You know their story as well

as I.

Hard-core silver bugs believe that the so-called “poor man’s

gold” is still money. And some are apparently near-religious in their

convictions that the United States of America should return to the bi-metallic

monetary system that was established in 1792 and officially done away with in

1900.

The US was on a defacto

silver standard for eleven years starting in1933 when Roosevelt devalued the

dollar by 70% and made ownership of gold bullion illegal. In 1944, the Bretton

Woods Agreement established the American dollar as the world’s reserve currency

backed by gold and ended that silver relationship.

Monetary silver’s finality in

the US of A occurred from 1964 to 1970 with a series of Congressional Acts that

ended the redemption of silver certificates, first for silver coins then for

bullion, and ceased the minting of silver coinage.

Once its value as money was

extinct, silver became predominantly an industrial metal and has been exactly

that over most of the last 50 years. 70% of new silver is a by-product of base

metal or gold mining and production is largely dependent on the prices of these

primary metals. 60% of the silver mined every year is now consumed by

industrial applications with 40% used for jewelry, silverware, coins, and

metals.

Although silver functions

mainly as an industrial metal, it is strongly tied to the price of gold and is

generally more volatile during upside and downside moves of the yellow metal.

In times of financial distress and economic calamity, silver tends to behave

more like a precious metal with widespread hoarding and speculation trickling

down from the gold market.

Silver aficionados are

adamant that the gold to silver price ratio should be less than 20:1. Their

argument is based on the silver content in the Earth’s crust at about 16 or 17

times that of gold and the ratio of silver to gold mined per year is around 9:1.

Accordingly, they claim it is

not a matter of “if” but “when” the price ratio will revert to its normal level of 16:1. Because this ratio

has not happened since 1884, the silver promoters cry “market manipulation”.

They apparently don’t savvy that 16:1 was a product of government manipulation.

In my opinion, this is an illogical

idea that ignores historical precedence for gold and silver values.

It is indeed true that over

the 228-year history of American money, the gold to silver ratio was less than

20 for 97 of those years. That is 42% of the time but let’s take a closer look

at the facts:

·

93 of those years

occurred when the price ratio of gold and silver was fixed by fiat at 15:1 (1792-1833)

and then 16:1 (1834-1884).

Outside of this 93-year

period when gold and silver prices were government-controlled, annual gold to

silver ratios of 20:1 or less occurred only over four other years. These

anomalous ratios were mostly caused by extraordinary government interventions designed

to either boost or reign in the price of silver.

·

In 1890, Congress,

in a disastrous attempt to raise the price of silver, required that the US Treasury

purchase domestic silver bullion, mint coins, and issue redeemable paper

certificates. This Act led directly to the Panic of 1893.

·

With gold at a

fixed price and huge debts from World War I piling up, a brief surge in the

silver price occurred in 1919 but was unsustainable.

·

In 1967 and 1968,

Congress allowed the price of silver to float freely after five years of price

suppression and failed attempts to prevent hoarding and melting of coins. These

were the last two years when silver bank notes issued in various tranches from 1878

to 1957 were redeemable in bullion. Silver bounced above $2.00 and the

gold-silver ratio dropped precipitously during this period.

In addition to the yearly

ratios, monthly gold to silver ratios were less than 20 in the first half of 1970.

Note this was when the dollar was collapsing and the official $35 per ounce gold

price was no longer working. It was a year prior to Nixon’s first in a series

of three executive orders that ended Bretton Woods, the gold standard, and

floated the dollar against other world currencies.

During the failed attempt by

the Hunt Brothers to seize control of the world silver market in early 1980,

the gold to silver ratio was less than 20 for two months.

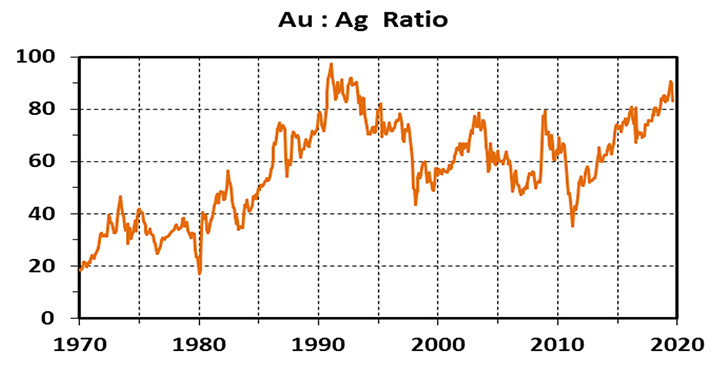

Here’s our chart of monthly

average gold-silver ratios since 1970:

We are now three months shy

of a 50-year record of freely-floating gold and silver prices; the mean

gold-silver ratio is 56.9 and the median is 58.6.

Note that both of these

statistical measures are somewhat skewed to the low side because we have chosen

to include abnormally low values during 1970 and the first half of 1971. This

1.5 year period illustrates conditions prior to the beginning of US executive actions

to abandon the gold standard.

When the price of silver

spiked to its all-time high in April and May of 2011 before quickly cratering,

the monthly gold-silver ratio briefly fell below 40 for the first time in

nearly 28 years. Folks, that’s more than twice the previous low established during

the Hunt Brothers’ debacle.

