Len Brownlie, President and CEO, Goldrush Resources Ltd.

at the New Orleans Investment Conference

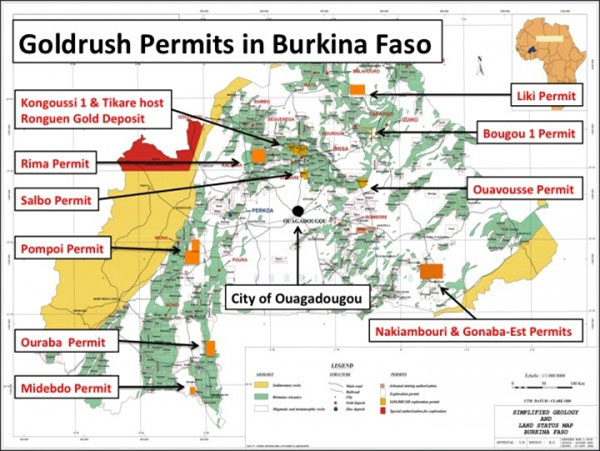

Goldrush Resources Ltd. holds 12 permits in Burkina Faso, one of the hottest gold exploration areas in the world. With 4 drill projects, which are either underway or about to begin, Len Brownlie, President and CEO, Goldrush Resources Ltd., thinks the current low price of the stock provides an excellent buying opportunity for investors to purchase before their drilling campaign gets fully underway. “With the current stock price at around 12 cents, there’s not much you can lose,” says Mr. Brownlie.

A junior exploration company, based out of Vancouver, Canada, Goldrush Resources Ltd. holds 12 highly prospective permits in the West African country of Burkina Faso.

A junior exploration company, based out of Vancouver, Canada, Goldrush Resources Ltd. holds 12 highly prospective permits in the West African country of Burkina Faso.

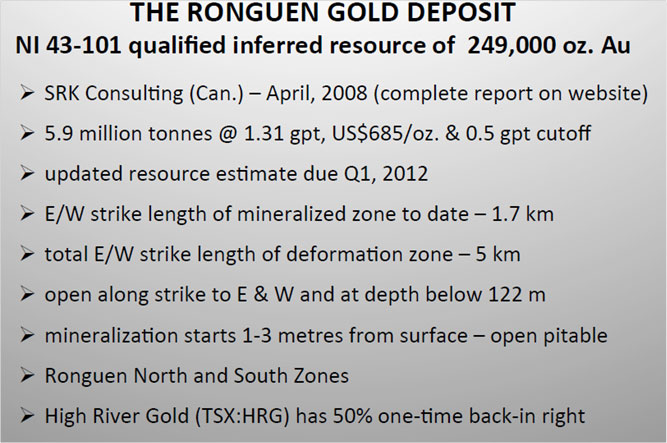

Ronguen Gold Deposit

Goldrush’s main project is the Ronguen Gold Deposit, which is about 6 kilometres away from High River Gold’s Bissa project.

“We have currently about a 9,000 metre drill program at Ronguen,” provides Len Brownlie, who has been President and CEO at Goldrush Resources Ltd. since 2001. “We had an initial inferred resource developed by 2008 of about a quarter million ounces. That was 1.31 g/t and 5.9 million tons. We’ve now recapitalized after the financial meltdown and put about $9 million into the project over the last few years and we’re anticipating a resource upgrade to be announced probably the end of Q1 2012.”

Mr. Brownlie continues, “Our main project will be an open pit situation. We’ve identified targets up to 430 metres away that have, in one or two holes, come back with some pretty good mineralization. We also have a couple target areas up to 5 kilometres away, which may be the extension of the Ronguen deposit.”

“Burkina is one of the hottest gold exploration areas in the world and we feel we have some well located exploration permits,” adds Mr. Brownlie. “Our permits cover in total about 2,000 square kilometers.”

