Some investors invest in a sector, others invest because of who runs the company, and still others try to time the market. But investors who are looking to invest in something a little different may find the Sprott Resource Corp. is worth a closer look.

Some investors invest in a sector, others invest because of who runs the company, and still others try to time the market. But investors who are looking to invest in something a little different may find the Sprott Resource Corp. is worth a closer look.

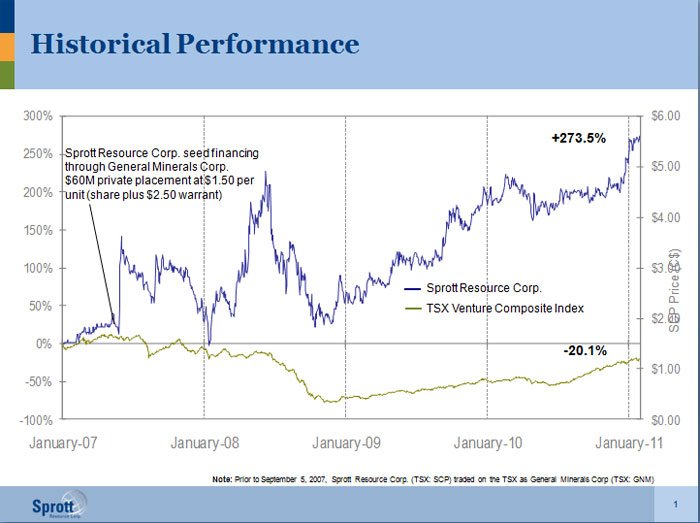

Sprott Resource Corp. (TSX: SCP) is managed by Sprott Consulting LP, which is a subsidiary of Sprott Inc. (TSX: SI). Sprott Resource Corp. builds or invests in private companies and then takes them public, and has an impressive track record of exciting, homerun investments. They work across several industries, including some that may surprise you, and even though they aren't working exclusively in the metals and mining sector, they are doing some interesting work there.

Recently, we talked to Kevin Bambrough, founder, CEO, and president of Sprott Resource Corp. He talked to us about his economic outlook and the work that Sprott Resource Corp. is doing.

But first, he gave us a quick introduction to the company and its background to get our readers up to speed: "Eric Sprott has been called 'the Warren Buffett of Canada'. I joined Eric in 2002." Together, they worked on Sprott Asset Management (another subsidiary owned by Sprott Inc.). "Then in September 2007, right near the top of the resource market, I founded Sprott Resource Corp."

Then Mr. Bambrough gave us details on how Sprott Resource Corp. got started, and the early win they enjoyed that helped to set the company on the course it's on today: "We took over a small mining company called General Minerals and renamed it Sprott Resource Corp. One of the biggest investments I made was in PBS Coals. We put $30 million into that company and then $25 million shortly thereafter. Then coal prices took off and we took the company from a private company to a public company and then engaged in a wholesale effort to divest the entire company. We made about $186 million on that transaction."

Sprott Resource Corp. Is currently in a number of companies across a number of sectors: Orion Oil and Gas, Waseca Energy, One Earth Farms, One Earth Oil and Gas, Stonegate Agricom, and gold bullion.

Sprott has only a couple of main focuses. The first focus is precious metals. They have a substantial holding in gold bullion because of Mr. Bambrough's belief that hyperinflation is a likely outcome of current economic practices. As for other precious metals investment, Mr. Bambrough could not provide a lot of details: "We're working on a number of things in that area right now."

Agriculture is a second focus for Sprott Resource Corp. "We have a significant holding in Stonegate Agricom [a company that does work in phosphates and agricultural nutrients]. We founded and are the largest shareholder in One Earth Farms, the largest farm in Canada. It will be one of the largest farms in North America this year, and it's in the position to be one of the largest farms in the world. With food inflation and food security concerns, it's a unique business."

Energy is a third key area of focus for Sprott Resource Corp. Mr. Bambrough said: "I'm a big believer in the peak oil theory: With the problems you see in the Middle East, I think oil prices will be much higher. I think it's inevitable that there will be regime changes throughout the Middle East and many of these nations sell oil for US dollars but I think they will end that practice over time. Instead, they'll be looking to exchange their oil for food and try to balance their trade." Mr. Bambrough explained another reason for price increases: "We've been following the work of experts who analyze oil discoveries and production declines. There are dramatic decline rates and I think it's just a matter of time before the major oil fields start to suffer and there will be a real crimp in production. Production peaked a number of years ago and it's been going down steady. The unconventional oils and heavier oils are being brought on to make up the difference. I think there's going to be a growing strain on production and increased demand."