Certainly the current gold -silver

ratio in the mid-80s is highly anomalous, and I would expect it to drop going

forward.

But based on the nearly 50-year

record, I suggest that the gold to silver price metric has entered a completely

different paradigm post-global economic crisis of 2008-2009. The case can be

made that we have seen the last of abnormally low gold to silver ratios in the

mid- to upper teens, 20s, 30s, and perhaps the 40s.

Some CEOs of struggling

silver miners with obviously vested interests have repeatedly forecast prices

of $50, $100, $175, and even $300 or $1000 for an ounce of silver over the past

three years. I don’t need to name names because if you don’t already know who

these people are, little due diligence is required.

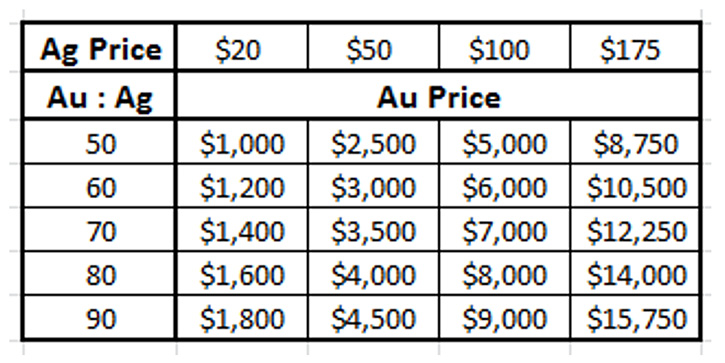

Let’s explore the

ramifications of outrageously high silver prices predicted by the

aforementioned CEOs. In the table below, we have listed various silver prices,

the range of gold to silver ratios over the past eight years, and the resulting

gold price.

We have ignored predictions

of $300 and $1000 per ounce for silver and can speculate this particular CEO

was in some altered state of mind when he suggested them.

There is no doubt that a $20

silver price is reasonable and seems likely occur in the near term. But I think

the higher predictions go from improbable to ridiculous to ludicrous.

So folks, here’s the really

bad news:

Were gold to reach $2500,

$5000, or $10,000 per ounce in the foreseeable future implies that the economic

system is on the verge of collapse, the US dollar is in hyperinflation mode

and/or is no longer the world’s reserve currency, and resource and/or religious

wars are raging across the planet.

These buggy-brained or

perhaps certifiably insane silver CEOs should be careful what they wish for. I

trust each has a bug-out bag by the door, and lots of gold, guns, gas, and

goods stashed wherever he/she/it plans on staging a last heroic stand as the

world regresses to survivalist lifestyles.

The good news is that a $100,

$175, $300, or $1000 per ounce silver price in my lifetime (or yours) is about

as probable as this:

Ciao for now,

Mickey Fulp

Mercenary Geologist

Acknowledgment:

Lukas Smith is the research assistant for

MercenaryGeologist.com

.

The

Mercenary

Geologist Michael S. “Mickey” Fulp

is a Certified Professional

Geologist

with a

B.Sc. in Earth Sciences with honor from the University of Tulsa, and M.Sc. in Geology

from the University of New Mexico. Mickey has 40 years of experience as an

exploration geologist and analyst searching for economic deposits of base and

precious metals, industrial minerals, uranium, coal, oil and gas, and water in

North and South America, Europe, and Asia

.

Mickey worked for junior explorers, major

mining companies, private companies, and investors as a consulting economic

geologist for over 20 years, specializing in geological mapping, property

evaluation, and business development. In

addition to Mickey’s professional credentials and experience, he is

high-altitude proficient, and is bilingual in English and Spanish. From 2003 to

2006, he made four outcrop ore discoveries in Peru, Nevada, Chile, and British

Columbia.

Mickey is well-known and highly respected throughout

the mining and exploration community due to his ongoing work as an analyst, writer,

and speaker.

Contact

:

Contact@MercenaryGeologist.com

Disclaimer

and Notice

: I am not a

certified financial analyst, broker, or professional qualified to offer

investment advice. Nothing in any report, commentary, this website, interview,

and other content constitutes or can be construed as investment advice or an

offer or solicitation or advice to buy or sell stock or any asset or

investment. All of my presentations should be considered an opinion and my

opinions may be based upon information obtained from research of public documents

and content available on the company’s website, regulatory filings, various

stock exchange websites, and stock information services, through discussions

with company representatives, agents, other professionals and investors, and

field visits. My opinions are based upon information believed to be accurate

and reliable, but my opinions are not guaranteed or implied to be so. The

opinions presented may not be complete or correct; all information is provided

without any legal responsibility or obligation to provide future updates. I

accept no responsibility and no liability, whatsoever, for any direct,

indirect, special, punitive, or consequential damages or loss arising from the

use of my opinions or information. The information contained in a report, commentary,

this website, interview, and other content is subject to change without notice,

may become outdated, and may not be updated. A report, commentary, this

website, interview, and other content reflect my personal opinions and views

and nothing more. All content of this website is subject to international

copyright protection and no part or portion of this website, report,

commentary, interview, and other content may be altered, reproduced, copied,

emailed, faxed, or distributed in any form without the express written consent

of Michael S. (Mickey) Fulp, MercenaryGeologist.com LLC.

Copyright © 2019

Mercenary Geologist.com, LLC. All Rights Reserved.