Investors who prefer junior resource mining companies love companies with a great location, sufficient capital, and an aggressive plan for growth.

If that describes the kind of companies that you like to invest in, NioGold (TSX-V: NOX) might be a company that deserves a closer look.

Northern Securities has a new report (September 30, 2011) on NioGold Mining (TSX-V: NOX) ($0.35). They continue to recommend the stock with a target of $0.85. Recent drilling has extended NioGold's Marban deposit to the east and at depth, with new high grade gold discovered at 500m and below suggesting the potential for continued expansion of the deposit.

Here is a link to Northern Securities’ report http://coal-harbor.com/www/_resources/093011_NOX.pdf

NioGold operates in the Abitibi region, a gold-rich belt of land that stretches between Quebec and Ontario. They have been exploring in one particular spot and have released an update about it a few weeks ago. But, as we learned from interviewing the President of the company, that's only just the beginning for them.

Recently, we spoke to Rock Lefrançois, President and COO of NioGold. He's a Professional Geologist with over 25 years of mineral exploration experience throughout North American and Central America. In the past, he's worked with Cambior and Aur Resources.

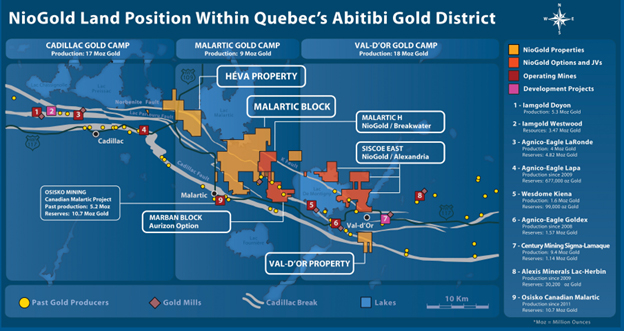

Mr. Rock Lefrançois, President and COO, opened by telling us about the property that NioGold owns: "We have a very large land package in the premiere gold camp in Quebec, called the Abitibi Gold Camp. Our land package is right in the heart of the Val d'Or-Malartic camps." According to NioGold's website, they own 12.5 miles of land along the fault-line and there are 7 gold-producing mines nearby.

Persistence has paid off for the company: "We've been drilling there since 2007 and have in excess of 960,000 ounces of gold resources (NI43-101 compliant indicated reserves of 600,000 ounces and inferred reserves of 360,000 ounces)," reported Mr. Rock Lefrançois, President and COO.

Now that they have some gold discoveries, Mr. Rock Lefrançois, President and COO, described a partnership with another company to help develop the project. "We've signed Aurizon Mines (TSX: ARZ) to an earn-in option in exchange for mine development. They can earn up to 65%, and right now they are earning their first 50% interest by spending $20 million in the ground. The $20 million will be spent in drilling to enlarge the resource base we have there. Then they'll bring the project down the line to a feasibility study and decision on production."

The work, these two companies have already done together, is impressive; which not only solidifies their working relationship but hints at the potential success of the project to come: "We just finished our first year drilling partnership with Aurizon Mines," said Mr. Rock Lefrançois, President and COO. "We drilled 50,000 meters. That first phase was completed on August 9th and we just came out with the release that highlighted some very impressive intersections at depth on the Marban deposit. It opens up all the ground to increase the resources. We've also highlighted some of higher-grade zones that we intersected near surface."

So, what did NioGold report? What can investors hope to see in the future? Mr. Rock Lefrançois, President and COO answered: "We have 4 to 5 impressive cuts at depth. One of them is 7 grams of gold (per ton) over 10.9 meters (approximately 35 feet), which is very good grade; it's very good mineralization. The mineralization we're intersecting at depth is wide and relatively good grade for being underground. As well, some of the higher grade intersections that we've announced – especially those near surface – were 900 grams of gold (per ton) over 2.9 metres (about 10 feet) of very impressive high grade mineralization."

That sounds like good news for the company and it's no surprise that their stock price climbed after that (although investors will be pleased to hear that the stock price, which hovers around $0.33/share right now isn't yet near its 52-week high of $0.55/share).

Now that they've enjoyed some good news from that development, Mr. Rock Lefrançois, President and COO insists that this is only just the beginning. He said: "The Marban Block property is only 14% of our land package. On the rest of the land package that we own 100% outright (on which no other company has an option to acquire an interest), we are going to keep for ourselves. We have a budget of CDN $2.5 million for exploration drilling. We're going to drill targets in the camp that have never been drilled before or are underexplored. We're doing all of this in the hope of making a new discovery."

So, NioGold has two initiatives going on right now – a partnership with some indicated and inferred gold resources, as well as an additional exploration project elsewhere on their property.

So, how is NioGold stacked up to move forward? Mr. Rock Lefrançois, President and COO, gave us several reasons why the company is perfectly poised to succeed, and why investors should take a closer look.

First, the company is in a great location. "The area we're in – the Abitibi gold belt – stretches across Quebec and Ontario and has produced about 170 million ounces of gold since the turn of the last century when the first discoveries were made. We're in a world class mining jurisdiction," said Mr. Rock Lefrançois, President and COO. Then he continued: "We're in a hot area in Abitibi – the Malartic gold camp. Three mines have recently been put in operation, two by Agnico Eagle and one by Osisko Mining – it's the largest open pit gold mining operation in Canada. They have about 11 million ounces in gold resources and we're right next door to them."

Second, they have compelling direction: An attractive project that is being developed further, as well as some strategic exploration for the future: "The company is aggressive on developing its current mine and [looking for] a new one," said Mr. Rock Lefrançois, President and COO.

Third, they are financially sound and attractive to investors. Mr. Rock Lefrançois, President and COO reported: "NioGold has 97 million shares in the marketplace. We have $13.5 million in working capital so we don't have to return to market for a while. We have sufficient funds to continue exploring for the next 2-3 years."

Fourth, the NioGold team is strong. "On the field, our main office is in the mining camp in Val d'Or. We have 15 permanent staff up there – they're a good technical staff of geologists and technicians. In management, I'm a Professional Geologist with 25 years of experience in mineral exploration. Our Chairman and CEO, Mike Iverson, is a businessman out of the west coast. This is his third junior mining company – the other two were very successful." Their team of directors, officers, and decision-makers brings a powerful mix of rich industry experience. Mr. Rock Lefrançois, President and COO added: "We're not a very big company. We have a very tight group of directors and officers. We have a very small group that makes most of the decisions for corporate development and in the field."

NioGold has a great location, they've had some early-stage success, and they're aggressively going after more. That's a company that investors will want to look closer at.

Disclosure: the Alper family owns NioGold’s Stock

REFERENCES

NioGold

Corporate Office

NioGold Mining Corporation

24549 53rd Avenue, Langley, British Columbia V2Z 1H6

http://niogold.com/

Toll Free: 1.877.642.6200