. This resource has a significant value at current uranium prices and an initial 2,000 meters of drilling was recently completed on this large carbonatite intrusion. Recent surface samples showed up to 0.08% U3O8 (1.656 lb/ton).

Map of the Prairie Lake Carbonatite

Well-Financed and Moving Forward

Since the 2006 decision to revise the corporate structure, Nuinsco has created Victory Nickel and helped Campbell Resources expand production. Development of the Corner Bay copper deposit is also being completed, and Victory Nickel is advancing the Minago deposit towards production. Victory Nickel is also determining near-term production potential at Lac Rocher and Mel nickel deposits.

“And we had a significant increase in our working capital which is rather unique for an exploration company,” he added.

Stokes credits this as one of the company’s greatest achievements: to implement a strategy of funding exploration activities with minimal solutions by generating cash from production revenue, from the sale of assets and other non equity means of financings. “We accomplished this by selling our Rainy River project, which gave $6 million and allowed us to not dilute with equity financing,” he said.

For example, the 22 percent of Victory Nickel owned by Nuinsco is worth $31 million, liquid assets that could be potentially sold off to finance exploration, according to Stokes. Additionally, the Corner Bay joint venture should generate significant cash flow to Nuinsco’s account in the near term.

Campbell Resources

In mid-2006, Nuinsco announced its entry into mine management through an agreement with Campbell Resources Inc. (TSX: CCH). Under this agreement, Nuinsco owns an approximate 9% equity interest in Campbell, including the Joe Mann gold mine and Copper Rand copper mine in Chibougamau, Quebec.

Joe Mann Gold Mine

Stokes explained that Nuinsco’s equity investment in Campbell Resources is worth about $9 million and provides for a 50/50 share in cash flow from Corner Bay. Nuinsco expects to begin receiving cash flow from production at Corner Bay, which will be the Company’s first cash flowing mine, in 2008. Mining the upper portion of the deposit (between the surface and 500 meters) will generate cash flow to Nuinsco’s account of an estimated $29 million, in addition to consulting fees of about $2 million that Nuinsco receives under its consulting agreement with Campbell Resources.

Nuinsco’s 50%-owned Corner Bay Copper Deposit

In describing Corner Bay, Stokes revealed that the upper portion of the deposit, at a 3 percent copper cutoff, has measured resources of 181,000 tons at 5.07 percent copper for 19 million pounds of contained copper. The indicated resource is 265,000 tons at 5.93 percent or 35 million pounds. The inferred is 1.441 million tons at 6.76 percent copper for 214 million pounds of copper. “As you can see, that’s a pretty nice resource grade, particularly at current copper prices,” he said.

Campbell’s Copper Rand Deposit

The first cash flow to Nuinsco’s from Corner Bay is expected in 2008, but there is also potential for more exploration upside at depth. The deepest hole is 1200 meters with 9.27 percent copper over 6.7 meters true width.

Seeking Copper, Zinc and Gold in Turkey

Berta and Elmalaan are the company’s two projects in Northeastern Turkey near the Georgia border.

“We have done some drilling this year at both Elmalaan and Berta and got some very good results. They’re both very grassroots and a lot of work has been done, but these are very underexplored properties with incredible potential,” said Stokes.

Berta copper porphyry project

Nuinsco is a 50 percent partner with Xstrata Copper in the Berta copper porphyry project. Covering about 6,000 hectares, in the prolific Pontide Mountains Metallogenic Belt, Berta hosts what is reputed to be the largest copper anomaly in the Turkish Pontides. Widespread anomalous copper mineralization, from 450 parts per million (ppm) copper to 1,000 ppm copper has been found, as have gold values greater than 1.0 g/t, and ranging up to 12.8 g/t.

In drilling earlier this year, Nuinsco intersected a significant, continuous domain of strong sulphide mineralization grading up to 30.0% copper and 7.19% zinc. Copper, gold, silver and zinc values occur over the entire 771.5 metre length of hole SD-07-08 which was drilled adjacent to the interpreted Berta copper porphyry system and ended in mineralization. These results highlight the tremendous potential of the essentially unexplored Berta property, and the Company expects further drilling prior to year end.

