Metals News had a chance to catch up with Michael Willett, the CEO of Tamerlane Ventures in Vancouver to talk about their work at the Pine Point property. A historic property that has not been utilized since it closed in 1987, Tamerlane Ventures is moving toward bringing Pine Point back into production with a new batch of targets.

Willett is excited to be using his breadth of experience to help Tamerlane move forward on their Pine Point Project. He said, “I'm a mining engineer by trade and have been working in mining for thirty years.” Willett has a great deal of metals experience. Said Willett, “My space has been base metals and gold, all underground.” With the experience that he has, he is focused on helping Tamerlane to develop Pine Point. Said Willett, “I've brought my experiences to the plate for Tamerlane and am excited to be able to work on this project in Northern Canada.”

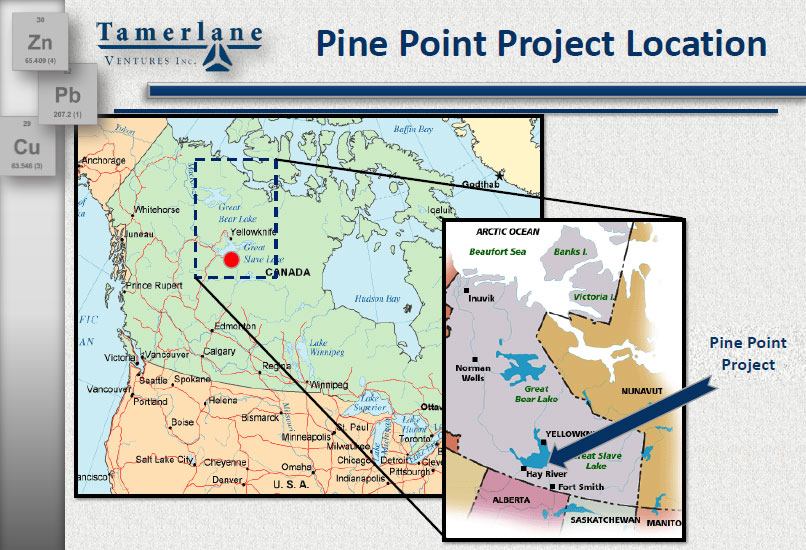

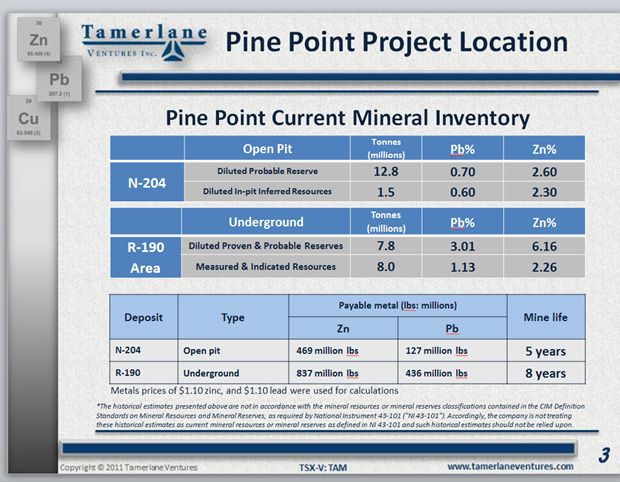

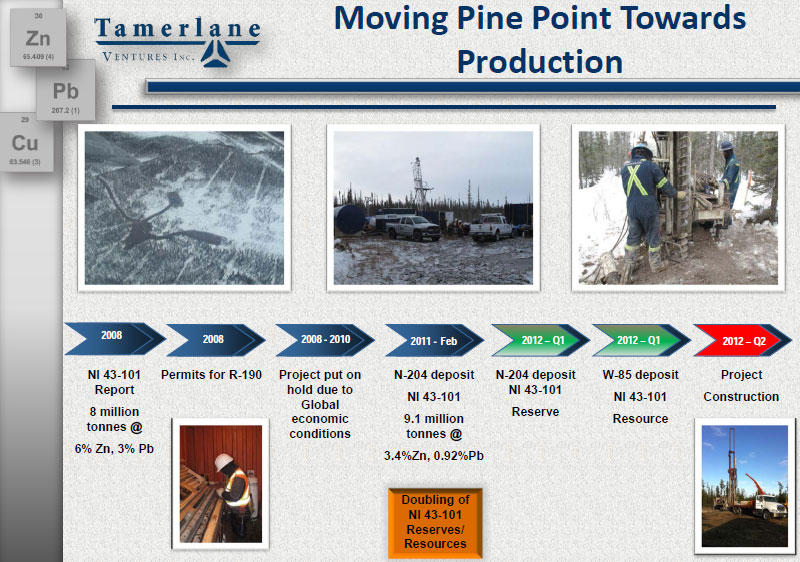