Pompoi

In discussing Goldrush’s other projects, Mr. Brownlie explains, “The one I would really highlight today is one called Pompoi, which is immediately adjacent to Roxgold’s Yaramoko permit. Roxgold recently announced some spectacular gold assays and their drill sites are 2.9 kilometres west of our permit boundary.”

Mr. Brownlie says their intention is to begin a drill program at Pompoi between 4 and 10,000 metres to start middle of November.

Salbo

Mr. Brownlie continues, “Thirdly, we have a permit called Salbo, which is about 30 kilometres south of the Ronguen deposit. There’s some very encouraging gold mineralization, which we identified in earlier drilling in the spring.”

Of 363 rock samples taken at Salbo, 20 assays returned greater than 1.2 g/t gold, to a maximum of 30.9 g/t gold.

Finishing discussion on Goldrush’s projects, Mr. Brownlie concludes, “So, right now we have 3 to 4 drill projects which are either underway or about to begin.” He continues by talking about some of Goldrush’s strengths, “We have a good size crew, so we can manage those projects effectively. Our treasury is around $2.7 million at this point. We have a very good institutional support in the form of Dundee Precious Metals, Sprott Asset Management, and Pinetree Capital. So, in total we feel our institutional shareholder base is somewhere around 50 to 60 percent, including managements participation. So, we’re well capitalized, we have good institutional support and a number of drill projects underway. So, it’s a very exciting time for Goldrush.”

Goldrush Stock at Bargain Prices

Regarding Goldrush’s current stock price, as Mr. Brownlie has said in the past, one risk is that investors may miss the opportunity to purchase their stock at this level before their drilling campaign gets fully underway. Mr. Brownlie explains, “As with many of the junior explorers, the risk premium has certainly come off, given the European monetary problems. So, right now we’re trading at a whole 12.5 cents. Our year high was, I believe, 30 cents. So, it’s actually a great time to invest in the company at around 12 cents, there’s not much you can lose.”

4 Reasons to Invest in Goldrush

Mr. Brownlie actually thinks there are more than 4 reasons, but the top reasons he provides begin with an established and experienced team, and location is Mr. Brownlie’s second reason. According to Mr. Brownlie, “Burkina Faso is the hottest place in the world for gold exploration today.” He continues, “The fact that we are drilling 3 to 4 different projects over the next 3 months is another reason to be interested. And part of your investors due diligence has been performed already.” He explains, “The institutional investors, to some extent, have provided some due diligence for everyone else. If they think we have a good shot, I think your reader’s should think we have a good shot.”

Experienced Team

To explore Mr. Brownlie’s claim that he has an established and experienced team, you just need to look to his close to 30 years experience. Though he has a PhD in sports sciences, Mr. Brownlie has worked in the administration and management of junior management companies since 1983. Mr. Brownlie continues, “Our senior management includes our chief geologist, John Learn, who’s been responsible for 5 gold discoveries in West Africa. Our VP exploration is a fellow named Driff Cameron, who has 30 years experience as a professional geologist. Driff and John along with our administrative manager have all come over from High River Gold, which was involved in West African exploration since 1996. Our other directors, Al Williams and Kim Phillips, have been involved in junior company exploration and financing since about 1980. So we have a very experienced team that has been responsible for a number of discoveries in West Africa.”

Mr. Brownlie finishes, “We’re a seasoned group and of all my time in the business, this has been the best opportunity that I’ve been involved in.”

Disclosure

The Alper family owns Goldrush Resources Stock.

For more information:

http://goldrushresources.ca

Head Office:

550 – 800 West Pender St.,

Vancouver, BC V6C 2V6

Telephone: +01-604-602-9973

Fax: +1-604-681-5910

Email: info@goldrushresources.ca

Toronto Office:

Suite 5600 – First Canadian Place

100 King St. W., P.O. Box 270

Toronto, Ontario

Canada, M5X 1C9

Telephone: +01-416-306-5790

Fax: +1-416-6744-8801

Email: info@goldrushresources.c