Elmalaan copper-zinc property

Nuinsco has a 100% interest in the 947-hectare Elmalaan zinc-copper-gold-silver property located 6 km south of the Black Sea coast. Previous work identified massive sulphides in outcrop and locally-derived boulders that graded up to 30.38% copper and 56.30% zinc.

Drilling earlier this year returned high-grade polymetallic mineralization over significant widths. Hole EKD-07-06 intersected 2.43% zinc, 0.50g/t gold and 31.07g/t silver over 10.10 metres between 98.90-109.0m; between 102.6-103.2m zinc values peak at 9.25%, gold at 2.85g/t and silver at 211g/t.

“These are excellent results from such an early-stage exploration program, and we intend to aggressively follow up at both Elmalaan and Berta as soon as possible,” Stokes said.

Developing a Blue-Chip Management Team

Nuinsco Resources Limited has its roots in the Noranda mining camp of northwestern Quebec, where company founders Doug Hume and George Archibald met while working on different projects in the mid-1960s. Together they sought other strategic partnerships, which led to the birth of New Insco in 1970. Early on, they discovered approximately one million tons of 3% copper and a massive sulphide deposit.

The company was reorganized as Nuinsco Resources in the early 1980s, to soon follow with the acquisition of the Cameron Lake project. Rainy River, Lac Rocher, Minago and other projects followed. Thirty-five years later, Nuinsco has a multifaceted stake in base metal, precious metal, and uranium projects.

“I believe Nuinsco’s greatest asset is the management team, a blue-chip board in a junior company, and that’s something that’s quite rare,” said Stokes.

Nuinsco’s CEO and Vice Chairman, René Galipeau, has been around the exploration industry more than 30 years. One of the founders of Breakwater Resources, he has held senior positions with a number of gold and base metals mining companies in Canada and the U.S Having joined Nuinsco as a director in 1993, he was Chairman and became CEO in June 2006.

At the same time, Warren Holmes, who was the CEO and Vice-Chairman, became non-executive Chairman. Warren was the Senior VP of Operations for Falconbridge. He has close to 40 years’ experience and is extremely knowledgeable in operations, particularly in nickel projects, according to Stokes.

Other experienced Board members are geologist George Archibald, metallurgist Mike Young, Howard Stockford, Frank Crothers, Tom Judson, David Lewis and Peter Nesbitt Thomson.

“All together, I think it’s more than 400 years of mining experience that we can bring to bear. The board is very active. They participate and lead this company to new things,” Stokes said.

In management, Brian Robertson, President, has 30 plus years of mining experience, both open pit and underground companies, including Placer Dome, Royal Oak and North American Palladium.

Paul Jones, Vice President of Exploration, has more 20 years’ exploration experience with Nuinsco and numerous junior companies and was instrumental in several of Nuinsco’s discoveries.

Normand Lecuyer, Vice President of Québec operations, has vast palladium development operational experience to help with both Campbell’s and Nuinsco’s assets in Québec.

Setting Goals for the Year Ahead

Stokes said that for 2007 and 2008, Nuinsco’s goals are to aggressively advance Canadian uranium properties through approximately $3 million of exploration and drilling. They hope to discover a uranium super deposit at the Diabase project, and to identify a significant uranium resource at the Prairie Lake project. They also plan to build on positive results from Turkish assets through further drilling and to acquire additional uranium assets as well as assets in Turkey. They will also consider the viability of creating a second pure-play company, either with the uranium or Turkish assets.

“All things considered, we think we’re financially in pretty good shape. The sale of liquid assets and revenue from Corner Bay production and consulting fees could generate cash of $68 million, which is equal to 85 percent of all the equity raised in the last four decades in Nuinsco,” said Stokes. “So we think we’ve done a very good job over the last year of getting Nuinsco to a place where we can really move forward with the assets, and we’re looking forward to unlocking the value for our shareholders.”

Nuinsco Resources Limited

80 Richmond St. W, Suite 1802

Toronto, Ontario M5H 2A4

Tel: 416.626.0470

Fax: 416.626.0890

Email: info@nuinsco.ca

http://www.nuinsco.ca/

http://www.victorynickel.ca/

René R. Galipeau, C.E.O.

Brian E. Robertson President

Paul L. Jones Vice-President Exploration

Normand Lecuyer, Vice-President, Quebec Operations

Sean Stokes, Corporate Secretary and Director, Investor Relations