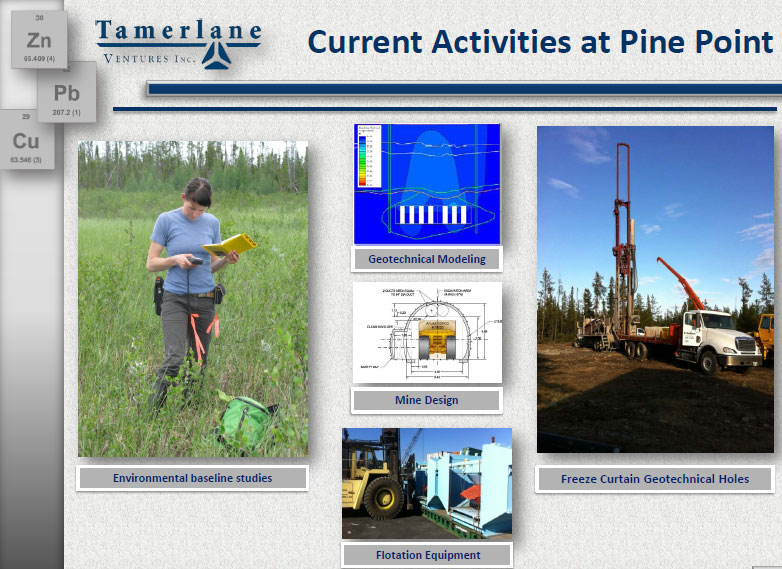

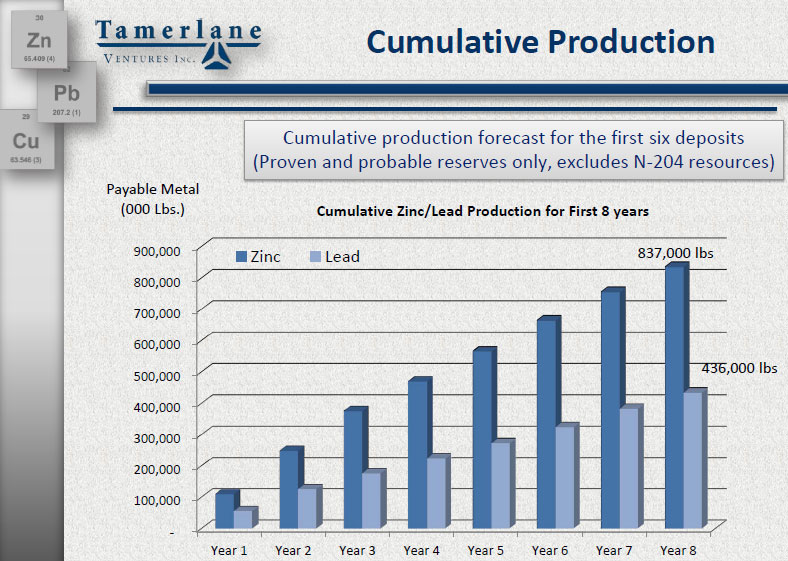

The Pine Point project has been in production before as a profitable lead-zinc mine, located 129 kilometers south of Yellowknife and only 40 kilometers east of Hay River, historically, Pine Point was in operation several decades ago. Said Willett, “It is a previous producer from '64-'87. It produced over 64 million tons.” Given the historical success of Pine Point, Willett and his team are looking to recreate that success. He said, “We've been able to acquire the project which includes 42 deposits that have been identified.” The next step for Tamerlane is to bring them into production. Said Willett, “We are looking to bring six underground deposits and one open pit deposit on line, which include proven and probable reserves of 20 million tonnes, representing over 13 years of initial mine life. We have our permits and our next step is to secure project financing, after which we will start construction and go into production.”

