"We're very high grade, a low tonnage operation," says Richard Goodwin, President and COO of Fire River Gold (TSX.V-FAU). He's talking about his company's Nixon Fork gold mine which is situated just over 300 kilometers Northwest of Anchorage in Alaska.

Richard Goodwin, President and COO of Fire River Gold (TSX.V-FAU).

Its remoteness means that access is by air, "It’s a flying operation with a 1,200 meter long air strip," explains Richard, "It'll take a Hercules aircraft which is the way most of the equipment has arrived to site."

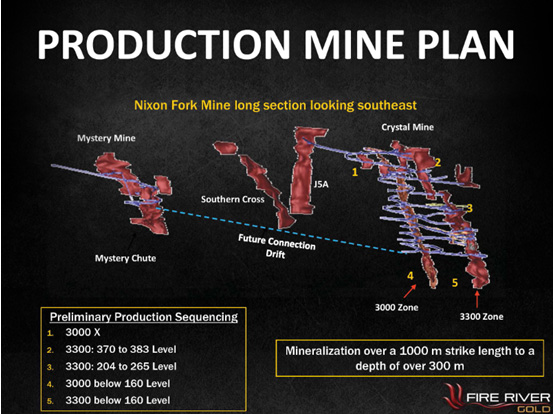

Richard outlines the Company’s progress: "We are currently in production. We have one main project which is the Nixon Fork gold mine which is in Central Alaska in the Tintina Gold Belt. It’s a former producer which was previously owned and operated from 1995 to 1999 under Nevada Goldfields and then from 2006 to 2008 under St Andrew Goldfields." The site has potential. He explains, "We have brought it back into production. We started commissioning on June 27 and began production July 4th, and we will be into full production by the end of October 2011. Although he's relatively new to Fire River Gold, Richard has been in underground mining for a long time - 25 years: "10 years as operations, 10 years in consulting and consulting management. That's all in Vancouver," he explains, "and 5 years as an executive manager; exclusively underground.” That was before he came to guide his company through their development of Nixon Fork. "I took over the job of project manager and vice president in November 2009, managing the Nixon's Fork project as we advance it towards operations here. I then took over as president at the end of April 2011."

Just before Fire River Gold, Richard worked for Redcorp where he ran a $300m construction project for a 2,000 tonnes a day polymetallic mine. Fortunately for Fire River Gold, there's not quite as much construction work to do at Nixon Fork - one of the advantages of it having a 'history'. Richard describes the building program: "We have one construction project ongoing at site which is the completion of the cyanidation circuit. It's a CIL plant and that will be mechanically complete in September and operational in October this year. So, our plan is to start operations through the summer on the two separation systems – gravity and flotation - and then add cyanidation in October.

He explains in more detail, "The recovery for the summer will be about 80%, ramping up to 96% when we start the extraction. We also have an asset down the hill which is a tailings pond. It has a capacity of 140,000 tonnes and it averages a grade of around 8g/tn. The plan will be, once cyanidation circuits are in place that becomes supplemental feed to complete the recovery of gold from it." He expects to then achieve "a higher percentage of recovery - up to the 96% level or so."

There are 85 workers on site at the moment but that will increase to around 90 when the mine’s at full production. Running it all is Vice President of Operations, Tim Smith, "He's a metallurgist and we complement each other because I'm a mining engineer," Richard laughs.

At the heart of it, of course, is extracting the remaining gold from the mine at a profit and Richard believes that his company can comfortably achieve this. "I'm interested in somewhere around $600 an ounce, all-in," he declares, "but, as I said, the gold goes out in the copper con so we're anticipating that the con will cover the shipping, and the transport will be paid for by the copper, and the gold will be profit. The copper con will line up about 500g per tonne of gold in it."

Fire River Gold has 99m shares issued at present which, with "warrants and fully-diluted, we're at 140m". The current share price is around $0.45, having fallen back from its high of $0.72 at the end of last summer. The company has a market capitalization of $45m and, Richard claims, it is "cash-strong. We have $9m cash right now which will carry us through to full operations."

In his opinion, Fire River Gold’s money in the bank is one of the key reasons for investing in them, "We have no debt, no commitments, no hedging, so we control our own destiny that way," he states. Richard also urges potential investors to take the mine's location into account with its "very low political risk", and the fact that the mine will be producing 12 months a year. "We will recover tailings as supplemental feed for the 6 months that aren't frozen and operate the mines the whole year round. So we'll operate year-round at 150 tonnes a day and then, in the summer, it will be operated at 250 tonnes a day with supplemental feed from the tailings."

As for the future of Nixon Fork? Richard thinks that it should be good for a few years yet: "Currently we have resources that will support a mine life of 4 years but our objective is to replenish what we mine on an annual basis. So we'll mine 50,000 ounces a year, we'll drill 50,000 ounces a year. Under that scenario, I wouldn't be surprised if it carries forward for 10 years even though our current resource is only 200,000 ounces."

SUMMARY

Richard Goodwin of Fire River Gold spoke to us at the CIM Conference & Exhibition 2011 about how his company was poised to bring their Nixon Fork Gold Mine in the Tintina Belt, Alaska back into full production.

Above, he describes how, through good organization and planning, they intend to keep the mine operational all year round.

For more information:

Contact Information

Fire River Gold Corp.

2303 West 41st Avenue

Vancouver, B.C.

Canada

V6M 2A3

Office: + 1 604 685 1870

Fax: + 1 604 685 8045

Toll Free: 1 800 667 1870

E-mail: info@firerivergold.com

Website: www.firerivergold.com

Contact: Investor Relations

Tel: +1 604 648-1428