Next we turned our attention to Mr. Bambrough's economic outlook and how it shapes his investment decisions. One of the overriding themes in how Mr. Bambrough chooses investments is his belief that prices are going to rise dramatically: "I'm a long-term hyper-inflationist; I see growing competition from emerging markets for resources and I think it's inevitable that the US dollar will lose its status as the reserve currency of the world. That process is accelerating. I feel more confident about it than ever when I look at what's going on in the Middle East, India, and China. I see a protest against inflation, which is really against fiat currency and the lack of purchasing power that people are able to get from their current wages because their countries’ currencies are pegged to the US dollar. I'm not just down on the US dollar; I'm down on all currencies. These are fiat currencies and hardly any of them have any backing to them whatsoever. Country debt levels are too high, compared to GDP. And to meet obligations, they're going to have to print more money."

So, what should investors do instead? Mr. Bambrough is adamant that there is one smart investment to hedge against hyperinflation. He said: "Resources in general are where people should be investing their money. A lot of people view resource investing as risky; I view it as being involved in real assets. So if you get involved in high quality businesses – companies with long-life resources that are low-cost producers (so that even in a bear market, you'll still get a decent return on capital) – I think resources are a good place to be."

Indeed, the Sprott "family of companies" have adopted a resource-heavy weighting to take advantage of the opportunities in the resource sector. "Through Sprott Asset Management (another subsidiary of Sprott Inc.), we have a number of funds that very significant weightings in gold and silver. Through our gold funds, hedge funds, and equity funds, we have significant exposure to precious metals – probably the most exposure of any asset management firm. We have a $1 billion precious metals fund. In our hedge fund and equity fund, we own about 30% of the fund in physical bullion as well as an additional 30% to 40% in precious metals stocks. We also have a Sprott Physical Gold Bullion Trust and a Sprott Physical Silver Trust. It's like a gold ETF and a silver ETF, but the difference is that we actually keep all of our gold and silver stored at the Royal Canadian Mint and the shares are redeemable in physical gold or silver."

That is some serious money in precious metals, and it's nice to see an asset management company put its money where its mouth is.

Sprott Resource Corp has a great track record of making the right decisions when it comes to sectors and investments. Mr. Bambrough gives his "secret" to the company's success: "We have a system at Sprott Resource Corp. I like to think of it as a money-making system. We find great private companies either distressed or trading at a low value and need capital to get to the next level. We invest in these private companies at a significant discount to their public company comparables – typically 50% less. So if we do nothing else other than get involved in great private companies, and then take them public, we're going to make a great return."

The first key is knowing when to invest. Mr. Bambrough gives a couple of examples of the benefit if timing: "When we bought Orion Oil and Gas, the oil price had just dropped from $140 to $40 and was just starting to turn income back. Natural gas price dropped $2.00 when we agreed to buy the company. The company had a strong cash flow and would make even at low oil and gas prices." But now that prices have increased, the investment is that much better. Another example is Stonegate Agricom. "When we invested in [the property], phosphate rock prices were $50 to $60 per ton. It was an uneconomic deposit, even though it was still one of the lowest cost deposits in the world. It was an unsustainable situation [at those prices] but now that phosphate rock prices are approaching $200 per ton, it's a very valuable asset with potentially a billion tons of phosphate rock. [The investment was] a $53,000 option on a phosphate deposit will be a more than $100 million market win and we've realized a portion of that already."

Along with timing, Sprott is willing to make a big bet. "When we get involved in something," Mr. Bambrough said, "we generally to do it in a big way. We're not afraid to take big bets in significant assets." Of PBS Coals,” Mr. Bambrough said: "We put 50% of our available cash into one company because I thought it was trading at 3 times free cash flow. And we were able to make such a huge gain when the coal price rose. We put about $110 million into Orion Oil and Gas and that was [about one third] of our Net Asset Value. Today, based on market prices, our investment has more than doubled."

Sprott Resource Corp. is an entrepreneurial company doing exciting things in a number of industries. While most of our readers are metal sector investors, Sprott Resource Corp is a resource company with a twist offering an interesting way to diversify a metals-heavy portfolio, while continuing to hedge against hyperinflation.

REFERENCE

www.sprottresource.com

Sprott Resource Corp.

Royal Bank Plaza, South Tower

200 Bay Street, Suite 2750, P.O. Box 90

Toronto, Ontario M5J 2J2

416 977 7333

info@sprottresource.com

http://www.sprottinc.com/

http://www.sprottconsulting.com/