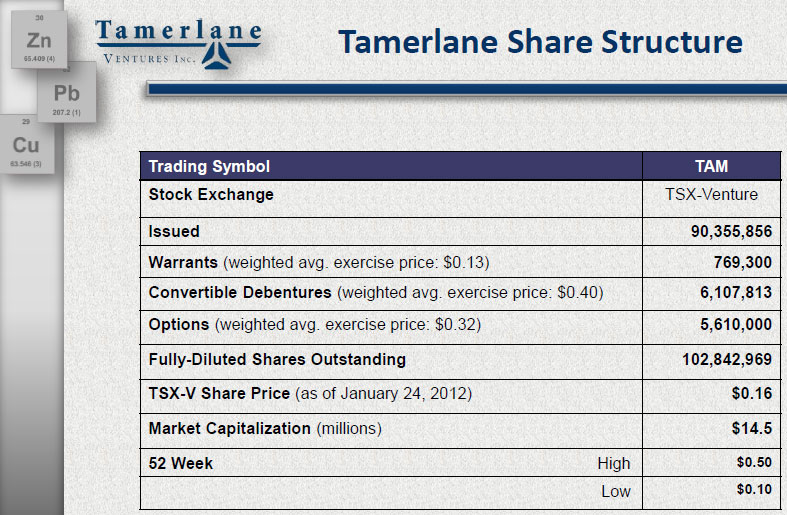

Any large operation requires funding and Tamerlane's efforts at Pine Point are no different. Said Willett, “We require approximately $121 million dollars of pre-production capital to finance the project.” Financing may occur in several different ways, including a combination of off-take agreements, equity financing and debt.

Pine Point's lead zinc reserves and resources should provide a significant mine life. Said Willett, “The proven and probable reserves alone support a mine life in excess of 13 years from both underground and open pit ore sources.” These first seven deposits are just a small portion of what Tamerlane would like to do at Pine Point. Said Willett, “The intention is to extend the mine life by continuously upgrading historical resources, which currently total approximately 34 million tonnes, into resource and reserve categories.” Pine Point also benefits from existing infrastructure, a key factor that significantly reduces the capital intensity of the project. Said Willett, “There is an existing 365-day all-weather road and hydro power to the property, in addition to a rail head nearby. We will truck the material up from underground or from the open pit to the processing plant and then truck the concentrate to the railhead, where it is shipped out by rail.”

With this large of a project, Tamerlane is facing the challenges of financing it fully to move it to the next stage of development. Said Willett, “The biggest challenge for us right now is the financing. The positive part of the project is that it does not involve any complex designs and there is good infrastructure. Said Willett, “We have been working on de-risking it from the beginning. It is a simple project. It is a very basic operation.”

If Willett seems calm in the face of such a large undertaking, he is leaning on his years of experience. With knowledge that helped to bring three mines into production, he has extensive experience that will help Tamerlane with the Pine Point project.

Why should investors take a look at Tamerlane? Willett believes it is because of the potential of their project. He said, “The infrastructure is already in place. It is already permitted and we have an experienced team to put it into production.”

Willett believes that there is a perfect storm coming that will benefit Tamerlane and its shareholders. He said, “That is the great story behind this. We believe the market will be in an upswing with a lot of production going offline and not a lot coming on to replace that lost supply. Furthermore, analysts are predicting continuously increasing demand from India and China, and other global markets for the remainder of the decade. We are looking at a positive position for our project. By 2014 we are expecting lead and zinc metals prices to be significantly higher than current levels.” 2

Given all that is going on with Tamerlane, Willett is enthusiastic about what the future holds. He said, “I'm excited to be part of this project. That's my background to put mines into production.” Pine Point isn't Tamerlane's only upcoming project. Once the Pine Point project is in production, they will begin to focus on additional properties. Said Willett, “One of our future focuses is that we have some excellent exploration properties. That will give us exposure to not only base metals but also to precious metals.” . Said Willett, “We have a great package here and we look forward to being a metals producer by 2014.”

http://www.tamerlaneventures.com

Brent Jones

Director, Corporate Communications and Investor Relations

bjones@tamerlaneventures.com

(360) 332-4636

(360) 332-5025