Chesapeake Gold has one of the largest undeveloped gold and silver deposits in the Americas

P. Randy Reifel, President - Chesapeake Gold at PDAC 2011

According to Randy Reifel, the President of Chesapeake Gold, the massive Metates Project in Durango, Mexico, has quite a future. He said, “Chesapeake’s gold and silver project in Durango, Mexico has in the measured and indicated categories, 17.2 million ounces of gold, over 450 million ounces of silver and 3.4 billion pounds of zinc. Without question the largest undeveloped precious metals deposit in Mexico.”

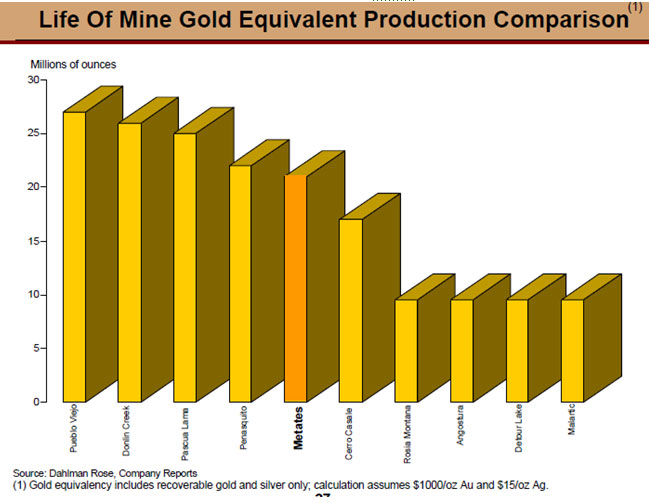

Currently, Chesapeake is working on advancing Metates to the pre-feasibility stage. He said, “We just finished an updated scoping study on the project, which will outline the scale and the process flow sheet that will be employed in the pre-feasibility study. Currently, we are looking at a 120,000 tons per day open pit mine which, over a twenty year mine life, would produce annually 750,000 ounces of gold, and almost 20 million ounces of silver.” Clearly, a staggering amount. Reifel said, “It will be one of the largest gold mines and the sixth or seventh largest silver mine in the world once it is in production. Life of mine cash costs will be $436 dollars per ounce of gold produced. In the first five years, we do have a sweet spot in this mine because of higher grade and a lower strip ratio. During these years the cash costs are closer to $300 per ounce.”

Metates will be a large open pit mine that necessitates a large capital investment. Reifel said, “The Cap X on this project is about $3 billion, or approximately $150 per ounce on a Cap X basis, which is in line with similar scale projects. Plugging in long term metal prices ($900 gold/oz, $18 silver/oz, $1 zinc/lb) the economic returns are excellent. The IRR (pre-tax) is 17% and the capital payback is less than 4 years. That's where we are heading in the prefeasibility study.”

When asked about how Reifel believes that Chesapeake fund Metates into production, he replied, “That's a good question, because it is a big Cap X number. We do have two or three options available. First the project would replace the declining reserves and production of several senior and intermediate mining companies which might well attract a purchaser. We might bring a partner in, which is a second option. Or thirdly, we'll go it alone. That would indeed be more difficult, but it's not unfathomable with the right production team . In these markets there's a lot of interest in these big projects. So we'll just see what happens once the prefeasibility is completed. That will give us the template going forward. We're hoping to have the prefeasibility done by the end of 2011.”

In terms of the Company’s financial standing, Reifel reports that they “have 38 million shares outstanding and our market cap is around $475 million dollars. Our stock is trading under $12. Chesapeake has a treasury of $25 million dollars and we have warrants that are going to expire within the next twelve months which will bring in another $35 million dollars. We're in a good position to take the project through to feasibility. Not just prefeasibility, but feasibility. And, during that time, we have lots of time to explore the options for development.”

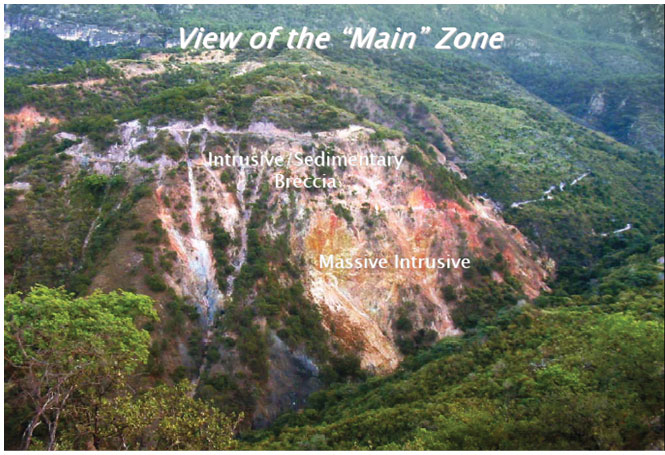

Metates Deposit

With such a large project, Reifel believes that Chesapeake is attractive to investors. He said, “If you are a big bull on silver, Metates is going to be one of the largest silver mines of the world. So, it's kind of a sleeping giant. Also, when you look at this project in terms of gold projects worldwide and specifically, life of mine recoverable precious metal production, Metates will be in the top ten in the world. Metates is also located in an internationally recognized mine-friendly jurisdiction which is important for a long mine life.”

Chesapeake's success is largely due to their management team. Reifel said, “Before this, I was the President of Francisco Gold, which discovered the El Sauzal and Marlin gold mines in Mexico and Guatemala. We did take El Sauzal to feasibility, which is an open pit mine in the Sierra Madres, so we're quite capable of advancing Metates to feasibility. Francisco was bought by Glamis Gold, Ltd. for almost $400 million in 2002. Chesapeake was spun out from that transaction. We bought Metates in 2005 when gold was around $400 per ounce and I'm glad we had the vision to do that. Currently, the Board is mainly comprised of the previous Francisco Gold members. Reifel said, “There are two mining engineers and a senior geologist on the board. We bought Metates from a company founded by Sun Valley Gold and we now have two of their directors on the Board. Another important piece of the puzzle is when Cambior Inc. was exploring this project in the 1990's, their project manager was Gary Parkinson. When Chesapeake bought Metates, we went looking for Gary Parkison and likewise hired him to be our project manager. The legacy of his knowledge from the 1990's is invaluable and has been very constructive moving this project forward. We've also hired M3 Engineering to undertake the scoping work and complete the feasibility studies. M3 Engineering did the feasibility work and was the mine contractor for Goldcorp’s Mexican Penasquito mine in Zacetacas state. Penasquito is ramping up to 130,000 tpd and several aspects of its mining operation are similar to Metates. Hence, M3’s experience and real time data will provide confidence in the costing inputs for Metates feasibility studies.”

With an excellent team and an enormous resource, Chesapeake Gold is fast tracking the Metates deposit to feasibility and several interested parties are closely watching the Company’s developments.

For more information:

http://www.chesapeakegold.com

HEAD OFFICE - VANCOUVER

CHESAPEAKE GOLD CORP.

Suite 201 - 1512 Yew Street

Vancouver, B.C.

Canada V6K 3E4

Tel: (604) 731 1094

Fax: (604) 731 0209

E-mail: chesapeake@shaw.ca

MEXICO

MINERALES EL PRADO S.A. de C.V.

Cerro Blanco #410

Fraccion Lomas de Sahuatoba

Durango, Durango State

C.P. 34108 MEXICO

Tel: 52-618-130-2326

Fax: 52-618-130-2328